Written by: Luke, Mars Finance

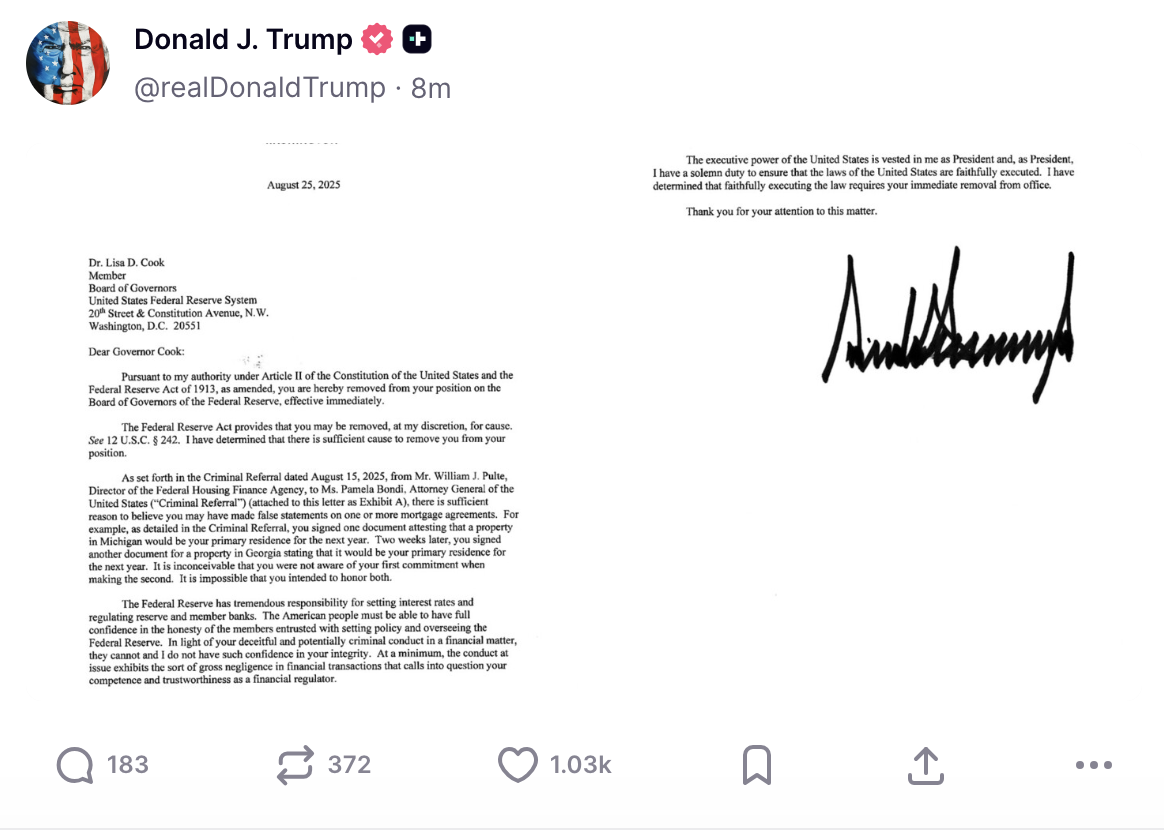

On Tuesday evening, a social media post shattered a political consensus in Washington that had lasted for over a century. U.S. President Donald Trump, in his characteristic dramatic fashion, announced an unprecedented decision: the immediate dismissal of Federal Reserve Governor Lisa Cook.

As the news broke, global financial markets reacted swiftly. On Wall Street, U.S. stock futures turned downward, while gold rose as a safe-haven asset. The market's response was not merely to a simple personnel change, but stemmed from a deeper fear: this was not a whimsical political revenge, but the first step in a systematic plan aimed at fundamentally reshaping the U.S. central bank—a formal initiation of a clear "three-step" roadmap.

The goal of this plan is singular: to completely dismantle the independence of the Federal Reserve and firmly place the power to decide U.S. dollar interest rates in the hands of the White House.

Step One: Seize the Board—Starting with Cook's Removal

The first and most critical step of the plan is to gain stable majority control within the seven-member Federal Reserve Board.

The Federal Reserve Board is the power core of the entire Federal Reserve system, and Trump's strategy has long been in motion. During his current term, he has successfully appointed two governors. Recently, with the early resignation of Adriana Kugler, a governor appointed by former President Biden, Trump quickly nominated his economic advisor Stephen Miran to fill this third seat.

At this point, Trump is just one step away from controlling the Board. The removal of Lisa Cook is aimed at freeing up this crucial fourth seat. Once successful, Trump will be able to appoint four of his own people, achieving a majority in the seven-member Board, thereby theoretically controlling all major decisions of the Federal Reserve.

