Original Title: "On-chain Data Unveils the Mystery: What is the Initial Circulation Rate of WLFI?"

Original Author: Azuma, Odaily Planet Daily

There are only two days left until the Trump family's cryptocurrency project World Liberty Financial (WLFI) officially welcomes its first unlock and opens for trading, but many users still do not have a clear understanding of WLFI's economic model and circulation status, and are even unclear about how much WLFI will initially circulate, making it difficult to formulate targeted trading strategies around WLFI's launch.

The reason for this situation is that, unlike other tokens that have clearly defined economic models at the same time as their Token Generation Events (TGE), WLFI adopts a "governance-first" model, and the unlocking rules for the vast majority of tokens are still not determined—it is expected that multiple rounds of community voting will be needed to finalize the plan.

As of the publication date, there is not much information we can confirm regarding the token economic model.

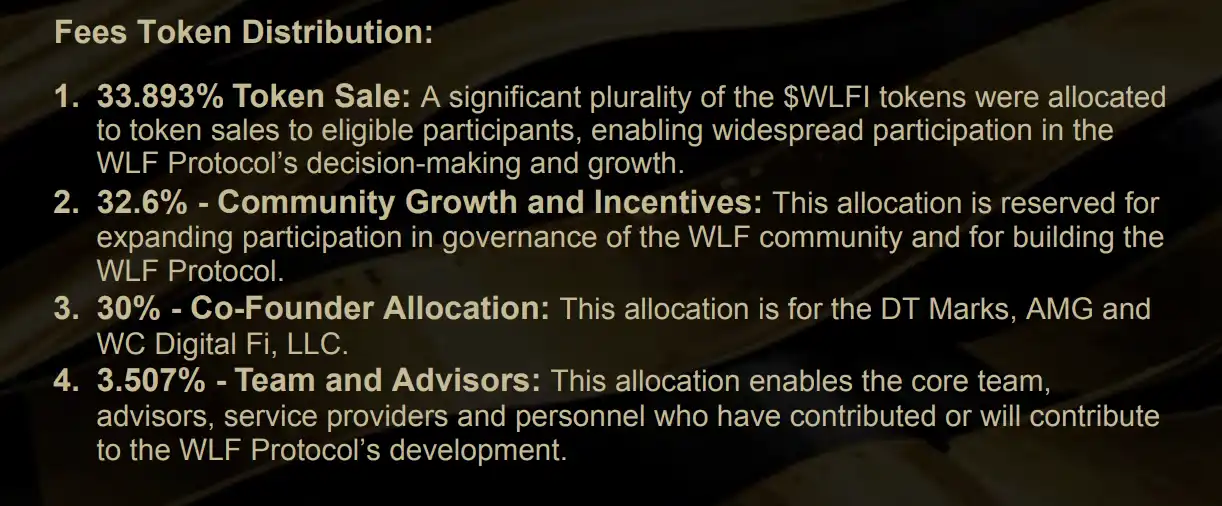

The first is the token distribution plan disclosed by WLFI in its "Golden Book," which is as follows:

· Total Supply: 10 billion WLFI;

· Token Sale: 3.39 billion (33.893%);

· Community Growth and Incentives: 3.26 billion (32.6%);

· Co-founders: 3 billion (30%);

· Team and Advisors: 350 million (3.507%);

