Aug 25–Aug 31, 2025 #LookonchainWeeklyReport

🟢 Onchain Overview

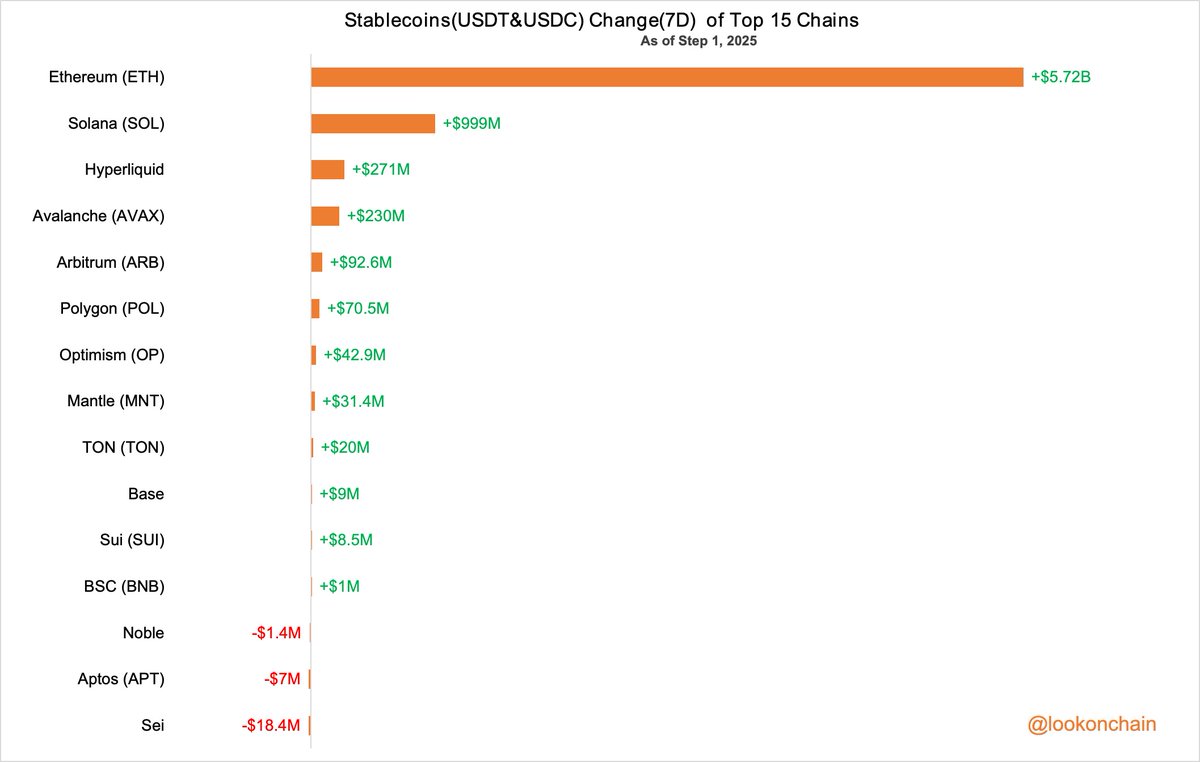

Last week showed a market divergence: despite a ~10% drop in DEX trading volumes, the stablecoin market cap grew by $6.65B, signaling fresh capital inflow.

While institutions continued to buy Bitcoin, the standout activity was a major strategic rotation by a Bitcoin OG out of $BTC and into $ETH, showing a strong conviction in Ethereum's outperformance.

🟢 Stablecoin Market

The total stablecoin market cap increased by $6.65B. Stablecoins(USDT&USDC) on #Ethereum increased by $5.72B and on #Solana increased by $ 999M.

🟢 Spot & Perps Trading Volume on DEXs

The DEX spot trading volume reached $114.437B last week, down 9.12% from the previous week.

Breakdown:

Uniswap: $30.628B (WoW -13.90%)

PancakeSwap: $13.878B (WoW -6.33%)

Hyperliquid: $7.403B (WoW -13.91%)

Meanwhile, DEX perps trading volume totaled $148.653B, a 10.80% decrease week-over-week.

Breakdown:

Hyperliquid: $88.096B (WoW -16.35%)

edgeX: $9.995B (WoW -24.59%)

Jupiter: $6.057B (WoW -1.53%)

