The prosperity of prediction markets goes without saying, from Polymarket, which ignited public opinion on the eve of the U.S. elections, to Football.Fun, which has rapidly broken into the scene on the Base chain, different products are seizing the narrative high ground in various ways.

Currently, the trading volume of prediction markets remains at over 50% of the peak levels seen in 2024. Whether it's turning the popularity of sports stars into tradable shares, transforming the BTC price one minute from now into a battleground for speculation, or directly converting news comment sections into betting arenas, prediction markets are infiltrating crypto narratives and users' daily lives at an unprecedented speed.

Who will be the next Polymarket? Who can maintain a lead in trading volume, user numbers, and capital attention? Rhythm BlockBeats has selected and organized several prediction market platforms in this article.

Football.Fun

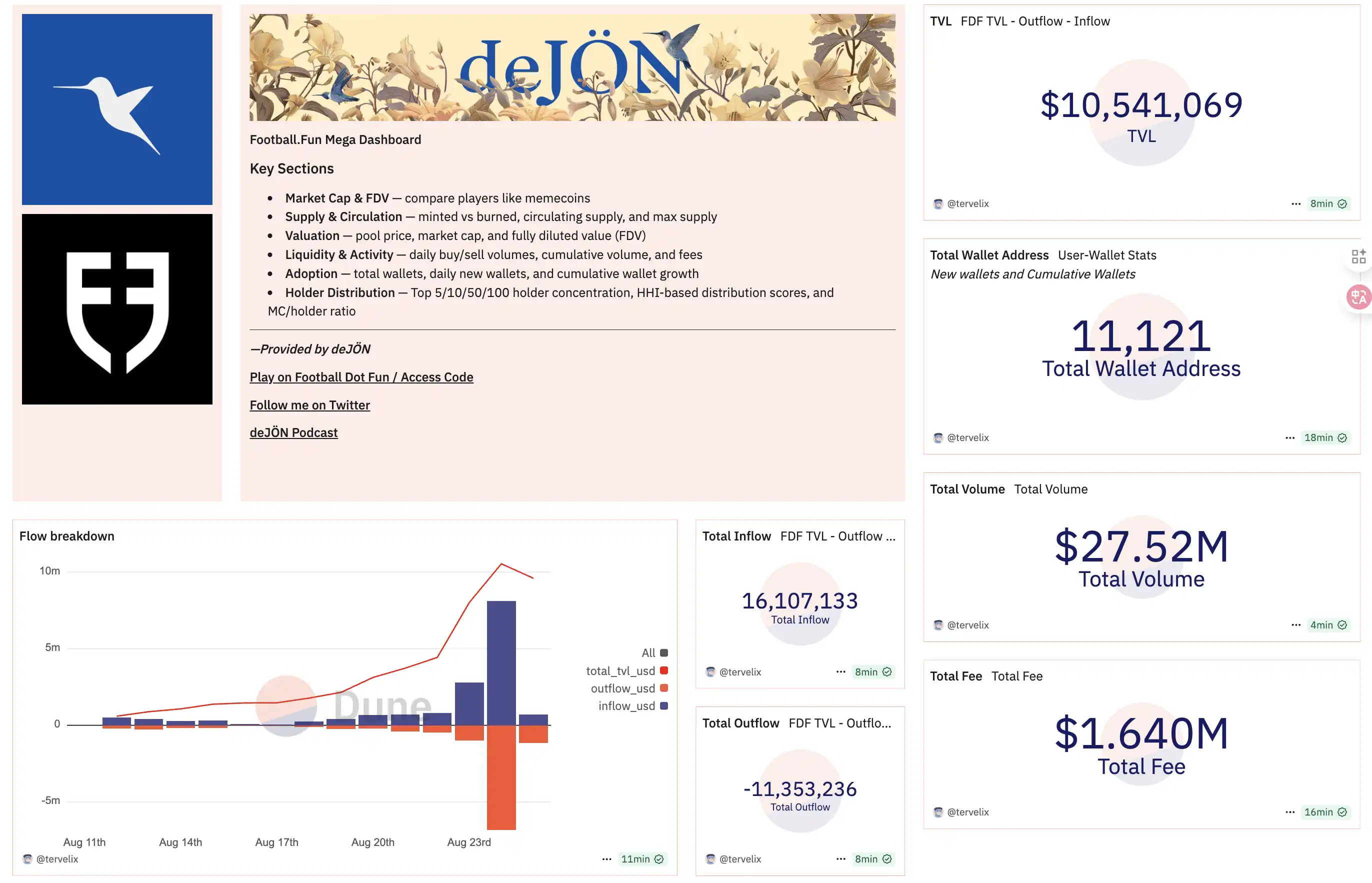

The hottest prediction market project this weekend is undoubtedly Football.Fun on Base. In just two weeks since its launch, it achieved over $14.85 million in single-day trading volume and over $10 million in total value locked (TVL), attracting more than 10,000 active wallet addresses.

