Image source: "The 1998 Version of Water Margin"

In 298 BC, the Pingyuan Jun of Zhao State had three thousand guests, and among them, Mao Sui could debate with the scholars in the court of Chu, winning opportunities for Zhao State.

More than two thousand years later, on September 1, 2025, a token named WLFI landed on global trading platforms. The Chinese capital network spanning the Pacific is supporting the digital empire of the American presidential family.

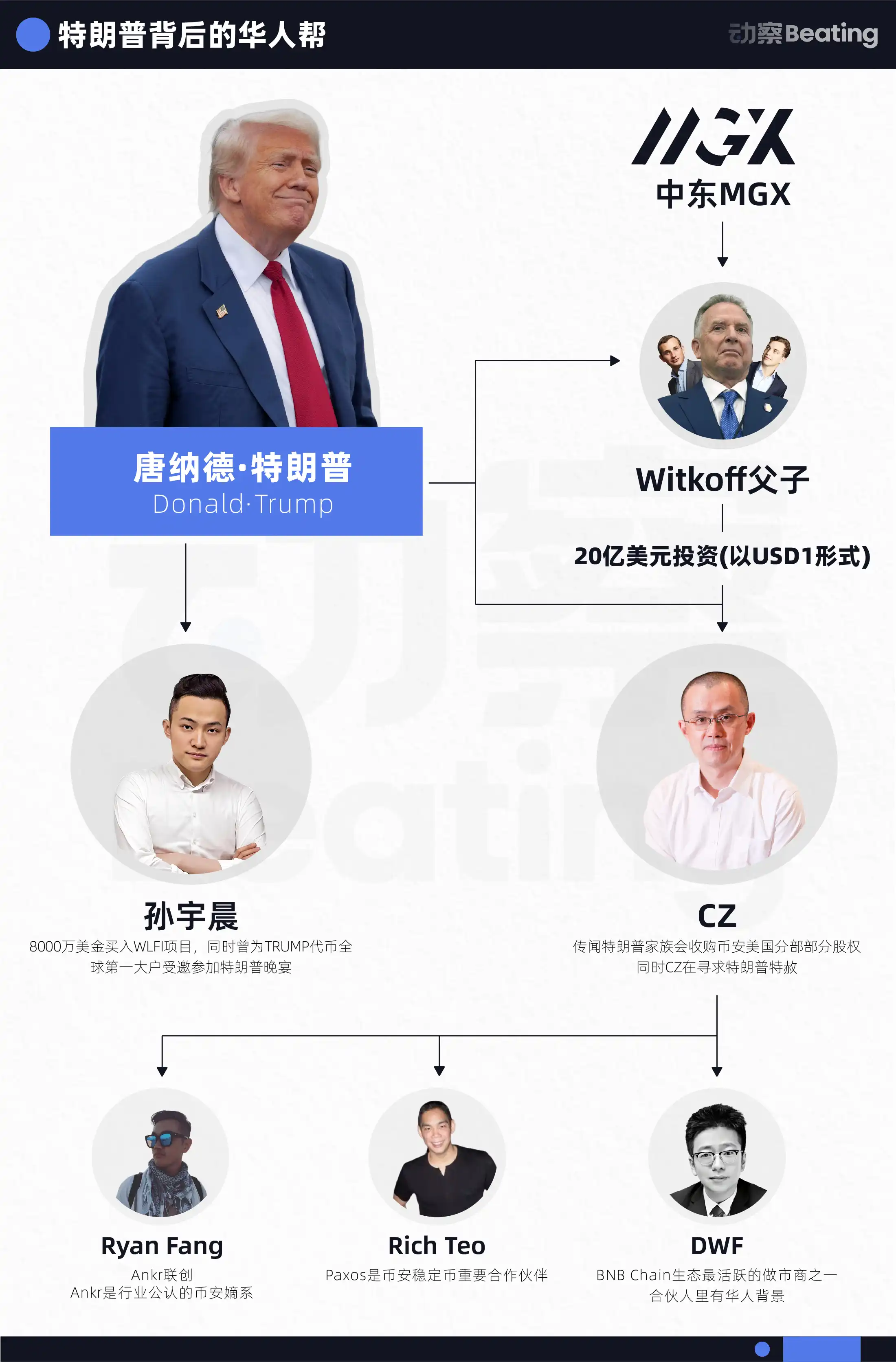

Behind this $40 billion project stands a group of modern "guests." There are Chinese billionaires who have invested $75 million, founders of trading platforms seeking presidential pardons, stablecoin experts deeply rooted in the Asian market, and an Eastern power described as "able to make the Trump family's wealth soar, yet can also bring them back to poverty overnight."

As the wealth of American political families intertwines deeply with Eastern capital, and as China influences the global crypto landscape through the Hong Kong market, a new geopolitical game is unfolding.

Binance, the Central Node of the Chinese Network

To understand the influence of Chinese individuals in the WLFI project, one must start with Binance, the world's largest cryptocurrency trading platform. Founded by Chinese entrepreneurs, this trading platform has become the nerve center of the entire Chinese crypto network.

Binance accounts for about 30% of global cryptocurrency trading volume, with a daily transaction volume exceeding $20 billion. Its penetration in the Asian market exceeds 60%, meaning that most capital flows must pass through its system. This level of control places Binance in a near-monopolistic position within the Chinese network.

Binance's founder, Zhao Changpeng (CZ), was sentenced to four months in prison for violating anti-money laundering regulations. According to insiders, CZ is seeking a presidential pardon through various channels. This rumor is not unfounded. During his first term, Trump had shown leniency towards several financial criminals, including his former campaign manager Paul Manafort. For CZ, while a four-month sentence is not long, for a business empire controlling hundreds of billions in assets, the founder's freedom is crucial to the stability of the entire system.

