Original | Odaily Planet Daily (@OdailyChina)

This column aims to cover low-risk yield strategies primarily based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risks can never be completely eliminated), to help users who wish to gradually increase their capital through U-based financial management find more ideal earning opportunities.

Past Records

Lazy Financial Management Guide | Katana, Agora double benefits; Huma 2.0 reopens (July 16);

New Opportunities

Binance Plasma USDT Deposit Activity

Binance opened the last phase of the Plasma USDT deposit activity with a quota of $500 million yesterday, and the deposit limit per account has been reduced to 10,000 USDT. There is still a certain amount available in this activity, and interested users may consider depositing.

To calculate the yield simply, this activity will provide a total of 1% (100 million tokens) of XPL tokens as incentives. The current pre-market price of XPL on Binance is reported at $0.5681, corresponding to a prize pool size of about $5,681. Based on a total deposit limit of $1 billion, the rough annualized yield during the deposit period (60 days) is about 36.5% (including a 2% basic yield on USDT) — as long as the price of XPL does not drop significantly, the yield is still quite attractive.

USD.AI Receives Investment from YZi Labs Again, Pendle Earns + Points Double Benefits

In the last issue, we mentioned the stablecoin protocol USD.AI that provides credit for AI, which has completed a $13 million financing led by Framework Ventures, with participation from Bullish, Dragonfly, Arbitrum, and others.

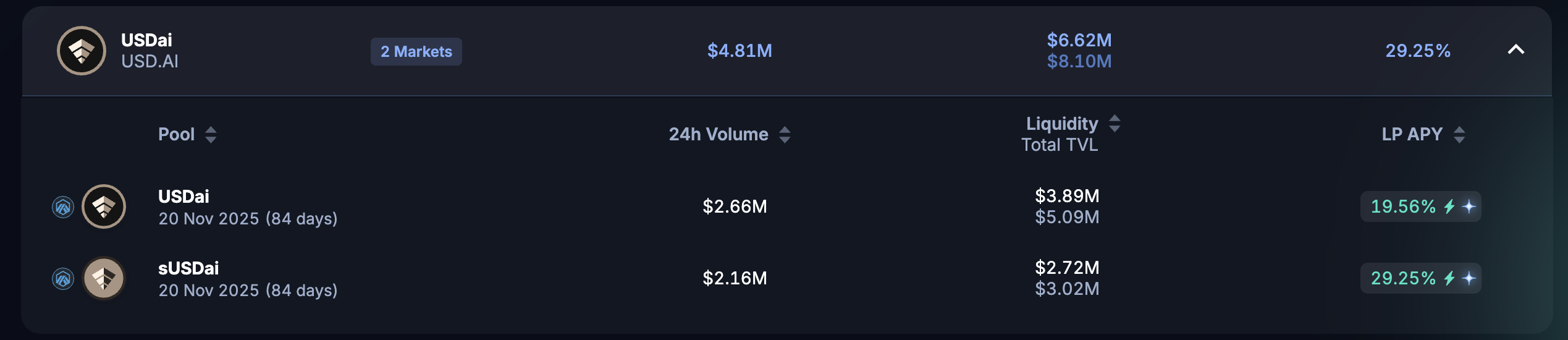

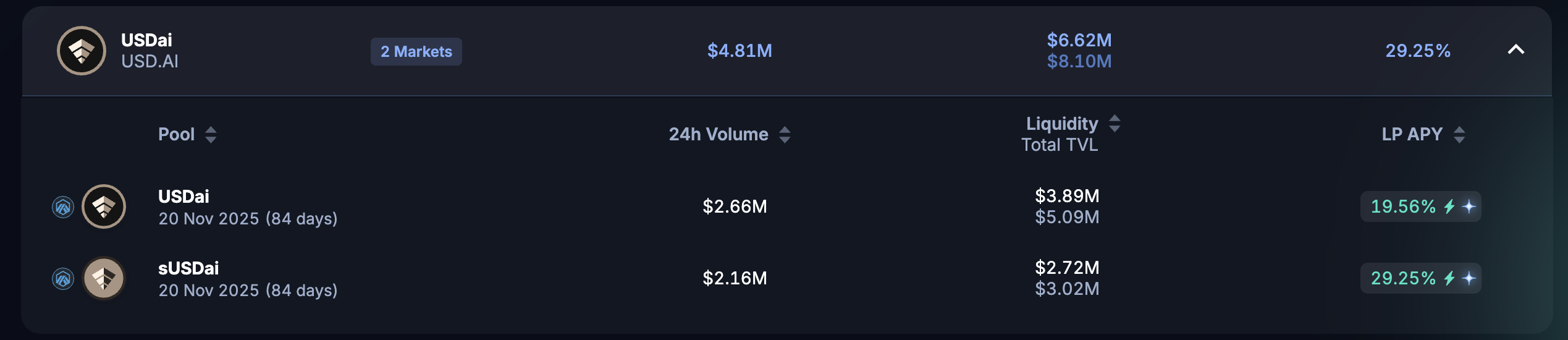

Last week, USD.AI officially launched on Arbitrum, allowing users to exchange USDC for USDai, or to stake it again as sUSDai (APY 7.38%). Additionally, USD.AI completed integration with Pendle at the launch, currently, providing liquidity in the Pendle USDai pool can earn up to 19.56% APY (base APY 15.78%) and 25 times points rewards; providing liquidity in the Pendle sUSDai pool can earn up to 29.25% APY (base APY 23.19%) and 12 times points rewards.

