On August 28, 2025, a closed-door dinner event named "SELECT VIP DINNER" concluded in Hong Kong. This event was hosted by Select, a one-stop quantitative fund aggregation investment platform, and brought together key figures from top quantitative funds, family offices, and investment institutions. During the dinner, the Select team officially announced the global launch of its platform and elaborated for the first time on its strategic vision to reshape the landscape of quantitative investment. This move marks the transition of quantitative investment from being an "exclusive game" for institutions to a "trustworthy tool" for the public.

Select believes that true returns come from execution, not speculation. In a complex and ever-changing market environment, Select focuses on creating a platform that investors can trust for the long term, utilizing professional quantitative models, a strict risk control system, and transparent data presentation.

Breaking the Deadlock: Deconstructing the "Black Box" and Building a Trustworthy Quantitative Ecosystem

Quantitative investment has long been hindered by a lack of transparency in strategies and high capital thresholds, making it difficult for investors to build trust. Select addresses this by adopting a one-stop aggregation model, carefully selecting high-quality quantitative fund strategies from around the world, and presenting key performance indicators through real-time, tamper-proof data, allowing investors to make clear and transparent decisions.

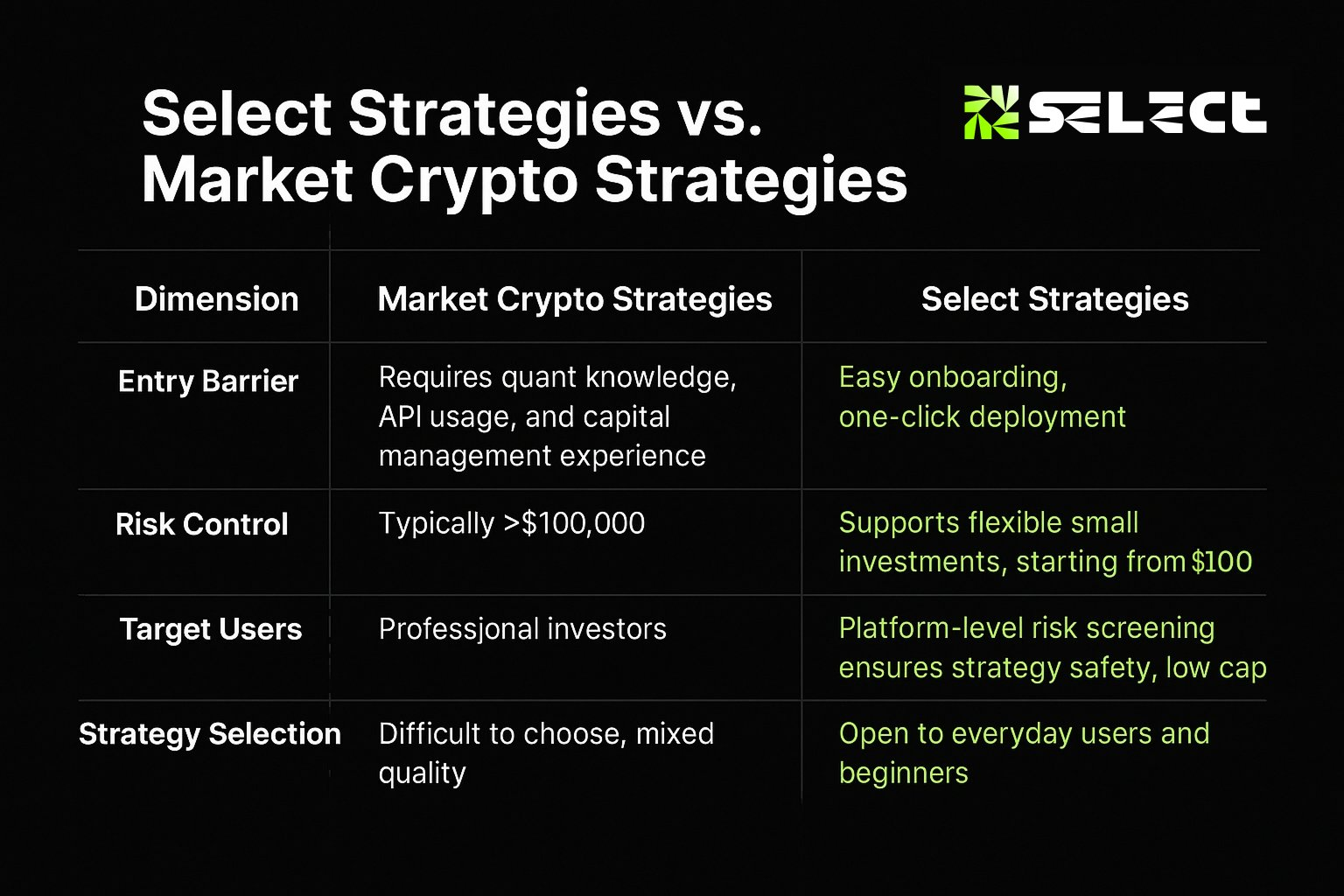

Compared to traditional crypto strategies in the market, Select has lowered the capital threshold (starting from 100 USDT), simplified the onboarding process (easy subscription and one-click deployment), and strengthened risk control security (real-time monitoring by the platform), enabling ordinary users to participate in professional quantitative investment.

Proof of Strength: Multi-Dimensional Strategy Matrix and Innovative Market Strategy

Select's core competitiveness lies in its tested strategy matrix and innovative market entry strategies.

- Risk-layered strategy supermarket: The first batch of strategies launched on the platform covers the full spectrum of needs from low risk to high return, with all strategies executed on top exchanges and secured by third-party custodians. Among them:

- Cross-exchange Arbitrage Strategy (OWLQ-U based) — Stability is the primary goal. Current 7-day return is 54%, 30-day annualized return is 15.95%, with a maximum drawdown of only 0.08%. This provides the best choice for funds seeking steady appreciation.

- CTA Trend Strategy (OWLQ-U based) — The core weapon for capturing extreme market conditions. The recent 7-day return is 97%, with a 30-day annualized return as high as 88.7%, and a maximum drawdown of 3.56%. It demonstrates the ability to follow trends and amplify profits in unidirectional or strong trend markets.

