Today's homework isn't too difficult to write. Although the price of $BTC dropped from $117,000 on Friday and even fell below $111,000, the changes in the U.S. stock market haven't been significant. This means that if it were a systemic risk, the pullback in the U.S. stock market should have been larger. However, in reality, the U.S. stock market hasn't declined much. From the early session on CME until the opening of the U.S. stock market, the average volatility of the Nasdaq and S&P was only around 0.2%, indicating that U.S. stock investors currently don't perceive much risk.

Of course, last Monday was also like this, and the market started to decline on Tuesday. But at least for now, the U.S. stock market seems relatively healthy, just that Bitcoin has dropped more sharply. Moreover, during Trump's press conference, he didn't make any overly aggressive comments about the economy, suggesting that some institutions have not yet raised objections to the information regarding a U.S. recession.

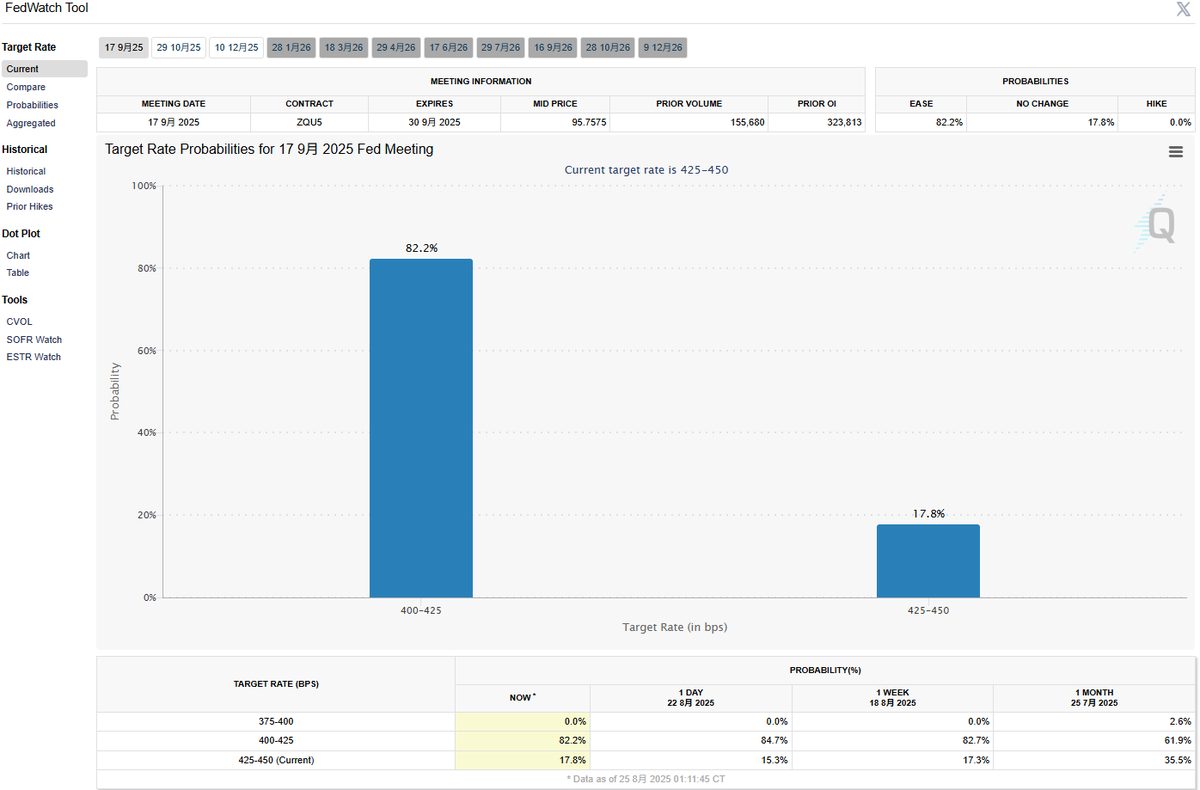

Overall, the market has returned to the game between Trump and the Federal Reserve regarding interest rate cuts. The market's probability of a rate cut by the Federal Reserve in September has now decreased to 82.2%. On one hand, this is a reflection of Powell's speech, and on the other hand, there are concerns about whether the U.S. economy will really enter a recession. Today, Barclays Bank predicts that the U.S. economy may be entering a stagnation phase, with a 50% chance of a recession occurring in the next two years.

They believe that due to concerns about an economic recession, the Federal Reserve will choose to cut rates in September and December. I can't determine whether Barclays is right or wrong, but at least for now, their statements haven't completely turned U.S. stock investors bearish. If the U.S. stock market isn't in a bearish state for the time being, then BTC, which is highly correlated with the U.S. stock market, shouldn't perform too poorly either.