Earlier today, USD.AI announced again that it has received investment from YZi Labs. Although the amount was not disclosed, it is expected to bring more attention to the protocol. Currently, USD.AI has a TVL limit of $100 million, with $72.41 million already deposited, so users interested in depositing may need to act quickly.

Cap Officially Launches

On August 19, the yield-generating stablecoin Cap, which raised $11 million, announced its official launch. Users can now deposit USDC on the Ethereum mainnet to exchange for cUSD to start accumulating protocol points (caps); or stake cUSD as stcUSD to earn 12.75% yield — in short, if you want to earn without points, you can't earn; if you want points, you can't earn. However, given that the protocol has just launched, holding cUSD currently offers a 20 times points increase, and the points have not yet been overly diluted, so storing points may be a better strategy.

For an analysis of Cap's mechanism, see "How does Cap build a 'self-sustaining' stablecoin?." In summary, in the current competitive landscape of stablecoins, Cap's unique yield and risk distribution mechanism is quite innovative and is expected to become a dark horse in this field.

Euler Finance Launches EulerEarn

Euler Finance today announced the launch of the simple yield product EulerEarn, where users only need to make a one-time deposit to obtain various advanced strategy yields managed by Euler DAO. Euler Finance will also provide $50,000 USDC as a short-term incentive.

Currently, the deposit APY for EulerEarn is reported at 11.71%, which is not too high, but it is simple and convenient.

Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azumaeth_)

This column aims to cover low-risk yield strategies primarily based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risks can never be completely eliminated), to help users who wish to gradually increase their capital through U-based financial management find more ideal earning opportunities.

Past Records

Lazy Financial Management Guide | Katana, Agora double benefits; Huma 2.0 reopens (July 16);

New Opportunities

Binance Plasma USDT Deposit Activity

Binance opened the last phase of the Plasma USDT deposit activity with a quota of $500 million yesterday, and the deposit limit per account has been reduced to 10,000 USDT. There is still a certain amount available in this activity, and interested users may consider depositing.

To calculate the yield simply, this activity will provide a total of 1% (100 million tokens) of XPL tokens as incentives. The current pre-market price of XPL on Binance is reported at $0.5681, corresponding to a prize pool size of about $5,681. Based on a total deposit limit of $1 billion, the rough annualized yield during the deposit period (60 days) is about 36.5% (including a 2% basic yield on USDT) — as long as the price of XPL does not drop significantly, the yield is still quite attractive.

Last week, USD.AI officially launched on Arbitrum, allowing users to exchange USDC for USDai, or to stake it again as sUSDai (APY 7.38%). Additionally, USD.AI completed integration with Pendle at the launch, currently, providing liquidity in the Pendle USDai pool can earn up to 19.56% APY (base APY 15.78%) and 25 times points rewards; providing liquidity in the Pendle sUSDai pool can earn up to 29.25% APY (base APY 23.19%) and 12 times points rewards.

Earlier today, USD.AI announced again that it has received investment from YZi Labs. Although the amount was not disclosed, it is expected to bring more attention to the protocol. Currently, USD.AI has a TVL limit of $100 million, with $72.41 million already deposited, so users interested in depositing may need to act quickly.

Cap Officially Launches

On August 19, the yield-generating stablecoin Cap, which raised $11 million, announced its official launch. Users can now deposit USDC on the Ethereum mainnet to exchange for cUSD to start accumulating protocol points (caps); or stake cUSD as stcUSD to earn 12.75% yield — in short, if you want to earn without points, you can't earn; if you want points, you can't earn. However, given that the protocol has just launched, holding cUSD currently offers a 20 times points increase, and the points have not yet been overly diluted, so storing points may be a better strategy.

For an analysis of Cap's mechanism, see "How does Cap build a 'self-sustaining' stablecoin?." In summary, in the current competitive landscape of stablecoins, Cap's unique yield and risk distribution mechanism is quite innovative and is expected to become a dark horse in this field.

Euler Finance Launches EulerEarn

Euler Finance today announced the launch of the simple yield product EulerEarn, where users only need to make a one-time deposit to obtain various advanced strategy yields managed by Euler DAO. Euler Finance will also provide $50,000 USDC as a short-term incentive.

Currently, the deposit APY for EulerEarn is reported at 11.71%, which is not too high, but it is simple and convenient.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。