Original | Odaily Planet Daily (@OdailyChina)

Anxiety, a lot of anxiety. I always feel like I haven't made any money yet, but the market is already starting to shout about turning bearish, and various news is making me dizzy. Bitcoin's weekly chart is facing a MACD death cross, while Ethereum is struggling to hold its ground. Recently, Trend Research, which has achieved impressive results by calling for a bullish ETH from the bottom, had previously been firmly bullish on the Ethereum ecosystem, but this morning chose to quietly take a loss and liquidate PENDLE and ENS.

At such a moment, should I hold on or retreat? I can only keep looking through the market's voices, hoping to find someone who can "recharge my faith" and provide an outlet for this anxiety.

The Game of Ethereum and Bitcoin Stirred by Whales

In the past two weeks, the main character in the crypto market has been none other than an ancient whale. Its large-scale selling of BTC to switch to ETH can be said to be the "culprit" behind Bitcoin's weakening performance. This big player has cumulatively sold 34,110 BTC, cashing out about 3.7 billion USD, and bought 813,298.84 ETH, worth about 3.66 billion USD. Currently, he still holds 49,816 BTC in his remaining two wallets, worth about 6 billion USD. The question is: will he continue to sell? How much? It feels like a sword that has yet to fall, hanging over Bitcoin's head. One can only say that the selling side is too strong.

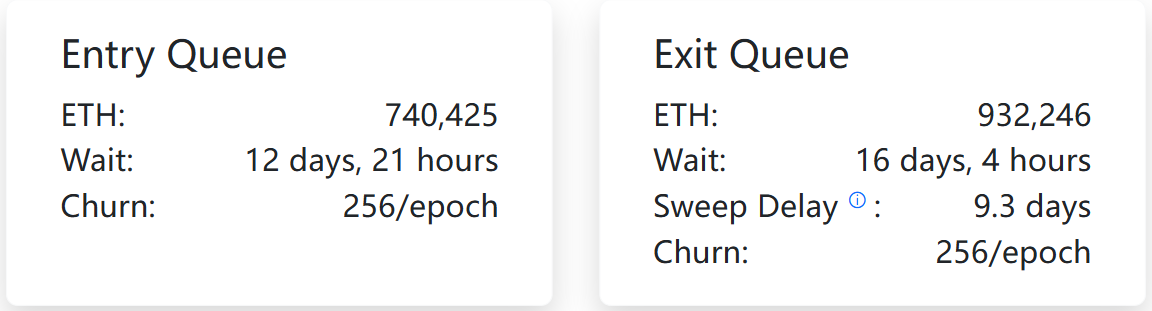

For Ethereum, the whale's switch is obviously a positive sign. This may be one of the important reasons why ETH has been relatively stronger than BTC recently. However, Ethereum will also face challenges in the next two weeks, as there are currently 932,246 ETH waiting to be unstaked, which could represent a potential sell-off of about 400 million USD that might impact the market.

Now it all depends on the whale's actions; if it can absorb Ethereum, it will inevitably lead to a significant drop in Bitcoin, and a game of existing supply is still ongoing.

Super Week: The Collision of Data and Rate Cuts

In the coming weeks, the global market's attention is almost entirely focused on the Federal Reserve. Today's CME "FedWatch" data shows an 87.4% probability of a 25 basis point rate cut in September, with investors betting that the Fed is about to embark on a new round of easing.

This week is truly a "Super Week," with ADP non-farm employment data, ISM services PMI, and especially the core non-farm employment report, all of which will influence the Fed's decision during the FOMC meeting on September 16-17. If a series of data, especially non-farm data, shows weakness, the market may bet that the Fed will initiate rate cuts more quickly and earlier; if the overall performance is strong, it will weaken market expectations for rate cuts. Regardless of the outcome, the market is bound to experience significant volatility this week. For investors, caution is the only answer.