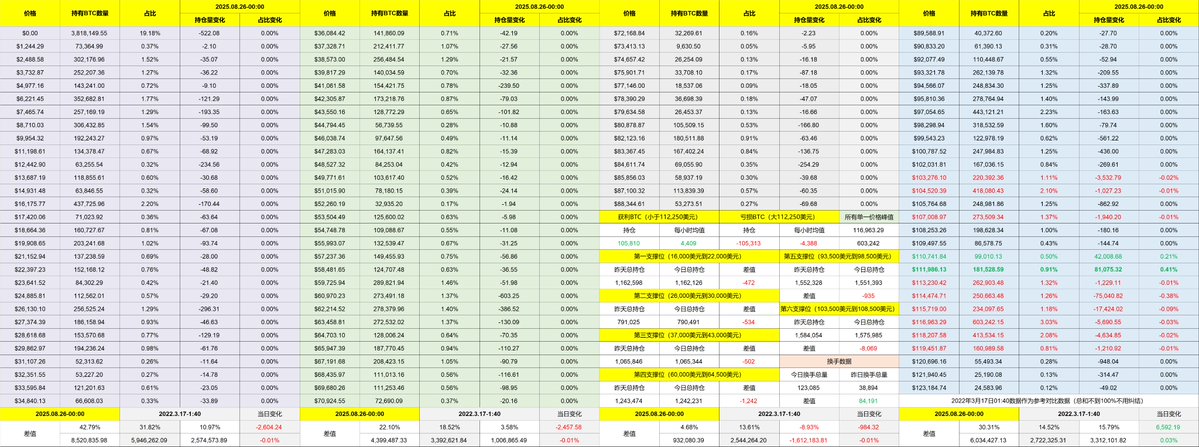

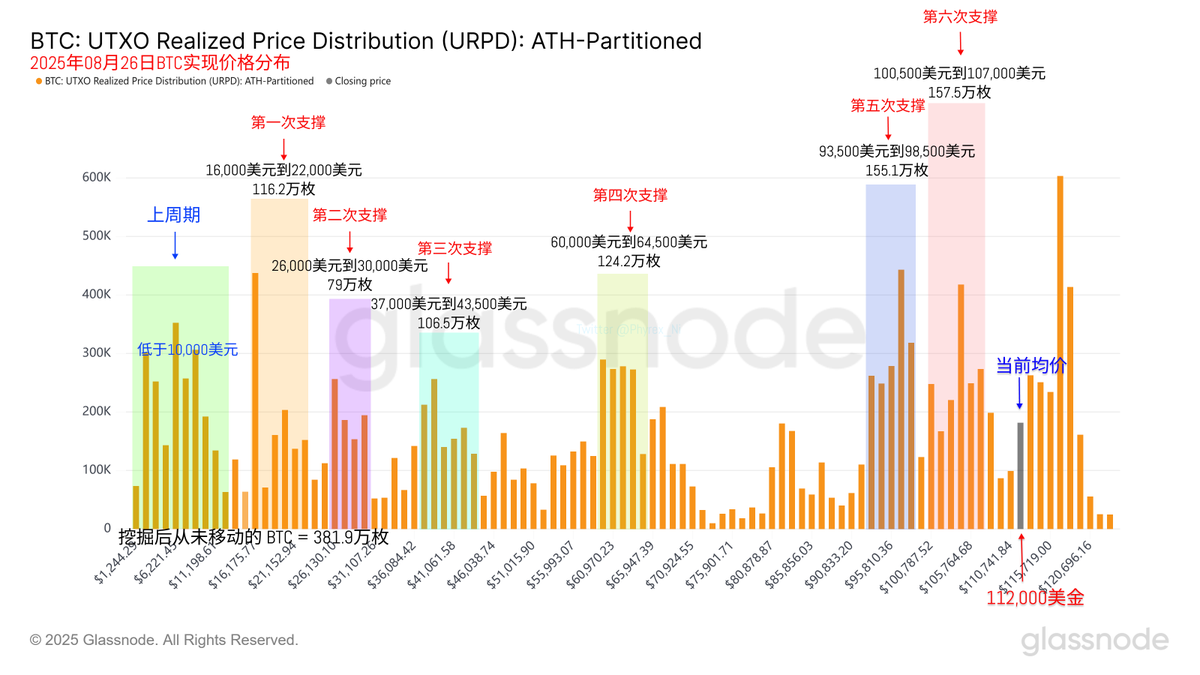

Looking back at Bitcoin's data, Monday's decline triggered a lot of investor turnover, especially among those who bought the dip in the last two days and are now facing losses. Earlier investors haven't reacted much, and although the price has dropped, the reasons for this decline are the same as last week's—concerns about rate cuts and recession in September. Therefore, the support level between $111,000 and $112,000 currently appears to be relatively stable.

Personally, I opened a long position at $111,500 and didn't choose to exit at $113,500 this morning. Although it might be a bit greedy, I still think this position is stable. Unless new negative news emerges, it should be fine.

Based on last Monday's situation, I want to see whether the U.S. stock market will accelerate its decline like last Tuesday or start to stabilize before making further plans.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。