On March 13, 2025, The Wall Street Journal reported that the Trump family was negotiating to acquire a significant stake in Binance US, but CZ strongly denied it. Subsequently, Bloomberg also published an article stating that they were confident that some of the sources were very reliable, citing four anonymous individuals familiar with the situation, including that both parties were set to launch a stablecoin, which is what we now see as USD1.

Despite strong denials from both sides, the interaction between USD1 and Binance still reflects a close relationship.

At the end of April, WLFI and CZ's official social media accounts released photos of the three co-founders of WLFI meeting with CZ in Abu Dhabi, stating that the discussions included how to expand global adoption, set new standards, and elevate cryptocurrency to new levels.

In early May, Eric Trump, Trump's second son, revealed during the Token2049 event that the Abu Dhabi investment company MGX had invested $2 billion in Binance, with the payment made in USD1 stablecoin. Normally, this fund should be quickly converted into dollars, but Binance kept $1.9 billion in its own address, directly becoming the largest holder of USD1, accounting for 92.8% of the total circulation.

This operation directly pushed the market value of USD1 from $130 million to $2.1 billion. If this portion of funds is excluded, the actual circulation of USD1 is only around $100 million. The inflated data on the surface became a key support for WLFI's $40 billion valuation. Such inflationary practices could constitute market manipulation in traditional financial markets, but have become common tactics in the relatively loosely regulated cryptocurrency field.

In the same month, WLFI officially tweeted to openly support Binance's BNB Chain ecosystem-building cultural mascot Meme coin $B (BUILDon), purchasing about $25,000 worth of $B. The news caused a stir in the market, and the token price skyrocketed, with its market value briefly exceeding $300 million.

WLFI's public endorsement of $B is not just a small investment. For Binance, Meme coins serve as amplifiers of community sentiment and natural entry points for traffic. The attention brought by the hype around $B quickly fed back into the narrative of USD1. It is no longer just a newly launched stablecoin but is packaged into a larger story of "ecosystem expansion" and "community co-construction."