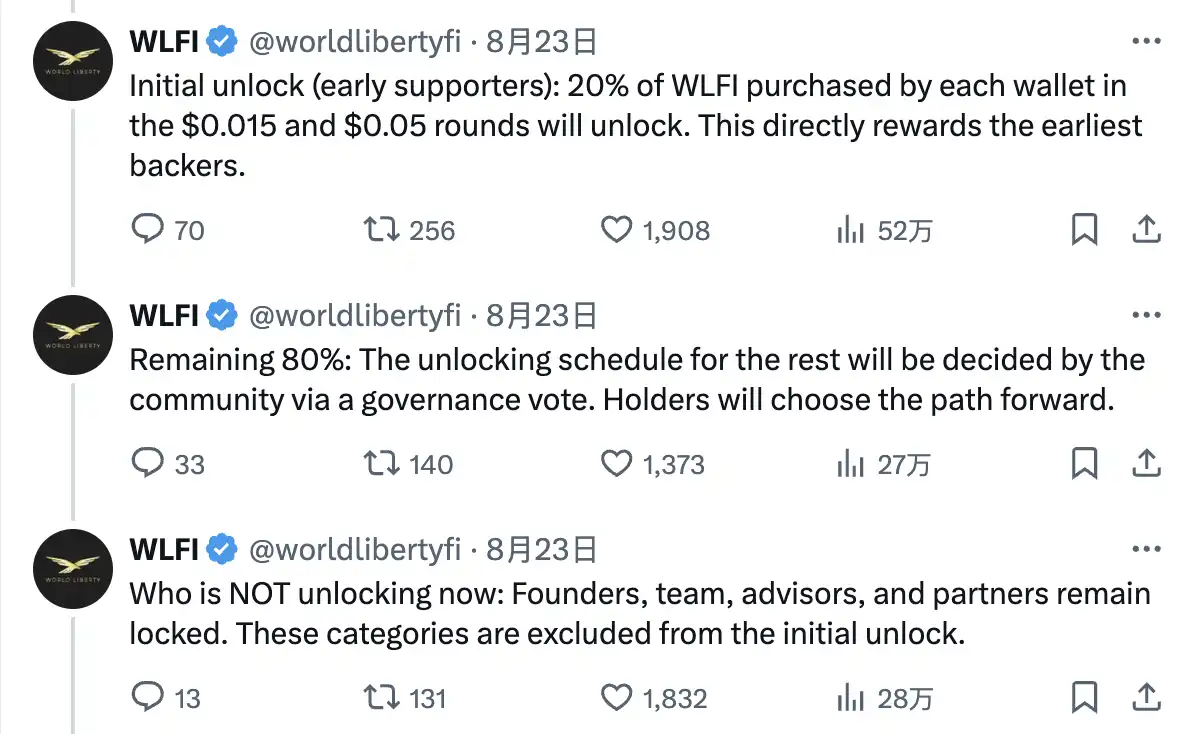

The second is the initial unlocking rules announced by WLFI on August 23—only the token shares of early presale users will be unlocked at the initial launch of WLFI. Specifically, 20% of the WLFI purchased by each address in the rounds at $0.015 and $0.05 will be unlocked, while the unlocking plan for the remaining 80% will still be decided by the community through governance voting. The token shares of founders, team members, advisors, and partners remain locked and will not be included in the initial unlock.

In short, to answer the question of WLFI's initial circulation rate, we do not need to consider other types of shares; we only need to track the token shares of early supporters who participated in the $0.015 and $0.05 fundraising rounds. Fortunately, this data does exist in the WLFI contract.

