Recently, we are indeed in a macro vacuum period, which is the most challenging for cryptocurrencies without an independent narrative. After all, the U.S. stock market can still anticipate the development of AI due to Nvidia's earnings report, so even in a macro vacuum period, the U.S. stock market can still show some upward trends. However, the sentiment in the cryptocurrency space has to rely on itself.

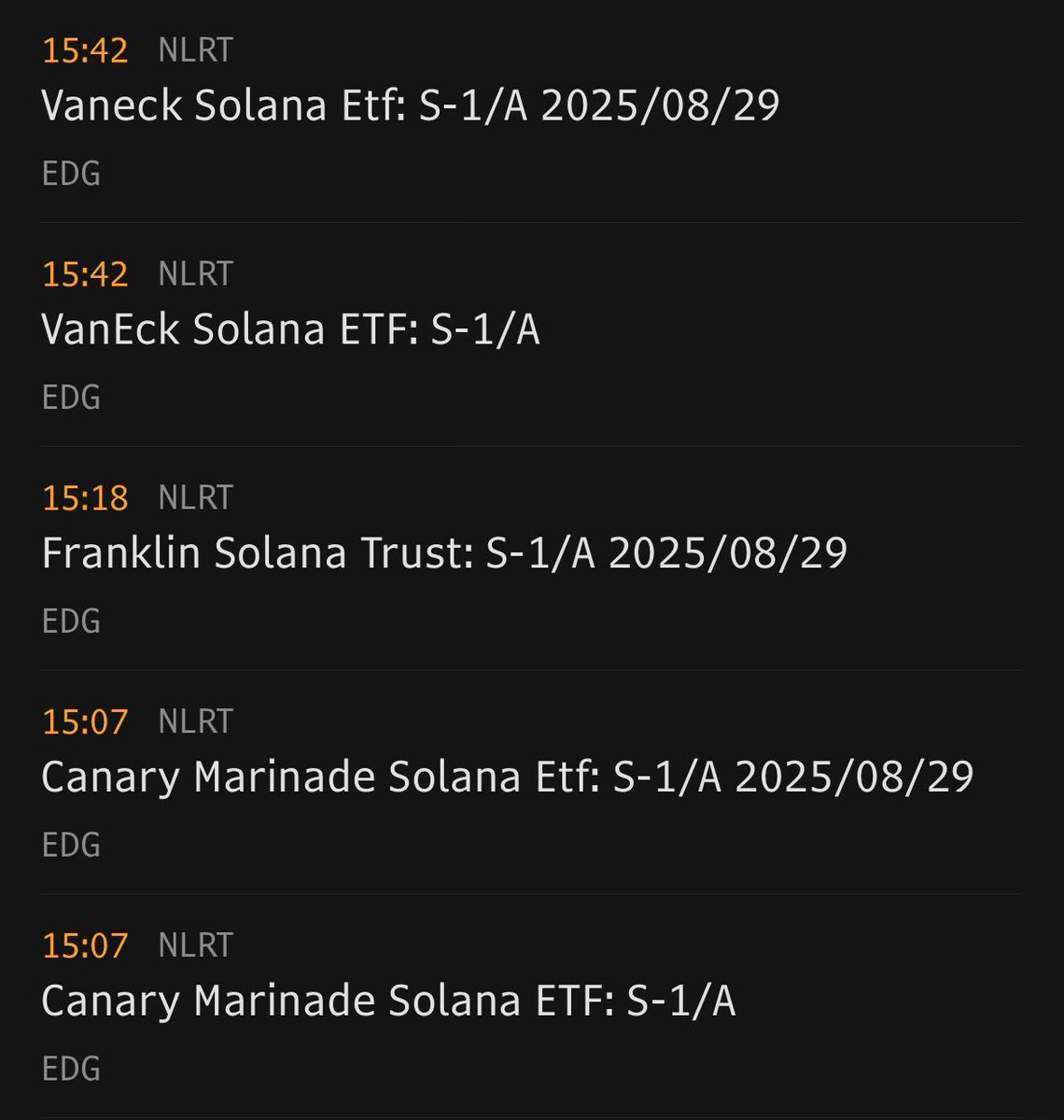

Recently, there have been intensive reports about a $SOL spot ETF, so relatively speaking, the performance of SOL will be better. Previously, I discussed the strategic reserves of SOL with @qinbafrank. My viewpoint at that time was that the strategic reserves should be held back, waiting to enhance the situation after the approval of the spot ETF.

However, cryptocurrencies with relatively little information may face more challenges, but they will still be highly correlated with the U.S. stock market. In my personal opinion, as long as there is no systemic risk in the U.S. stock market, it will be difficult for the cryptocurrency sector, especially $BTC, to experience a significant decline.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。