Today I ran to the hospital again, and I have to go out tomorrow. I hope that after this round, I can return to a normal update state. Today's assignment is not difficult to write; it's actually simpler than yesterday's because the US stock market has made a good statement. Today, the US stock market rebounded slightly. Although it hasn't recovered the decline from yesterday, it indicates a different state compared to last week. Investors in the US stock market are not as overly concerned about the interest rate cut in September and the economy as they were last week.

The focus of the market today is Trump's dismissal of Federal Reserve Governor Cook. As analyzed during the day, Trump surely knows that the so-called presidential order has no direct effect on Cook, but the pressure he exerts is aimed at the Federal Reserve, essentially telling the other governors that if you do not support an interest rate cut, it would be best not to have any dirt on you that I can use against you.

There is also a good saying that Cook's departure might have been due to something discovered by Trump's team, leading to an agreement. It's hard to say for sure. After nearly a day of fermentation, it can be seen that American investors have not shown significant concern about the independence of the Federal Reserve. After all, it has been proven that Trump indeed does not have the ability to dismiss Federal Reserve governors without reason. However, if certain governors have something to hide, they could easily find themselves in a passive situation.

In a speech later, Trump also addressed this issue and publicly stated that his faction's seats in the Federal Reserve would increase. With the first and second, who can guarantee there won't be a third and fourth? Currently, Trump's supporters are Bowman, Waller, and Milan, but Milan has not yet taken office and is still waiting for Senate approval. It is uncertain whether he can make it to the September interest rate meeting.

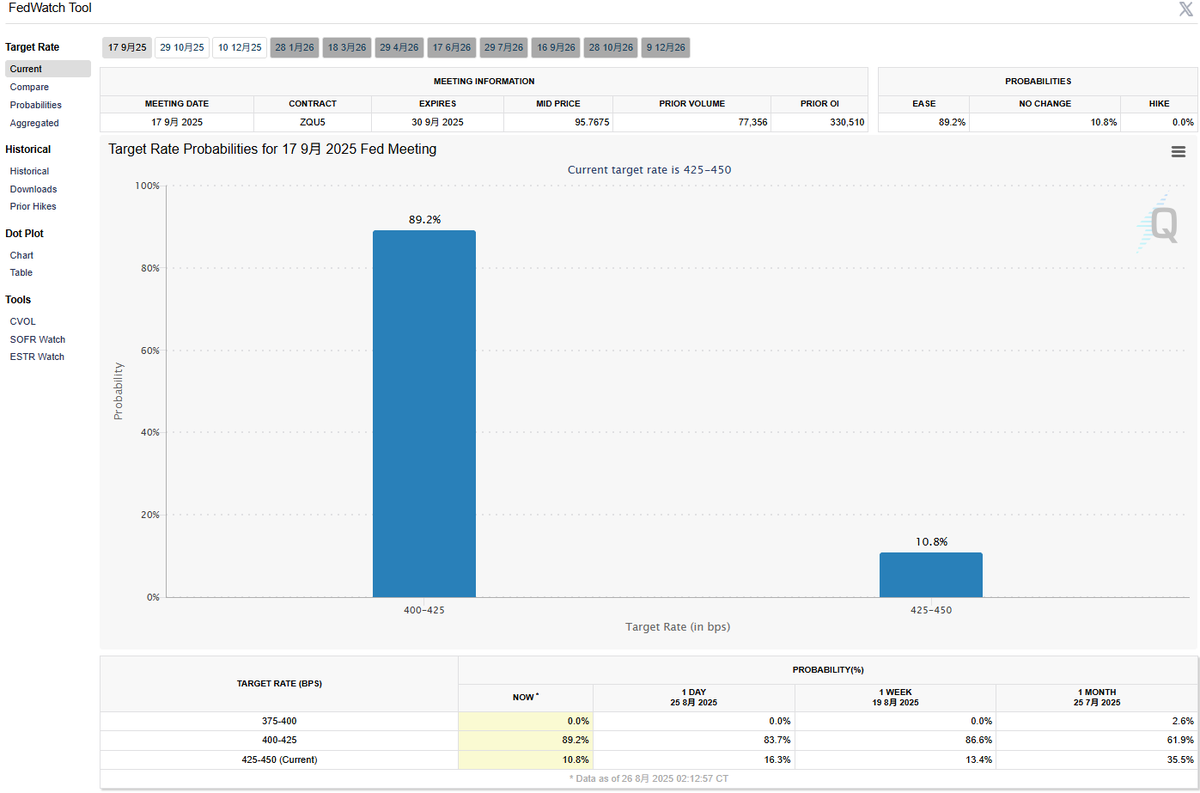

Trump's urgent action against Cook might indeed stem from concerns that there may not be an interest rate cut in September, hoping to exert pressure on the Federal Reserve through such means.

