Is the Bull Market Over?

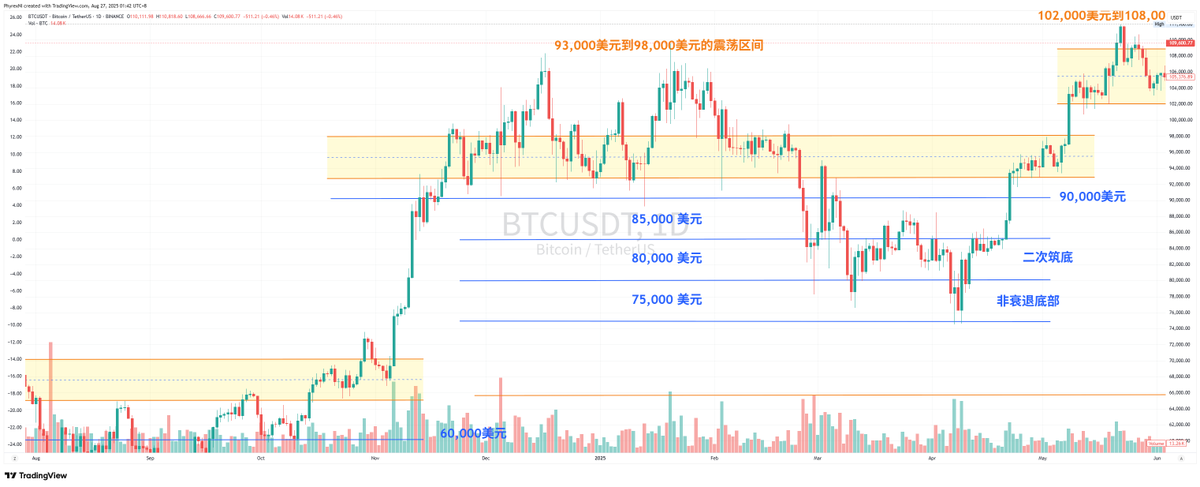

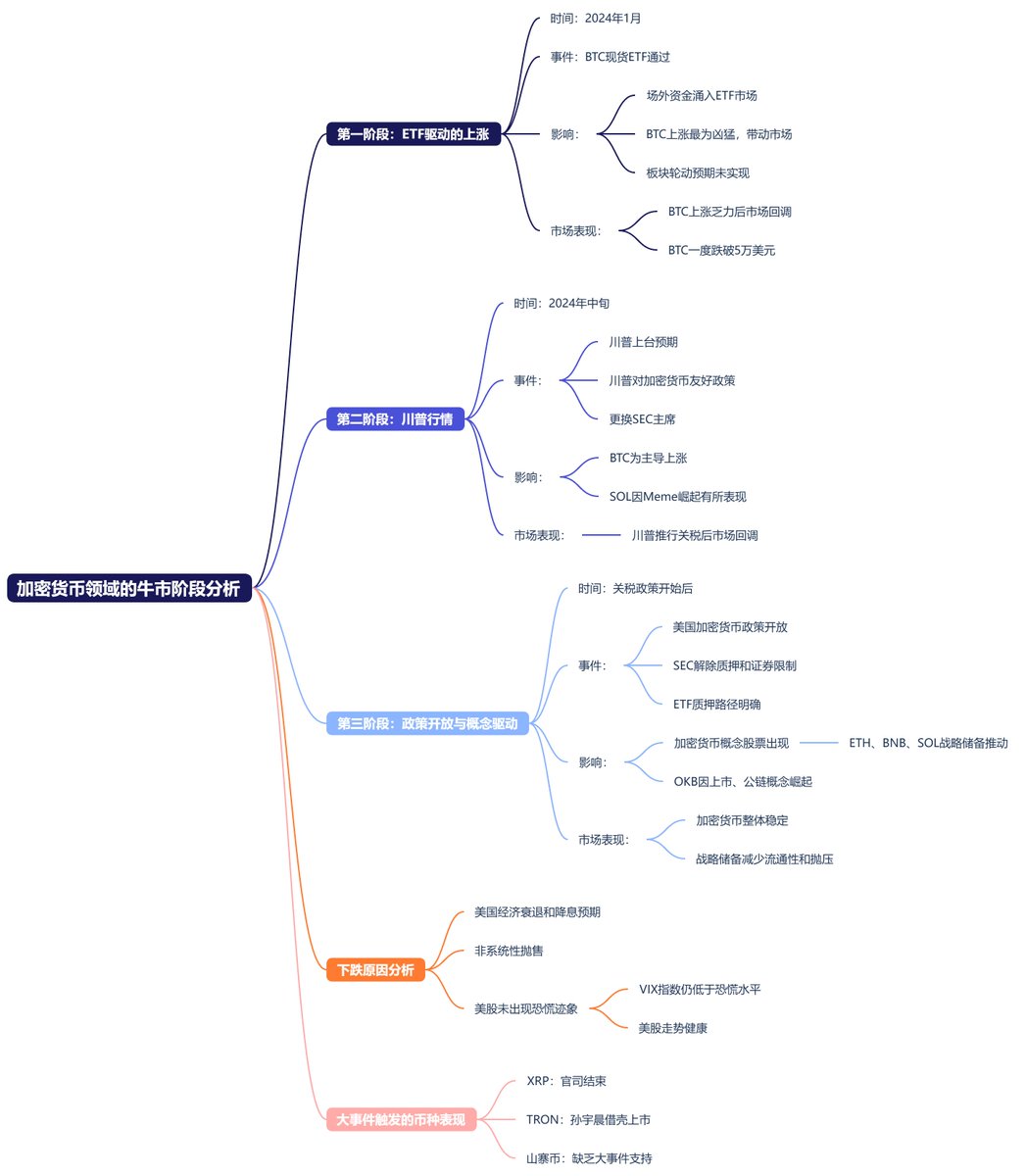

From the beginning of 2024 to now, there have been three phases of upward movement. The first phase was driven by the approval of the $BTC spot ETF, which led to a significant influx of off-exchange funds buying Bitcoin in the primary and secondary markets after its approval in January 2024, propelling BTC's rise.

However, since only BTC had additional sources of funds, it experienced the most vigorous increase. There was an expectation that BTC's rise would lead to sector rotation, but in reality, after BTC began to lose momentum around mid-2024, the overall market fell into a correction, with BTC even briefly dropping below $50,000.

The second phase began due to expectations surrounding Trump's presidency, as well as his friendly stance towards cryptocurrencies and BTC as a strategic reserve, along with changes in the SEC chair, which led to a wave of bullish sentiment known as the Trump rally, primarily affecting BTC.

The narrative mainly revolved around BTC, while other cryptocurrencies like $ETH and $BNB did not see significant gains. Only $SOL experienced some growth due to the rise of memes, but as Trump began to push tariffs, the market entered another correction.

