Written by: J1N, Techub News

The U.S. publicly traded company Yorkville Acquisition Corp. (NASDAQ: YORK), Trump Media Technology Group (NASDAQ/NYSE Texas: DJT), and the American cryptocurrency exchange Crypto.com reached a business merger agreement, announcing the joint establishment of "Trump Media Group CRO Strategy, Inc.," a digital asset reserve company focused on acquiring the Cronos token CRO.

The total capital of the company amounts to $6.42 billion, which includes $1 billion in CRO (6,313,000,212 tokens, accounting for 19% of the market value), $200 million in cash, $220 million in warrant cash, and a $5 billion equity credit line. After the business is completed, the three parties will jointly hold a majority stake as founding partners, making it the world's first and largest publicly listed CRO reserve company. Following the announcement, the price of CRO briefly reached 0.236 USDT, with a daily increase of 54%.

At the same time, CRO has also appeared in several key narratives previously. On July 8, Trump’s Truth Social submitted a cryptocurrency ETF proposal to the SEC that allocated 5% of CRO; on-chain data shows that Flow Traders is suspected of acting as a market maker for CRO, having withdrawn 607 million CRO from Crypto.com over four months, of which 98.8% has been transferred to a BitGo contract address. However, as CRO continues to be packaged as the "core of political and capital narratives," on-chain detective ZachXBT tweeted suggesting that Crypto.com had previously covered up a significant event but could not disclose it due to restrictions, leading to strong market speculation and concern.

In response, ZachXBT emphasized that he is currently "not allowed to share the details of the event." When Coinbase product head Conor Grogan inquired whether it was related to Crypto.com transferring 320,000 Ethereum to competitors, ZachXBT clearly stated, "It is obviously for other reasons."

Meanwhile, Crypto.com has also faced community controversy for reissuing 70 billion CRO that had been destroyed in 2021. Many believe this action contradicts the decentralized and transparent spirit advocated by the cryptocurrency industry. Although CEO Kris Marszalek defended this as a strategic consideration due to changes in the U.S. political environment, many observers are concerned that Crypto.com, holding 70-80% of governance voting rights, may pose risks of voting manipulation and governance imbalance.

In this context, the outside world has begun to re-examine the "dark history" of this exchange, trying to find clues about the "undisclosed significant event" hinted at by ZachXBT from past security vulnerabilities, governance operations, and regulatory storms.

Reviewing the "Dark History"

Hacking Incident: $35 Million in Cryptocurrency Assets Stolen

In January 2022, Crypto.com admitted to suffering a serious hacking attack, with 483 user accounts compromised, resulting in the theft of approximately $35 million worth of Bitcoin and Ethereum. The company initially reported a loss of $15 million but later admitted that the actual amount stolen was much larger due to public pressure.

According to official statements, on January 17, the company discovered unauthorized withdrawal transactions from some accounts, with some transactions even bypassing users' two-factor authentication (2FA). As a result, Crypto.com urgently suspended all token withdrawals for 14 hours, subsequently requiring all customers to log in again and enable new multi-factor authentication measures. Crypto.com stated that "user funds are secure," as most illegal withdrawals were blocked, and the remaining amount was fully compensated by the company.

To restore trust, the company launched several security upgrades after the incident: a new notification mechanism for withdrawal addresses, where users receive notifications when binding a new address and have a 24-hour revocation period; and a Global Account Protection Program (WAPP), which promises compensation of up to $250,000 for users who enable multi-factor authentication and can submit a police report.

Crypto.com CEO Kris Marszalek stated at the time: "While we remain vigilant against bad actors intending to commit fraud, this brand new Global Account Protection Program, along with the new MFA infrastructure, will provide users with unprecedented protection for their funds, allowing them to feel secure."

Million-Dollar "Refund Mix-Up," Real-Life Bicycle Becomes Lamborghini

In May 2021, Crypto.com mistakenly transferred $10.47 million to Australian user Jatinder Singh and his girlfriend Thevamanogari Manivel due to an accounting error that should have refunded a $100 deposit. It wasn't until seven months later during an internal audit that the funding gap was discovered. After receiving the funds, Singh and Manivel quickly squandered it. They purchased two houses and two plots of land; gifted $1 million to friends; and transferred funds to overseas accounts, including $4 million to a Malaysian bank account.

