Written by: Tia, Techub News

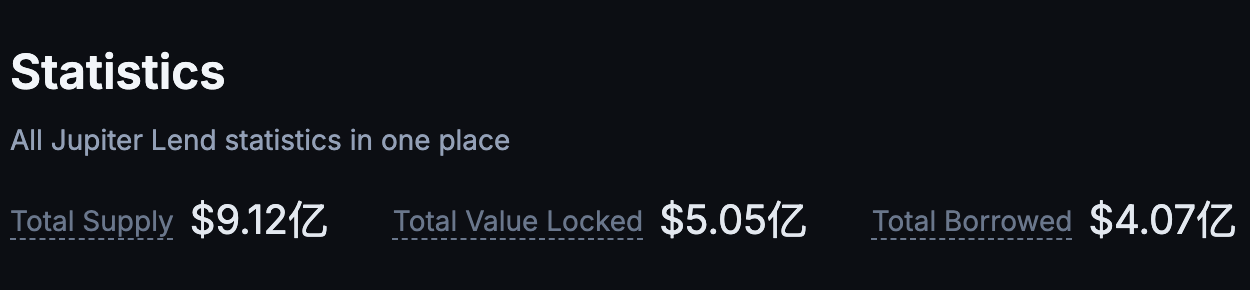

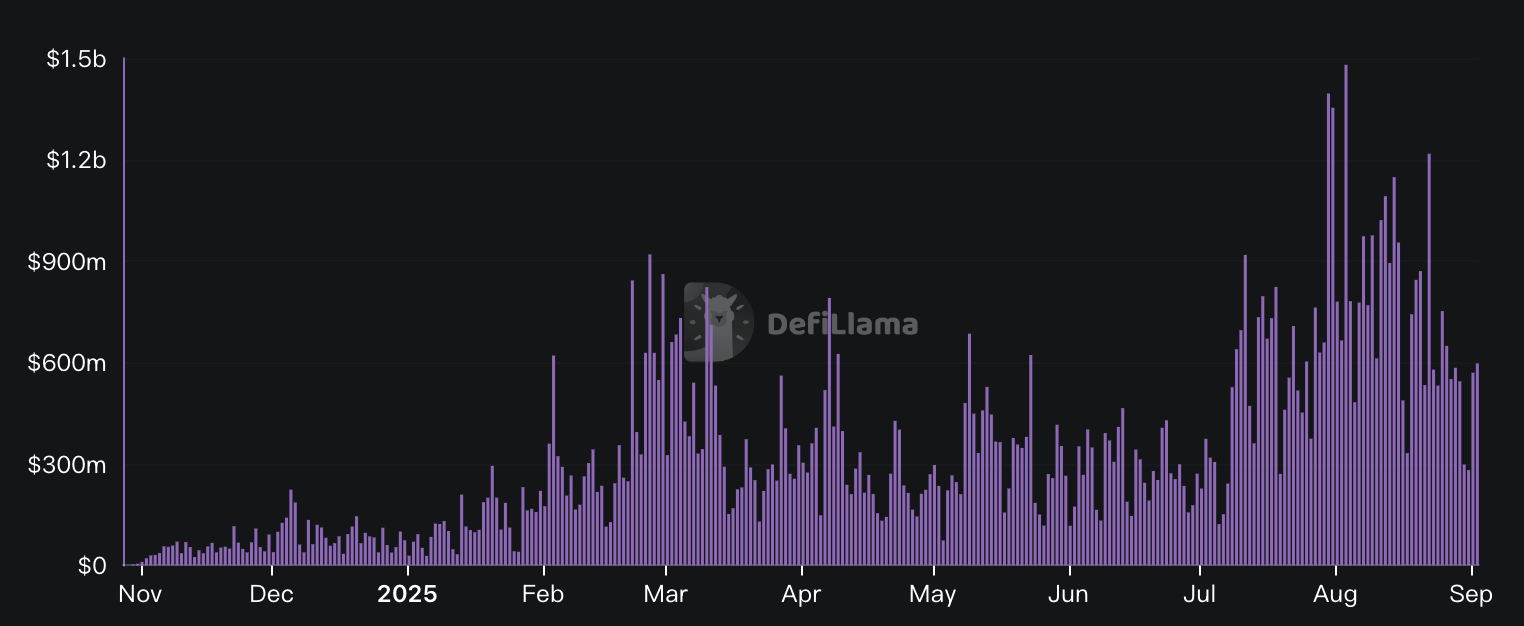

Within less than 24 hours of its launch, the deposit amount exceeded $500 million; just a week later, this figure rapidly jumped to $912 million. The impressive debut of Jupiter Lend in the Solana lending space undoubtedly reshapes people's imagination of the influx of capital. It is worth noting that many established DeFi protocols often take months or even years to accumulate a similar amount of funds. Jupiter Lend's ability to ignite the market in such a short time is closely tied to the technical support from its partner, Fluid protocol.