Within this system, Binance is using familiar methods to tie the promotion of stablecoins to the frenzy of the Meme market, first attracting attention with Meme coins, then embedding USD1 in the role of "base currency." Hype has turned into a strategy, and popularity has become a tool for market education. The ecological promotion of USD1 has thus gained far more visibility than its actual size in a short time.

Gathering of Chinese Guests

Beyond Binance, a group of technical projects has also gathered, and their collaboration with WLFI has tightened the connections within the entire ecosystem. These seemingly independent companies are actually weaving a sophisticated network of Chinese capital together.

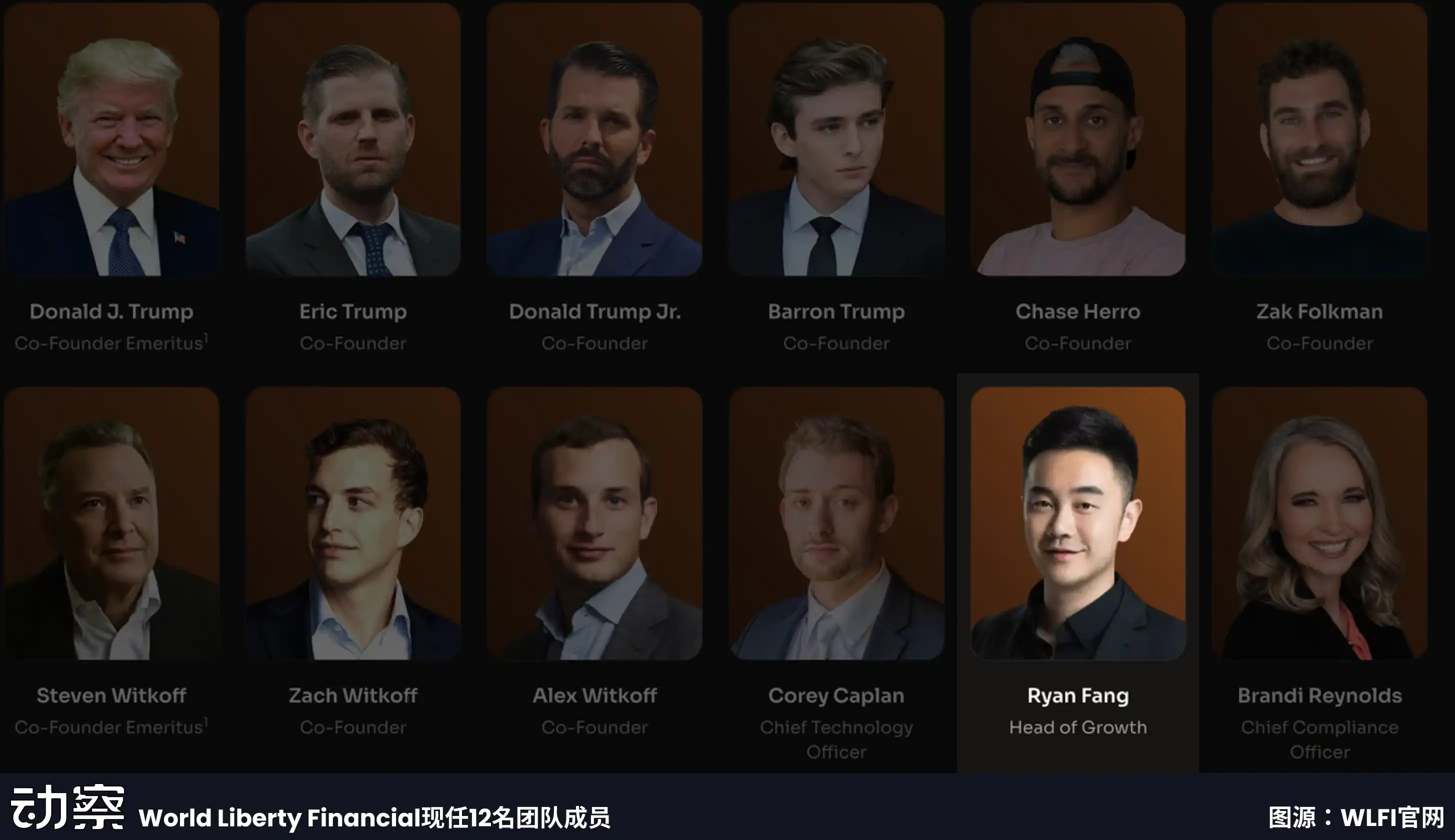

Ryan Fang: The Only Chinese in the Current Team, Binance's Most Trusted Project Operator

In the Chinese technology network of WLFI, Ryan Fang occupies an important position as the only Chinese member of the current team. Ankr is also recognized as a "direct line" of Binance; in addition to BSC nodes and liquidity staking services, well-known projects in the BSC (now BNBChain) ecosystem such as BounceBit, Auction, and Neura all come from the Ankr team.

Ryan is the co-founder and COO of Ankr and has also participated in the creation of PrimeBlock and Tomo. He worked at Morgan Stanley in his early years and later entered the private equity industry, accumulating experience in traditional finance. This background allows him to understand the combination of capital and technology in the blockchain world more quickly.

Ankr, as a leading global blockchain infrastructure service provider, provides RPC nodes and cross-chain tools for multiple projects, including Binance's BSC chain. The circulation of USD1 relies on these nodes to complete transaction confirmations and ensure network stability, and through Ankr's cross-chain services, USD1 can be freely transferred across multiple chains such as Ethereum, BNB Chain, and Polygon.

In WLFI, Ankr plays another role. Its Liquid Staking product allows USD1 to be staked and generate returns, transforming this token from a mere payment tool into a financial asset. While users earn returns, they also contribute liquidity to the entire ecosystem. Ankr has provided services for over 8,000 blockchain projects, and these existing customer relationships form a natural channel for USD1 to expand outward. For stablecoins to enter new application scenarios, they can leverage Ankr's network for distribution.