Jatinder Singh (right) and his lawyer

In March 2022, Thevamanogari Manivel was arrested while attempting to board a flight to Malaysia. Court records show that Jatinder Singh ultimately admitted to stealing $6.09 million, with his defense attorney arguing that he did not "fully understand the seriousness of his actions," while prosecutors deemed it "opportunistic crime." Ultimately, the two "innocent" users were sentenced to 209 days in prison and received 18 months of community correction orders.

Afterward, Crypto.com took legal action to recover most of the funds, but $4 million remains unreturned.

MCO Forced Conversion to CRO, Completely Diluting Early Investors' Shares

Crypto.com was formerly known as the cryptocurrency exchange Monaco. According to overseas forum Reddit disclosures, in 2017, Monaco and its platform token MCO completed a $26 million fundraising through an ICO, promising to launch a cryptocurrency credit card with generous rebates. However, the project did not progress smoothly, and in 2018, the team spent $12 million to acquire the crypto.com domain name and gradually shifted focus to the new token CRO.

By August 2020, Crypto.com announced the complete abandonment of MCO and forced MCO holders to exchange their tokens for CRO within a limited timeframe, at a conversion rate of 1 MCO = 27.64 CRO. However, according to the on-chain data at that time, the circulation of MCO was approximately 31.58 million tokens. If all holders completed the exchange, they would collectively receive about 873 million CRO. Given that the total supply of CRO is 100 billion, this means MCO holders would receive less than 0.873% of the CRO.

In other words, Crypto.com retained over 99% of the new token supply. This operation was viewed by the community as a blatant "plunder," with the interests of early investors nearly completely diluted.

If this were stock market behavior, founder Kris Marszalek would likely face legal liability for "forced dilution" and "false promises." However, in the then-unregulated cryptocurrency market, the affected investors had to accept this in the form of "governance decisions."