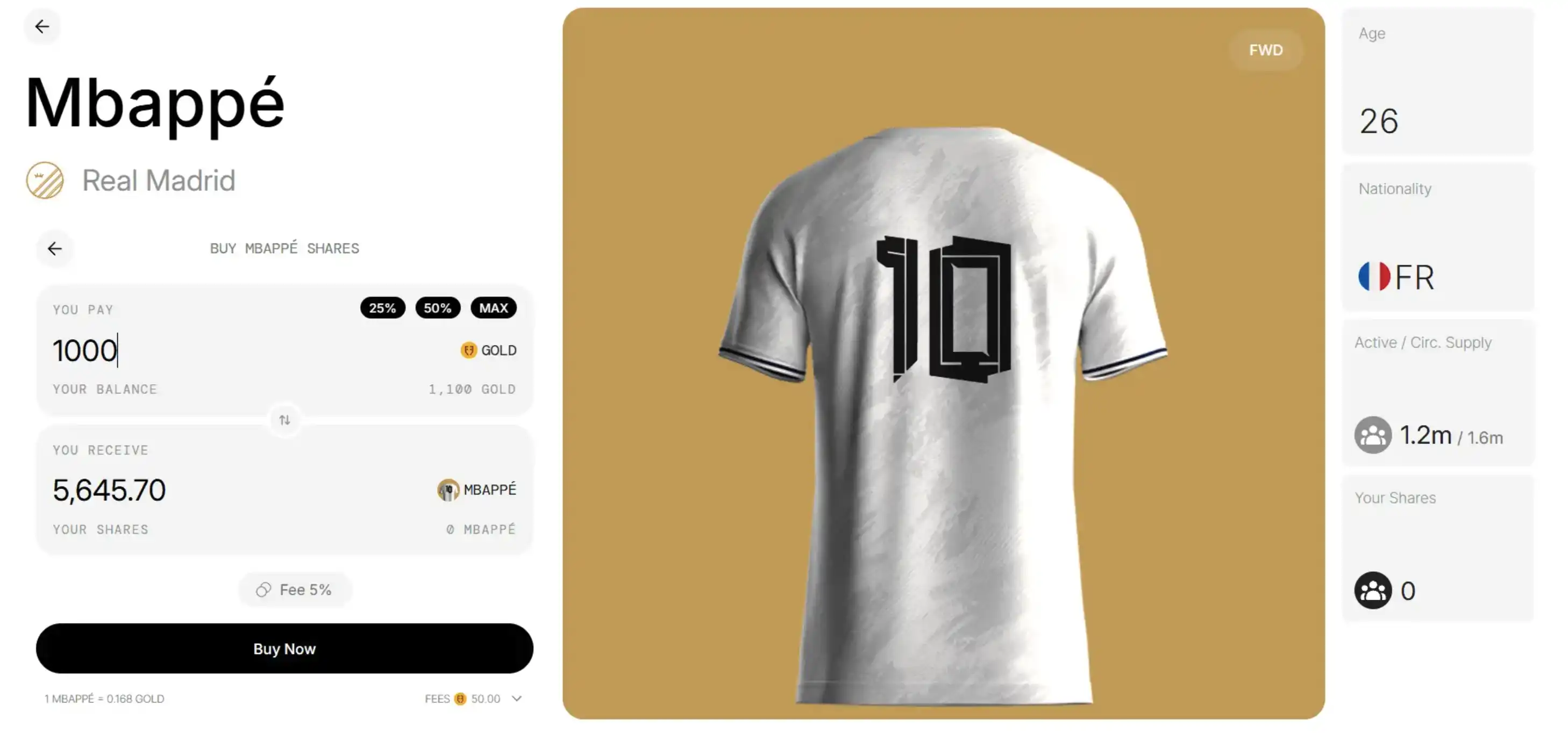

The design philosophy of Football.Fun is very clear: it aims to convert fans' passion for football into tradable on-chain assets by tokenizing football players into tradable "shares," allowing users to invest in and trade their favorite players just like stocks.

On the platform, each professional player is tokenized into "shares," with prices fluctuating based on market demand and the player's performance in real matches. Users can participate at a very low cost, with initial share prices as low as $0.0125. "Gold" serves as the in-game currency, pegged 1:1 to USDC.

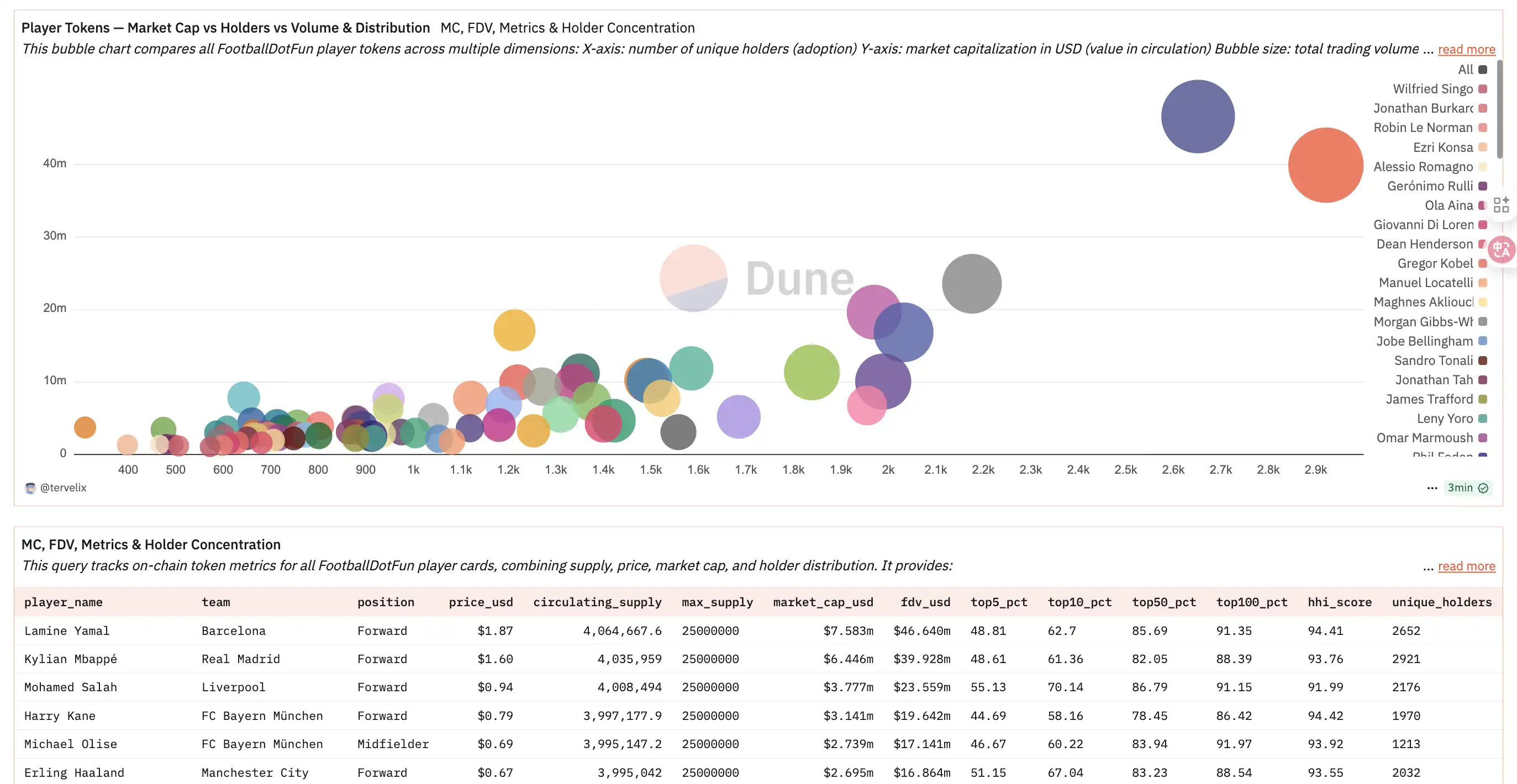

Currently, the top player cards are Lamine Yamal and Mbappé, with market values of $7.583 million and $6.446 million, respectively.

