🧐 Your sUSDe is rising, but why is your LP still losing?丨 @Terminal_fi: A DEX born for yield-bearing stablecoins—

We often say that a bull market brings a new class of assets.

If the last round was about meme coins and LSDFi, this round might be about "yield-bearing stablecoins."

From traditional USDT and USDC to native yield-generating USDe and sUSDe, the market's focus is shifting from what assets are pegged to, to how to capture yield.

This raises a key question:

When the assets in your hands are quietly appreciating every day (like sUSDe), can you still use the old AMM logic to trade and provide liquidity?

Terminal provides a completely different answer in this new phase.

1️⃣ Your assets are rising, but LP is secretly losing money?

Setting aside technical details, let's ask a simple question:

If you create a sUSDe/USDT trading pool on Uniswap, one is a yield-bearing coin that can appreciate, and the other is a regular stablecoin, what will LP ultimately receive?

The answer is often: you thought you could earn the yield from sUSDe, but a month later you find that your sUSDe has decreased? It has all turned into USDT?

Why does this happen?

Because sUSDe itself is "appreciating" every day (automatically generating yield on-chain), and to maintain price balance on both sides of the pool, AMM will continuously convert your sUSDe back into USDT.

Arbitrageurs are profiting from this "invisible yield."

And you, as an LP, not only earn no interest but also become a tool for price stabilization.

Worse still, if you are using a concentrated liquidity (CLAMM) model, this "yield-shrinking IL (impermanent loss)" will be even more severe, and LP may end up with only non-yield assets, making it less cost-effective than holding assets separately.

This is not an operational issue, but a mechanism issue: the design of traditional AMM cannot adapt to yield-bearing assets.

Thus, arbitrageurs have an opportunity, and LP becomes a passive buyer, forcing project teams to continuously subsidize to retain liquidity.

Terminal's first principles thinking starts from here:

If the structure of assets changes, then the structure of AMM must also be rewritten.

2️⃣ Terminal's solution: separating "yield" from trading

Terminal does not attempt to optimize traditional AMM but chooses to dismantle the root cause of IL.

It has designed a structure called Redeemable Token, which wraps native yield-bearing assets, allowing them to behave as a "non-appreciating" stablecoin in AMM.

For example:

1) Users deposit sUSDe and receive rUSDe;

2) rUSDe ≈ USDe, price pegged, excluding yield;

3) However, the system will track the price growth of sUSDe and distribute the yield separately to holders by "issuing more rUSDe";

4) Therefore, LP only holds rUSDe and does not bear the IL caused by "price appreciation";

5) At the same time, the "extracted yield" can be uniformly allocated by the protocol: part goes to LP, and part enters the bribe market for incentive distribution.

In this way, Terminal completely separates price liquidity from yield liquidity; trading is trading, and yield is yield.

This not only addresses the yield mismatch issue for LP in traditional AMM from the source of the mechanism but also provides a natural source of value for incentive mechanisms.

This is equivalent to Terminal splitting the right to generate yield from the assets and redoing the incentive logic.

