Original | Odaily Planet Daily (@OdailyChina)

In the early hours of August 25, the price of Ethereum broke through $4,900, setting a new historical high. However, the celebration among ETH holders was ruthlessly interrupted by a downward spike in Bitcoin's price. Bitcoin's price briefly fell below $111,000, with a 24-hour decline of 4.3%, dragging the entire market into a brief panic. In contrast, while Ethereum and Solana also faced pressure, their daily declines were kept around 5%, demonstrating relative resilience and capital support.

According to analysis by @CryptoDJ 04, the trigger for Bitcoin's rapid decline originated from an address marked as HTX Origin: Hot Wallet: this address concentratedly sold 24,110 Bitcoins through Hyperliquid, totaling approximately $2.6 billion. While selling Bitcoin, another associated account bought 416,598 ETH, worth $2 billion, and simultaneously went long on 135,263 ETH. Moreover, while aggressively buying ETH, it gradually closed its long positions in ETH. In other words, the operator almost simultaneously completed an "extreme swap" operation: heavily selling BTC while fully betting on ETH.

The identity of this operator remains a mystery. According to on-chain tracking by institutions like Arkham, this wallet was previously linked to an old deposit address of HTX (Huobi), but the true owner remains anonymous. Speculations include Sun Yuchen and his associates, assets judicially disposed of by Chinese authorities, or an early Bitcoin holder from China. However, given the aggressive nature of the operations, it is more aligned with funds related to Sun Yuchen or strategic swaps by early Bitcoin whales, rather than a simple "judicial auction" scenario.

More notably, in the past week, several Bitcoin whales have almost simultaneously shifted their chips towards Ethereum, subtly forming a "swap tide" in the market.

- [Ancient Bitcoin Whales]: Sold 19,663 BTC through two entities, cashing out approximately $2.22 billion, and exchanged for 455,672 ETH. Of these, about 279,000 ETH, worth $1.13 billion, have been staked. This whale still holds BTC on HyperLiquid and plans to continue exchanging for ETH, holding 176,616 ETH on-chain, valued at approximately $832 million.

- [Sleeping Whale for Seven Years]: An OG address that received 100,784 BTC seven years ago recently ended its dormancy. On August 22, it sold BTC while purchasing 62,914 ETH in spot and establishing a long position of 135,265 ETH. Currently, this address has taken profits on part of its ETH long positions and staked 269,485 ETH, worth $1.25 billion, to the ETH 2 Beacon Chain on the evening of the 25th. This staking amount directly surpassed the ETH holdings of the top 4 Ethereum foundations (231,000 ETH), reducing the difference between the exit and entry queues of the Ethereum PoS network to 260,000 ETH.

- [Another Early Bitcoin Holder (Bitcoin OG)] transferred 6,000 Bitcoins (approximately $689.5 million) to purchase Ethereum. This address has now accumulated 278,490 ETH (approximately $1.28 billion), with an average purchase price of $4,585, while holding a long position of 135,265 ETH (approximately $581 million).

These are just some of the cases tracked on-chain; more swapping behaviors are quietly unfolding behind the K-line. The collective exit of whales essentially reveals a structural change in the flow of funds: the long-term holding logic of Bitcoin is being re-evaluated, while the asset allocation value of Ethereum is being re-priced.

