Written by: Splin Teron

Translated by: Luffy, Foresight News

The pitfalls I’m about to discuss are ones I’ve personally encountered, and I’ve lost quite a bit of money because of them.

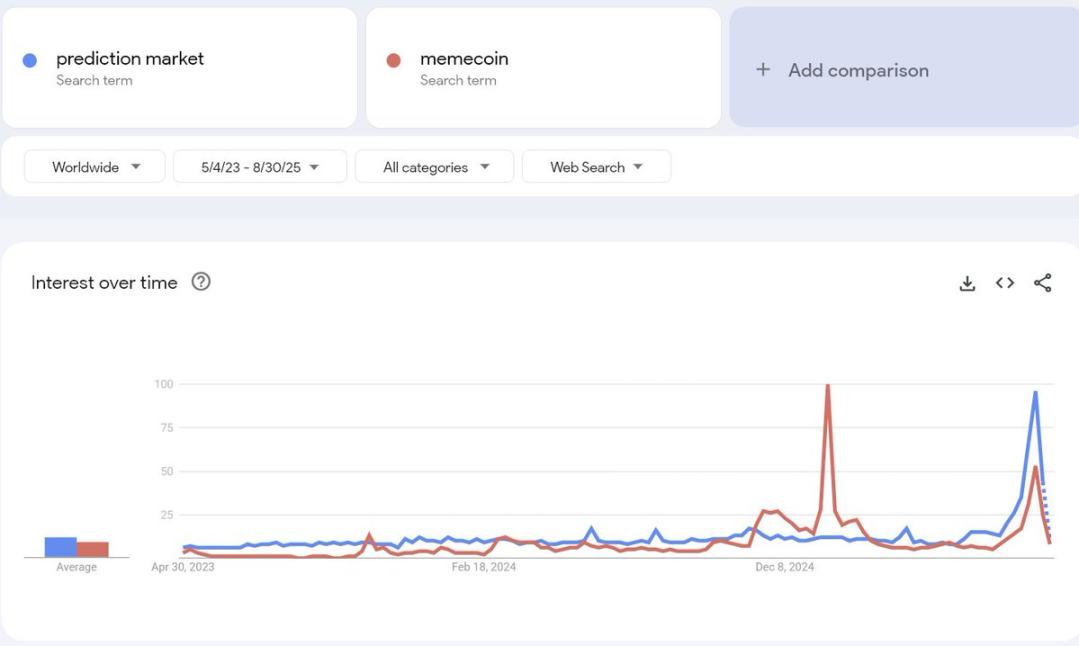

There’s no need to deny the current trend. Google Trends shows that the search volume for "prediction markets" has now reached the same level as that for "memecoins" at the beginning of the year.