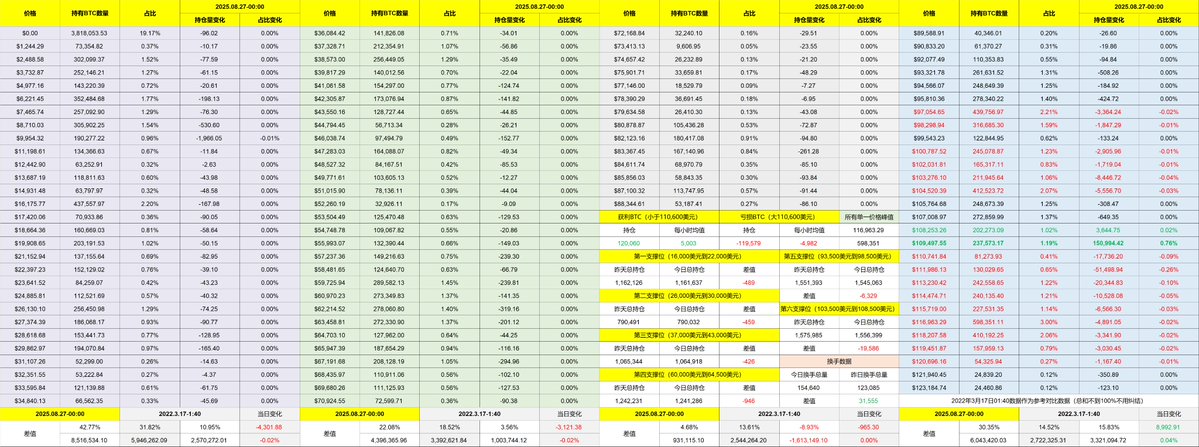

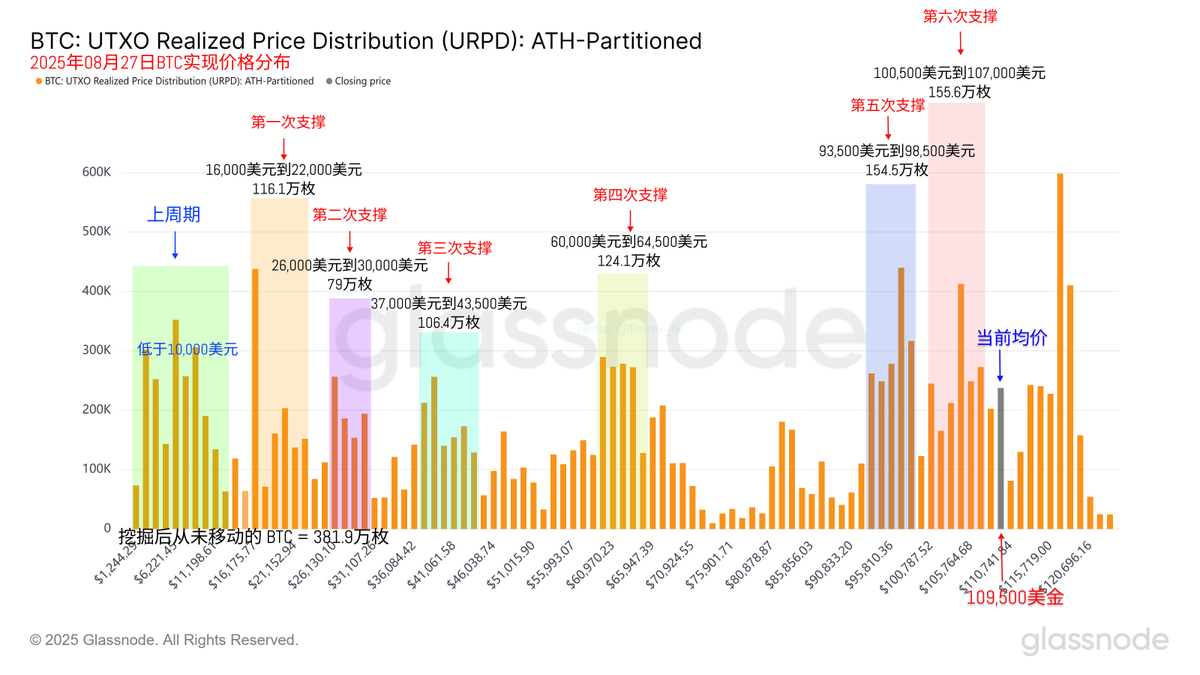

Looking back at Bitcoin's data, today's turnover rate continues to increase, mainly due to the drop in $BTC prices triggering panic among some investors. It is evident that not only have investors who bought the dip in the last two days shown signs of cutting losses, but even those holding positions under $100,000 are showing a trend of exiting, possibly out of fear of further declines in BTC.

From my personal perspective, this drop, like last week, is due to concerns about the interest rate cut in September and the potential economic recession in the US. There have been no new negative factors, so the difference between last week's bottom and this week should not be significant. Although it briefly broke below $110,000, the support at this price level is still quite evident.

Furthermore, the next support level is at $108,000, which is even stronger. Unless new negative factors emerge, I believe the probability of breaking this support level is low.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。