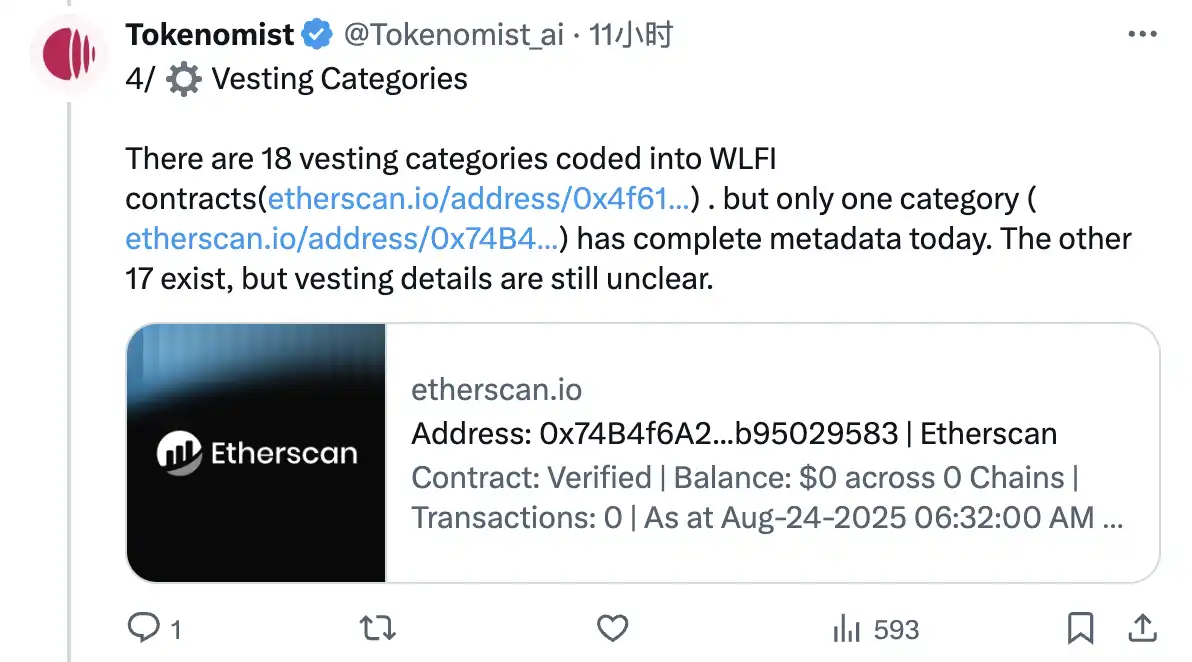

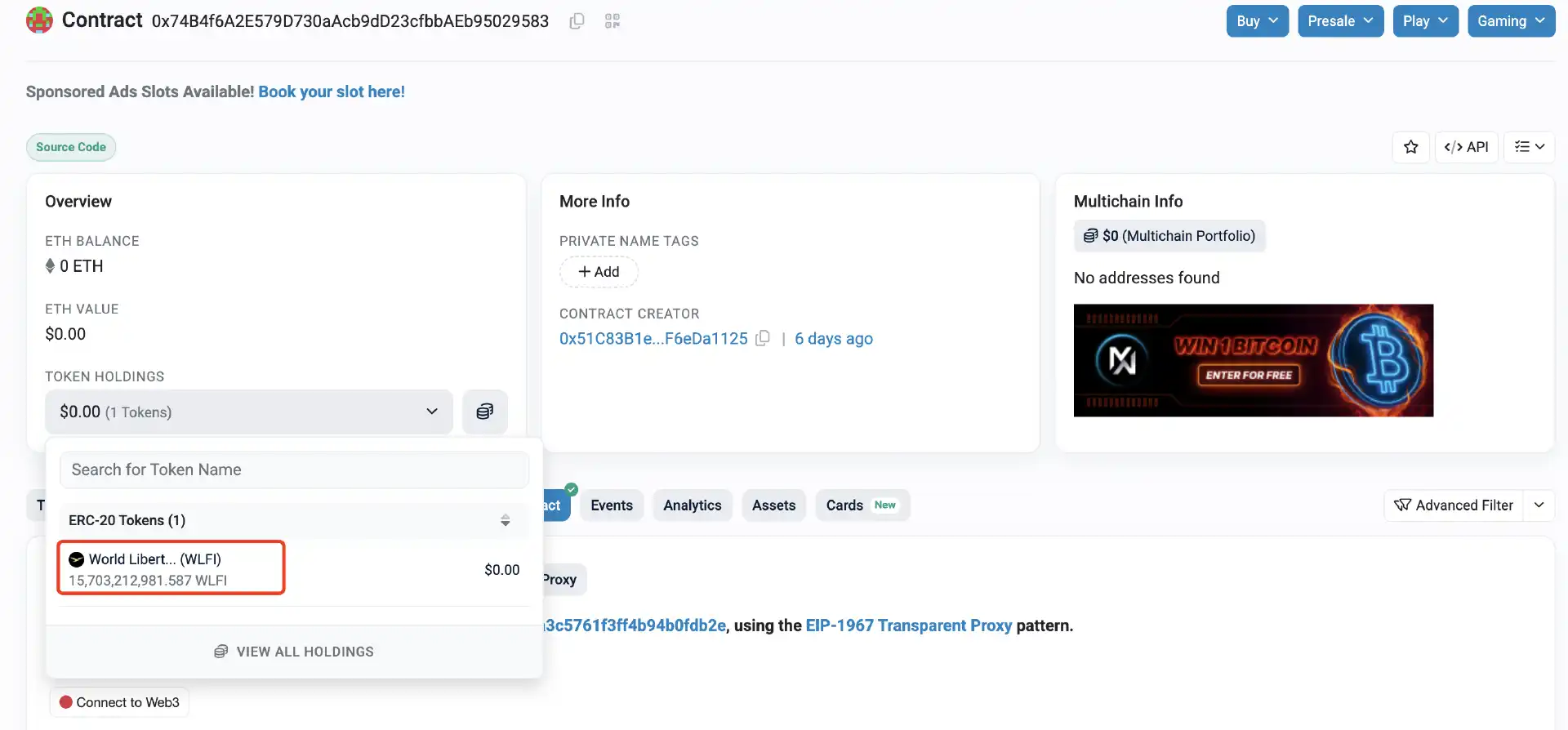

Token economic model analysis agency Tokenomist posted on X last night, stating that WLFI has encoded 18 attribution categories in its smart contract (https://etherscan.io/address/0x4f61A99e42e21eA3c3EaF9B1b30Fb80A7900d3ce), but currently, only one category (https://etherscan.io/address/0x74B4f6A2E579D730aAcb9dD23cfbbAEb95029583#code) has complete metadata, while the specific attribution details of the remaining 17 categories are still unclear.

The user category with clear metadata is the early presale user shares recorded by WLFI, with a total amount of approximately 18.43 billion—regarding why this data is 18.43 billion instead of the total sales of 25 billion from the two presale rounds, Chinese on-chain analyst "Crypto Cat Snow" (@CryptoNyaRu) has provided a more detailed analysis, indicating that 6.57 billion of the 25 billion was not counted. For details, click the original link: https://x.com/CryptoNyaRu/status/1959999708086321439

