Author: Fidelity Digital Assets

Compiled by: Aki Wu on Blockchain

This article does not constitute any investment advice. Readers are advised to strictly comply with the laws and regulations of their location and not to participate in illegal financial activities.

Fidelity's latest Ethereum report provides a detailed analysis of the current state, advantages, disadvantages, technical roadmap, governance structure, fundamentals, and market competition of Ethereum. Based on this analysis, it extrapolates the competitive risks Ethereum faces under different scenarios. The report points out that Ethereum, as a pioneer in decentralized smart contract platforms, has significant network effects and reliability. Through smart contracts and decentralization, it offers high transparency and resistance to censorship. However, Ethereum sacrifices some layer one value capture in its modular scaling path and proof-of-stake mechanism, facing technical, regulatory, and governance risks. Investors should continuously track Ethereum's technological upgrades and market dynamics to assess its long-term value.

I. Key Points of Ethereum

1. Current Facts

Ethereum, as a decentralized platform, was the first to support the innovation of "smart contracts" (code that executes automatically on the blockchain).

Ether (ETH) is the native token of the Ethereum network, used to pay transaction fees (Gas).

Ethereum has a continuously advancing technical roadmap, implementing network upgrades primarily on an annual basis.

2. Advantages

With the first-mover advantage of its smart contract platform, Ethereum has formed significant network effects.

Ethereum prioritizes security and decentralization, providing stronger reliability, resistance to censorship, and transparency compared to other existing smart contract platforms.

Ethereum generates "free cash flow" through its transaction fee mechanism and reduces the total supply of ETH through fee burning, functionally similar to "automated share buybacks."

Ethereum fundamentally differs from Bitcoin in functionality and can be seen as a potential diversification asset in an investment portfolio.

3. Disadvantages

Ethereum adopts a "modular scaling" path (primarily layer two), sacrificing some layer one value capture while bringing in more users.

Its degree of decentralization is between Bitcoin and Solana, making it more susceptible to challenges in terms of "monetary asset" competitiveness and overall performance.

Ethereum typically undergoes a significant upgrade once a year, and each network change carries potential risks that investors should assess cautiously.

II. What is Ethereum? What is its core value proposition?

Ethereum was proposed by Vitalik Buterin in 2013 and went live in 2015. In the Ethereum white paper, Buterin stated: "The Ethereum protocol provides a platform with unique potential; it is not a closed, single-purpose protocol designed for specific application scenarios. Ethereum is designed to be open, and we believe it is well-suited as a foundational layer for a multitude of financial and non-financial protocols in the years to come."

The Ethereum protocol can be seen as a digital "blank canvas" for developers: applications can be written and secured by a global network of computers. These applications, composed of smart contracts, are at the core of Ethereum's value proposition. The decentralized nature of the Ethereum protocol is key to its differentiation from competitors. Its open design allows for broad and creative applications. This combination of "utility + decentralization" has made Ether (ETH) the second-largest digital asset by market capitalization, with a market cap close to $300 billion.

Ether (ETH) is the essential asset for transactions on the Ethereum network. Each transaction includes a "Gas fee" (paid in ETH) to complete execution. Whether developers create and launch new applications or users interact with applications, the associated transactions require Ether to pay fees.

III. Investment Thesis for Ethereum

Ether (ETH), as a necessity for using the Ethereum network, is at the core of its investment thesis. Theoretically, if the demand for various applications on Ethereum grows over time, the demand for the token should correspondingly increase.

Just as Bitcoin represents a non-sovereign store of value and payment method, Ethereum represents a globally neutral, open-source application network. Therefore, this report posits that networks like Ethereum may follow the "typical adoption curve (S-curve)" seen in other disruptive technologies to achieve expansion.

Currently, decentralized finance (DeFi) and stablecoins account for a significant portion of activity on the Ethereum network. Although Ethereum's underlying attributes are inherently financial, the applications built on Ethereum cover a wide range of computable scenarios, thus its total addressable market (TAM) is extensive.

On the supply side, the new supply of ETH primarily comes from proof-of-stake (PoS) issuance, which is more stable compared to other cryptocurrencies. Its mechanism aims to prevent malicious inflation, with an annual net inflation rate cap of about 1.5% in extreme cases. In practice, under the current design, ETH supply typically fluctuates slightly within the range of -1% to 1%.

Combining the demand generated by "network adoption" with relatively stable supply means that this investment thesis largely depends on the actual trajectory of the adoption curve over the coming decades. Thus, investors can assess the potential scenarios for adoption outcomes and determine whether this demand trend is worth allocating/investing in. However, given that Ethereum's roadmap is still advancing, investors need to continuously track relevant progress and adjust their thesis accordingly.

