The Ethereum core protocol is becoming increasingly powerful, yet the ecosystem is facing unprecedented complexity

In the past year, Ethereum has staged a textbook-level engineering miracle. From the Dencun upgrade, which fundamentally addresses the L2 cost issue, to the Pectra upgrade aimed at optimizing core staking economics, this "digital leviathan" of the digital world has precisely executed its public roadmap. However, a peculiar paradox stands before all observers: the certainty and success of the protocol layer seem to have not brought tranquility to the ecosystem layer, but rather have given rise to unprecedented complexity and potential risks. The engine room of Ethereum (the main protocol) has never been so strong and clear, yet its vast new continent (L2 and Restaking ecosystem) is filled with the clamor of opportunities and the fog of chaos. We must pose a new question: when the war of the underlying protocol is essentially over, where will Ethereum's next battlefield be?

To understand the current state of Ethereum, one must first acknowledge the tremendous success of its core engineering. This victory consists of two key upgrades:

First, the economic transformation triggered by the Dencun upgrade in early 2024. By introducing Proto-Danksharding (EIP-4844), the Ethereum mainnet has opened up dedicated, low-cost data channels (Blobs) for Layer 2 networks. This is not a minor fix, but a fundamental cost revolution. Over the past year and a half, we have witnessed L2 transaction fees plummet and maintain extremely low levels for an extended period. The market has cast its most honest vote with capital: in recent months, while the price of ETH has remained stable, its performance has lagged behind leading L2 ecosystem tokens. This clearly indicates that the expectation of value growth has successfully shifted from the execution capacity of the mainnet to the prosperity of L2 applications driven by cheap data. Ethereum has successfully transformed itself from a "congested world computer" into the "secure settlement and data anchor" of the entire ecosystem.

Second, the governance evolution brought about by the Pectra upgrade completed in May this year.

If Dencun addresses the "cost" issue, then Pectra directly confronts the challenge of "control." In the face of the trend of power centralization among validators under the PoS mechanism, Pectra has reduced the operational advantages of large staking pools by improving the effective balance limit for validators (EIP-7251) and optimizing the participation experience for decentralized staking. This is a precise, surgical intervention aimed at alleviating centralization pressure from the protocol level. Although a single upgrade cannot eradicate all problems, it sends a strong signal to the entire community: Ethereum core developers have the capability and willingness to defend the network's decentralized characteristics.

The successful delivery of these two upgrades means that the main contradictions at the protocol level of Ethereum have been largely resolved. The engine room is operating well, providing an unprecedented foundation of certainty for the expansion of the upper structure.

However, the success of the engine room has pushed complexity to the broader ecosystem layer, giving rise to two major fogs:

First, the maturity of the Restaking track and its inherent systemic risks. Re-staking protocols represented by EigenLayer have evolved from an emerging concept into a vast, complex financial Lego over the past year. By sharing Ethereum's economic security, it provides a foundational launch for numerous emerging protocols (such as DA layers, oracles, bridges), which is undoubtedly a significant innovation. However, its essence adds new layers of leverage and risk that are not directly constrained by the main protocol on the credit foundation of Ethereum. A failure of a re-staking service could trigger the confiscation of ETH principal, leading to a series of chain liquidations. This "potential systemic risk" has become a core issue that analysts cannot avoid when assessing Ethereum's long-term stability.

Second, the side effects brought about by the prosperity of the L2 ecosystem: severe fragmentation. Dozens of Rollup networks operate independently, forming isolated liquidity islands and user experience gaps. The process of transferring users' assets between different L2s is not only cumbersome but also faces security risks from various cross-chain bridges. This escalating "L2 war" has, while stimulating innovation, greatly harmed the overall effect of the network. A digital nation that should be unified has, in reality, split into countless city-states with different languages and incompatible transportation.

The commonality of these two issues is that they cannot be resolved merely through the next upgrade of the Ethereum main protocol. The battlefield has shifted.

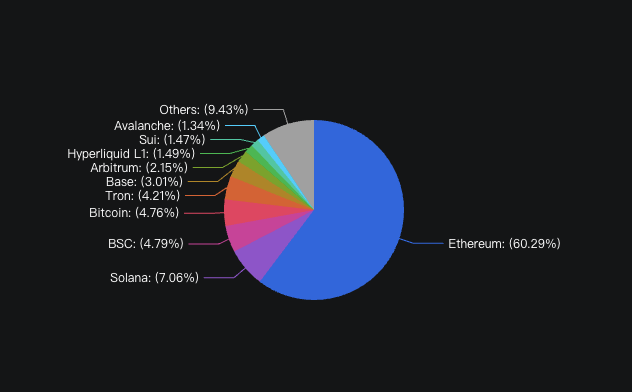

Image caption: Layer 2 Total Value Locked (TVL) market share pie chart, data source: defillama

The Ethereum Foundation's mature governance beyond pure technical thinking

In the face of the ecological chaos that the protocol layer cannot directly intervene in, the Ethereum Foundation's response strategy, the "Ecosystem Development Plan (EcoDev)," is playing the role of an "active gardener," using "soft power" to bridge the cracks in the ecosystem. By reviewing its recent funding strategies, we can see that EcoDev's investments are highly targeted. It does not simply reward the most successful projects but heavily allocates resources to areas that can enhance the "public goods" of the entire ecosystem:

- Funding standardized tools: Supporting the development of universal L2 cross-chain communication standards and developer toolkits to reduce the negative impact of fragmentation.

- Supporting academic research: Providing long-term funding for cutting-edge fields such as ZK technology and MEV mitigation solutions to ensure technological reserves.

- Cultivating global communities: Investing resources in emerging markets such as Asia, Africa, and Latin America to ensure that Ethereum's culture and developer base remain global and diverse.

The core idea of this strategy is: since it is impossible to enforce unity through protocol rules, we should guide the ecosystem to spontaneously move towards integration by cultivating public infrastructure and common standards. This is a softer and more long-term governance philosophy.

The future path of Ethereum is already clear. It has successfully completed the modernization of its core protocol, establishing a robust and efficient foundation. Now, its focus is shifting from being a "protocol engineer" to a more decentralized "ecosystem gardener."

This is a dual-track parallel long march: at the protocol layer, continuously conducting refined optimization and security reinforcement; at the ecosystem layer, responding to new challenges arising from success through strategic investment and cultivation. What we see is no longer just a development team focused solely on technical implementation, but a mature organization that understands how to govern a large, complex, and vibrant digital economy.

This ability to navigate complexity, face new problems calmly, and respond with diverse means is Ethereum's most trustworthy asset.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。