Unlike traditional football management, which requires complex roster management, Football.Fun's mechanism is more intuitive: as long as users hold shares of a player, they can automatically participate in weekly tournaments without manually adjusting their rosters. Players' performances in real matches translate into point rewards and player card prices.

Tournaments are another major feature of Football.Fun. The platform automatically hosts two events each week, divided into midweek and weekend matches. The system automatically selects the optimal roster for each user to participate in the matches, and after the matches, dual rewards are distributed: on one hand, the holders of the best-performing player shares can share in player rewards; on the other hand, the platform has set up team rewards, with the top ten guilds able to share an additional 19% of the prize pool. This reward structure not only motivates individual players to carefully select players but also further promotes community and guild ecosystem activity.

In terms of technical architecture, Football.Fun fully leverages the performance advantages of the Base network to achieve low fees and instant settlement. The platform uses smart contracts to isolate user assets from team funds, ensuring transparency and security. To avoid supply imbalances, it has introduced an automatic issuance mechanism called "Motty," which only releases new player shares when market demand rises. Coupled with a fixed 5% trading fee, this system provides stable income for operations while preventing excessive speculation. In mid-August, the team also launched an anti-dumping mechanism called "Jeet Jail," specifically designed to restrict short-term speculative behavior to maintain healthy market development.

Behind the project is a compact yet resource-rich team. Founder Adam (@AdamFDF_) is also an active member of the well-known crypto gaming community WolvesDAO; he is both a product builder and a community promoter. From feature iterations and anti-bot mechanisms to the transparency of tournament scoring, Adam is directly involved. Marketing head Caleb Rebelo is responsible for driving user growth and referral programs.

The registered entity of the company is Sport.Fun Panama Corp., which has received significant industry support in financing and resources. In July 2025, Football.Fun completed a $2 million seed round of financing, with investors including 6th Man Ventures, Zee Prime Capital, Sfermion, and others. Shortly after the financing news was announced, the team boldly launched its go-live plan.

The project's timeline can almost be described as "high-speed." Financing was completed in mid-July, and by early August, on-chain player packs began selling, each pack costing 20 USDC and containing shares of four players. On August 11, the platform officially opened the market to the public on the Base chain; two days later, the first ten players were listed for trading; on August 15, the anti-dumping mechanism "Jeet Jail" was launched; from August 18 to 20, the first official tournament was successfully held; on August 23, the platform announced that trading volume had surpassed $10 million; just one day later, a single-day trading volume record of $14.85 million was set, and TVL also exceeded $10 million. This series of high-density iterations and data explosions is a rare phenomenon in the Web3 gaming field.

The data performance more intuitively showcases the explosive growth of Football.Fun. Within two weeks of its launch, the platform's cumulative fee revenue exceeded $1.5 million, and the total market value of player shares reached $935 million. Star players that fans are most concerned about, such as top star Lamine Yamal, saw share market values exceed $10 million, while Mbappé reached a high of $8.5 million, with Salah, Haaland, and Kane also ranking in the top five. On social media, Football.Fun's official account saw its follower count soar from 20,000 to over 30,000, and on-chain data shows that there were over 80,000 deposits and more than 9,000 unique addresses participating in a single day, with activity ranking among the top in the Base ecosystem.

Football.Fun has set multiple remarkable records. It became the fastest game on the Base network to exceed $10 million in TVL and $15 million in daily trading volume, achieving this feat just 14 days after its public launch. The platform also set the record for the highest single-day trading volume of any game application on the Base network and achieved the highest transaction frequency record with over 80,000 on-chain deposits within 24 hours. It is not only the highest trading volume game application on the Base network but also a benchmark case for on-chain fantasy sports.

