Written by: FinTax

With the surge of blockchain technology, cryptocurrency mining companies have become a global investment hotspot. In this digital gold rush, the United States is rapidly emerging as the absolute high ground for global crypto mining, leveraging its unique advantages—friendly regulatory environment, low energy costs, and a localization manufacturing trend driven by geopolitical factors. According to data from the White House Office of Science and Technology Policy, as of 2022, the U.S. accounted for over 37.84% of the global Bitcoin mining hash rate, ranking first in the world, while attracting dozens of publicly listed companies to compete for positioning, causing the industry landscape of crypto mining to expand at an unprecedented pace.

However, beneath this prosperous scene, mining companies that mine and directly sell cryptocurrencies in the U.S. are facing the dilemma of double taxation. The cryptocurrency earned from mining must be reported for income tax at fair market value at the time of acquisition; when sold in the future, the appreciation portion relative to the acquisition must also be taxed under capital gains tax regulations. This layered tax burden objectively brings a heavy tax load to crypto mining companies. However, through appropriate tax arrangements, mining companies can legally and reasonably reduce substantial tax payments, transforming the original tax burden into additional competitiveness.

1. Comparison of Capital Gains Tax Systems: U.S., Singapore, and Hong Kong

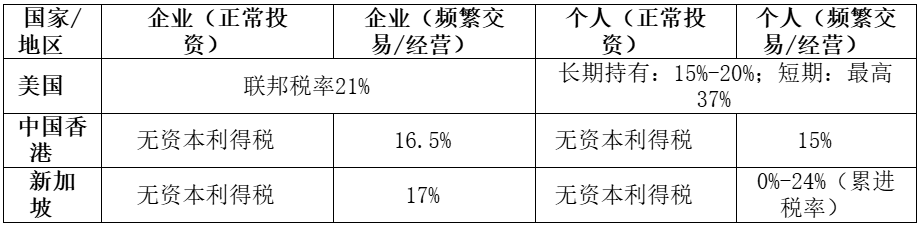

The tax policies for cryptocurrencies vary across different jurisdictions. The U.S. treats cryptocurrencies as property, and the income from their sale or exchange is subject to capital gains tax. Corporate (default C-corporation, hereinafter the same) asset appreciation is taxed at a federal uniform tax rate of 21%, while individuals are subject to different tax rates based on the holding period: short-term holdings (less than one year) are taxed at the highest ordinary income tax rate of 37%, while long-term holdings (over one year) enjoy a preferential tax rate of 15% to 20%. Whether occasionally selling coins for cash or engaging in frequent trading or operations, U.S. tax law treats all taxable transactions equally—any taxable transaction that generates profit must be reported for tax. This "tax on every gain" tax system design places significant tax pressure on domestic crypto investors and miners.

In contrast, the capital gains tax policies in Singapore and Hong Kong are much more favorable. Currently, both regions do not tax individuals and companies on capital gains from non-recurring investments in cryptocurrencies. This means that as long as the relevant transactions are recognized as investment income under capital, investors do not need to pay taxes on the appreciation of assets, thus truly achieving a zero-tax rate benefit for long-term holdings. Of course, if a taxpayer's behavior is deemed frequent trading or operating as a business, they must pay corporate (or personal) income tax on their profits. The Singapore tax authority taxes at approximately 17% corporate income tax, while individuals are subject to a progressive tax rate of 0%-24% based on income levels; Hong Kong taxes profits from frequent crypto trading (corporate tax rate of 16.5%, personal tax rate of 15%). Although frequent traders still need to pay taxes, the rates in Hong Kong and Singapore are undoubtedly more competitive compared to the U.S. maximum personal tax rate of 37% or the 21% federal corporate tax.

2. Using Singapore as a Path: An Option for U.S. Mining Companies

Based on the tax system differences across jurisdictions, a tax arrangement scheme tailored for U.S. crypto mining companies has emerged. Taking a Bitcoin mining company in the U.S. as an example, it can legally reduce the tax pressure from cryptocurrency appreciation by establishing a cross-border structure: the company can set up a subsidiary in Singapore, first selling the Bitcoin earned from daily mining to the subsidiary at market fair price, and then the subsidiary can sell it to the global market. Through this "internal first, external later" transaction arrangement, the U.S. parent company only needs to pay corporate income tax on the initial mining income, while the appreciation profits from the Bitcoin held by the Singapore subsidiary may have the opportunity to apply for the capital gains tax exemption policy when conditions are met, thus avoiding capital gains tax.

The tax-saving effect brought by this structural design is evident. Since Singapore does not impose capital gains tax on the appreciation portion obtained from the resale of long-held crypto assets, the profit from the sale of Bitcoin by the Singapore subsidiary is almost tax-free locally. In contrast, if the U.S. company directly holds Bitcoin until it appreciates and sells it domestically, this appreciation income would be subject to a federal long-term capital gains tax of up to 21%. By shifting the price appreciation phase to a jurisdiction that exempts capital gains tax, the overall tax burden of the mining company can be significantly reduced, freeing up more funds for reinvestment or shareholder dividends, thereby creating greater profit potential for the company.

3. Risk Warning: Multiple Considerations for Tax Arrangements

It is important to emphasize that any tax arrangement must be conducted within a legal and reasonable framework, and to achieve the tax effects outlined in the above scheme, transaction pricing and business substance must be meticulously arranged to ensure compliance with local requirements. For example, on one hand, U.S. tax law has strict transfer pricing regulations for asset transactions between related parties, requiring all related transactions to be conducted at fair market prices; otherwise, they face serious tax audits and penalties. On the other hand, the Singapore tax authority will also assess the frequency and purpose of transactions to determine whether the profits from the subsidiary's sale of Bitcoin are classified as capital gains or business income. Only appreciation profits recognized as investment nature can enjoy tax exemption. Therefore, this cross-border structure requires the support of professional institutions for tax arrangements and compliance operations during implementation to ensure that the scheme achieves tax-saving objectives without triggering compliance risks.

4. Conclusion

The tax arrangement ideas shared in this article are merely a preliminary thought. In actual operations, various factors such as the business model of crypto mining companies, shareholder composition, state laws, and international tax treaties will all influence the design of the optimal scheme. Tax arrangements are not a one-size-fits-all formula but need to be "tailored" to the specific circumstances of the enterprise.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。