For a long time, Solana has been known for its leading DEX trading volume, but it has a natural shortcoming in the lending field, characterized by a small market size and insufficient user confidence, often referred to as the "poor man's money market." The strong alliance between Jupiter and Fluid aims to fill this gap. Through Jupiter Lend, Jupiter fully leverages its deep foundation and user network within the Solana ecosystem, while Fluid provides underlying technical architecture and liquidity solutions based on its successful experience in the EVM market with integrated DEX and lending. The combination of the two creates a new soil capable of supporting large-scale lending for LPs and users.

From its design logic, Fluid is not merely a foundational tool for a single product but has the potential to become a cross-ecosystem liquidity infrastructure. By sharing a liquidity layer and innovative mechanisms (such as Smart Debt), it has already proven its ability to enhance capital efficiency in the EVM market. With the collaboration with Jupiter, introducing this architecture into Solana not only addresses the long-standing lending shortcomings but also showcases Fluid's potential to horizontally expand across multiple public chains, becoming a financial foundation for different ecosystems.

Before collaborating with Jupiter to launch Jupiter Lend, Fluid's track record was already impressive. In terms of lending products, Fluid still lags significantly behind the leading AAVE. However, from the DEX perspective, Fluid has performed quite well, once exceeding Uniswap in 24-hour trading volume.

What is Fluid?

The Fluid protocol is not a standalone lending platform or exchange but a combination of both. Its core concept is the shared liquidity layer: integrating lending and decentralized exchanges tightly within the same liquidity pool, avoiding the inefficiencies of traditional DeFi models where funds are fragmented across different protocols and scenarios.

In most lending protocols, the logic of lending is quite simple: users deposit assets and then receive interest allocated by the platform. However, Fluid is different; it reconstructs lending itself into a shared liquidity layer.

By treating lending liquidity as shared liquidity, DEX solves the cold start problem. Unlike Curve, which requires subsidies to attract LPs, Fluid can cold start without subsidies.

Siphoning Liquidity: Smart Lending & Smart Collateral & Smart Debt

In Fluid, there is not only pure lending but also a Smart Lending model. What you deposit is not a single asset but a pair of tokens. This is not just a "deposit"; it also provides liquidity for Fluid's DEX. As a result, you can earn both regular deposit interest and trading fee income (Liquidity APR and Trading APR). The trade-off is the potential for impermanent loss, but currently, the main supported pairs are stablecoins, which have minimal volatility, making impermanent loss almost negligible.

After the shared liquidity resolves the DEX cold start issue, Smart Lending can, in turn, subsidize lending users with DEX transaction fees, attracting more users to engage in lending.

The same idea extends to the Borrow module. In addition to conventional lending, Fluid offers a more flexible "Smart" mode. In Smart Collateral, the collateralized assets are no longer idle but enter the liquidity pool in LP form, earning fees while being collateralized.

In the Smart Debt model, even the liabilities you lend out can be recorded as LP shares, continuing to generate trading fee income. This means that in Fluid, even liabilities can become tools for enhancing capital efficiency.

The ordinary LP process involves putting out two types of tokens (for example, ETH and USDC) into the AMM pool. When others trade these two tokens, the LP earns fees. However, in the Smart Debt scenario, you are not depositing assets but borrowing A and B (for example, -1000 A, -1000 B). On the ledger, this will be recorded as a negative LP position. When others trade, the debt position in the pool will also change with the transaction.

For example, if a user exchanges 100 A for 100 B: your position changes from -1000/-1000 to -900 A / -1100 B.

Essentially, the amount of borrowed debt adjusts dynamically with transactions, just like LP. When you need to repay, the amount of A and B you need to return may differ from when you borrowed. If market prices are favorable, you may find it easier to repay than expected. If unfavorable, your liabilities may increase, requiring more repayment. Throughout this process, trading fees are still counted towards your debt LP share. Thus, your debt is also passively earning fees, which can offset part of the debt cost.

Although Smart Collateral and Smart Debt are just small modifications, they are highly attractive to LPs and borrowers. Smart Debt can provide additional income to borrowers, lowering their loan interest rates, while Smart Collateral can increase the yield on users' collateral. This back-and-forth can significantly reduce borrowing costs for users.

Highly Efficient Liquidation Mechanism

Fluid's efficiency in liquidation mechanisms represents an order of magnitude improvement over traditional lending protocols. In traditional protocols, liquidation is "peer-to-peer" — liquidators must monitor which user's position triggers risk and then liquidate that position individually. Therefore, liquidators must track all positions and prepare funds or initiate flash loans, which is a high barrier to entry, suitable only for professional liquidation bots.