TryLimitless

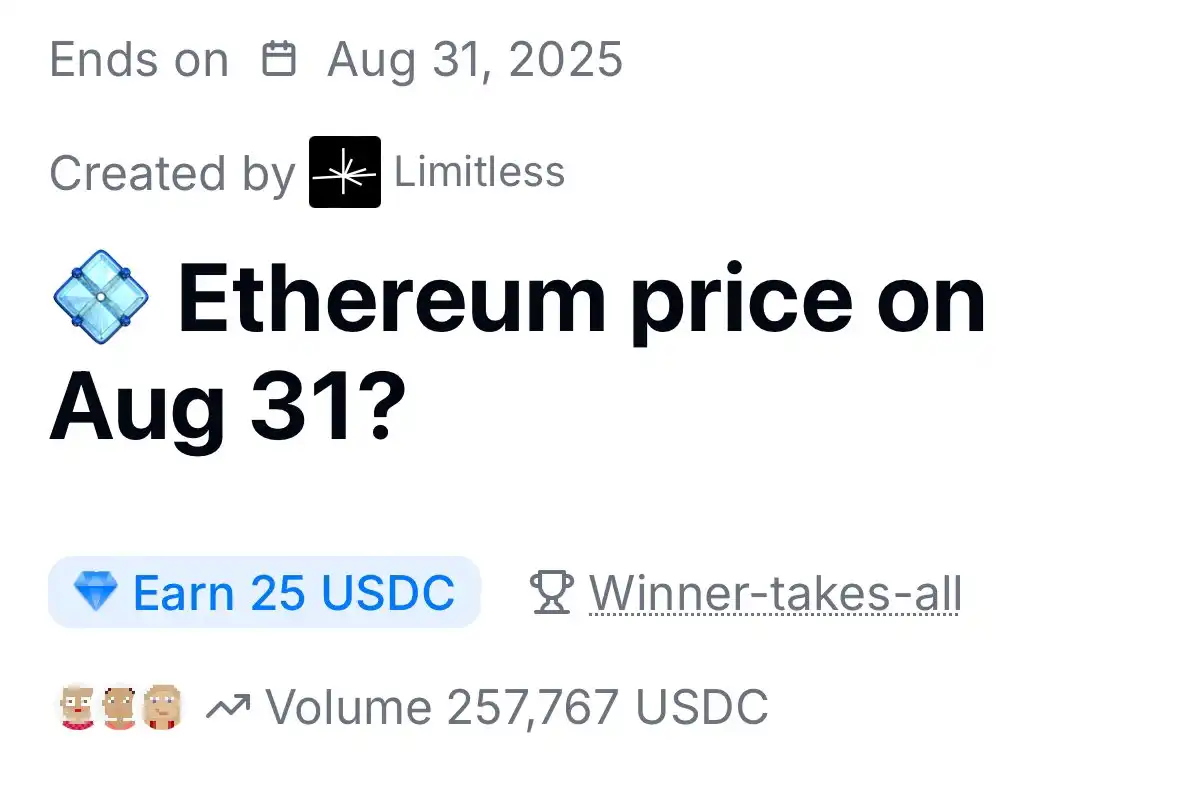

Another prediction market platform competing with Football.Fun for the highest trading volume on the Base network is Limitless.

Limitless's unique product features revolve around ultra-short-term trading, offering single asset price threshold markets (e.g., "Will BTC's closing price at 9 AM Eastern Time be above $111,000?") and Negrisk multi-choice range markets. Expiration times range from 1 minute to 1 day, catering to different risk preferences and trading strategies. The platform has also launched a liquidity provider reward mechanism, proportionally distributing daily USDC incentives based on order book depth and proximity to the median price. A mobile-first user interface was launched in July 2025, synchronized with a points program.

In terms of business model, Limitless generates revenue by charging trading fees on win/loss shares, while also planning to launch a token and points system to guide liquidity and capture protocol value.

The team and financing behind Limitless are also noteworthy. Founder and CEO CJ Hetherington previously served as a cryptocurrency reporter for the Financial Times and now leads Limitless Labs. In July 2025, BitMEX co-founder Arthur Hayes joined the project through his family office Maelstrom, serving both as an investor and strategic advisor, bringing deep expertise in derivatives trading and industry influence to the platform.

In terms of financing, Limitless has completed a total of $7 million in two rounds of funding. The first round was a $3 million pre-seed round led by 1confirmation. On July 1, 2025, the company completed a $4 million strategic round of financing, with investors including Coinbase Ventures, Maelstrom (Arthur Hayes), Collider, Node Capital, Paper Ventures, Public Works, Punk DAO, and angel investors from the Base ecosystem fund. The funds from this round of financing are primarily used for the upcoming TGE and points program launch.

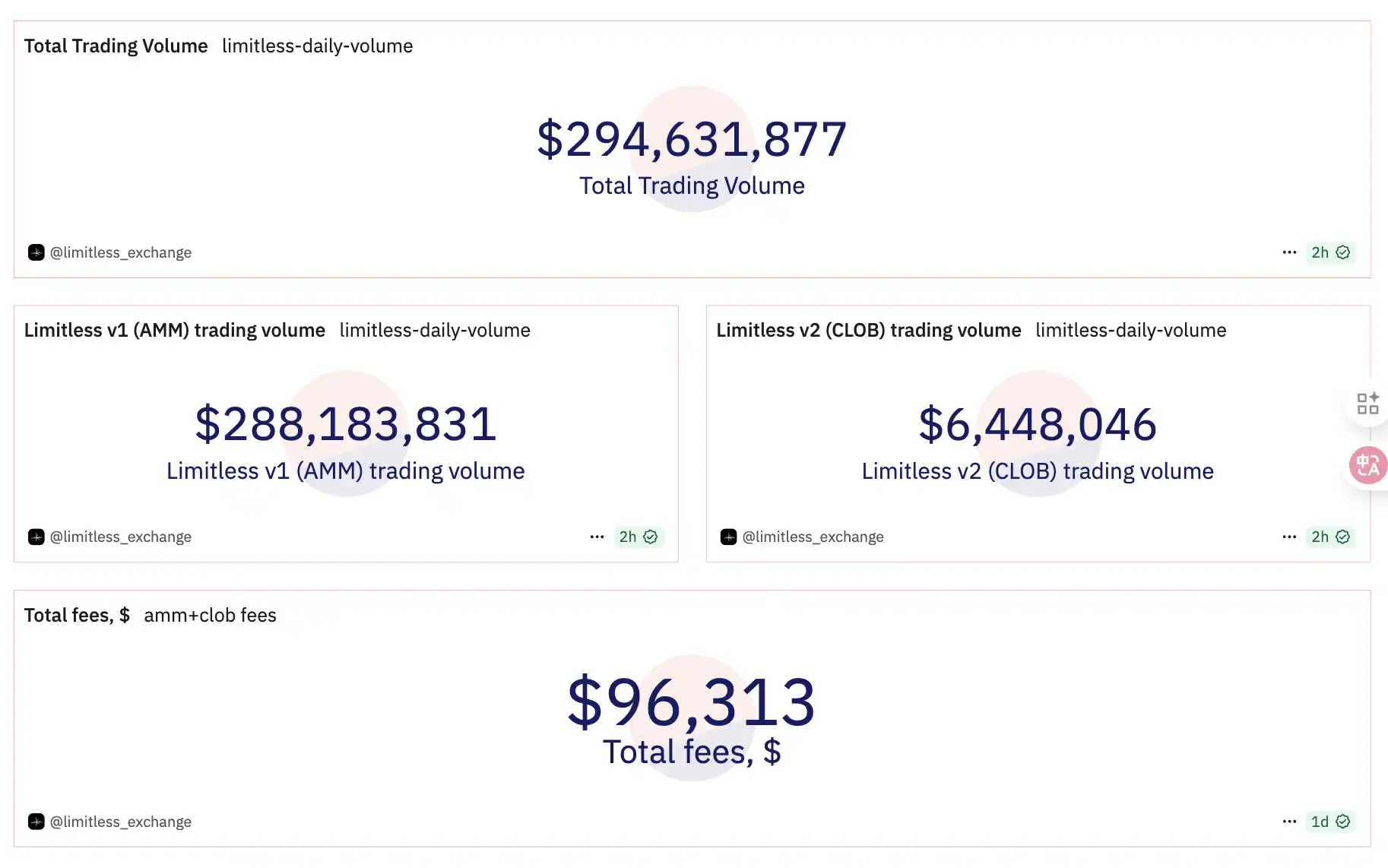

From the on-chain data performance perspective, Limitless has shown impressive results on the Base network. Although the platform's total locked value on Base is about $416,000, accounting for only 17% of the protocol's total TVL (with the entire chain's TVL around $2.4 million, where Arbitrum accounts for 82% and Linea less than 1%), the trading turnover rate is extremely high. In the three months since the mainnet launch in May 2025, the cumulative trading volume deployed on Base has exceeded $250 million, demonstrating a very high capital utilization efficiency. The platform has processed "hundreds of thousands of bets," with daily active wallets fluctuating between 1,000 and 3,000.

