In just over two and a half years, Hyperliquid has firmly established itself as a leader in the decentralized perpetual contract market. If we only consider the top 100 perpetual contract trading pairs, last week, Hyperliquid's perpetual contract trading volume reached an "82 open" compared to the USD-denominated perpetual contract trading volume on Binance.

Achieving such success, Hyperliquid's core team consists of only 11 people. On August 20, HyperliquidFR released data showing that Hyperliquid generated an average annual revenue of $102.4 million per employee, making it the highest revenue-generating company per capita in the world.

Looking back at Hyperliquid's development journey, there have been periods of quiet dormancy, astonishing wealth creation through airdrops, and even moments of decline. As $HYPE reached a new all-time high for the third time this year, let us revisit the legendary journey of Hyperliquid.

Dormancy

On December 27, 2022, Hyperliquid sent out its first tweet, announcing the launch of the Hyperliquid L1 testnet.

During that almost unnoticed dormancy period, Hyperliquid's founder, Jeff, was focused on building his own underlying logic. He had previously worked at Citadel in quantitative and high-frequency trading research, grew up in Silicon Valley after attending Harvard, and understood how traditional financial systems maintain matching efficiency and fund security under extreme pressure.

"How to provide an execution experience on-chain that matches Wall Street standards" was a question Jeff constantly pondered. Against this backdrop, Jeff chose not to build a contract trading platform on existing public chains but insisted on creating a new Layer 1, keeping the entire matching, clearing, and risk control system in his own hands.

In the following months, Hyperliquid's official Twitter account saw little progress. On April 20, 2023, Hyperliquid tweeted about distributing referral rewards to 81 addresses. A user in the comments expressed happiness about earning a $3 reward, and surely, in the future, such early participation provided him with substantial returns far exceeding that $3. One wonders if he envisioned a bright future at that time.

On May 17, 2023, Hyperliquid announced the launch of the community's native market-making treasury "HLP," which became the first tweet to receive significant attention. Now, HLP's TVL has reached approximately $573 million.

On June 17, 2023, HLP suffered its first attack. The attacker manipulated the price of $SNX on CEX, sold $SNX on Hyperliquid, and then closed their position on CEX, profiting about $37,000. Hyperliquid quickly made adjustments, and at this point, it was clear that Hyperliquid anticipated that as it developed, HLP would face more challenges.

On November 1, 2023, Hyperliquid launched a points system. On the 24th of the same month, Hyperliquid announced that the platform's total trading volume had reached $10 billion. By the end of 2023, Hyperliquid announced that the total trading volume had reached $21 billion, with over 31,000 users. In the first week of 2024, the weekly trading volume surpassed dYdX, making it the top player in the decentralized perpetual contract market.

It can be said that Hyperliquid had entered a phase of rapid development since then. The leader was subtly emerging, and the dormancy was about to end.

Astonishing Rise

If Jeff during the dormancy period was a dedicated engineer, by 2024, in the "astonishing rise" phase, he began to showcase clearer strategic ambitions. Hyperliquid was not satisfied with merely holding a leading position in the contract market; Jeff emphasized on multiple occasions that he hoped Hyperliquid would become a "fully functional on-chain financial ecosystem," rather than just a single Perp DEX.

Thus, on March 29, 2024, Hyperliquid announced support for native spot trading and launched two native token standards, HIP-1 and HIP-2. HIP-1 is a native token protocol that allows users to issue custom tokens on Hyperliquid L1. HIP-2 is a liquidity solution that provides market-making strategies for tokens issued under HIP-1, ensuring liquidity without relying on external platforms like Raydium.

At the same time, Hyperliquid announced that the first token to be listed for spot trading would be the meme coin $PURR, issued by itself on Hyperliquid L1. $PURR was the first gift for all users who participated in the Hyperliquid points system, peaking with a market cap exceeding $600 million, and currently still holds a market cap of $108 million, making it the largest native meme coin on Hyperliquid L1.

On May 20, 2024, Hyperliquid announced support for native EVM, signaling that Hyperliquid was not content with the success of its contract products but had greater ambitions to build an ecosystem, aiming to empower users to fully embrace the Hyperliquid ecosystem without needing CEX or other blockchains.

On November 29, 2024, Hyperliquid's native token $HYPE was launched, closing at $6.25 on its first day. Early users reaped substantial rewards, but even greater surprises were yet to come, as in less than half a month, $HYPE surged more than fivefold, reaching a peak of $35.

Twitter was filled with discussions about $HYPE, and whether or not one was a contract player, people began to recognize Hyperliquid's existence.

Challenges

With great success comes great scrutiny. Hyperliquid, which had been rapidly developing almost smoothly, soon faced its first challenge after the issuance of $HYPE.