Data Perspective: The Rise of Ethereum and the Weakness of Bitcoin

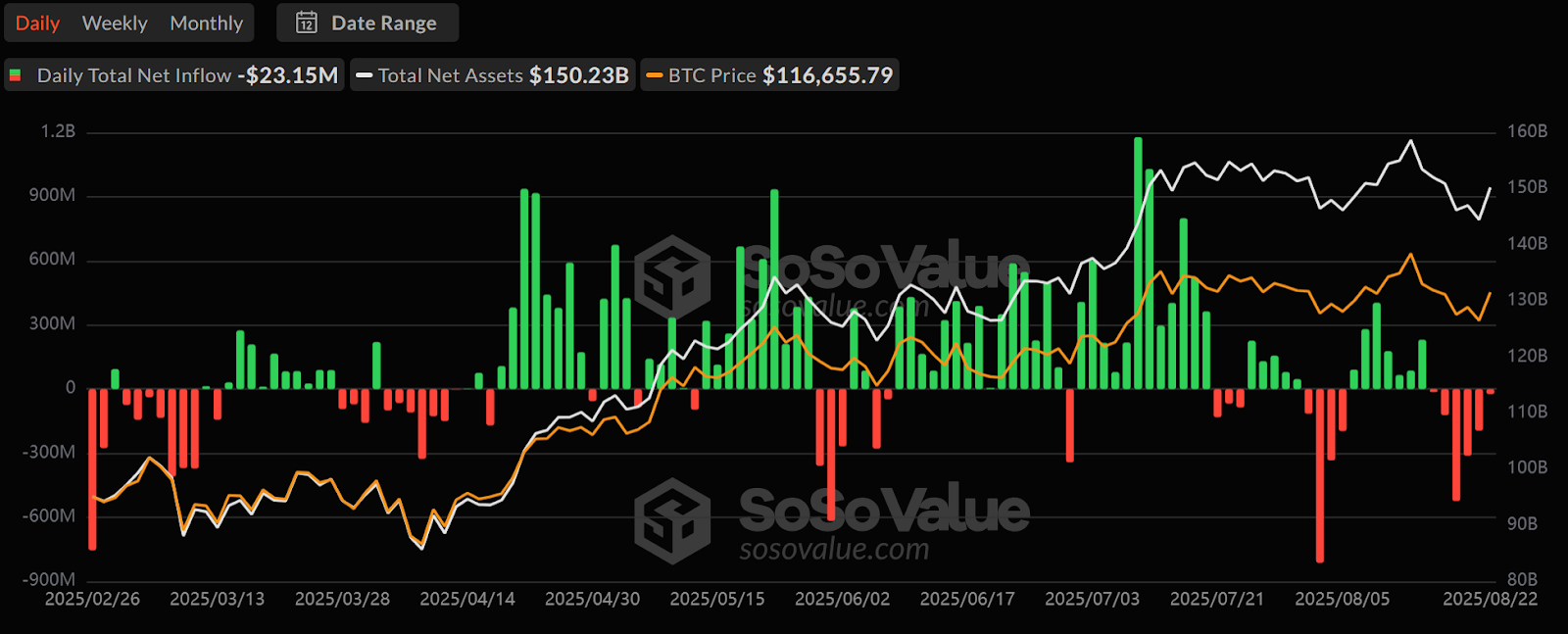

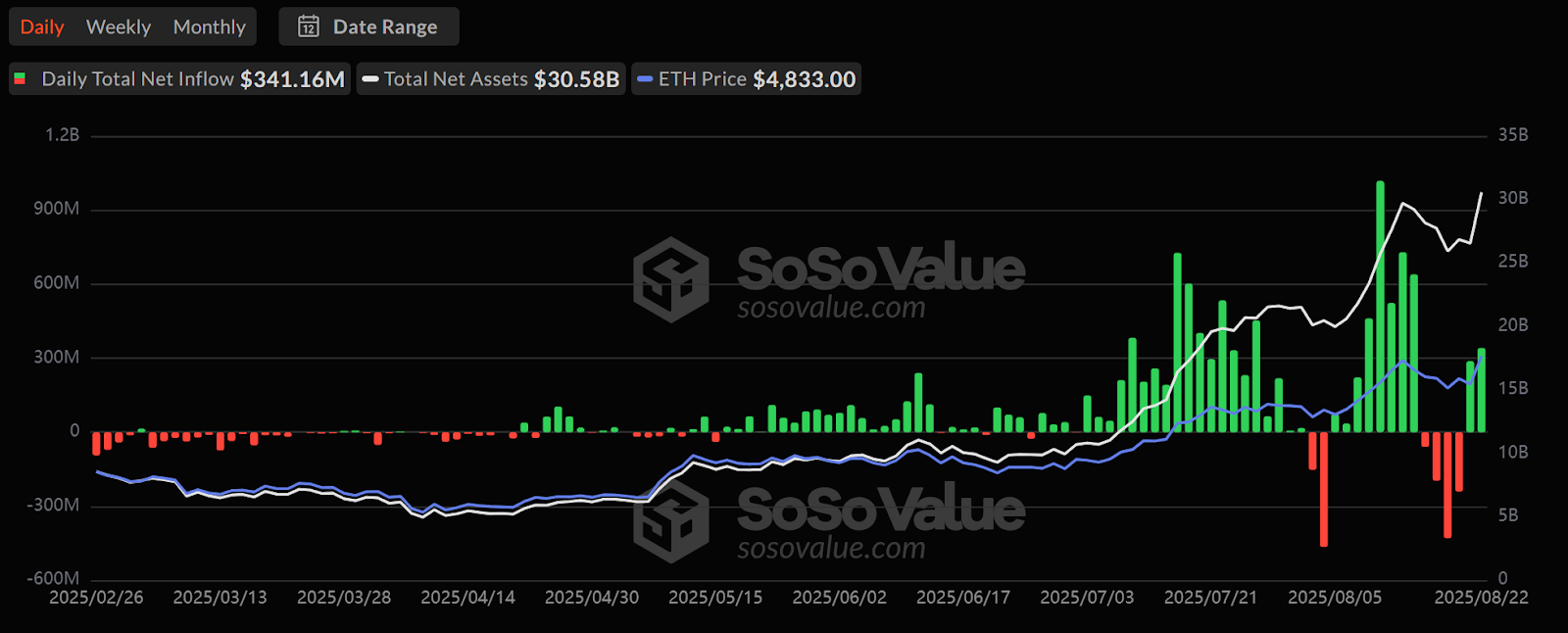

Spot ETFs are an important barometer of market sentiment in this cycle. Over the past month, inflows into Bitcoin spot ETFs have shown signs of fatigue, with a recent six-day streak of net outflows, significantly cooling market enthusiasm. In stark contrast, Ethereum spot ETFs have performed exceptionally well, with continuous large-scale inflows, becoming the "new darling" of the market.