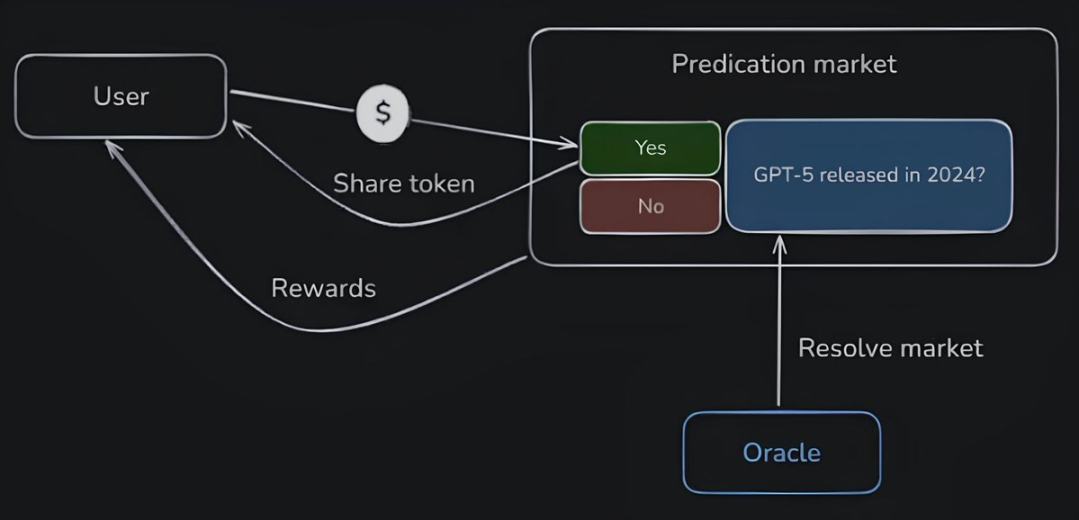

But first, let’s quickly understand how prediction markets operate:

- Deposit USDC;

- Purchase a result token, either "Yes" (bullish) or "No" (bearish);

- The token will be locked in a smart contract until the event concludes;

- Once the event is settled, the oracle will lock in the result;

- If your bet is correct, you can redeem the token and earn a profit; if you bet incorrectly, you will lose your principal.

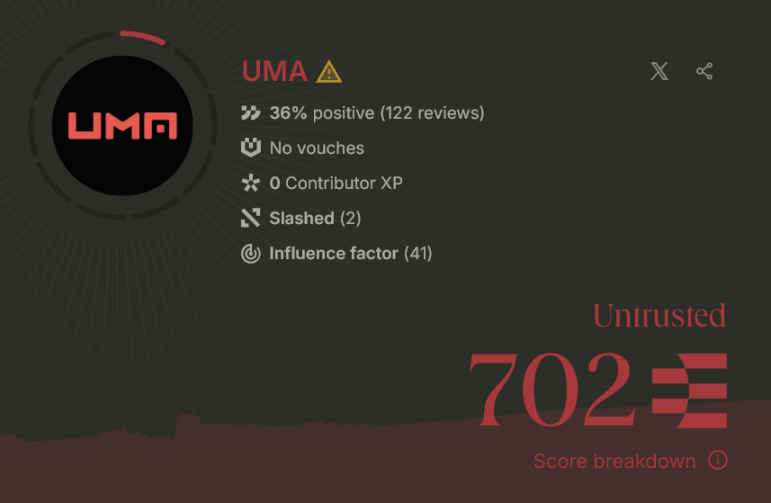

So… the oracle is the external source of truth. On the Polymarket platform, this role is fulfilled by UMA.

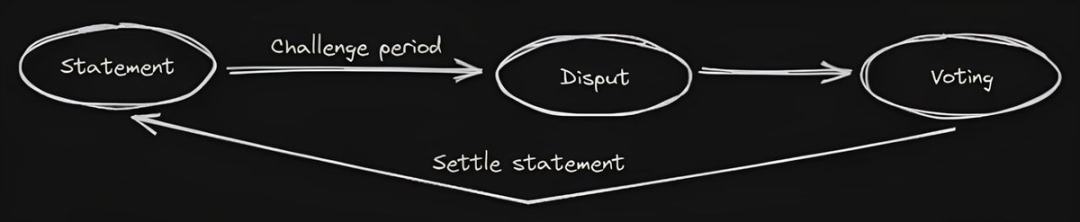

After the event concludes, the oracle sends a signal to the contract: "Yes" or "No." It is at this point that funds are redistributed among participants.

The entire market's trust relies on the oracle. If the oracle makes a "misjudgment," or determines the result in a questionable manner— even if the facts are obvious—some will profit while others will incur losses.

The problem is… "misjudgments" by the oracle are actually quite frequent. Or, as the community puts it, the oracle is "biased towards whales"!