However, in Fluid, all "bad debts" are consolidated into a "bad debt pool." Liquidators (or even ordinary traders) do not need to monitor specific positions but interact directly with this pool, akin to trading bad debts in a trading pair, similar to trading within active liquidity ranges in Uniswap v3. Because bad debts are packaged into liquidity similar to AMM, DEX aggregators (like 1inch, Paraswap, etc.) can directly route users' ordinary trades to the liquidation pool, completing the liquidation. This design not only enhances market efficiency but also significantly expands the range of liquidation participants and reduces liquidation costs.

Liquidators do not need extensive liquidation infrastructure — running full nodes or tracking all network positions, further lowering the entry barrier and making the market more decentralized. As long as they connect to the bad debt pool, they can easily participate in liquidation.

This allows Fluid to impose very low liquidation penalties (the fees users pay to liquidators during liquidation). Mainstream lending protocols typically have liquidation penalties ranging from 5% to 10%, while Fluid's liquidation penalties can be as low as 0.1%, meaning users' losses are reduced by 50 to 100 times.

The gas costs required for Fluid's liquidation are also low. Since liquidations do not require liquidators to engage in complex arbitrage, they can be handled natively, significantly reducing the gas required for liquidation. Overall, Fluid's Vault protocol liquidation requires only about 150k gas, while other protocols often require 300k to 1M. Moreover, Fluid can liquidate any number of positions in a single transaction without significantly increasing additional gas costs, whereas the same operation in other protocols would require multiple transactions, leading to linear gas consumption.

At the same time, Fluid's "partial liquidation" logic can also prevent over-liquidation found in traditional lending protocols. While protocols like Aave and Compound typically also liquidate in batches, such as liquidating a maximum of 50% of a position at a time, liquidators may sell collateral far exceeding what is necessary to "restore the position to health" in pursuit of profit, often leading to over-liquidation. Fluid only liquidates up to the Liquidation Threshold (safety line). The system calculates users' collateral ratios and risk levels in real-time. When a position falls below the liquidation line, Fluid calculates the "minimum collateral needed to return to a safe zone." Liquidation only sells this small portion of assets (in most liquidations, the amount of debt liquidated is close to 5%). The sold portion enters the bad debt pool, eliminating the need for liquidators to monitor positions. Liquidation execution relies on logic and modularity rather than human judgment.

By only liquidating necessary assets, the ecosystem benefits significantly. If all users in the ecosystem use the Vault protocol to manage their debt positions, the negative externalities caused by forced selling and chain reactions can be reduced by 5 to 10 times, making the entire ecosystem more efficient and stable.

Buyback

Since DEX does not need to issue incentives to LPs and part of the trading fees will flow to the Fluid treasury, Fluid also plans to use this portion of funds for buybacks. The proposal was published on August 20 for discussion in the community.

The proposal outlines three buyback models:

Model One is a dynamic buyback based on FDV. In this model, the percentage of income allocated for buybacks will depend on the FDV of FLUID. If the FDV is below $500 million, 100% of the income will be used for buybacks. As the FDV increases, the allocation for buybacks will decrease according to a specific function curve.

Model Two is a buyback based on the 30-day time-weighted average price (TWAP). If the current price is below the 30-day TWAP, 100% of the income will be used for buybacks; if the current price is above the 30-day TWAP, no buybacks will occur.

Model Three is a hybrid mechanism. In a bull market, the protocol will minimize buybacks and retain income; in a bear market, the function curve from Model One will be applied to adjust the buyback scale based on FDV, ensuring more aggressive buybacks when the token is severely undervalued.

Additionally, the proposal supports discussing the option of not conducting buybacks, which would allow more income to be retained for growth and reinvestment.

Fluid DEX v2

Following the launch of Jupiter Lend, Fluid is set to release version V2. The core of Fluid DEX v2 is the operation of singleton contracts built on top of the Fluid liquidity layer. This unified structure achieves infinite composability while significantly improving capital efficiency and gas usage, and allows for cross-collateralization to expand the inclusion of long-tail assets.

When DEX v2 is released, it will support four main types of DEX: DEX v1 Smart Collateral, DEX v1 Smart Debt, Smart Collateral Range Orders, and Smart Debt Range Orders.

The latter two types of DEX v2 allow LPs to provide liquidity across price ranges. Smart Debt and Smart Collateral can choose to create range orders, allowing them to be positioned anywhere along the curve when providing liquidity. For Fluid, which already has enhanced capital efficiency, the integration of range order functionality will make it even more attractive to professional LPs.

Moreover, DEX v2 has been designed with modularity and permissionless scalability in mind. In the future, Fluid will allow completely permissionless Smart Collateral and Smart Debt, enabling users and protocols to create any type of collateral and debt positions.

Summary

For Fluid, truly scaling up requires a strong product architecture as one aspect of competition, but having a robust partner/distribution network will also provide significant ecological support for the protocol.

From a product perspective, Fluid has already demonstrated strong competitiveness. The collaboration with Jupiter Lend has proven to be a successful validation of Fluid's potential to potential distribution networks. As more protocols connect with it, we may see a new DeFi liquidity network gradually taking shape across different chains.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。