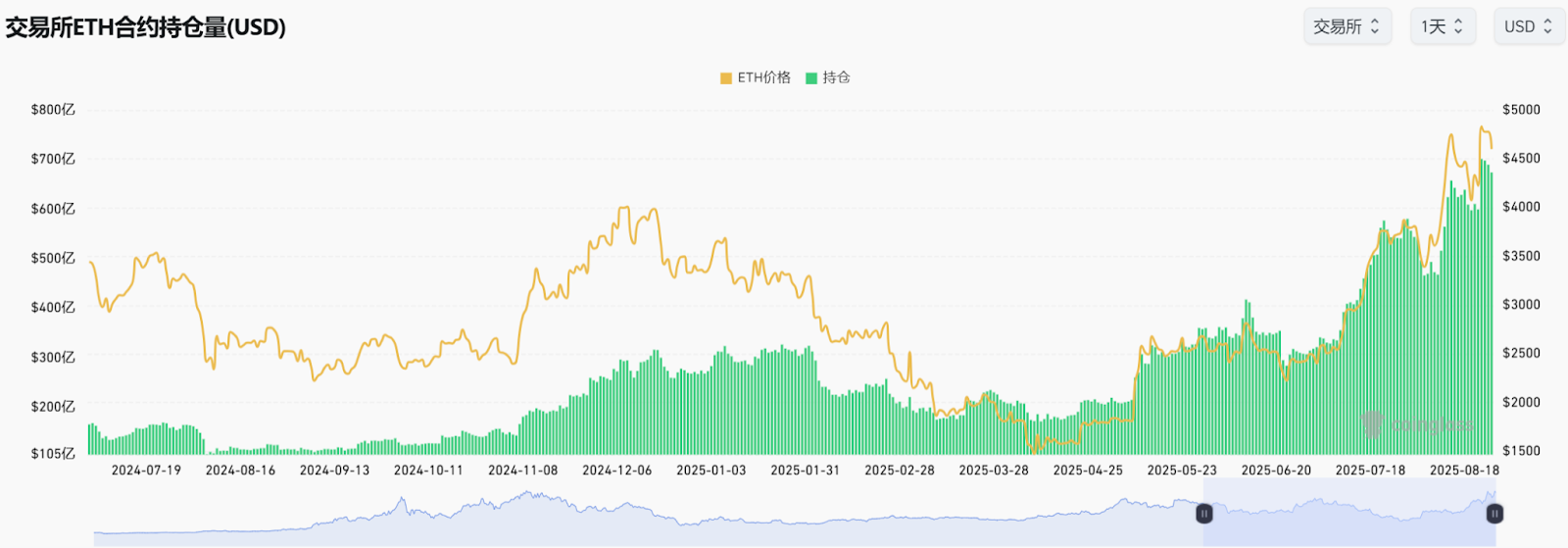

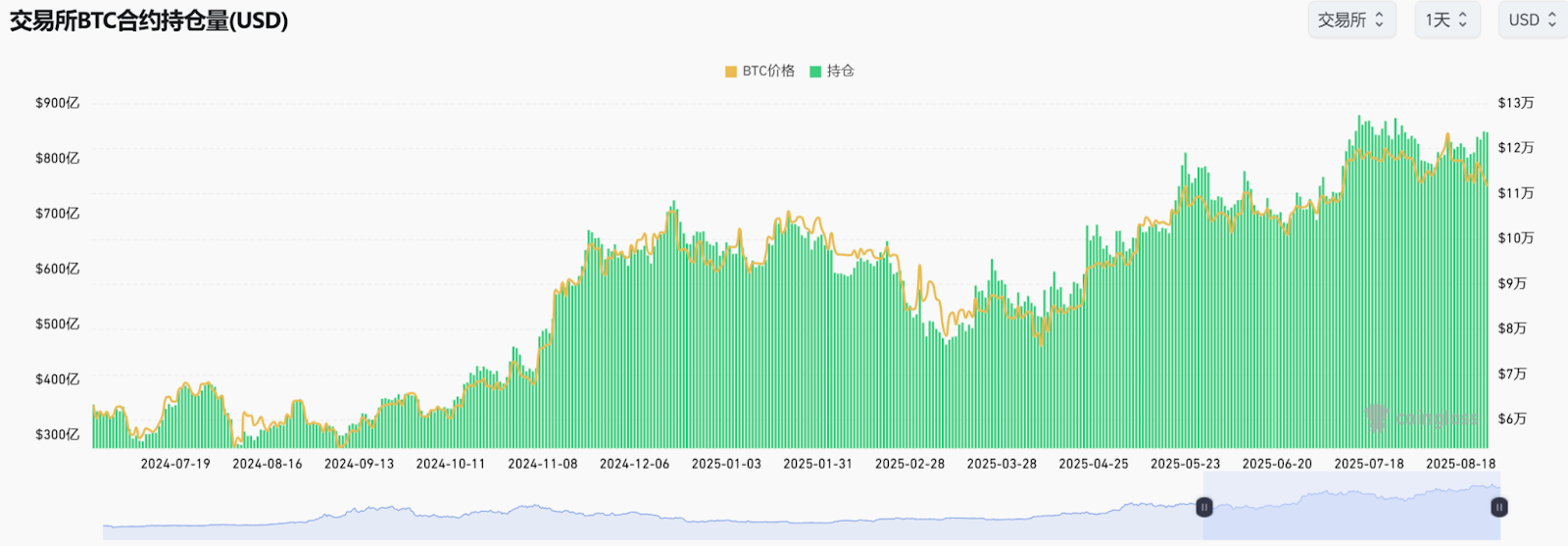

Exchange contract positions further corroborate this trend. Currently, Ethereum contract positions have risen to $67.4 billion, gradually approaching Bitcoin's $84.7 billion. More notably, Ethereum contract positions have increased by over 20% this month, setting new highs; while Bitcoin's contract positions have slightly declined compared to last month.