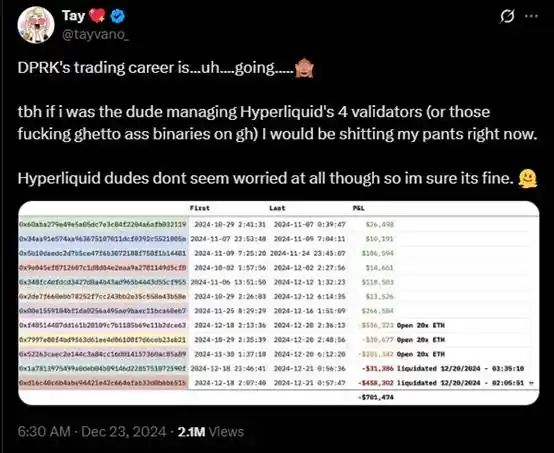

On December 30, 2024, renowned security researcher Tay (@tayvano_) tweeted a warning—multiple identified North Korean hacker addresses had traded on Hyperliquid from October 29 to December 18, 2024, incurring losses exceeding $700,000.

Although Hyperliquid had not shown any signs of being attacked at that time, this could indicate that Hyperliquid had already been viewed as a potential target by North Korean hackers. In the tweet, Tay also mentioned, "If I were one of Hyperliquid's four validators, I would be scared to death," which sparked discussions in the market about the potential security issues arising from Hyperliquid's low number of validators.

A day later, in an official announcement, Hyperliquid Labs stated that they were aware of reports regarding the so-called North Korean hacker addresses. In fact, Hyperliquid had not suffered any attacks from North Korean hackers—no form of attack had occurred. All user funds were being managed properly.

On January 7, 2025, node operator Chorus One published an open letter on Twitter, detailing multiple issues with the Hyperliquid testnet, including frequent node shutdowns, operational difficulties due to closed-source code, and single point of failure risks from centralized APIs, along with several improvement suggestions aimed at enhancing the chain's transparency and decentralization.

In response to these concerns, Hyperliquid founder Jeff replied, emphasizing that the validator selection criteria had been explained in the announcement; the Hyperliquid official account also posted separately on X platform to clarify the issues mentioned in the letter and stated that node code would be open-sourced when safe.

On March 27, 2025, Hyperliquid found itself in a significant market trouble. A whale on-chain established a large number of short positions on JELLY, leading to a sudden price fluctuation of the JELLY token that caused a liquidation. After Hyperliquid's counterpart vault took over the position, it faced a near liquidation situation, putting the entire protocol vault at risk of going to zero. Meanwhile, CEXs seized the opportunity to launch JELLY contracts to target and hunt Hyperliquid.

The incident concluded with Hyperliquid delisting the JELLY token and settling the short positions at $0.0095 (far below market price), without losing any funds. However, FUD continued. Arthur Hayes tweeted that Hyperliquid could not handle the JELLY incident, claiming it was not decentralized at all, and dared to bet that $HYPE would soon fall back to its original point. Bitget CEO Gracy Chen further stated that Hyperliquid's handling of the incident was immature, unethical, and unprofessional, suggesting that Hyperliquid could become FTX 2.0.

This incident did not halt Hyperliquid's progress. After the first week of April, $HYPE began to regain momentum and continuously set new all-time highs.

Whale's Preference

In March 2025, Hyperliquid first gained market attention due to the actions of a whale. At that time, a "Hyperliquid 50x leverage whale" emerged, widely noted for its high win rate and massive profits earned through high-leverage trading, earning it the nickname "Insider Brother."

In May, James Wynn faced off against this "Insider Brother" in a long-short showdown, with James Wynn's position at one point exceeding one billion dollars, ultimately leading to his victory.

However, he soon encountered a significant failure. By the end of May, James Wynn had reached a profit of up to $87 million, but subsequently not only gave back all his profits but also incurred a loss of $21.77 million in principal. At his peak at the end of May, he opened a massive $1.23 billion BTC long position on Hyperliquid.

Regardless of whether the whales succeed or fail, the movements of whales on Hyperliquid have become an important market indicator, serving as a living brand for Hyperliquid.

Just two days ago, according to on-chain data analysis from Arkham, a whale, also known as the "ancient whale who switched from BTC to ETH after seven years of dormancy," staked ETH worth $1.25 billion again. So far, this unknown whale has purchased $2.55 billion worth of ETH through Hyperliquid (Hyperunit) and staked all of it.

With so much ETH, this whale now ranks among the top 10 in total ETH holdings on Ethscan, holding approximately 2.5 times the amount of ETH currently held by the Ethereum Foundation. This whale's actions have significantly impacted the Bitcoin market, causing a 3% drop due to selling pressure. Perhaps wanting to maintain its mystery, this whale used Hyperliquid for its operations.

Providing a CeFi-level trading experience on a fully decentralized Layer 1, Hyperliquid has achieved this, which is the core reason for its appeal to whales.

Conclusion

The cryptocurrency world is indeed a place where miracles happen. Considering that Hyperliquid is challenging giants like Binance and OKX, and looking at Hyperliquid's speed of development and revenue scale, it is hard not to marvel at Hyperliquid as yet another "miracle in the crypto space."

Reflecting on Hyperliquid's journey, it is easy for people to focus on the dazzling numbers and stories. However, if we zoom in, we will find that Hyperliquid's essence is, in fact, Jeff's essence.

Jeff is not a founder who enjoys frequently appearing in public; he rarely gives interviews and almost never engages in excessive marketing. In a recent interview, he mentioned that Hyperliquid has only 11 team members and no internal marketing team.

Behind the beautiful story, Hyperliquid has also experienced a little-known period of dormancy and growth, facing various doubts and challenges. Today, they continue to persevere and will keep reaping rewards.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。