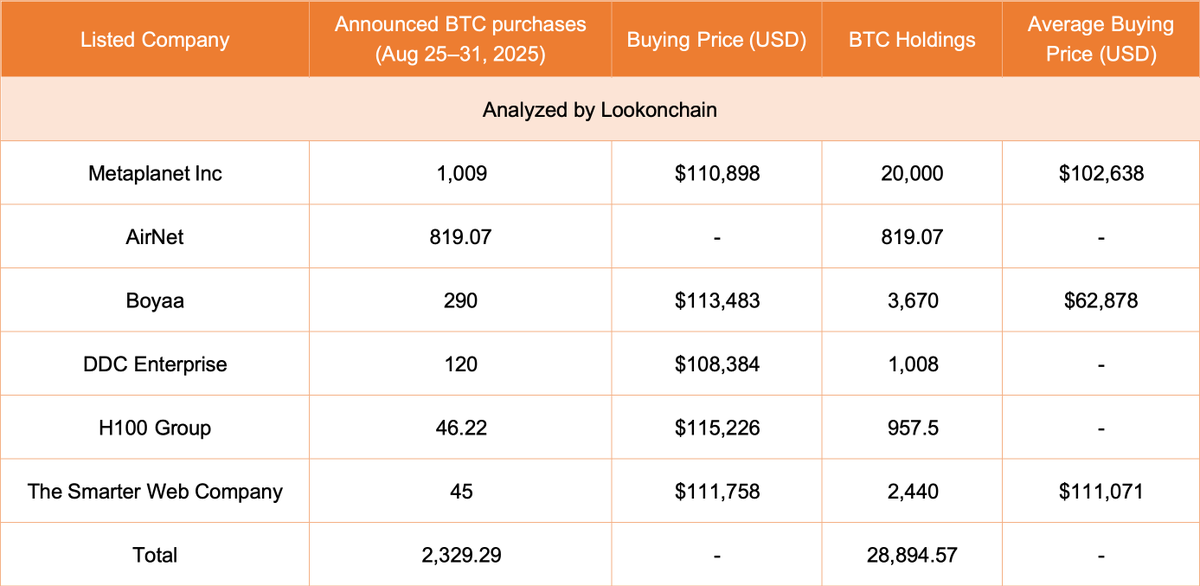

🟢 $BTC purchases

6 listed companies purchased 2,329.29 $BTC($253M) last week.

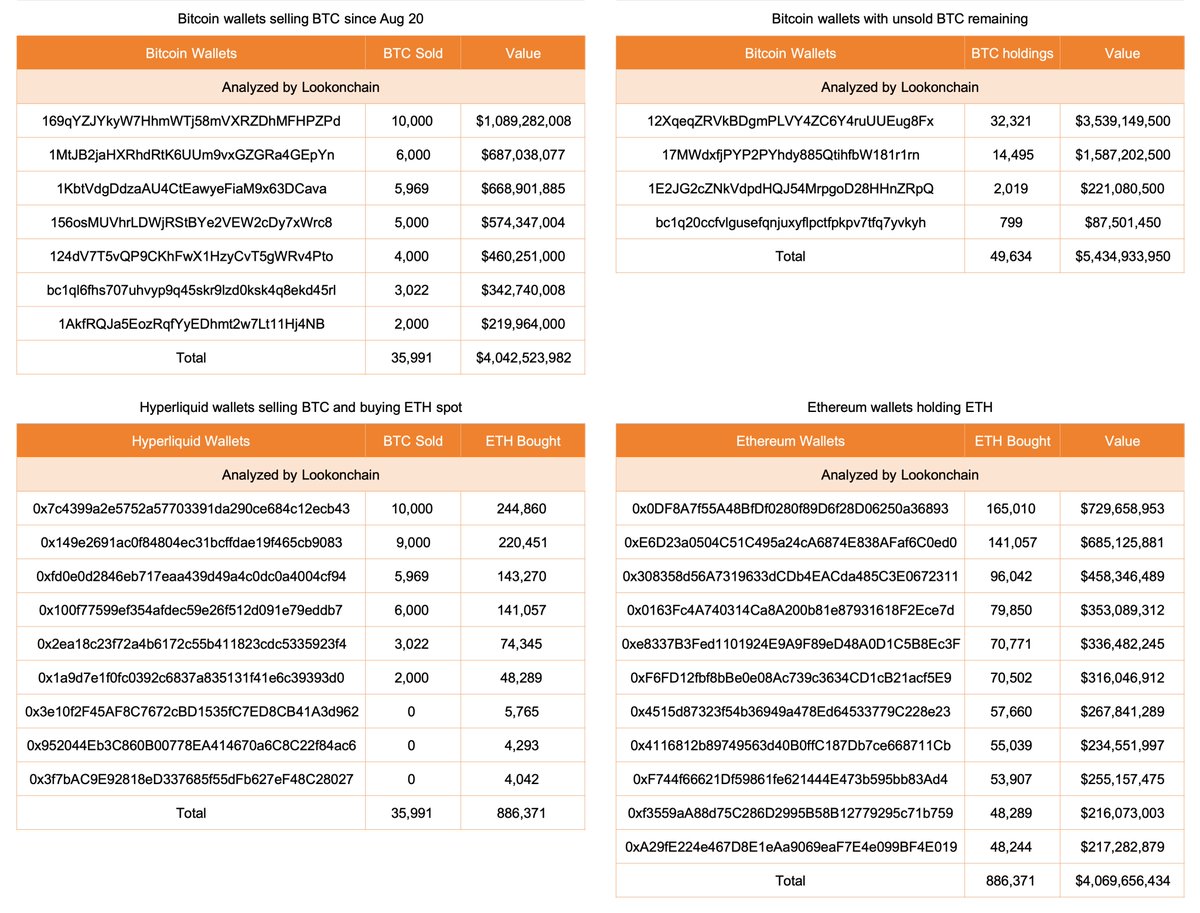

🟢 Institutional/Whale Activity

This Bitcoin OG kept selling $BTC and buying $ETH spot last week.

Since Aug 20, he has sold 35,991 $BTC($4.04B) and bought 886,371 $ETH($4.07B) at a 0.0406 rate on #Hyperliquid.

He still holds 49,634 $BTC($5.43B) in 4 wallets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。