IV. History and Future

1. Initial Token Distribution

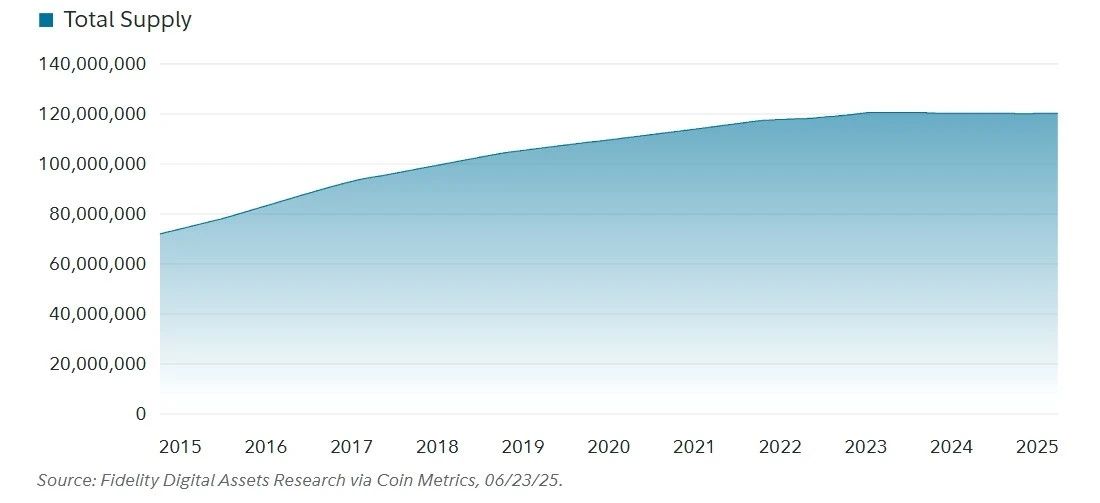

The current Ethereum ecosystem is vastly different from when the mainnet launched in 2015. Ethereum initially launched as a proof-of-work (PoW) blockchain—under this mechanism, miners verify transactions and secure the network by solving computational puzzles; at the same time, the project conducted a "genesis sale" to raise funds for the Ethereum Foundation.

Source: CoinMarketCap, 2025/07/15

Note: Theoretically, the total supply of Ether is not capped, but protocol parameters are set to ensure that the annual inflation rate does not exceed 1.5%.

Interestingly, the difference between the initial supply of Ethereum at genesis and its current supply can largely be attributed to the issuance and distribution during its proof-of-work (PoW) phase. Compared to other networks that adopt proof-of-stake (PoS), this mechanism allowed ETH to achieve a distribution and decentralized holding similar to Bitcoin early on. Given that a significant amount of supply was allocated to Ethereum miners during the PoW phase, this broad distribution provided a solid foundation for the network's transition to proof-of-stake.

2. Transition to Proof of Stake

Ethereum's "Merge" marks a critical transition from proof-of-work (PoW) to proof-of-stake (PoS). This process began with the launch of the "Beacon Chain" in 2020 and was completed in 2022, integrating the Beacon Chain with the Ethereum mainnet. This move significantly reduced Ethereum's energy consumption by approximately 99.95% and decreased the issuance of Ether by about 89%, leading to a more stable supply.

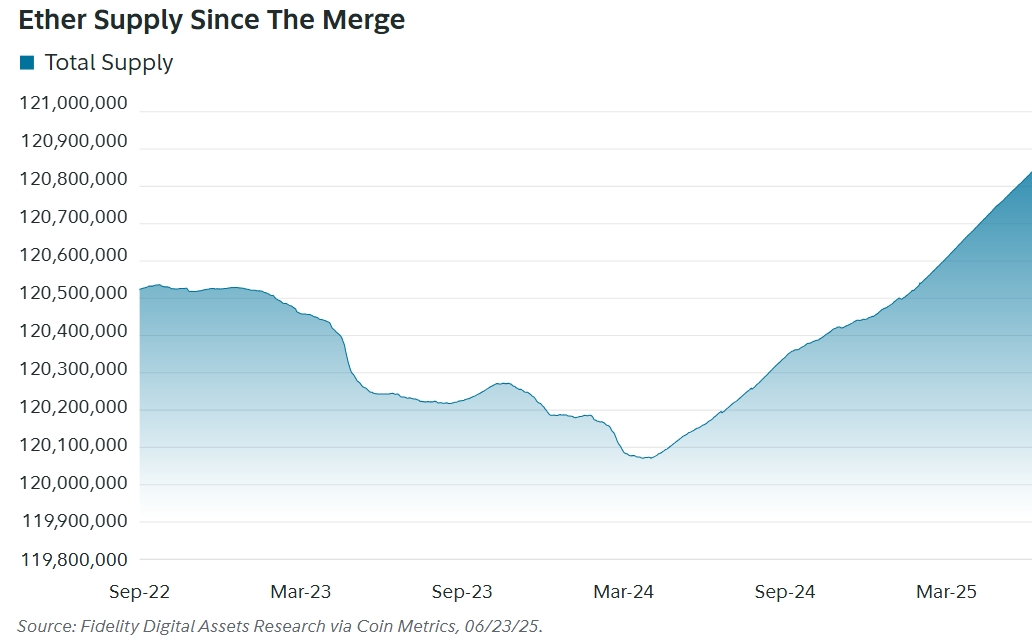

Since the Merge, the substantial reduction in issuance has further solidified the stable characteristics of Ether (ETH) supply. Under the PoS mechanism, constraints on ETH issuance ensure that network security can continue to improve without excessive increases in maintenance costs.

3. Modular Scaling Path

In 2021, due to high demand, Ethereum faced significant scaling challenges, with transaction costs soaring at times. The so-called "modular scaling" involves splitting different on-chain functions across different layers to enhance transaction processing and data management efficiency. Ethereum's core positioning along this path remains as a secure, decentralized data availability layer (Data Availability, DA), which facilitates transaction execution.

4. Roadmap

Understanding Ethereum's overall roadmap and potential changes is crucial, as each upgrade impacts the network. Ethereum is a continuously evolving network—investors should plan and adjust accordingly.

Strategic initiatives:

Expand L1: Increase the capacity of Layer 1 to provide sufficient block space for asset issuance, governance, DeFi, and Layer 2 settlement activities.

Expand Blob: Increase the scale and capacity of Blobs—temporary data packets introduced to enhance data availability and reduce costs—to provide the most attractive data availability services in the digital asset space.

Improve User Experience (UX): Achieve a unified, seamless, and secure user experience across the entire Ethereum ecosystem.