However, prior to this, several users, including DeFiGuyLuke (@DeFiGuyLuke) and lil SK (@SKbigSteppppa), pointed out that Limitless has serious and obvious data manipulation issues: the platform launched many markets with only 1.5 hours of duration, which are not visible on the front end. These markets have very clear outcomes, such as the BTC price market, which is based on events that are either highly unlikely to happen or have already occurred. They set an extreme price, such as 0.95, and since this market has zero fees, a large number of arbitrageurs are inflating the volume for profit.

MyriadMarkets

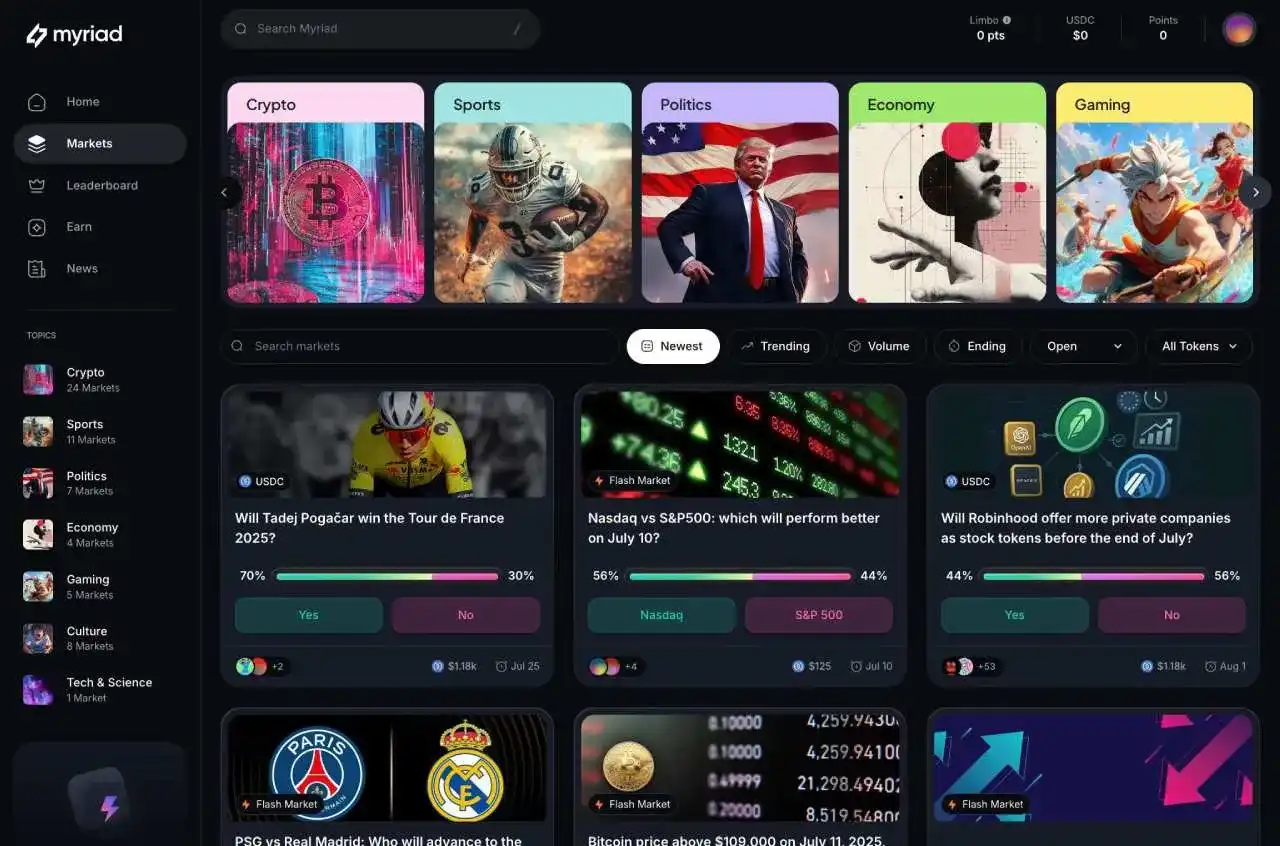

Myriad Markets is an on-chain prediction market plugin platform centered around news content, belonging to DASTAN, the parent company of Decrypt. As a holding company, DASTAN currently owns two well-known blockchain media brands, Decrypt Media and Rug Radio, providing Myriad Markets with a unique advantage in media resource integration. Users can directly participate in prediction markets through common media such as social media and news websites, covering various fields including cryptocurrency, politics, sports, and entertainment.

The platform's core mechanism is built on an automated market maker (AMM) joint curve model, rather than a traditional order book system. This design ensures that users can buy and sell shares at any time, even in thin liquidity conditions. When users add or remove shares, the constant function market maker automatically re-prices to maintain the balance of the liquidity pool.

Myriad Markets supports various market types, including binary options (yes/no), categorical options (multiple results), and scalar options (ranges), catering to different prediction needs. All outcomes are settled through on-chain oracles, and if an event is canceled, users' betting funds will be refunded. From a technical architecture perspective, Myriad Markets adopts a multi-chain deployment strategy, primarily operating on the Abstract L2 network while also being deployed on the Linea network. The upcoming "liquidity hub" will aggregate cross-chain liquidity pools to deepen the price discovery mechanism.

The most innovative feature of Myriad Markets is its browser extension, which currently has over 60,000 users. This extension can inject prediction widgets into any page on X (Twitter), YouTube, major news websites, etc., allowing users to trade without leaving the current site and earn points by reading, sharing, or answering quizzes.

