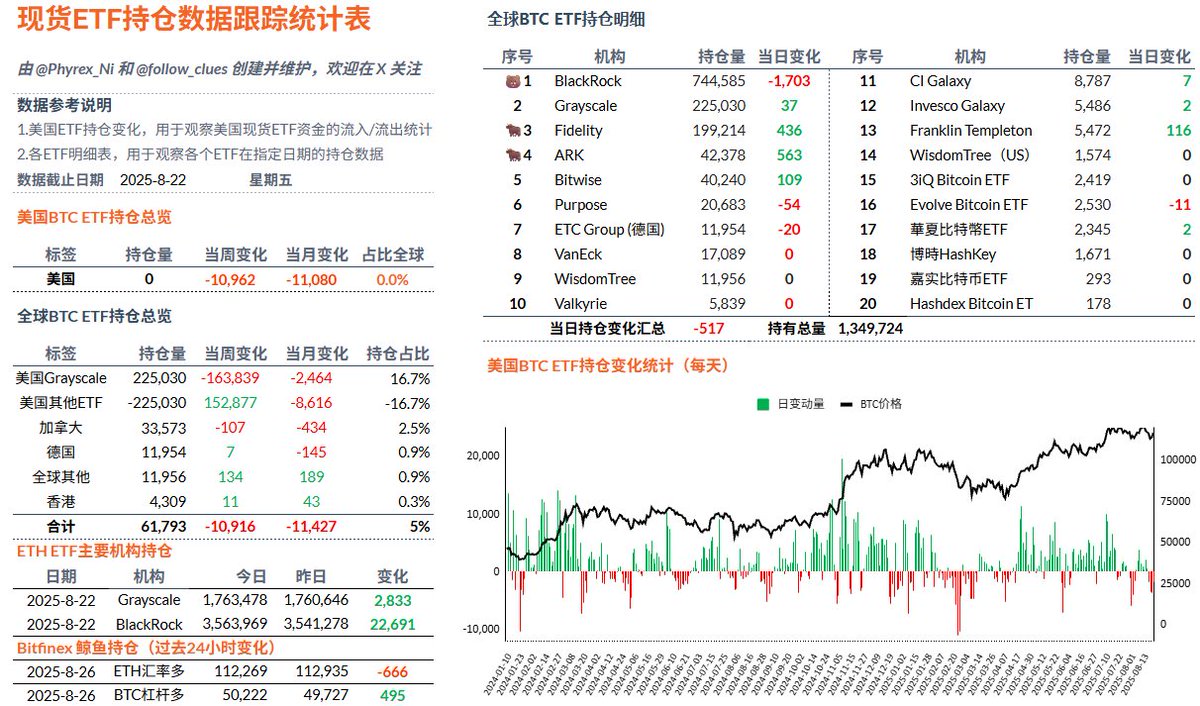

I originally thought the data on Friday would be good, especially since after Powell's speech, the price of $BTC briefly broke through $117,000. However, now looking at Friday's ETF data, although there was only a slight net outflow, it is rare to see that aside from BlackRock, all other investors had no net outflows. Nevertheless, the changes in the data were minimal, still indicating that the majority of investors are not bearish on Bitcoin.

From the data of the past 84 weeks, investor buying sentiment has not been strong. Compared to the net inflow of over 5,000 in week 83, week 84 saw a net outflow of more than 10,000 BTC, with the largest outflow coming from BlackRock investors, who withdrew a total of 5,359 BTC, followed by Fidelity investors, who withdrew around 2,500 BTC.

I want to emphasize again that the price of BTC is maintained more due to reduced selling pressure, and now with decreased buying power and increased selling, it indeed puts some pressure on the price of BTC.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。