V. Ethereum Governance Structure

1. Ethereum Foundation

The Ethereum Foundation (EF) is a non-profit organization that supports the overall Ethereum ecosystem. Its functions include funding protocol layer development, promoting ecosystem growth, and advocating for and disseminating information about Ethereum. The foundation's executive board consists of three members, including Vitalik Buterin.

Since its establishment in 2015, the foundation has adhered to two core principles: long-termism and subtraction. The foundation believes its work should be measured on a long-term scale—timeframes should span decades or even centuries, rather than just quarters and fiscal years. At the same time, the principle of "subtraction" means actively reducing its own power where possible and resisting the organization's natural tendencies toward expansion and power accumulation. The foundation's overall goal is to allow the network to thrive with broad community support rather than relying on the foundation and its board itself.

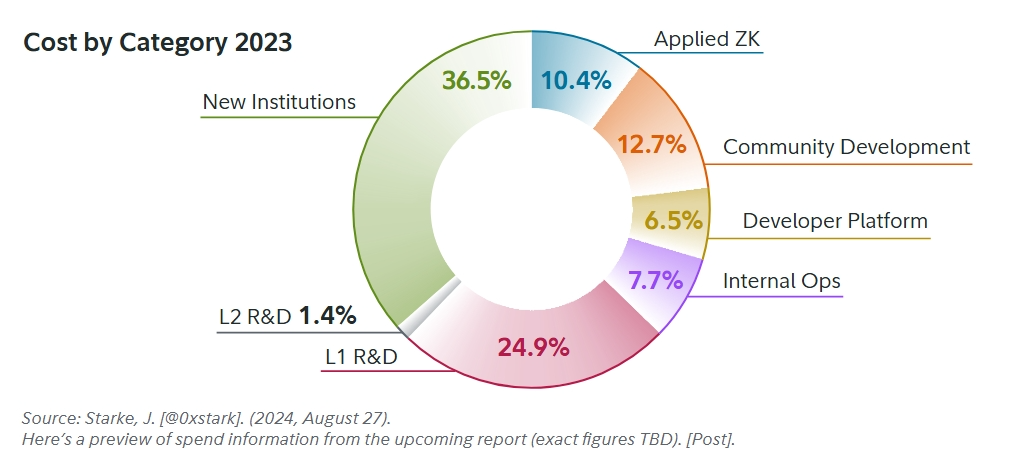

In the ecosystem, the foundation's most "obvious" role is financial support. During the initial token issuance, the foundation was allocated 3.5 million ETH and has a budget of about $100 million per year to fund various aspects of research and development.

The following shows the funding allocation details for 2023 (indicative):

Funding amounts and their allocation details will be continuously adjusted based on what the community deems should be prioritized. Although the Ethereum Foundation does not directly decide the specific work the community should undertake, it does have some influence in directing funds toward its areas of focus. Overall, the Ethereum Foundation plays a key role in the Ethereum ecosystem primarily through research and funding; however, the organization is also committed to gradually diminishing its role over time.

2. Ethereum Improvement Proposals and Upgrades

Ethereum's governance advances protocol changes through "Ethereum Improvement Proposals" (EIPs) in a structured process. Relevant proposals are discussed in All Core Devs (ACD) meetings, where core developers collaboratively determine the upgrade content. The process begins with drafting an EIP, followed by community review and discussion; when a proposal receives broad (even overwhelming) community support, it undergoes rigorous testing and security audits.

It is important to emphasize that decisions on how to improve Ethereum's governance occur off-chain. The decision-making process takes place in public forums, and changes arise from community consensus rather than top-down directives. Once an EIP has undergone sufficient review, it will be included in a network upgrade to ensure that the relevant changes can be implemented safely and stably. Compared to the early stages of network development, the frequency of upgrades has significantly decreased. Developers have formed a general expectation that in the future, several proposals will be bundled and implemented in a single upgrade on an annual basis.

3. Token Issuance

The goal of Ethereum's token issuance mechanism is to achieve Minimum Viable Issuance (MVI), which means issuing only the minimum amount of Ether (ETH) necessary to maintain network security. Although there have been several adjustments to the issuance curve historically, the core objective of minimizing issuance while not compromising security has remained consistent. This approach seeks to balance security needs with inflation suppression, leading to ongoing discussions about "what constitutes the optimal security threshold."

VI. Technical Composition of Ethereum

1. Smart Contracts

Smart contracts are at the core of Ethereum's uniqueness. The simplest way to understand them is to view them as programmable logic—somewhat similar to applications on a mobile phone. The fundamental difference lies in where they are deployed and how they operate.

Smart contracts deployed on Ethereum benefit from the blockchain's auditability and high availability: any user can view the application's operational logic and publicly verify its correctness and validity. Additionally, Ethereum has not experienced a complete network outage since its launch, providing extremely high availability and accessibility for the applications it hosts.

This contrasts with most internet applications today: the core business logic of the latter is typically not open to the public, requiring users to trust the application providers to handle data properly and execute correct operational processes; meanwhile, internet-based applications often rely on smaller server clusters to function normally, increasing the likelihood of outages.

Therefore, smart contracts not only possess the complete functionality of other mainstream applications but also benefit from the higher transparency, resistance to censorship, and reliability provided by Ethereum.

Ethereum initially adopted a proof-of-work (PoW) consensus mechanism; however, its roadmap has always planned for a final transition to proof-of-stake (PoS). The shift to PoS has had a significant impact on the network's economic mechanisms and the investment characteristics of Ether (ETH).