Although Powell's speech on August 22 sent dovish signals, it did not provide strong guidance on the persistence and magnitude of rate cuts. A recent research report from CICC pointed out that the market should not overinterpret Fed Chair Powell's "dovish" remarks at the Jackson Hole meeting. Given the current backdrop of higher tariffs and tightening immigration policies in the U.S., the risks of employment and inflation coexist; if inflation risks surpass employment, the Fed may halt rate cuts. Even if a 25 basis point rate cut occurs in September, it does not mean the start of a sustained easing cycle. CICC warns that if "stagflation-like" pressures intensify, the Fed will face a dilemma, and market volatility may increase.

On the Trump front, there are attempts to push for a tighter team within the Federal Reserve Board to tilt policies towards dovishness. The Fed Board is currently full with 7 members; apart from Cook, who is "in a lawsuit" with Trump, two members appointed by the Biden administration, Jefferson and Barr, are aligned with Powell; Bowman, Waller, and Milam are generally seen as Trump supporters. If the court rules that Trump can dismiss Cook, he will quickly nominate his successor to gain a majority in the board with a 4 to 3 vote. However, this ruling is unlikely to be completed before the September meeting, but Cook's absence may lead to a tie among the three Trump-appointed members, the two Biden-appointed members, and Powell. The September meeting may become a watershed moment for market direction.

Tom Lee, head of research at Fundstrat Global Advisors, stated that it is correct for investors to remain cautious in September as the Fed, after a long pause, is reopening a moderate rate-cutting cycle, making it difficult for traders to determine their positions. This long-term bullish analyst on U.S. stocks predicts that the S&P 500 will drop 5% to 10% this fall, before rebounding to between 6800 and 7000 points.

WLFI Sucking the Market Dry?

Another "super bomb" is also on a countdown. The Trump family's crypto project World Liberty Financial (WLFI) will launch tonight at 8 PM. Many cannot help but recall the previous TRUMP token: making a small wave of wealth for some, while crashing the entire market. Thus, many are concerned: will the plot of TRUMP repeat itself with WLFI?

According to on-chain analyst @ai_9684 xtpa, WLFI has conducted 8 rounds of public fundraising, raising a total of 2.26 billion USD. Based on the current pre-launch price of 0.32 USD, the minimum cost of the first public offering was only 0.015 USD, indicating a profit margin of over 20 times, which means there is a high possibility of a "dump" after WLFI goes live.

The two public offering rounds have clearly stated that 20% of the TGE will be unlocked, with the remaining 80% awaiting community voting to decide. The tokens for the team/advisors/partners are locked, but there is still no clear statement on whether the strategic round tokens will be unlocked. Currently, the entire network is focused on the TGE circulation, with Coinmarketcap.com data showing a circulation of 27.2 billion tokens, worth about 8.7 billion USD. CMC's CEO stated that this circulation data has been repeatedly confirmed with the project party, which means that the strategic round tokens will also circulate during the TGE. If this is indeed the case, a "dump" upon launch may become inevitable.

However, crypto KOL @0xDylan_ (suspected to be a member of the WLFI Wallet team) posted that the WLFI token economic model has been updated, with 8% allocated to Alt 5 Public Company and already locked, 10% reserved for future incentive plans, points, etc. (locked, details to be announced by the official). The shares for the team and institutional investors are locked as well. Additionally, 3% is allocated for centralized exchange liquidity (CEX liquidity) and decentralized exchange liquidity (DEX LP), and 5% is allocated to investors. This means that the circulating supply accounts for 5% of the unlocked tokens and 3% for liquidity, totaling 8%, which translates to 8 billion tokens, worth 2.56 billion USD.

Odaily Planet Daily previously predicted the script for WLFI's launch in the article "WLFI Pre-launch Halved, Will It Rise or Fall on September 1?," suggesting another possibility that WLFI also has Trump's endorsement, and on the day WLFI officially launches, it is highly likely that Trump will congratulate WLFI on social media or make various "pump" statements, and the ambiguous relationship with the president will bring more speculation space for WLFI.