- Statistical Hybrid Strategy — Balancing flexibility and robustness. For example, the WIN4-U based strategy has a recent 7-day return of 5%, with an annualized return of 47.57%, showcasing a balance of risk and return under a multi-factor model.

- High-Yield CTA Strategy — For instance, the DeepSea-U based strategy has achieved a 30-day annualized return of 94%, realizing high return potential through trend capture and dynamic position management.

- Disruptive "Super Agent" and Experience Fund Model:

To lower the participation threshold, Select has introduced two major innovative initiatives:

- Super Agent Model: Allows users to share the platform's value through social recommendations and enjoy up to 50% commission, building a self-sustaining distribution network.

- 200 USDT Experience Fund: New users can receive an experience fund upon registration, allowing them to experience the power of quantitative strategies in a real environment at zero cost, completely eliminating psychological barriers to first-time attempts.

Hong Kong Night, Gathering Industry Consensus

The launch of the product requires strong support, and Select chose Hong Kong—Asia's Web3 hub—to announce its arrival with a high-profile industry gathering.

Participating in the conference hosted by New Fire Technology and holding the VIP dinner is significant, marking Select's formal recognition and attention from both traditional finance and the crypto-native field. At the dinner, dozens of guests from family offices, exchanges, and top quantitative teams engaged in in-depth discussions on cross-market arbitrage opportunities, compliance development, and other topics. Select not only showcased its technological products but also demonstrated its strategic layout in gathering core industry resources and collaborating for future development.

Tonight, we gather here not only to celebrate the launch of a product but also to witness the beginning of a more open and fair era of quantitative investment. Select aims to be the bridge connecting top quantitative wisdom with universal investment needs.

Towards a Transparent, Aggregated, and Trustworthy Future

In today's rapidly evolving digital asset market and its integration with traditional finance, compliance, transparency, and professionalism have become irreversible trends. With its clear strategic positioning, solid product matrix, and top-tier industry resources, Select is precisely positioning itself to seize this historic opportunity. Its emergence undoubtedly sets a new benchmark for the entire industry.

The future has arrived; only the trustworthy will succeed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。