The issuance contraction achieved by "The Merge," combined with the burning mechanism implemented in 2021 (EIP-1559), has gradually given Ethereum the attributes of a "productive asset": its "net cash flow" returns to investors in the form of token burn.

It is important to emphasize that Ethereum's net cash flow is dynamic and will change with ongoing network demand and protocol evolution.

2. Issuance and Burning

Ethereum initially adopted a proof-of-work (PoW) consensus mechanism; however, its roadmap has always planned for a final transition to proof-of-stake (PoS). The shift to PoS has had a significant impact on the network's economic mechanisms and the investment characteristics of Ether. The issuance contraction brought about by "The Merge," combined with the burning mechanism implemented in 2021, has gradually given Ethereum the attributes of a "productive asset": its "net cash flow" returns to investors in the form of token burn. It is important to emphasize that Ethereum's net cash flow is dynamic and will change with ongoing network demand and protocol evolution.

Supply of Ether (ETH) since the Merge:

3. How Does Staking Work?

Ethereum's migration to proof-of-stake (PoS, i.e., "The Merge") introduced a new "collateralization" method to prove that validators are contributing value to the network. To participate in consensus, validators must stake at least 32 ETH to a smart contract and enter an activation queue. Once activated, a validator is randomly selected from the pool of validators to propose a block for the current "slot."

Ethereum generates a new slot every 12 seconds; 32 slots constitute an epoch (epochs are used to group slots/blocks in the blockchain system for processing and consensus). Each slot also randomly selects a group of validators to form a "committee" that witnesses and votes on the validity of the proposed block. The purpose of setting up a committee is to distribute the network load and ensure that all active validators participate in witnessing as planned during each epoch.

Newly issued ETH is generated at the consensus layer. The number of rewards received by a single validator fluctuates with the total number of participating validators. As of June 23, 2025, the average daily issuance was approximately 2,602 ETH, corresponding to 1,078,281 participating validators. The same entity can run multiple validator instances. Additionally, about 0.33% of validators can exit from the consensus layer daily.

4. Ethereum's Burning Mechanism

In recent years, Ethereum has implemented a burning mechanism as part of the London upgrade (this 2021 network upgrade adjusted the fee structure and introduced a mechanism to burn a portion of transaction fees, thereby reducing supply over time). Unlike Bitcoin, Ethereum does not have a total supply cap. One of the purposes of introducing the burning mechanism is to create value return through transaction activity rather than relying solely on staking; this value return is directly reflected at the level of Ether holders in the form of "burning/token buybacks."

To execute a transaction on the Ethereum chain, a base fee must be paid. This base fee fluctuates between blocks based on transaction activity. During the PoW era, the base fee was rewarded to miners. However, since the London upgrade (and subsequently The Merge), this portion of the base fee has been burned, thereby reducing the total supply of ETH. Since the burning mechanism was implemented in August 2021, approximately 4.6 million ETH have been burned. As of June 23, 2025, this amount is valued at approximately $13 billion, which would have originally gone to miners or validators.

5. Layer 2

Ethereum also has a second layer (Layer 2, L2) for processing more transactions. This layer consists of multiple layer two blockchains built for performance optimization. On these chains, transactions are completed in larger batches and at lower fees. Subsequently, these transactions are aggregated, packaged, and published to Layer 1 (the base layer). In this process, transaction fees are not charged individually as they are on the base layer, but rather billed in batches, with each transaction only sharing a small portion of the total fee, thus enhancing efficiency and reducing user costs.

Publishing and storing Layer 2 transaction data on Ethereum not only brings efficiency through batch processing but also provides additional security for Layer 2 users. By publishing transaction batches to Ethereum, any relevant party can independently verify the validity of these transactions from other chains. Therefore, Layer 2 blockchains can focus on performance optimization while anchoring some of their security on Ethereum.

As of June 2025, the most recent network upgrade was the Prague–Electra upgrade implemented in May 2025. This upgrade doubled the capacity of Blobs (temporary data packets introduced to enhance data availability and reduce costs), further improving transaction efficiency; the result is lower Layer 2 Rollup fees, while the amount of ETH burned has decreased. The upgrade for scaling also highlights the differing interests between ETH investors and users: due to the existence of the burning mechanism, higher fees benefit investors; whereas for users, lower fees mean lower transaction costs.

Since the Prague–Electra upgrade, the supply of ETH has increased, indicating that the efficiency gains from the upgrade have not yet been fully offset by on-chain transaction activity (i.e., the amount burned has not been sufficient to cover the issuance). However, the net effect is a lower inflation level and lower fees, which can be seen as a compromise state. It is still in the early stages, and subsequent upgrades may continue to change Ethereum's network dynamics. In any case, continuously tracking the inflation/deflation trends of ETH supply remains valuable.

VII. Fundamental Analysis of Ethereum

1. Transactions

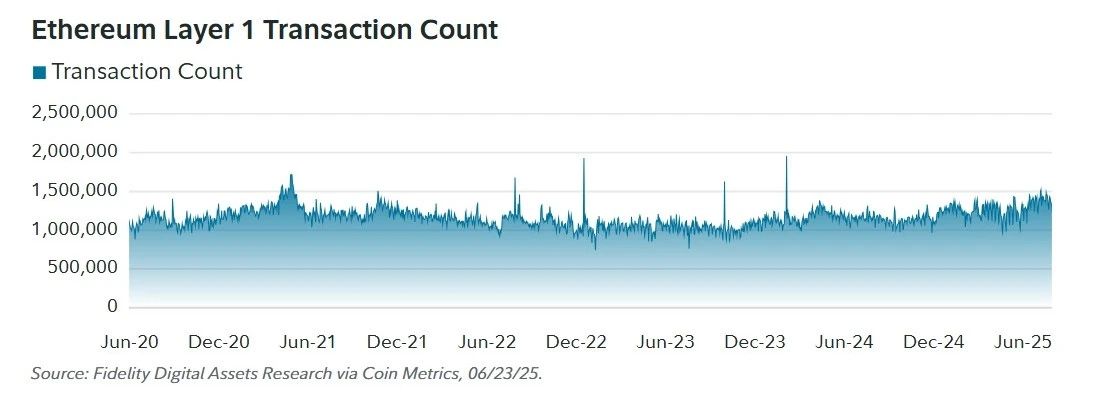

Over the past four years, the average daily transaction volume on Ethereum's base layer (Layer 1, L1) has been approximately 1.14 million transactions.