If we also consider the mere 8% circulation, it is not impossible for WLFI's price to be continuously pushed up upon launch. However, the high FDV and potential selling pressure from the strategic round are ticking time bombs; once the unlocking ratio expands or speculation cools down, a sharp correction may still occur.

Other Market Voices: Bitcoin Remains Faith, but Caution is Needed in the Short Term

Safe-Haven Logic: Gold and Bitcoin Running Parallel

Robert Kiyosaki, author of "Rich Dad Poor Dad," once again mentioned Bitcoin, stating that Europe is facing a serious debt crisis, France is close to a "Bastille Day-style" rebellion, and Germany is experiencing excessively high manufacturing costs due to energy policies, even facing risks of internal turmoil. He pointed out that since 2020, U.S. Treasury bonds have dropped by 13%, European bonds by 24%, and UK bonds by 32%, leading to a loss of confidence in the major economies' ability to repay debts. Kiyosaki stated that Japan and China are selling U.S. debt and turning to gold and silver, urging investors to protect themselves by holding gold, silver, and Bitcoin.

André Dragosch, head of European research at Bitwise, also stated that gold is usually the best hedging tool when the stock market declines, while Bitcoin shows more resilience when U.S. Treasury bonds are under pressure. Historical data also shows that gold tends to rise during stock market bear markets, while Bitcoin is more supported during U.S. debt sell-offs. By 2025, gold prices are expected to rise over 30%, while Bitcoin is expected to rise about 16.46%, reflecting investors' differentiated choices between the two amid rising yields, stock market volatility, and the current president Trump's supportive stance on cryptocurrencies.

Traders' Caution and Waiting: An Upward Trend Expected in Fall 2025

Trader Eugene Ng Ah Sio posted on his personal channel that he is currently not participating in market trading but needs to clarify for his followers that if they hope for substantial fluctuations in altcoins, they must rely on Bitcoin's upward breakout to drive the market; however, Bitcoin's performance has not met the bulls' expectations.

Previously, Eugene had closed most of his ETH positions on August 14 to significantly reduce risk exposure, and on August 24, he stated that the bull market cycle would come to an end, and his personal ETH trading has completely concluded.

In the latest issue of the "Matrix onTarget" report, Matrixport also mentioned its shift to a more conservative stance, indicating that this round of correction may still continue. Seasonal weakness has been evident since the end of July, and phase pressure is accumulating.

This week, U.S. employment data is about to be released, and Bitcoin is at a critical technical juncture. If the price further declines, it may catch most traders off guard, but this risk cannot be ignored. Historical experience shows that interest rate cuts are often seen as a positive for the crypto market, but they are usually accompanied by fluctuations.

CryptoQuant analyst Crypto Dan stated that the cryptocurrency market cycle is slowing down, and an upward trend is expected in the fall of 2025. From the proportion of Bitcoin held for over a year (based on realized market value), past cycles (Phase 1 and Phase 2) showed that the market surged significantly and reached a peak. However, in the current phase (Phase 3), the slope of the upward trend is gradually flattening, and the cycle has become longer.

CryptoQuant's research director Julio Moreno posted on the X platform that from a short-term valuation perspective, if Bitcoin cannot quickly recover to $112,000, then the downward support level is around $100,000. The current BTC price is reported at $107,420.

Conclusion

Whether it is the reallocation by whales, the macroeconomic game of interest rate cuts, or the cautious attitude of professional traders, almost all voices convey a common point: the current market is in a gray area, and waiting and caution are the only strategies.

Anxiety may not disappear; it will continue to accompany us as we sway with each market fluctuation. But perhaps, this is the norm of the market—it never provides certainty, only choices.

What we can do is not to eagerly seek someone to "recharge our faith," but to find our own position amid uncertainty and cultivate patience through repeated testing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。