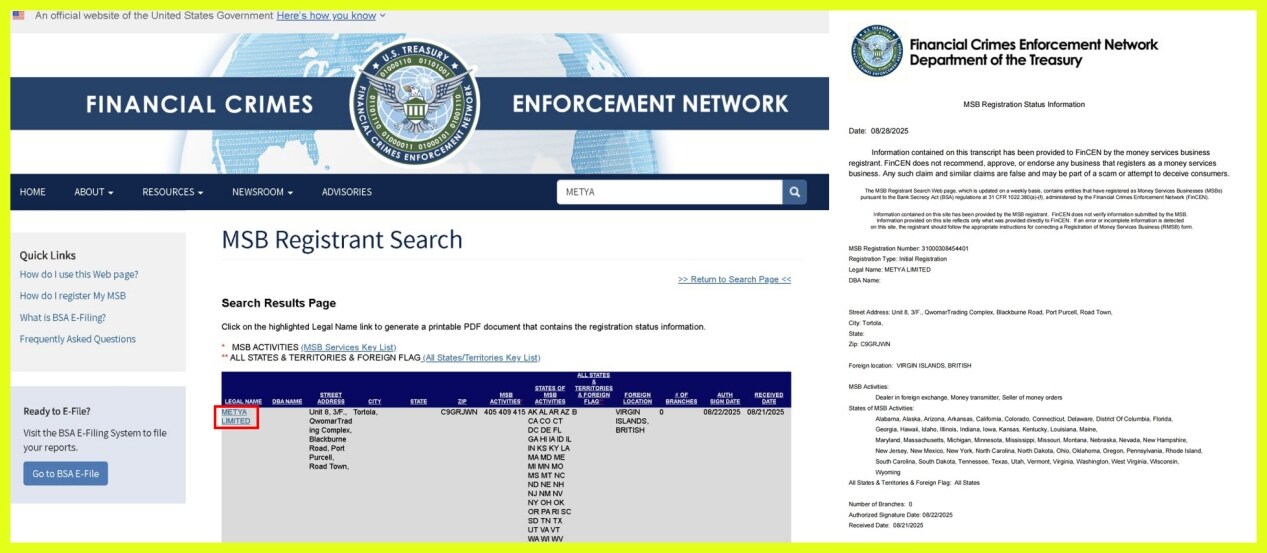

The social payment project Metya has announced that it has recently successfully obtained the Money Services Business (MSB) license issued by the U.S. Department of the Treasury (FinCEN) (Registration Number: 31000038454401), with business types including fund transmission and digital asset exchange.