Transaction counts on Ethereum Layer 1 from June 2020 to June 2025:

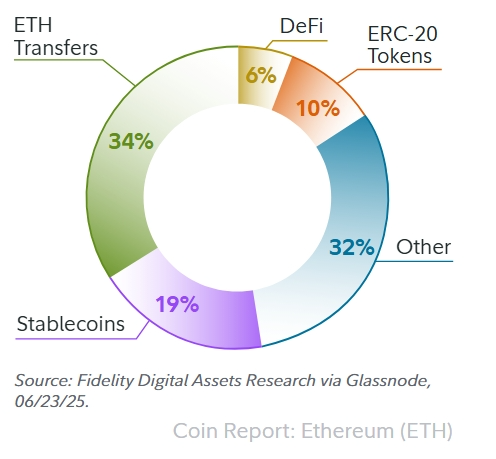

The most common transaction uses on the Ethereum network include:

- Ether (ETH) transfers

- Stablecoins

- ERC-20 tokens

- Decentralized Finance (DeFi)

As of 2025, these four categories collectively account for 69% of all transactions on the Ethereum network, translating to an average of approximately 873,000 transactions per day. Below is a complete breakdown of the various transaction types.

Composition of Ethereum Transaction Types

The Ethereum ecosystem supports both Ether (ETH) and various non-native tokens. This stands in stark contrast to Bitcoin, which only supports its native token. The two most common types of non-native tokens are ERC-20 tokens, with stablecoins being a subclass. As shown in the chart on the right, the support for non-native tokens is clearly necessary: ERC-20 tokens and stablecoins together account for 29% of daily transaction volume.

2. Functionality of Smart Contracts

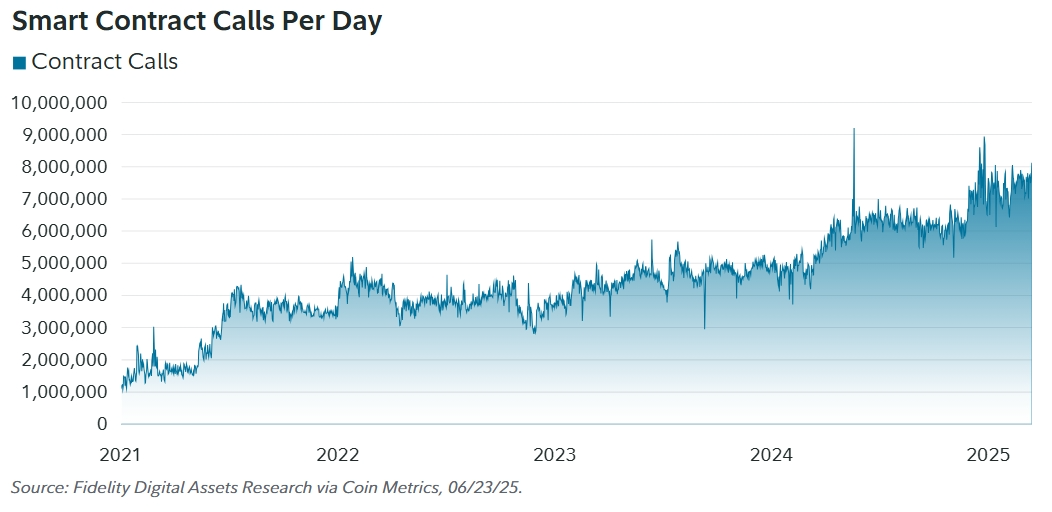

Smart contract calls can serve as a proxy indicator for measuring Ethereum's overall functionality; therefore, more calls typically indicate that more complex transactions are occurring and/or users are gaining more usability. Since Ethereum's launch, the number of daily smart contract calls has steadily increased. As of June 23, 2025, the average daily number of smart contract calls on the network exceeded 7 million.

Given that smart contracts are essentially programmable logic, the above indicator can be used to approximate the overall functionality and user usability of the network. The continuous growth of smart contract calls on Ethereum indicates that users are able to perform more complex on-chain operations than before, thereby benefiting from the higher utility of applications on the network. It should be noted that this data includes both successful and failed contract calls, but it still clearly points to a sustained increase in network usability.

Daily Smart Contract Call Count:

3. Layer 2 Analysis

Ethereum relies on Layer 2 (L2) to handle most transactions at a lower cost, while Layer 2 depends on the security and censorship resistance provided by Ethereum. The most mainstream types of Layer 2 are Zero-Knowledge (ZK) and Optimistic (OP). Both aim to carry and process transactions, but they inherit security from Ethereum through different mechanisms. The differences in security guarantees between these two types of solutions are particularly important for users; for investors, it is essential to recognize that both can scale Ethereum, but there are differences in their security mechanisms.