This embedded media integration feature is its biggest differentiating advantage. Decrypt articles will directly render prediction widgets related to the content within the body of the article, while Rug Radio podcasts will display odds information in real-time during the show. This "content-native" model transforms passive consumption into active participation while driving traffic to the Myriad Markets platform.

In terms of team background, Myriad Markets is part of DASTAN Inc., which was formed after the merger of Decrypt and Rug Radio in 2024. Public-facing executives include CEO Loxley Fernandes and President Farokh Sarmad, both of whom frequently appear in Decrypt's reports about Myriad Markets. This natural integration of media resources provides the platform with strong marketing and user acquisition advantages.

In terms of funding support, Verda Ventures led a strategic investment round in July 2025, with the specific amount undisclosed, but the investors clearly support Myriad Markets' "content-native" concept. The acquisition of this investment demonstrates institutional investors' recognition of the platform's innovative model, providing financial assurance for future development.

In terms of business model, Myriad Markets adopts a dual settlement currency system. The points system is used for non-transferable rewards within the app, supporting task completion, reputation building, and leaderboard competition. The USDC market is used for real money betting, and the platform charges a commission fee on trading volume, positioning prediction fees as a new source of media revenue. Additionally, the platform is expanding its revenue prospects through sponsored tasks, brand tournaments, and potential token issuance hinted at in the DASTAN ecosystem roadmap.

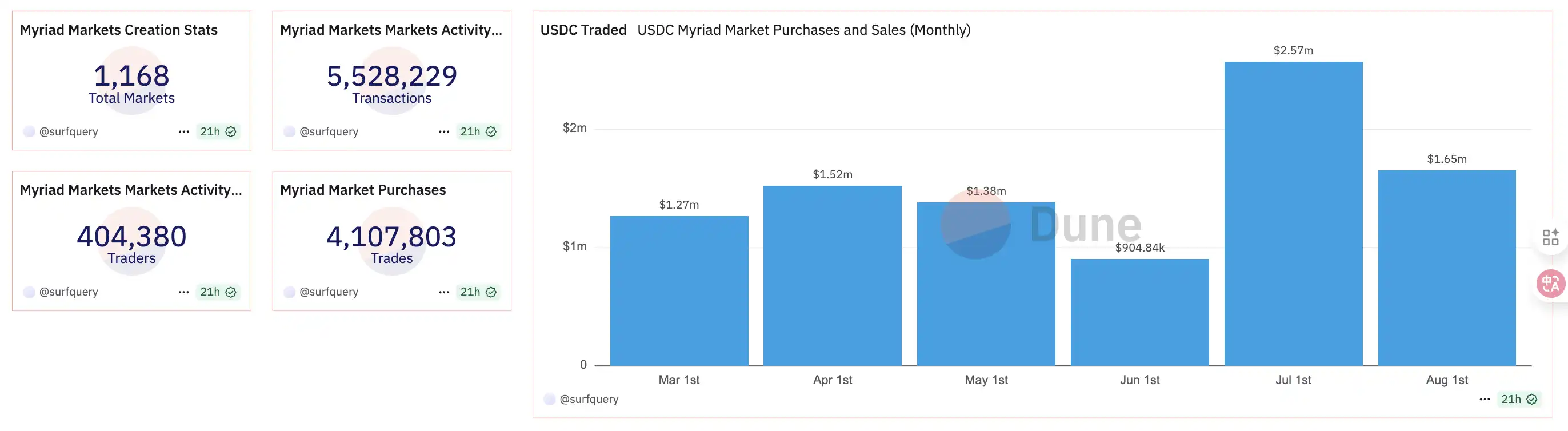

From market performance data, the Myriad Markets platform has attracted 415,000 Abstract wallet registrations, processed 1.2 million predictions, and the total USDC trading volume has exceeded $2 million, with the number of active wallets reaching 26% of Polymarket's.

On Twitter, the prediction market sector has regained attention, with Myriad Markets frequently mentioned alongside Polymarket and Kalshi. The community's expectations for airdrops are also an important factor driving participation. Community members generally anticipate that Rug Radio holders may receive a large token allocation during the TGE, which has fueled speculative enthusiasm. At the same time, the platform's deep integration with Abstract Chain has received positive feedback, allowing users to gain on-chain native experience while making predictions, effectively enhancing user stickiness through this dual incentive mechanism.

From user feedback, traders appreciate the hedging opportunities and diverse narratives (sports, macro, crypto) provided by the platform, but occasionally question the depth and liquidity of niche markets. Some users have highlighted attractive odds for specific macro scenarios, indicating perceived value compared to traditional betting venues. In the future, Myriad Markets' main challenge will be how to maintain liquidity depth and broad user retention after the airdrop incentives fade.

fantasy_top

Fantasy.top is an innovative SocialFi trading card game platform that allows users to collect hero cards representing real cryptocurrency KOLs, scoring and competing based on these influencers' actual performance on X (Twitter), and earning profits through market trading.

The project was initially launched on the Blast network and successfully migrated to the Base network in July 2025, providing users with a unique social finance gaming experience by combining traditional fantasy sports concepts with blockchain technology.

According to Dune Analytics data, the Fantasy.top platform has accumulated protocol fees of $7.05 million, primarily generated on Blast before the migration to the Base network in July 2025. The platform has attracted over 32,000 unique wallet registrations, a figure derived from tracking addresses interacting with Fantasy.top's smart contracts, including card minting, pack opening, and market trading activities. The cumulative trading volume has exceeded 1,800 ETH, with the number of weekly active wallets reaching 21,500 during the platform's peak (mid-May 2024).

However, the platform has also faced significant user attrition challenges. Since the peak in May 2024, the number of active wallets has decreased by about 80%, dropping to around 2,000 by June 2025, while protocol fees have also declined by 93%, from over $2 million at peak to about $200,000. This sharp decline prompted the team to make the strategic decision to migrate from Blast to the Base network.

The migration process showcased the platform's technical strength and user loyalty. During the migration window from July 15-21, 2025, approximately 18,400 Fantasy NFTs (62% of the minted supply) were successfully bridged from Blast to the Base network, while about $3.6 million in ETH funds also completed cross-chain transfers, representing about 80% of the remaining in-game funds. In the five weeks following the migration, the average number of weekly active addresses on the Base network was 4,500, showing early signs of recovery.