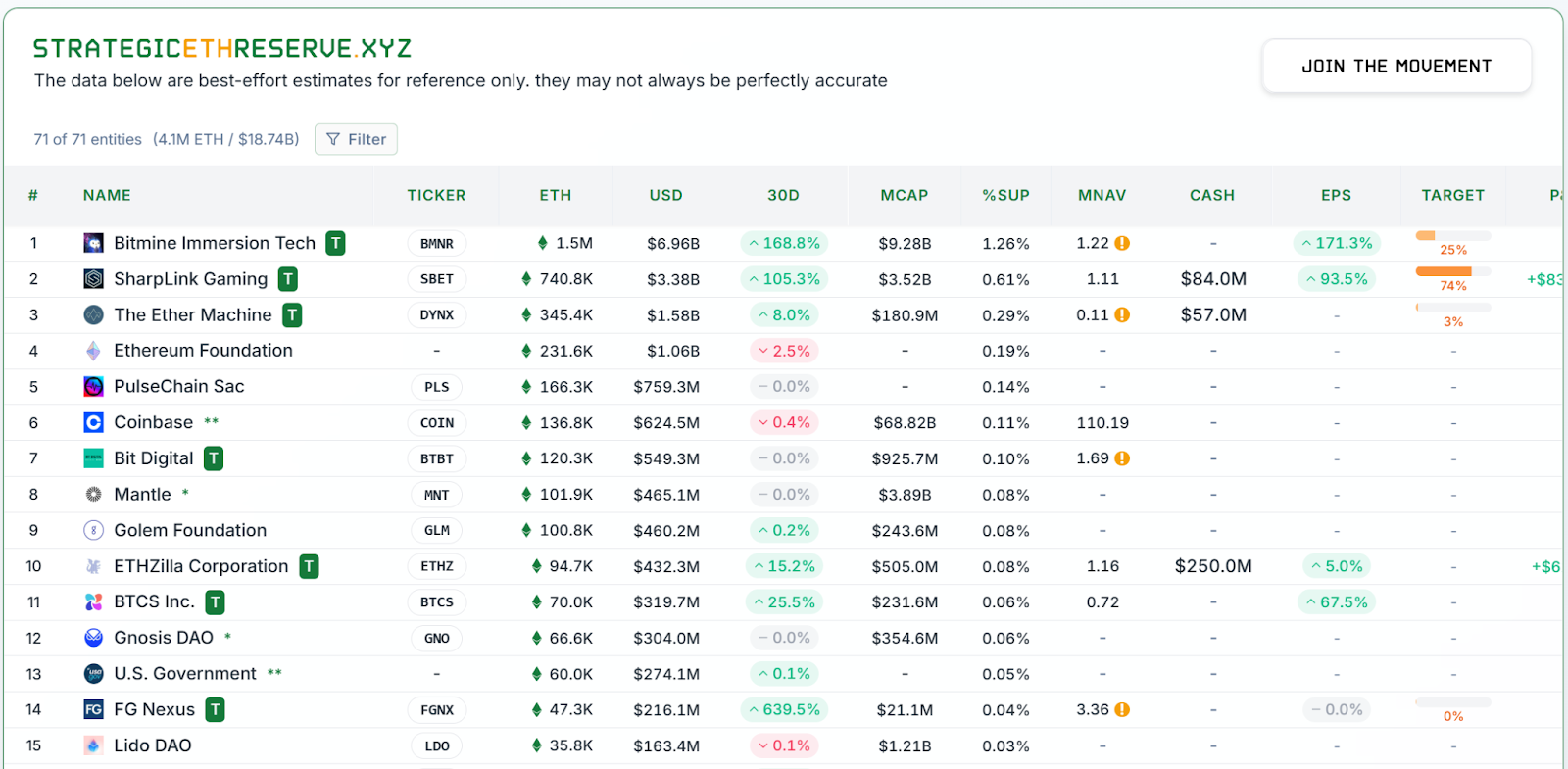

The strategic layout of treasury companies is a significant driver of Ethereum's rise. SharpLink and Bitmine have recently initiated a "strategic arms race" for Ethereum, significantly increasing their holdings through multiple rounds of financing exceeding $100 million, with holdings surging by 168% and 105%, respectively, totaling $6.96 billion and $3.38 billion.

On the Bitcoin side, as a pioneer in Bitcoin treasury, Strategy Company has significantly reduced its purchase scale in the past two weeks, dropping from thousands of coins to just hundreds.

New member KindlyMD, which joined the Bitcoin reserve camp, purchased 5,765 BTC on August 19, worth $640 million, but overall, this pales in comparison to the wave of increased ETH treasury holdings.

Capital Logic: Why Ethereum?

Ultimately, this ebb and flow is driven by a shift in narrative and capital preferences.

Bitcoin has long held its position as the "digital gold" of the crypto throne, with its decentralization, scarcity, and anti-inflation characteristics making it the preferred choice for capital seeking refuge. However, as old capital chooses to cash out, new capital has yet to enter on a large scale, causing Bitcoin's upward momentum to stagnate.