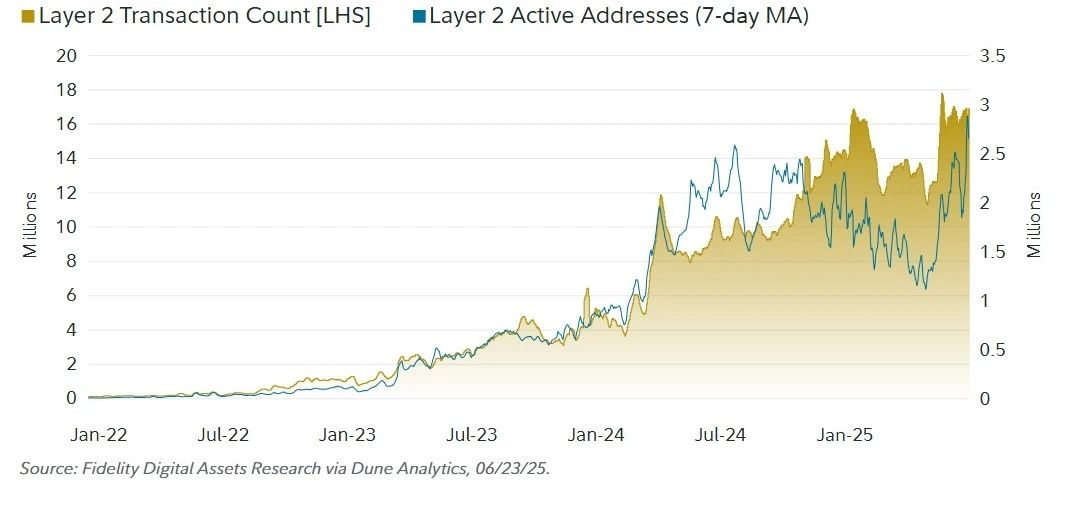

To measure the on-chain activity of these Rollups, this article will focus on two indicators: daily transaction counts and daily active addresses.

Layer 2 Transactions and Active Addresses:

As of June 24, 2025, there are approximately 3 million active users initiating 16 million transactions daily on Optimistic and Zero-Knowledge Rollups. Over the past year, the user base and activity levels on these platforms have significantly increased, indicating that Ethereum has the capacity for sustained expansion through a modular scaling approach. From the perspective of Metcalfe's Law, this "modular argument" has driven a significant increase in the value of the Ethereum network in recent years.

However, this path involves trade-offs in terms of value return/value capture. Compared to transactions occurring on Layer 1, the value returning to ETH from transactions on Layer 2 is much smaller in terms of "cash flow." From the perspective of value capture and finance, this trade-off is quite clear: before the introduction of Blobs (dedicated block space for Layer 2 data), Layer 2 platforms accounted for about 20% of Ethereum's total revenue (primarily from fees). After the upgrade, due to the decrease in fees generated by Layer 2, they now account for only about 1% of total fees.

It can be said that through Blob scaling, Ethereum has exchanged some revenue and value capture from Layer 2 platforms for lower fees for users and enhanced network capabilities. This "leverage" essentially oscillates between Metcalfe-style network scale effects and value capture. In the long run, if Layer 2 activity achieves significant and sustained growth, Ethereum's revenue may still rise, but this remains to be seen. Therefore, the long-term prospects for Ethereum's value return largely depend on a significant increase in demand on the Layer 2 side to compensate for the revenue space that has been ceded.

VIII. Competitor Analysis

1. Market Share / Dominance

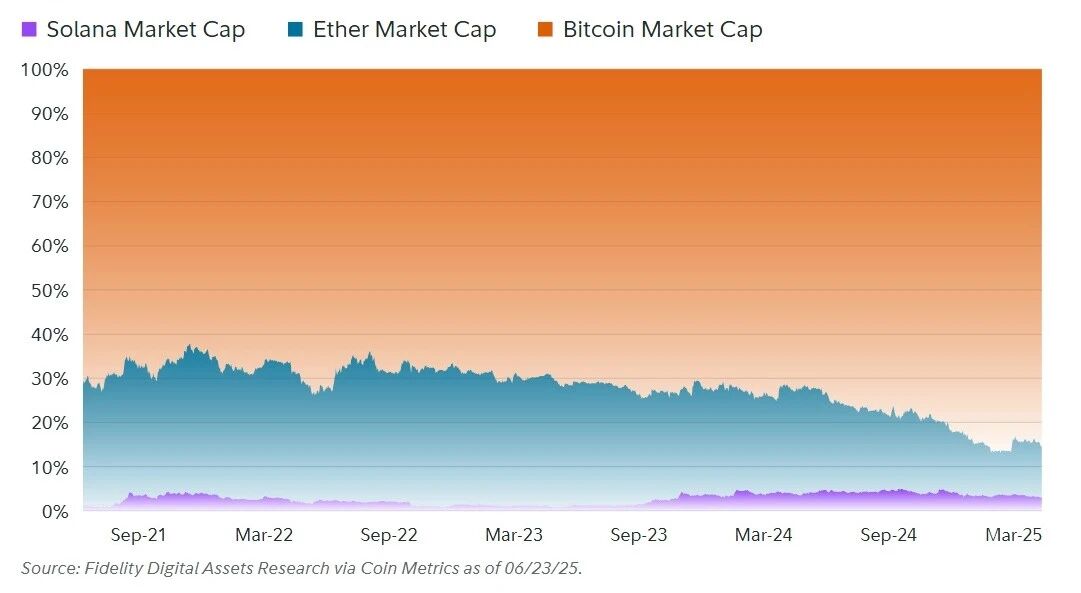

As the preferred smart contract platform, Ethereum always faces the possibility of being surpassed by newcomers—its largest competitor to date, Solana, has shown some momentum in this regard. On April 20, 2025, Solana reached an all-time high in price measured in Ether (ETH): 1 SOL could be exchanged for 0.087 ETH.

