🧐 Avantis: The Leading Perpetual DEX on Base, a Breakthrough with Zero Fees and RWA | Recent Activity Interpretation——

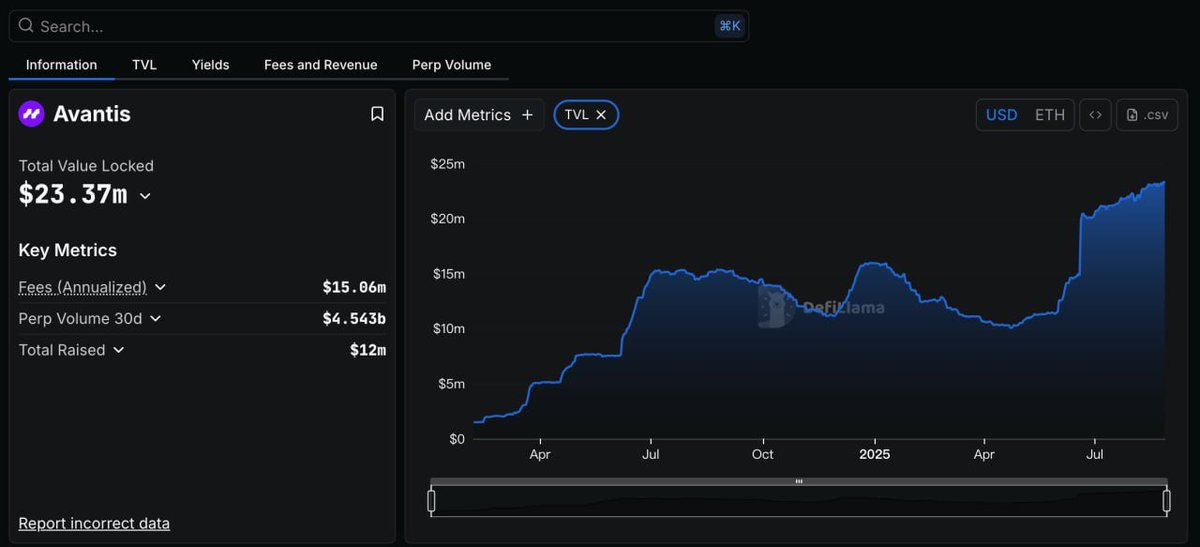

Recently, while browsing trading data on Base, I discovered an interesting perpetual protocol: Avantis @avantisfi.

I wonder if anyone has noticed that it is clearly not an ordinary DEX; rather, it resembles the "favorite child" of the Base ecosystem—

Avantis is backed by top VCs like Pantera Capital and Founders Fund, and even BASE itself, giving it a "halo effect." Base is an L2 launched by Coinbase, closely related to institutions like Pantera and Founders.

In addition to having a daily trading volume that has stabilized at the top, its biggest feature is: Zero Fee Perpetual Model (ZFP) 👇

1⃣ Opening a position incurs 0 fees / 0 funding rates; it offers up to 500x leverage, and in the forex market, it can go up to 1000x leverage.

2⃣ Profitable trades only require a low profit fee of 2.5%, and there are no fees for losing trades, which is simply paradise for high-frequency, hedging, and quantitative trading.

Moreover, there are many thoughtful mechanisms, such as: vAMM → zero slippage for large trades, reverse cashback → even in extreme market conditions, you can get back 20% of losses;

XP system → all interactions accumulate points, which may be linked to future airdrops.

Additionally, the asset range is very broad, which is quite rare—

In addition to 75+ cryptocurrencies, it also supports forex (including offshore RMB), gold, silver, and crude oil: essentially bringing RWA directly into DeFi, allowing for one-stop multi-asset allocation.

Base needs a leading player that can truly support the derivatives track:

Avantis's zero-fee model + RWA expansion just forms a differentiated advantage, meeting the ecosystem's need to expand its user base and attract TradFi funds.

In other words, its positioning naturally aligns with Base's development strategy, making it exactly the type of project that the officials want.

Today, Avantis just released the tokenomics for its ecosystem token $AVNT, which, from a design perspective, is the core that drives the flywheel—

Total supply: 1 billion tokens, fixed supply.

Community allocation accounts for as much as 50.1%, including:

12.5% airdropped to early users (traders, LPs, contributors since February 2024, snapshot yet to be announced);

28.6% for future XP seasons and on-chain incentives (trading, liquidity, referrals, community contributions);

9% for the ecosystem fund, supporting SDKs, AI trading assistants, Telegram trading bots, and other applications.

👉 Core Value:

1) Staking → $AVNT can be staked in the Security Module, providing a safety net for LPs; stakers receive rewards, up to 50% fee discounts, and XP boosts.

2) Community Incentives → Long-term rewards for traders, LPs, and referrers, creating a positive flywheel.

3) Governance → Token holders can decide on new asset listings, fee structure adjustments, cross-chain expansions, etc.

In simple terms, $AVNT is not just an incentive token but a core asset that binds security—incentives—governance in a triple function.

✅ Additionally, I noticed that Avantis recently launched a competitive arena event with a total prize pool of 150,000 $OP tokens, which I recommend keeping an eye on!——

Event Duration: August 19, 2025 – September 16, 2025, all participants can trade any cryptocurrency or real-world assets (RWAs) with no minimum requirements.

Prize Pool Distribution: Total of 150,000 $OP; the prize pool for the first week is 15,000 $OP, increasing weekly thereafter.

Scoring Rules: Competition scores are based on trading fees + profit and loss (PnL); the more you trade and the higher your profits, the more points and rewards you can earn.

Since the points calculation is directly linked to fees and profits, if you are only aiming for the small prize pool in the first week, it may not be worth it, as sufficient trading volume is needed to offset costs.

A more reasonable approach is: trade casually + participate long-term, treating the event as an extra reward rather than solely grinding for rewards.

Entry: https://avantisfi.com/predators

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。