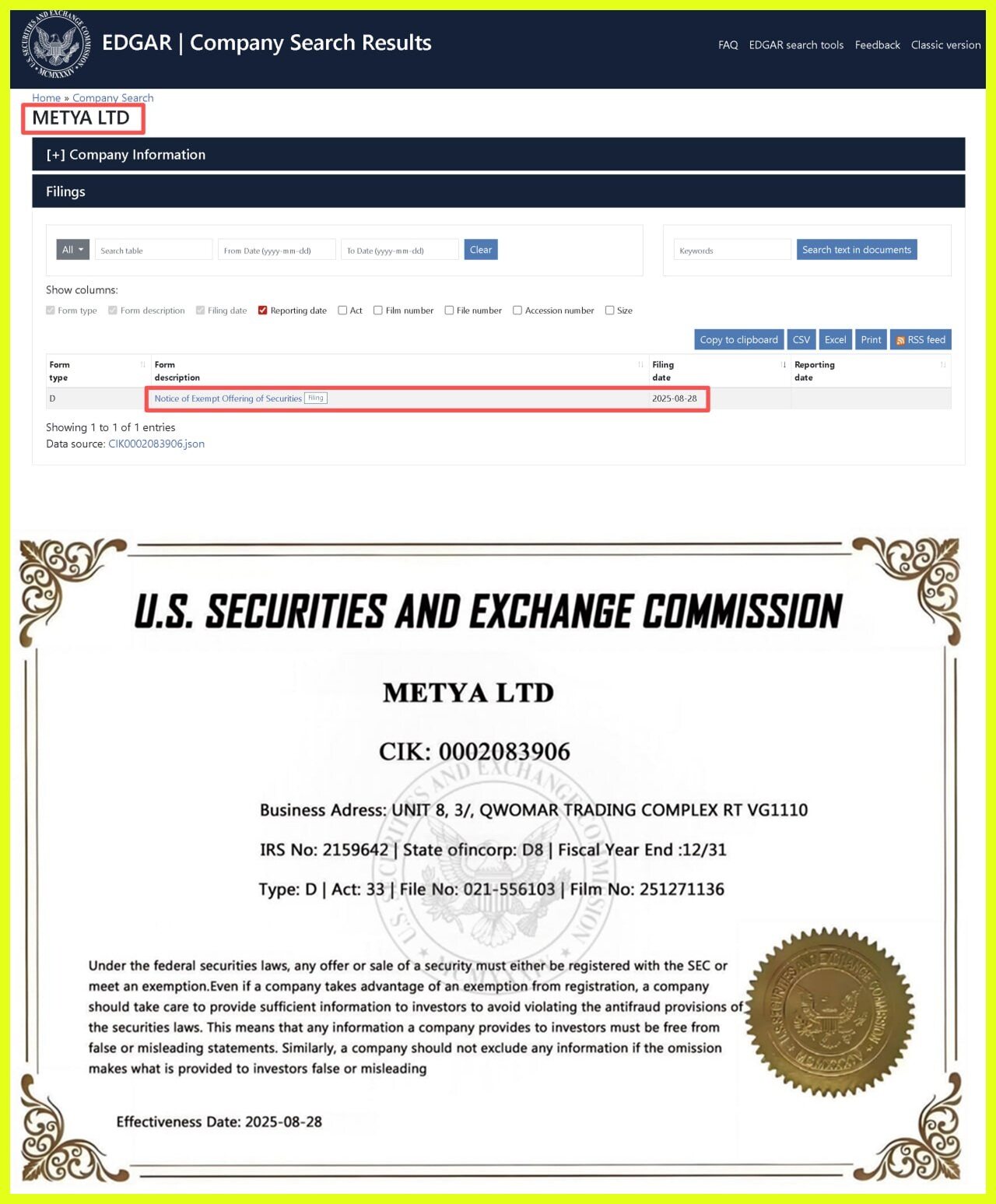

At the same time, Metya has completed filing with the U.S. Securities and Exchange Commission (SEC) (CIK Number: 0002083906).

This development marks a key step for Metya in the global compliance process and lays a solid foundation for international operations.

Holding the MSB license allows Metya to legally conduct digital asset exchanges, stablecoin transmissions, fund settlements, and cross-border payments in the U.S. and globally, significantly enhancing the platform's legitimacy and transparency in payment clearing and cross-border business expansion. Meanwhile, the SEC filing, as the highest level of regulatory endorsement in the capital market, has long been regarded as a core symbol of investor protection and market transparency. Completing the filing not only means that Metya's business has entered a higher standard compliance system, but also further proves its maturity and robustness in compliance governance and risk control.

Actively seeking compliance also provides institutional support for Metya's expansion into the European and American markets and builds a competitive barrier that distinguishes it from most projects.

According to the U.S. regulatory system, the compliance requirements of MSB and SEC cover anti-money laundering (AML), know your customer (KYC), counter-terrorism financing (CFT), and ongoing information disclosure. The application and filing process for the license sets very high thresholds for the company's compliance structure, technical security, and internal controls.

“This is not only a qualification upgrade but also an important milestone in our globalization strategy.” A spokesperson for Metya stated, “In the future, Metya will continue to expand its business landscape in the European and American markets with ‘compliance + innovation’ as dual engines, providing global users with safe, transparent, and efficient digital asset and payment solutions.”

The Metya team consists of senior experts from the fields of artificial intelligence, financial technology, and blockchain, focusing on the construction of a SocialFi, PayFi, and AI-driven compliance ecosystem. The company adheres to the principles of safety, transparency, and sustainability, committed to promoting the deep integration of digital assets and real-world application scenarios, and building an infrastructure-level platform for global users. In the context of the rapid evolution of the global digital finance industry, Metya's active pursuit of compliance is not only an important milestone in its international strategy but also provides solid support for expanding into multiple jurisdictions and attracting international partners.

About Metya

Metya is headquartered in the UK and is a new generation Web3 social payment (SocialFi + PayFi) platform. The project envisions “making the value of social behavior spendable,” connecting on-chain interactions, creator economies, and real-world payments, and building a “social is asset, payment is value” closed-loop ecosystem.

At the application layer, Metya offers diverse functions and scenarios: including AI-driven smart matching and real-time translation, live streaming rewards and task systems, as well as AR city exploration and merchant interaction tasks, covering the complete chain of social, creation, and consumption.

At the payment layer, Metya has launched the Metya Card, which can convert $MET and USDT into daily consumption usable in compliant scenarios, achieving a direct connection between on-chain value and real-world consumption.

By deeply integrating AI, social networks, and payment tools, Metya not only enhances user experience but also continuously increases the demand for token usage and ecosystem stickiness. The project is committed to becoming a bridge connecting digital assets and the real world, building a sustainable Web3 infrastructure for global users, with compliance as a prerequisite and innovation as a driving force.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。