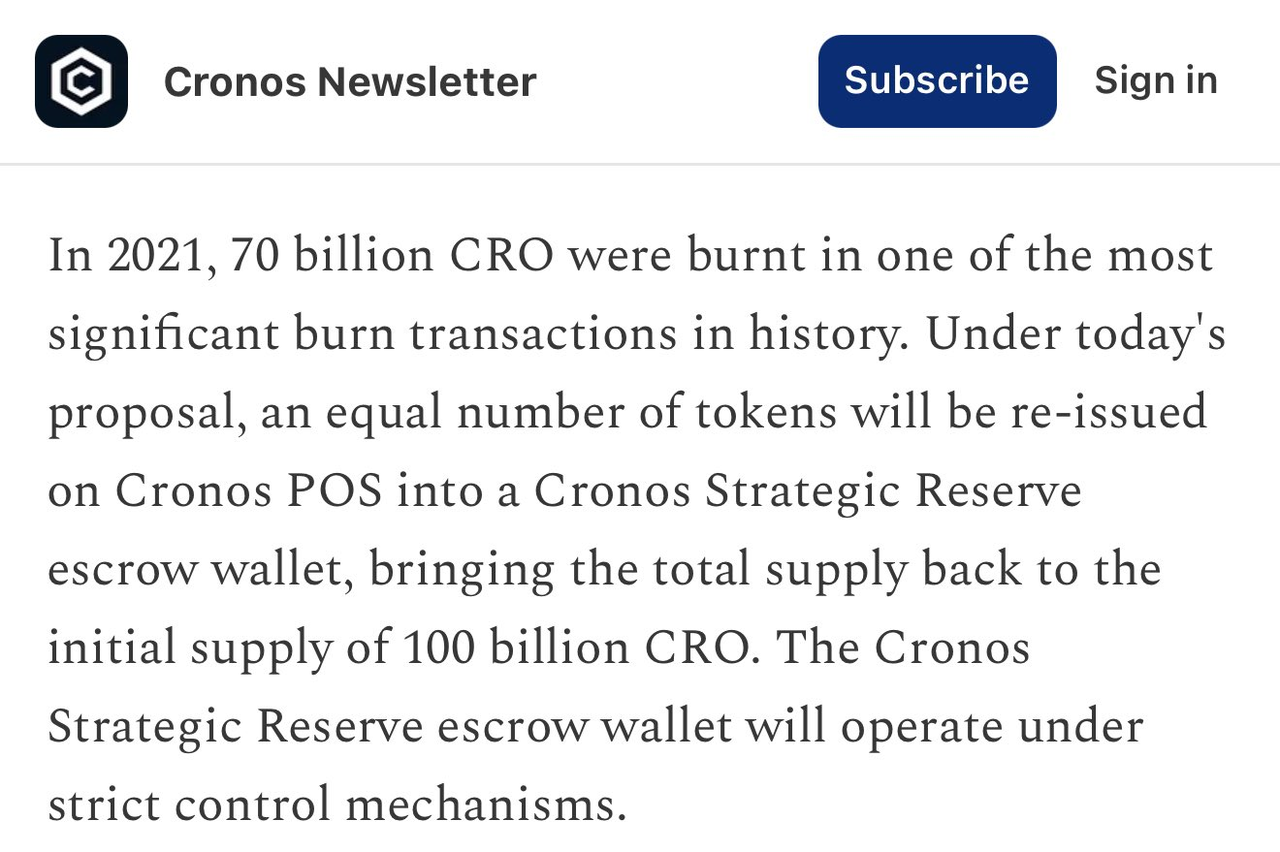

The Controversy of 70 Billion CRO Burn and Reissue

In February 2021, Crypto.com announced the "permanent destruction" of 70 billion CRO tokens, reducing the total supply from 100 billion to 30 billion, which was then referred to as "one of the largest token burns in history." However, in March 2024, Crypto.com announced the reissue of the 70 billion previously destroyed CRO and claimed through a governance proposal that it would "permanently destroy" them again.

The repeated operation of "burning, reissuing, and then burning" sparked strong protests from the cryptocurrency community. ZachXBT subsequently tweeted publicly accusing Crypto.com of "manipulating prices," stating, "Your team just reissued 70 billion CRO a week ago, which had previously been 'permanently destroyed' in 2021, accounting for 70% of the total supply. This goes against the community's will, as you control most of the supply. CRO is now no different from a Ponzi scheme."

In response to the criticism, Crypto.com CEO Kris Marszalek stated in an interview that the initial burn was "for the sake of preserving the company," and now "we have received strong support from the Trump administration, and to achieve success in the U.S. cryptocurrency space, we must invest actively." He even claimed, "This is what the community wants."

SEC Compliance Controversy

Against the backdrop of tightening U.S. regulations, Crypto.com also faced friction with regulatory agencies. In 2024, the U.S. Securities and Exchange Commission (SEC) issued a Wells notice to Crypto.com, which typically indicates that the regulatory agency is considering enforcement action. This immediately raised concerns about Crypto.com's compliance risks.

In the face of potential litigation, Crypto.com took a hard stance: it directly sued the SEC, arguing that the regulatory agency was "substituting enforcement for rule-making," severely undermining the operating environment for compliant cryptocurrency companies. The company contended that the existing regulatory framework is outdated and vague, making it unsuitable for the rapidly evolving cryptocurrency asset market.

After nearly a year of investigation, in March 2025, the SEC ultimately announced the termination of its investigation into Crypto.com, taking no further enforcement action. Crypto.com viewed this as a "compliance victory" and publicly stated that it would continue to promote industry transparency and the construction of a U.S. cryptocurrency legislative framework.

ZachXBT, known for his "courageous speech," chose silence

After reviewing Crypto.com's historical controversies, ZachXBT's warning undoubtedly became a "dark stone" weighing on the market. He did not directly present on-chain evidence as he had in the past but emphasized that he was "not allowed to disclose," which only intensified market panic and speculation.

Considering Crypto.com's past trajectory, I believe the event he referred to may likely focus on the following aspects:

First, significant security incidents may have been underestimated or concealed. In addition to the $35 million hacking incident acknowledged in 2022, are there larger, undisclosed financial losses? If it involves cold wallets or core system vulnerabilities, it would directly undermine user fund security; second, governance and high-level operational scandals. From the forced conversion of MCO to CRO supply manipulation, Crypto.com has long been criticized for its "centralization" issues, and ZachXBT's mention of "involving leadership" raises suspicions of potential high-level financial maneuvers, interest transfers, or internal asset transfers; third, financial and compliance risks. Although the SEC's investigation ultimately resulted in no penalties, does Crypto.com still face issues such as insufficient reserves, inaccurate accounts, or undisclosed hedging operations? In light of the FTX collapse, any doubts about "reserve authenticity" could trigger severe market reactions.

ZachXBT has always been known for his "courageous speech," but this time he chose silence, indicating that the issue may be sensitive enough to touch on legal and regulatory boundaries, making it inappropriate for public disclosure; or it may involve high-level responsibilities, and if exposed, could have a significant impact on the market and political narratives.

As Crypto.com becomes closely tied to the Trump Media Group and CRO is pushed to the forefront of politics and capital, this undisclosed shadow appears even more dangerous. The market is not worried about short-term price fluctuations but whether this exchange still harbors an unexploded bomb.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。