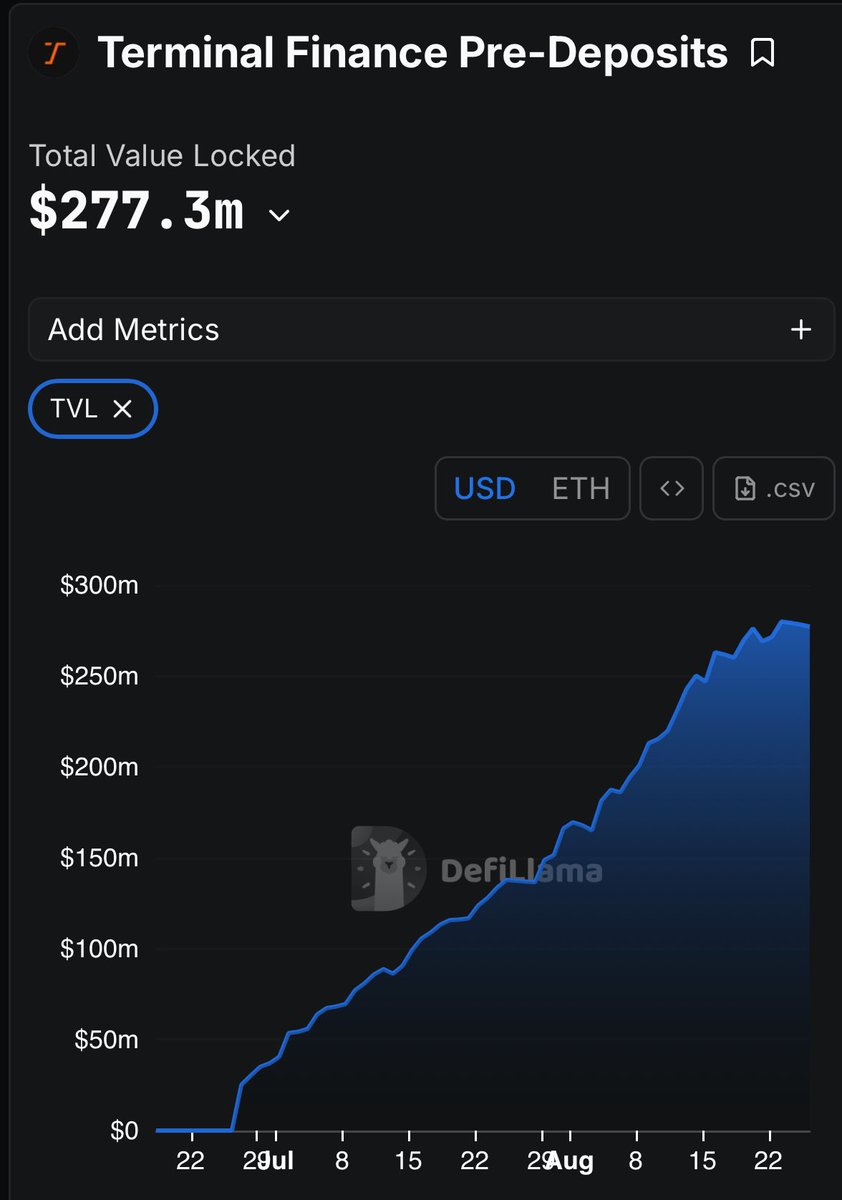

3️⃣ Current opportunity window: the last 30M USDe pre-deposit quota

The total quota for the USDe pre-deposit Vault set up by Terminal is 250M, and currently, only about 30M is left for participation.

I recommend everyone to participate in Terminal's deposits because for users/protocols:

📍 Now is the time window with the lowest entry threshold and the highest revenue share weight;

📍 Early LPs will enjoy higher yield extraction rights;

Official deposit link: https://terminal.fi/?ref=PZIUKEWY

In addition to native deposits, I also recommend a better participation path—directly participating in Terminal's tUSDe pool on @pendle_fi:

PT's current APR is stable at around 15%, making it very suitable for low-volatility stablecoin investment;

The rewards for YT and LP are also very high: 60x Roots + 50x Sats, which is a luxurious configuration;

Pendle deposit link (recommended, higher yield): https://app.pendle.finance/trade/markets?utm_source=landing&utm_medium=landing&search=tusde

Whether you want to earn stable interest with low risk or lay out structured track assets, I believe this is a cold start window worth serious research and participation.

Because stablecoins are not a short-term narrative but a core infrastructure that runs through the entire cycle.

The significance of Terminal is far beyond "another new DEX," but in providing a brand new dedicated AMM for native yield assets like sUSDe.

It is the core infrastructure of the @ethena_labs ecosystem, a deeply bound ecological partner carefully selected by Ethena:

Ethena is responsible for generating yield, Converge provides liquidation execution, and Terminal is responsible for receiving and allocating liquidity, together building the complete infrastructure layer for yield-bearing stablecoins.

If you believe—

The future is the era of yield-bearing stablecoins like sUSDe, then you really shouldn't miss Terminal now!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。