Market Share Trends:

Solana is the most representative case of the competitive risks faced by Ethereum. Its strategy of providing a low-cost Layer 1 blockchain—trading off some degree of decentralization for convenience and efficiency—has shown advantages. In contrast, within the Ethereum ecosystem, investors typically need to bridge or transfer tokens to Layer 2 to achieve a high-performance, low-fee environment comparable to Solana's Layer 1.

This highlights potential pain points for Ethereum when developers face the "blockchain trilemma": the higher the chain's performance, the more transactions it can process, and thus the greater the value that can be directly captured.

However, demanding higher performance from a blockchain often also means a greater degree of centralization and weaker security guarantees.

The "blockchain trilemma" was proposed by Ethereum founder Vitalik Buterin in 2017. This viewpoint suggests that decentralized databases/distributed ledgers like Ethereum can fully satisfy at most two of the three guarantees: decentralization, security, and scalability, making it difficult to achieve optimal performance across all three. Ethereum chooses to maintain higher decentralization, while Solana pursues maximum performance. Ethereum offloads transaction execution to Layer 2 platforms to maintain its decentralized attributes, but in doing so sacrifices some direct value capture from Layer 1. In contrast, Solana's native high performance allows it to process millions of transactions daily, which can more directly capture value for SOL holders.

Whether investors, developers, and users will recognize Ethereum's "prioritization of decentralization" remains to be seen. However, in the short term, Solana has made substantial progress in market share through a more centralized path. On the other hand, Bitcoin has succeeded through extreme decentralization and simplicity rather than performance. This indicates that there is no single correct path: Bitcoin and Solana achieve growth through completely different strategies (and use cases). At the same time, the industry space may be sufficient to accommodate multiple public chains with varying degrees of decentralization. For investors, the key question is which two aspects the market values more in the "trilemma."

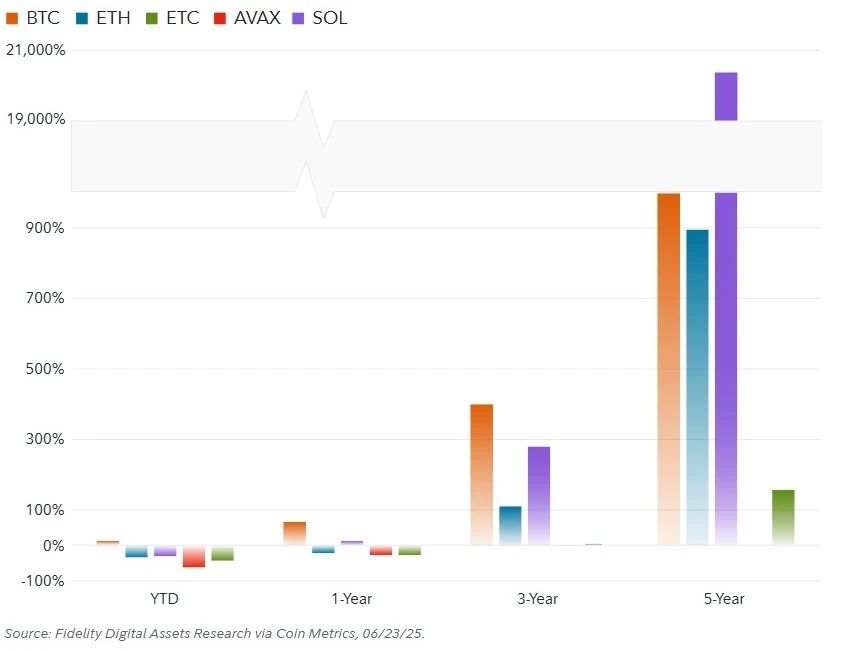

2. Price Performance

During the listed periods, both BTC and SOL outperformed ETH, indicating that Ethereum faces unprecedented competition. Although ETH has shown robust performance over a longer time frame, investors should seriously assess the risks posed by competition to Ethereum's future prospects. Recent price performance may stem from Ethereum's phase of "over-expansion" in 2021, requiring a repricing compared to competitors; it may also reflect a shift in overall market preferences.

It is worth noting that Ethereum Classic (ETC), as an early hard fork of Ethereum, has consistently underperformed ETH throughout its lifecycle. This can be seen as a signal that developer activity and community support play significant roles in the valuation of smart contract platforms. Despite having similar early histories, Ethereum has better met market demand through continuous development.

Fundamentals of Each Token (2025 Average):

From the fundamentals in 2025, although Solana has a clear performance advantage, the value locked in smart contracts (TVL) or existing in stablecoin form remains primarily concentrated in Ethereum, reflecting the power of network effects. Additionally, when compared to Solana, Ethereum's "user count/transaction count" ratio shows that Solana's average transaction frequency per user is significantly higher than that of Ethereum.

Financial Valuation (2025):

Due to strong scaling efforts, Ethereum has recently lagged behind Solana in total fees and token holder income. While this continues to bring strong user demand into the Ethereum ecosystem, the actual usage demand for Ethereum has not yet fully matched the effects of scaling. It is important to note that each public chain has different issuance and fee mechanisms, which can affect where value is captured and how it is distributed within the network.

For example, in Bitcoin, all fees are paid to miners; meanwhile, new issuance dilutes Bitcoin holders at a corresponding rate. For other networks that burn a portion of fees, the "fee reduction issuance" metric can be used to measure the scale of issuance dilution offset by fees.