Ethereum's logic is different. The entry of treasury companies injects new momentum into Ethereum on a financial level, while also adding a new narrative logic, gradually endowing it with the institutional potential to surpass a single crypto asset.

Why are Wall Street capital choosing to bet on Ethereum instead of Bitcoin? CryptoQuant analyst CryptoMe offers a unique perspective: Strategy Company, as a pioneer in Bitcoin treasury, holds 3.3% of the total BTC, but founder Michael Saylor controls 45% of the voting rights with only 10% of the equity, making Wall Street reluctant to further increase the concentration of wealth in Strategy.

In contrast, the holding pattern of Ethereum appears much more dispersed. BitMine Chairman Tom Lee's personal shares are far less than Saylor's absolute influence. BitMine has subsequently received investments from PayPal co-founder, Silicon Valley venture capital giant Peter Thiel, and "Wood" (Cathie Wood), the "female Buffett" under Ark Investment, with the former acquiring 9.1% of Bitmine shares and the latter subscribing to approximately 4.77 million shares of BitMine stock. Meanwhile, companies like SBET, ETHZ, and GAME are also continuously increasing their positions, making Ethereum's capital narrative gradually take on institutional and decentralized characteristics.

Market Perspective: Caution in August

On August 20, on-chain analyst BorisVest indicated that based on the analysis of fund flows on Binance, Bitcoin's price may face selling pressure in the next one to two weeks. Data shows that the net flow of Bitcoin on Binance has turned positive, while outflows have decreased, indicating that Bitcoin is in a distribution phase. Additionally, Binance's trading reserves continue to grow, suggesting that investors are sending their Bitcoins to exchanges to sell for profit. BorisVest pointed out that Binance's massive trading volume plays a crucial role in influencing the cryptocurrency market, and as new buyers enter, whale sell-offs often exert significant selling pressure on Bitcoin's price. Currently, the "weakness" in Bitcoin's market is validating his viewpoint.

Tom Lee, the new chairman of BitMine, a believer in Ethereum, recently stated in an interview: "I believe the probability of Ethereum's market cap surpassing Bitcoin is extremely high, even possibly reaching 50%. It's like the dollar breaking away from the gold standard in 1971."

Of course, there are differing opinions. Macro researcher Adam from Greeks.live believes: a liquidation waterfall will push BTC from the high of $114,000 down to $110,000, causing collective sentiment to shift rapidly from cautiously optimistic to bearish concerns. Despite the volatility, traders remain divided; some believe $110,000 is Bitcoin's bottom, while others expect further declines. However, most believe this volatility is the result of excessive leverage being washed out.

Matrixport stated that most institutional funds exited during the summer, but Ethereum continues to attract inflows, while Bitcoin ETFs may experience net outflows for five consecutive months. This month's outflow is expected to be around $1.2 billion, ranking as the second highest in history, only behind February's $3.5 billion. Seasonal factors may be temporary, but they remind us that the flow of funds is just as important as seasonality. After maintaining a bullish stance in July, we have turned cautious in August.

The current market is indeed under pressure due to a significant decline in investor trading confidence. However, a consensus is forming: funds are sliding away from Bitcoin and continuously increasing their positions in Ethereum. Nevertheless, the current market still needs to remain vigilant.

From a rational perspective, Powell's slightly dovish remarks briefly propelled risk assets into a pulse-like surge, but they quickly fell back from high levels. If we view "the swap from Bitcoin leading to market weakness" as the fuse, then the real powder keg lies in the cooling of emotions following "excessive uniform optimism." Powell's wording seems more like a conditional response to recent employment and inflation adjustments rather than an endorsement of the interest rate cut path for the year; the uncertainty surrounding the endgame of interest rates has not disappeared, but has been priced in by the market with a more optimistic risk premium, followed by necessary "retracement" at the trading level.

Conclusion

The dynamics within the current crypto market are quietly evolving, injecting new footnotes into this round of adjustments. Bitcoin remains the cornerstone of the crypto market, but it now resembles one end of a seesaw, representing existing funds and old narratives; while Ethereum is gradually becoming the other end, accommodating new funds and new narratives. The market's focus is slowly shifting, and the seesaw is gradually tilting under repeated selling pressure and increased positions.

Ethereum may not have yet welcomed its "El Salvador moment," but it is gradually moving towards its own institutional moment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。