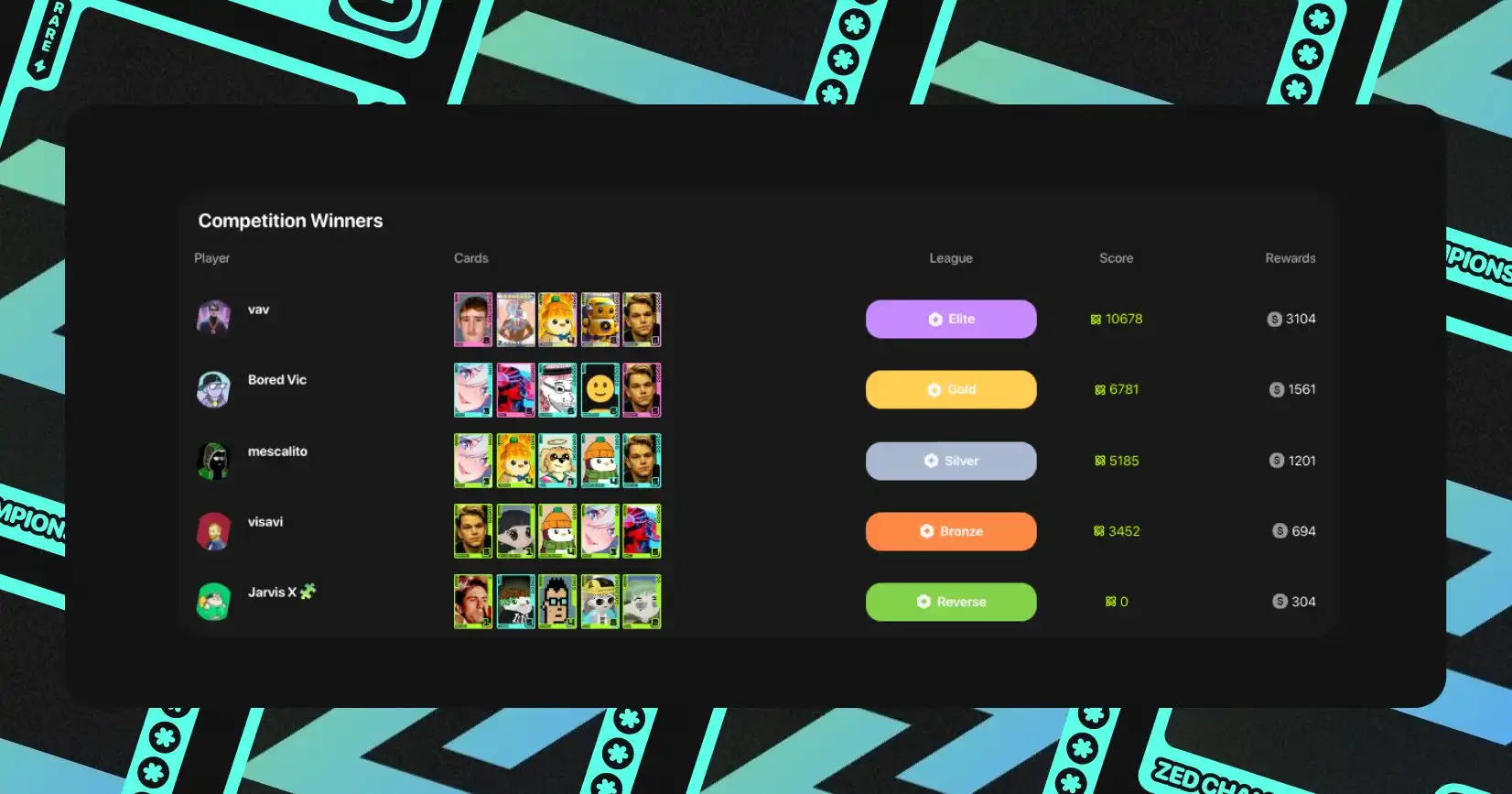

In terms of product mechanics, Fantasy.top employs a unique hero card system that transforms real cryptocurrency influencers into trading cards with different rarity levels. The cards are divided into four levels: common, rare, epic, and legendary, with rarity determining the scoring multiplier. The platform's revenue distribution mechanism is innovative, allowing influencers ("heroes") to earn 1.5% of secondary market trading fees and 10% of pack sales revenue, effectively binding KOLs to the platform's trading activities.

In terms of financing, Fantasy.top has demonstrated strong capital attraction. In December 2024, the platform completed a $4.25 million seed round of financing, led by DragonFly Capital, with participation from Manifold. Early strategic round investors also include well-known institutions and angel investors such as Fabric Ventures, Alliance DAO, and gmoney. This round of financing provides ample funding support for the platform's technical development, user acquisition, and reward pool.

In terms of team structure, Fantasy.top is led by a founder and CEO using the pseudonym Travis Bickle. Although the founder uses a pseudonym, the team has demonstrated a professional level in product development and strategic execution, successfully managing the complex cross-chain migration process and establishing close cooperation with the Base ecosystem. The platform has signed cooperation agreements with over 250 KOLs, with each hero card representing a fee-sharing agreement.

In terms of user experience, the free game mode launched in version 3 has lowered the entry barrier for new users, allowing them to test the game mechanics without upfront investment. Community members appreciate the smoother gaming experience and lower fee costs after the migration, but some have expressed concerns about the uneven liquidity of low-level hero cards, with some players reporting needing to relist multiple times to find buyers.