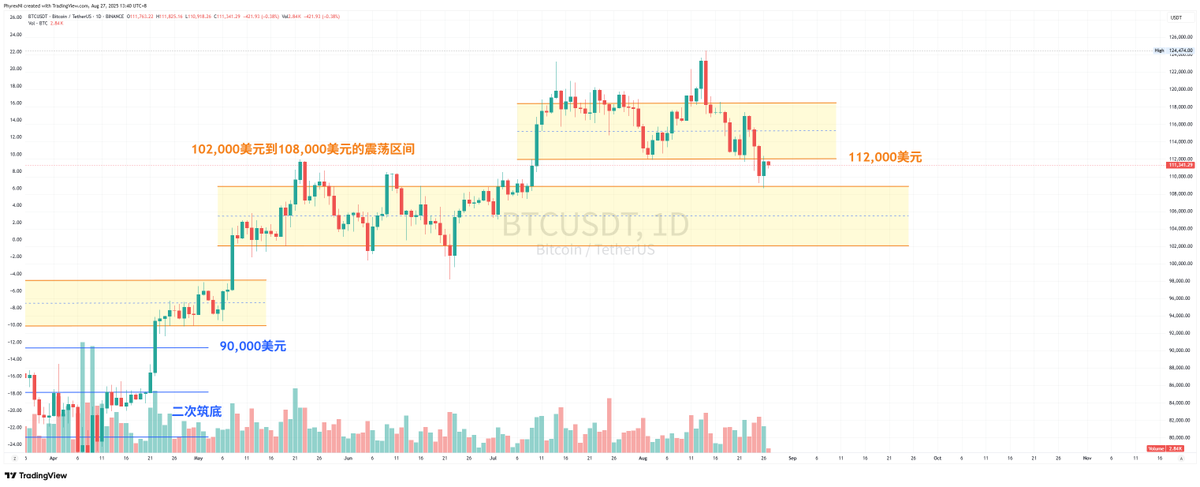

The third phase occurred when U.S. tariffs were not as aggressive as expected. During this time, BTC remained the main focus, but with the U.S. adopting a more open policy towards cryptocurrencies, the SEC clarified the separation of staking and securities, as well as the path for ETF staking. This led to a batch of stocks related to cryptocurrency concepts, using certain cryptocurrencies as strategic reserves to boost their stock prices.

The first to benefit were ETH, BNB, and SOL. Although there were voices advocating for strategic reserves for other cryptocurrencies, they had not yet formed a scale. Then there were listings, burnings, and the public chain concept of OKB, which also emerged strongly.

Currently, although the overall cryptocurrency market has seen a correction in the past two weeks, BTC, ETH, BNB, SOL, and even OKB still show relatively high stability. Moreover, among these four cryptocurrencies, companies holding strategic reserves do not have any selling expectations for now, which reduces liquidity in the market and alleviates selling pressure.

From the perspective of the three phases, there has been no significant breakdown. For instance, there have been no signs of large-scale selling of ETFs, and strategic reserves have not been liquidated; the selling has mostly come from spot investors.

The reasons for the decline have been discussed, stemming from pessimistic expectations regarding a rate cut in September and a potential economic recession in the U.S., suggesting that this selling may not be systemic. Additionally, from the perspective of the U.S. stock market, there has not been a large-scale downturn.

Even now, the U.S. stock market is only maintaining small-scale fluctuations and has not experienced the significant drop seen last week. Therefore, for U.S. stock investors, there are no signs of increased pessimism; rather, the U.S. stock market remains relatively healthy. The VIX is around 15, still far from the panic index of 30.

We have previously elaborated on the high correlation between the U.S. stock market and Bitcoin. As long as the U.S. stock market does not show signs of panic, BTC is likely to remain stable. The first three phases of the overall cryptocurrency bull market have already demonstrated the reasons for the rises of BTC, ETH, BNB, SOL, and OKB.

In addition to these, XRP has ended its lawsuit with the SEC, and TRON has performed well due to Justin Sun's reverse merger, both of which are largely triggered by major events. Most altcoins do not possess such capabilities.

Therefore, the cryptocurrency market has not entered a comprehensive bull market since the beginning of 2024. If one must categorize it, it should be seen as a non-typical bull market primarily belonging to compliant cryptocurrencies. Within this scope, cryptocurrencies like BTC and ETH still have good external funding support. Even on Monday, despite a significant drop, buyers of the spot ETF remained very enthusiastic.

BNB and SOL are expected to have strategic reserves, while OKB has expectations of listings and public chains, backed by top-ranking exchanges, all of which still have the potential to maintain upward momentum. As for other cryptocurrencies, or most altcoins, they likely have never entered a systemic bull market.

In summary, compliant cryptocurrencies like BTC and ETH, which exhibit high stability or rapid funding, still have the potential for continued rebounds. Additionally, BNB and SOL, which have opportunities in the coin-stock concept, are unlikely to enter a bear market. In contrast, other tokens that neither attract significant funding nor have sudden eye-catching events may find it quite challenging.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。