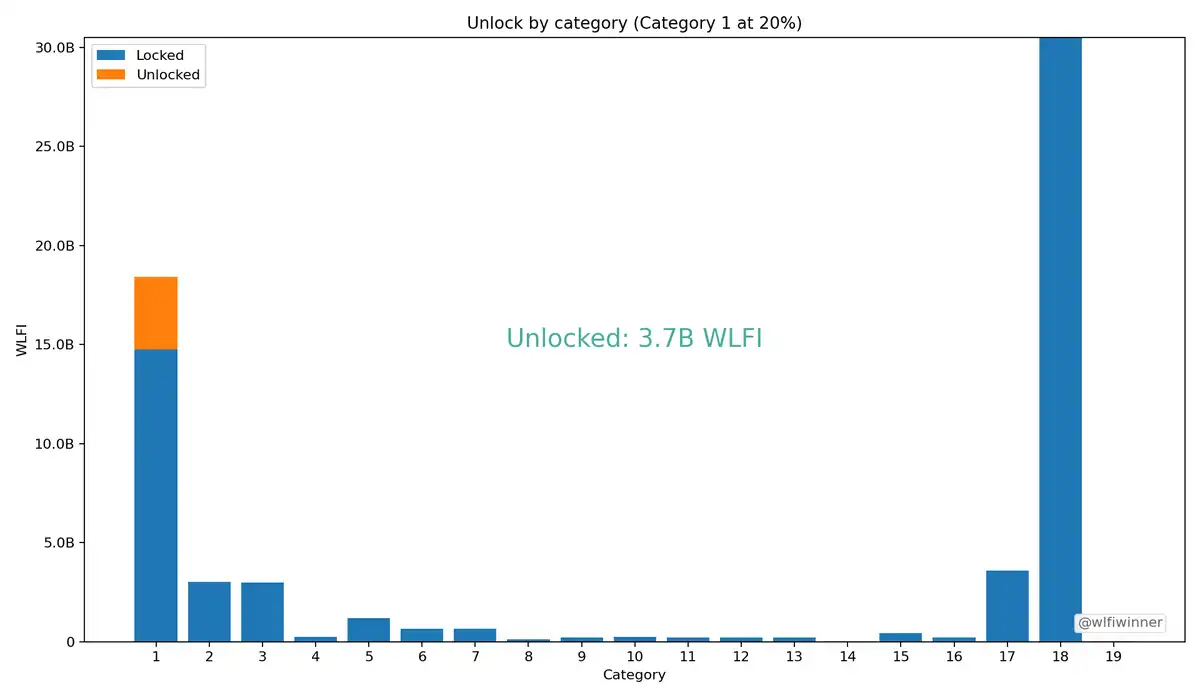

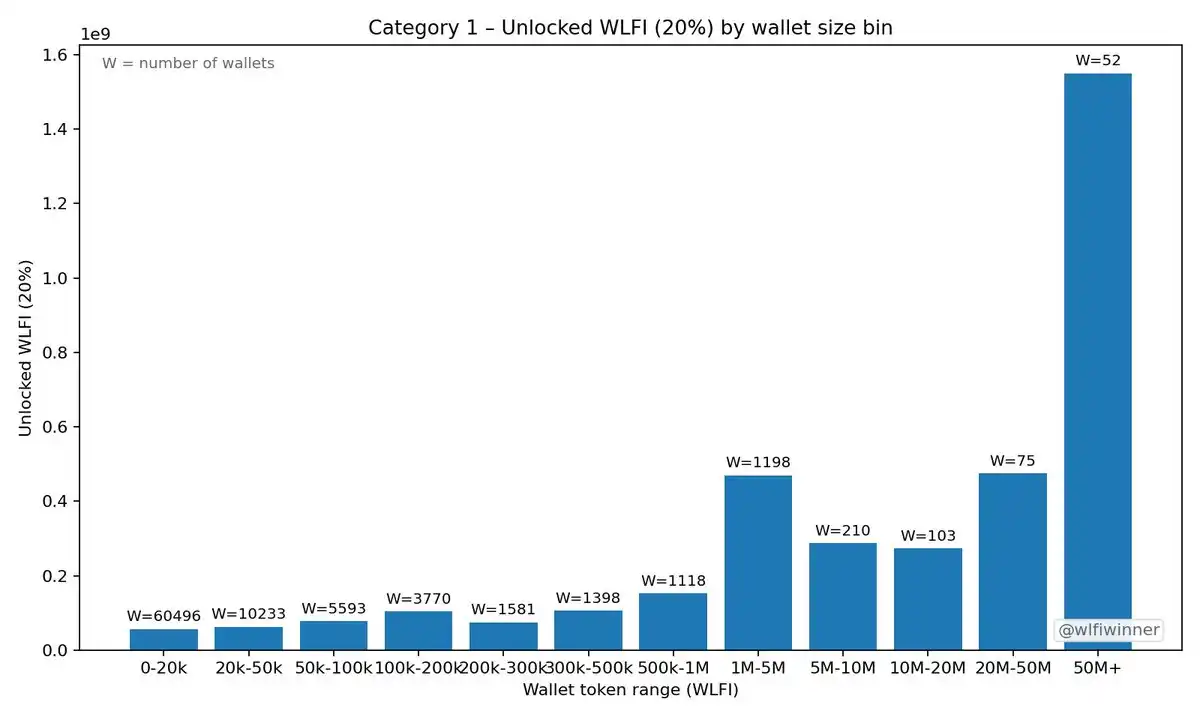

The WLFI ecosystem lottery project WLFI Winner has created clearer visual charts for this category and other categories of token shares, as detailed below.

Odaily Note: The number of token shares in different categories, of which only 20% of the first category will be unlocked at the initial circulation.

Odaily Note: The distribution of addresses with different holding sizes in the first category.

So far, the initial circulation situation of WLFI seems to be quite clear, with the maximum initial circulation amount being 18.43 * 20% = 3.69 billion, accounting for approximately 3.69% of WLFI's total supply, but in reality, this is not the end.

Regarding the initial unlock, WLFI has set up a "Lockbox" mechanism, meaning that even early presale users who meet the initial unlock requirements must sign an unlock agreement through the "Lockbox" and advance the unlocking process. After completing this process, all related WLFI will be transferred to a separate unlock contract (https://etherscan.io/address/0x74B4f6A2E579D730aAcb9dD23cfbbAEb95029583#readProxyContract).

As shown in the image above, the current amount of WLFI stored in the "Lockbox" contract is approximately 15.703 billion, which represents the total holdings of early presale users who have completed the unlocking process, i.e., the base amount that will be unlocked on September 1—based on this base amount, WLFI's initial circulation will be 15.703 * 20% = 3.14 billion, accounting for approximately 3.14% of WLFI's total supply.

Considering that more users will execute the unlocking process in the next two days, the final initial circulation ratio of WLFI is expected to be between 3.14% - 3.69%, corresponding to an initial circulation amount of approximately 3.14 - 3.69 billion.

As of the publication date, WLFI's pre-contract on Binance is reported at 0.2681 USDT** (BlockBeats Note: As of September 1 at 11 AM, WLFI's pre-contract price on Binance has rebounded to 0.3585)**, based on the above initial circulation amount, the initial circulating market value is approximately between 841.8 - 989 million USD.

The above is just an analysis of WLFI's initial circulation status. As for how to operate after the launch, you may refer to our earlier article “WLFI Pre-launch Halved: Will It Peak on September 1 or Plunge?”.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。