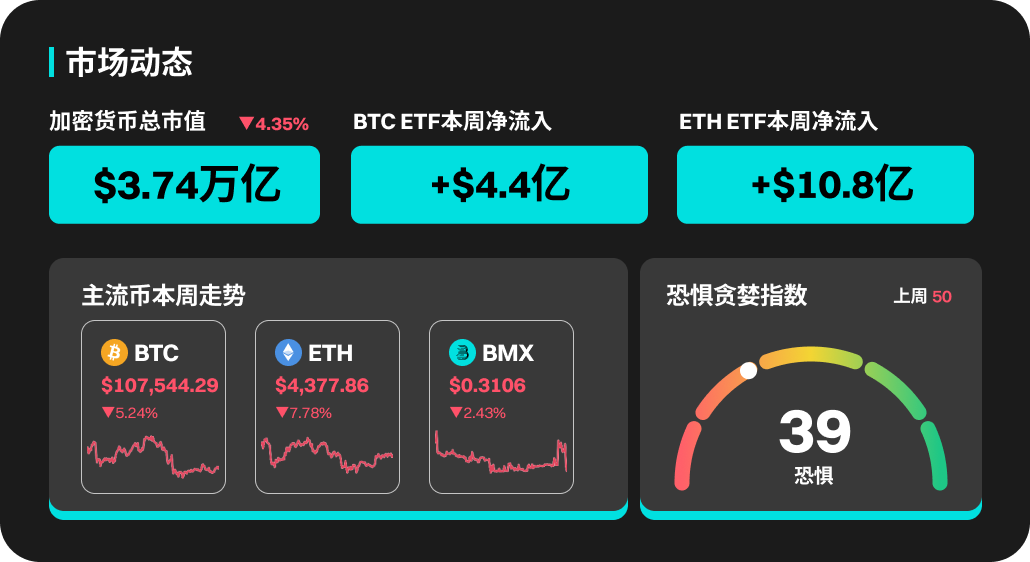

According to BitMart's market report on September 1, the total market capitalization of cryptocurrencies over the past week was $3.74 trillion, a decrease of 4.35% compared to the previous week.

This Week's Cryptocurrency Market Dynamics

Last week (8.25-9.01), the net inflow amount for BTC ETFs was $440 million, with BTC remaining in a narrow fluctuation range of $107,000 to $113,000 throughout the week. Currently, BTC's market share is reported at 57.3%, roughly unchanged from last week. BTC has retraced 13% from the historical high set in August, which the market considers a normal pullback after a surge.

Last week, ETH ETFs saw a net inflow of $1.08 billion, achieving significant capital inflow once again. In the context of strong capital inflow, ETH's market performance outperformed BTC during this period. ETH's market share is reported at 14.2%, and the ETH/BTC exchange rate is reported at 0.041, with various metrics remaining roughly unchanged from last week. ETH has currently retraced 11% from the historical high set in August, with the market awaiting further validation.

This Week's Popular Cryptocurrencies

In terms of popular cryptocurrencies, PYTH, CRO, MITO, TA, and M have all performed well. PYTH's price increased by 42.81% this week, with a 24-hour trading volume of $1.17 billion. CRO's price rose by 76.23%, reaching a peak price of 0.3792 USDT. TA and M increased by 140.49% and 47.04% respectively this week.

U.S. Market Overview and Hot News

Last week, the U.S. stock market experienced a slight adjustment, mainly influenced by inflation data, a pullback in AI tech stocks, and pre-holiday selling sentiment: the S&P 500 fell by about 0.1%, the Dow Jones Industrial Average dropped by about 0.2%, and the Nasdaq index also decreased by about 0.2%, while the Russell 2000 rose slightly by 0.2%. Overall performance this month remains strong: the S&P 500 is up 1.9% this month, the Dow is up about 3.2%, and the Nasdaq is up about 1.6%, marking four consecutive months of increases.

On September 3 at 21:00 (UTC+8), 2025 FOMC voting member and St. Louis Fed President Bullard will speak on the U.S. economy and monetary policy.

The Federal Reserve will release its Beige Book on economic conditions on September 4 at 2:00 AM (UTC+8).

On September 4 at 20:30 (UTC+8), the U.S. will announce the number of initial jobless claims for the week ending August 30 and the U.S. trade balance for July.

On September 5 at 20:30 (UTC+8), the U.S. will announce the unemployment rate for August, the seasonally adjusted non-farm payrolls for August, and the year-on-year and month-on-month average hourly wage.

Popular Sectors and Project Unlocks

Solana

Solana has performed outstandingly, with a cumulative increase of about 12.9% over the week, making it the best performer among mainstream L1 public chains, outperforming Ethereum (+11.0%) and Avalanche (+6.9%). SOL remains within an upward channel, with strong buying pressure and favorable technical indicators. If it breaks through the resistance range of $209–$211, it may further challenge higher price levels. Overall, Solana demonstrates strong growth potential and market attention against the backdrop of capital inflow and a rebound in market risk appetite.

Sui (SUI) will unlock approximately 44 million tokens at 8:00 AM Beijing time on September 1, accounting for 1.25% of the current circulating supply, valued at about $145 million.

Ethena (ENA) will unlock approximately 40.63 million tokens at 3:00 PM Beijing time on September 2, accounting for 0.64% of the current circulating supply, valued at about $27.1 million.

Immutable (IMX) will unlock approximately 24.52 million tokens at 8:00 AM Beijing time on September 5, accounting for 1.27% of the current circulating supply, valued at about $12.8 million.

Risk Warning:

The risks associated with using BitMart services are entirely borne by you. All cryptocurrency investments (including returns) are inherently highly speculative and involve significant risk of loss. Past, hypothetical, or simulated performance does not necessarily represent future results.

The value of digital currencies may rise or fall, and there may be significant risks associated with buying, selling, holding, or trading digital currencies. You should carefully consider whether trading or holding digital currencies is suitable for you based on your personal investment goals, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。