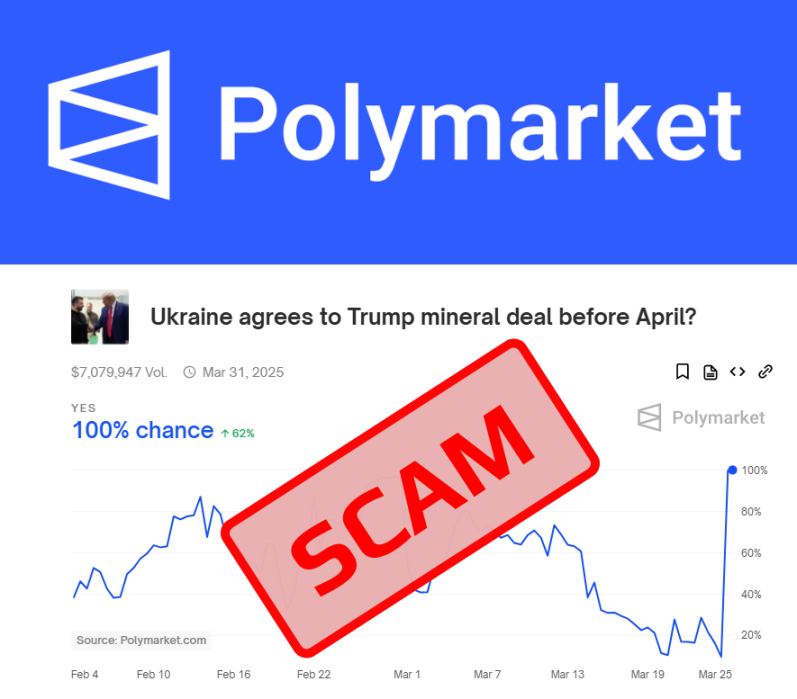

Case 1: Ukraine and Trump’s Mineral Deal

March 2025: The prediction market on Polymarket regarding "Ukraine and Trump reaching a mineral deal" ultimately ruled the result as Yes, but in reality, no deal was made; it was the UMA whales who forced this decision. Users lost millions of dollars as a result, and Polymarket announced it would not provide any refunds.

Case 2: Will TikTok be banned before May 2025?

January 2025: The prediction market on Polymarket regarding "Will TikTok be banned before May 2025?" ultimately ruled the result as Yes. Although the U.S. Supreme Court approved the relevant bill, TikTok was not banned and continued to operate normally. The UMA oracle directly locked in this result, bypassing the usual dispute resolution process. At that time, the market involved approximately $120 million. Users accused this of being manipulation, but the platform still did not provide refunds.

Case 3: Will Zelensky appear in a traditional suit?

July 2025: The prediction market on Polymarket regarding "Will Zelensky appear in a traditional suit?" attracted over $210 million in betting funds. Despite multiple media outlets and even the suit's manufacturer confirming that Zelensky wore a suit, the UMA oracle ruled the market result as No. They defended this result with a vague explanation, claiming "the core intention of the market was 'a suit with a tie'," which actually served to protect the whales and help them maintain their positions.

Case 4: Will the Houthis attack Israel before August 31?

August 2025: The prediction market on Polymarket regarding "Will the Houthis attack Israel before August 31?" had a trading volume of $13 million, ultimately ruling the result as Yes. However, official news confirmed that the missile was intercepted mid-air. According to the rules, this result should have been ruled as No.

I don’t want to list all the cases just to fill space… If you want to know more, you can search on Reddit or use Grok, ChatGPT, etc.

Why do those markets with obvious results end up ruling contrary to the facts? Who exactly has the decision-making power in the voting?

I don’t know the answer, but one key point is simple: this is indeed happening, and people are losing money because of it!

What filtering methods can help you avoid risks before trading?

- Manage your funds well: Do not bet more than 1%-3% of your deposit on a single market;

- Choose events with clear information sources, such as court rulings, official statements, on-chain data, etc.;

- Check the market liquidity and the list of top holders;

- Take profits early, for example, exit when profits reach around 95%, don’t wait for the final result to be determined.

And I hope you understand that prediction markets are more akin to gambling than investing. If you can’t control the impulse to bet, it’s best to stay away from this field…

But if you decide to delve deeper, I’ve attached a distribution map of different protocols to help you enter the world of prediction markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。