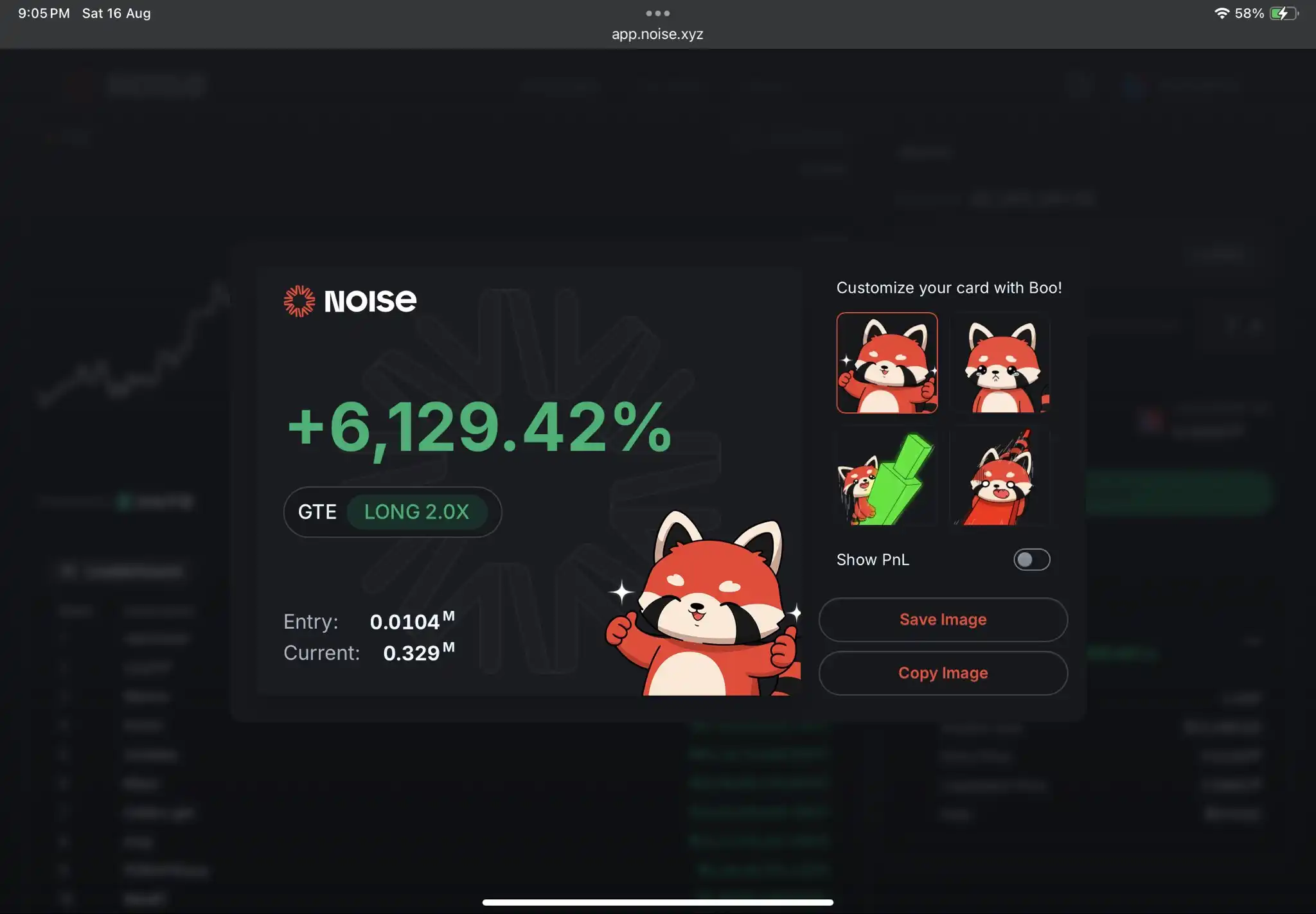

Noise.xyz platform continuously scrapes social media data from X/Twitter, news, forums, and other sources, using advanced natural language processing models to generate a "Relative Attention Index" (RAI) for each trending topic. This index is mapped to synthetic assets that support up to 5x leverage for both long and short positions.

Unlike traditional prediction markets, Noise's settlement does not rely on objective event outcomes but rather on the popularity of the narrative, allowing for higher liquidity and capital turnover. Supported by high-frequency pricing and real-time settlement technology, narrative prices can fluctuate continuously like futures curves, opening up new trading dimensions for market makers and quantitative strategies.

Founder and CEO Gabriel Carafa has extensive experience in algorithmic trading, co-founder Luca Cordova Stuart previously worked in data engineering, and another co-founder, Liangchen Zhou, has a strong background in cryptocurrency research. The team is headquartered in New York, maintaining a lean structure of 2-10 people focused on product development and technological innovation.

In terms of financing, Noise successfully completed a $6.99 million seed round on July 22, 2025, with SEC filings indicating the actual amount raised reached $7.1 million, involving 46 investors. Major investors include Anagram from the Cayman Islands and the well-known venture capital firm Figment Ventures.

From a technical architecture perspective, Noise has chosen to deploy on the high-performance Layer 2 network MegaETH, providing sub-millisecond confirmations, 10-15 millisecond block times, and an ultra-high throughput of 100,000 transactions per second, laying a solid technical foundation for real-time trend pricing. The protocol currently uses the "Mind-Share Oracle" provided by Kaito as its first attention data source, feeding prices every 10-15 milliseconds to ensure the real-time and accuracy of the attention index. Although a centralized solution is currently used for result determination, the roadmap indicates a future shift towards decentralized oracle sources to further enhance the system's credibility and decentralization.

The V1 version of Noise's product is currently invitation-only, allowing users to connect their wallets to browse current trending topics, view RAI curve changes, and execute long or short positions with one click. The platform offers flexible leverage options from 1 to 5 times, a continuous funding rate mechanism, and comprehensive liquidation protection, with an overall interface design more akin to decentralized exchanges than traditional prediction markets. It currently supports various contract types for crypto projects like Monad and Farcaster, as well as macro narratives such as AI and Memecoin trends, with plans to expand into broader fields like culture, sports, and current events in the future.

From a business model perspective, Noise builds a sustainable economic model through multiple revenue sources. Primary revenues include trading fees (market maker/taker fees), funding fee spreads, and a future plan to launch a "attention liquidity provider" mining project. The platform has not yet issued a native token, and protocol fees are denominated in USDC. The team has indicated that governance incentive tokens may be introduced later, but specific tokenomics models have not been detailed in the roadmap.

It is worth noting that since Noise is still in a closed testing phase and operates in an off-chain mode, its smart contracts have not yet been deployed or verified on the mainnet. Therefore, traditional on-chain data metrics such as trading volume, TVL, and active user counts cannot currently be obtained through blockchain explorers or analytics platforms. Nevertheless, Bankless reports that Noise is one of the five most active decentralized applications on MegaETH, with daily transaction counts on the testnet exceeding 10,000 in the early stages, indicating good user engagement and product appeal.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。