As a modern "guest," Ryan Fang embeds a newly issued stablecoin into the daily operations of the global crypto market through infrastructure.

Rich Teo: The Foxconn Factory of Stablecoins

The WLFI project also features Richmond Teo, co-founder of Paxos.

Paxos was once Binance's most important stablecoin partner. Its issued BUSD served as Binance's main stablecoin for a long time, with a market value exceeding $20 billion at one point. During 2022, Paxos became the world's leading stablecoin issuer and technology provider. Its co-founder, Rich Teo, had a good personal relationship with Binance CEO CZ, and at that time, there were quite a few rumors in the crypto circle, leading CZ to rarely post on social media to refute them.

By 2023, U.S. regulators required Paxos to stop issuing BUSD, and the company suddenly fell from grace, entering a long period of silence. The industry widely believed that Paxos had lost its competitiveness. However, with the advancement of U.S. stablecoin legislation, Paxos has once again become one of the teams benefiting from regulatory dividends, with stablecoins like PayPal's PYUSD and DBS Bank's USDG being issued by Paxos.

Teo was responsible for the Asian market business at Paxos and is very familiar with the compliance paths for stablecoins under different regulatory systems. The halt of BUSD was a heavy blow for him, but it also forced him to accumulate experience in dealing with regulation and market contraction. This experience is particularly important for WLFI, as the issuance and circulation of USD1 also face regulatory uncertainties.

Teo's presence signifies not just a personal return but also Paxos's attempt to find an opportunity to re-enter the stablecoin race through WLFI. This relationship makes USD1 more easily accepted in the market and adds a layer of assurance to Binance's trust in WLFI. For the entire Chinese network, Teo's addition means that a crucial piece has been filled in terms of compliance and regulation.

For the full article, please visit the 【Dongcha Beating】 public account

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。