Importantly, the security of proof-of-work (PoW) networks belongs to a continuously competitive market, typically requiring miners to sell a significant proportion of their issuance to cover costs; in contrast, maintaining security in proof-of-stake (PoS) networks often does not require the same level of ongoing costs. Therefore, the negative impact of inflation on price in PoS systems is usually not as severe as in PoW systems.

3. Scenario Analysis

(1) Optimistic Scenario

Smart contract platforms reshape many areas of society by enhancing global collaboration and trust. With continuous technological innovation, Ethereum remains the leading smart contract platform. A large number of users and enterprises prefer Ethereum for its decentralization, security, transparency, and reliability, and these characteristics have not come at the expense of user experience. On Layer 2 networks, transaction frequency is sufficiently high to keep per-transaction costs low; at the same time, cumulative effects create considerable value return/income for ETH holders.

(2) Benchmark Scenario

Smart contract platforms achieve improvements in specific sectors of financial and non-financial markets, operating as a counterbalance within traditional systems (primarily dominated by governments and large enterprises). A large number of users and enterprises benefit from a decentralized smart contract network. However, due to Ethereum's inherent financial attributes, its growth is slower than the typical adoption curve of technology. Although Ethereum continues to grow and eventually captures a certain share of its total addressable market (TAM), its integration into various sectors of society is slower than technologies like mobile phones or the internet. Ethereum remains the dominant smart contract platform, with reasonable prospects for value capture for investors. However, specialized competitors limit Ethereum's market share, causing it to focus more on use cases with the highest security and trust requirements.

(3) Pessimistic Scenario

Smart contract platforms exhibit cyclical fluctuations but fail to produce widely demanded products. Compared to distributed systems, centralized systems continue to iterate faster and provide higher utility to users. Most digital interactions do not prioritize decentralization, censorship resistance, or transparency. The growth of the Ethereum network is slow and unstable, making it difficult to attract a sufficient number of users, which is detrimental to value capture for ETH holders. Furthermore, in the few use cases that are indeed suitable for smart contract platforms, competitors may erode Ethereum's market share by offering a better user experience.

IX. Risks and Uncertainties

Like other digital assets, Ether (ETH) faces risks related to its investment attributes, the most frequently mentioned being its high volatility. ETH, like other digital assets, often experiences significant cyclical pullbacks, so investors should pay particular attention to the appropriateness of investment duration and position/weight settings when allocating.

In addition, compared to traditional financial markets, the regulatory environment for digital assets is relatively low, which means that related investments may lack investor protection and transparency. These risks may manifest as fraud or market manipulation; once they occur, investors often lack adequate legal remedies. For example, there is typically no deposit insurance or ongoing regulation of exchanges, which exposes investors to higher risks.

Regulatory bodies, including the SEC (U.S. Securities and Exchange Commission) and CFTC (U.S. Commodity Futures Trading Commission), are increasingly focusing on the digital asset market to address these issues. However, the regulatory landscape is still evolving, which brings both risks and opportunities. Investors should continuously monitor regulatory developments and fully assess potential risks when trading and investing in various digital assets.

The remainder of this section will focus on the unique/inherent risks associated with Ether (ETH), which may not apply to other digital assets.

1. Competitive Risk

Ethereum faces competitive risks from multiple blockchains. This risk may come from both existing public chains and newly emerging ones—as demonstrated by the rise of Solana in 2020. As blockchain technology gradually moves into the mainstream, competition will intensify, and the risk of being marginalized or eliminated will increase.

2. Technical Risk

The Ethereum community typically attempts to advance protocol upgrades on an annual basis. These upgrades bundle multiple EIPs and implement them all at once. Each upgrade alters the code that Ethereum runs on, introducing new technical risks that investors need to pay attention to. Since many investors cannot independently verify the correctness of these changes, such risks will persist for a period of time and will gradually decrease over time—consistent with the Lindy Effect (i.e., the longer a technology or institution survives, the longer its expected remaining lifespan).

3. Regulatory Risk

Ethereum crossed an important threshold in 2024 with the approval of Ether spot exchange-traded products (ETPs). This approval indicates that Ether (ETH) meets certain regulatory standards to some extent; however, it should be emphasized that future regulatory enforcement may still have a significant impact on the development of the Ethereum ecosystem. It is important to note that the overall application ecosystem on Ethereum still has room for further regulatory clarification, and financial institutions such as banks that provide fiat on- and off-ramps to the ecosystem also await clear applicable rules and compliance boundaries.

4. Governance Risk

The most direct impact of Ethereum's governance on the network is determining which parts need to be changed. Its community-driven governance process presents two commonly mentioned challenges.

First, any changes to Ethereum typically affect different stakeholders in various ways, making it difficult to reach consensus on certain issues, and sometimes even impossible. Compared to other networks with top-down governance structures that can advance more quickly, this structure has led to, and may continue to lead to, a relatively slower pace of development for Ethereum.

Second, one of the risks associated with Ethereum governance is referred to as "soft influence." This type of risk is difficult to quantify, and investors may find it challenging to assess accurately. It refers to the gradual change in community value orientations over the long term, which may benefit certain stakeholders while disadvantaging others. Such soft influences typically manifest gradually over a longer period, and any human-centered governance structure may carry this risk.

It is also important to note the potential "key person risk." Ethereum co-founder Vitalik Buterin remains actively involved in network research and is viewed by many as an opinion leader. This potentially gives him an outsized influence on the direction and consensus-building within the community.

Investors must understand that people are the ones deciding the direction of the network and continuously making decisions that affect its course. The prevailing view is that community-led governance is more likely to yield the best possible outcomes for the majority; however, it is nearly impossible for all stakeholders to benefit equally and be prioritized equally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。