Of course, executing this step is fraught with legal risks. Trump's justification for Cook's dismissal—allegations of fraud in her mortgage application prior to joining the Federal Reserve—has been widely viewed as a political excuse. Cook has swiftly filed a lawsuit, and a legal battle over the ambiguous interpretation of the "for cause removal" clause in the Federal Reserve Act is now inevitable. This lawsuit is likely to reach the Supreme Court, whose ruling will define the boundaries of presidential power in the future. However, in Trump's script, initiating this legal battle is itself a necessary path to achieving the first step's goal.

Step Two: Conquer the FOMC—A Power Extension from the Ground Up

Once the first step is completed, controlling the Federal Reserve Board, Trump's plan will quickly move into the second phase: indirectly controlling the Federal Open Market Committee (FOMC), which truly determines the direction of interest rates, through the Board.

The FOMC is the decision-making body most closely watched by global financial markets, composed of 7 Federal Reserve governors and 5 regional Federal Reserve bank presidents, totaling 12 voting seats. On the surface, even if all 7 governors are controlled, it may not be possible to fully dominate the FOMC. However, Nick Timiraos, a reporter for the "New Federal Reserve News Agency" and the Wall Street Journal, has revealed Trump's deeper strategy.

According to the law, the presidents of the 12 regional Federal Reserve banks are appointed by their respective boards, but ultimately require approval from the Federal Reserve Board in Washington. Timiraos analyzed that if Trump successfully controls the Board before March next year, his "majority" could refuse to reappoint those regional Federal Reserve bank presidents whose terms are expiring and who do not align with White House policies.

This is a power extension from the ground up. By vetoing the appointments of regional Federal Reserve bank presidents, a Board controlled by Trump could gradually "cleanse" independent voices from the FOMC, ensuring that the White House's will can flow smoothly in interest rate decision meetings. This would completely break the key firewall that has protected the Federal Reserve's independence since its establishment in 1913.

Step Three: Implement New Policies—Creating a "Rate-Cutting Majority"

After completing the first two steps of the power layout, the final goal of the plan will naturally follow: to make the Federal Reserve's monetary policy fully serve its political agenda, creating a steadfast "rate-cutting majority."

Trump's policy preferences have never been hidden. He has bluntly stated in cabinet meetings: "The interest rates people are paying now are too high. That’s our only problem." He desires a Federal Reserve that can significantly lower interest rates to stimulate economic growth, boost the real estate market, and create a prosperous economic backdrop for his political agenda.

A fully controlled Federal Reserve will become the most powerful tool for the president to implement his economic policies. At that point, interest rate decisions will no longer primarily depend on economic data such as inflation and employment, but will increasingly consider the short-term political needs of the White House.

Historical Warnings and the "Echo" in the Crypto World

The interconnected plan by Trump has triggered immense panic because it touches on one of the core principles of modern economics: the independence of central banks. History has repeatedly sounded the alarm, from the inflation crisis in the U.S. caused by Nixon's pressure on the Federal Reserve in the 1970s to the currency crises in countries like Turkey and Argentina due to the loss of central bank independence, the lessons are painful.

This power struggle occurring in 2025 is causing profound "echoes" in the crypto world. Since its inception, one of Bitcoin's core narratives has been a hedge against distrust in centralized financial systems. When Satoshi Nakamoto embedded headlines about banks on the brink of collapse in the genesis block, it set the tone for its opposition to fragile centralized institutions.

Now, as the "guardian" of the world's reserve currency—the Federal Reserve—faces an open challenge to its independence, Bitcoin's value proposition becomes particularly prominent. Supporters of the crypto world believe that when monetary policy can be altered at any time due to a president's political needs, an asset defined by code, with a fixed issuance rhythm, and not controlled by anyone, will see its appeal grow exponentially.

Moreover, it is noteworthy that Trump's reshaping of financial regulatory agencies is not an isolated case. While the Cook incident was unfolding, the U.S. Commodity Futures Trading Commission (CFTC) was experiencing a wave of high-level departures, and Trump has been working to bring pro-cryptocurrency Republican leaders into his administration. Regardless of the original intent, this series of actions has objectively created a more favorable regulatory expectation for the crypto industry, while further highlighting the uncertainties of the traditional financial system.

Regardless of the final outcome, this storm has already damaged the credibility of the U.S. dollar and the American financial system. In an era of global multipolarity and rapid technological change, every shock to the stability of the traditional financial system may objectively drive people to explore new possibilities. As the Wall Street Journal warns, this country will ultimately regret it. For the rising world of digital assets, this may be a moment to prove its value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。