CoinW Research Institute

Key Points

The total market capitalization of global cryptocurrencies is $4.17 trillion, up from $4.08 trillion last week, representing a 2.2% increase this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $53.8 billion, with a net outflow of $1.17 billion this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $12.43 billion, with a net outflow of $578 million this week.

The total market capitalization of stablecoins is $274.9 billion, with USDT's market cap at $167.1 billion, accounting for 60.78% of the total stablecoin market cap; followed by USDC with a market cap of $67.5 billion, accounting for 24.55% of the total stablecoin market cap; and DAI with a market cap of $5.37 billion, accounting for 1.95% of the total stablecoin market cap.

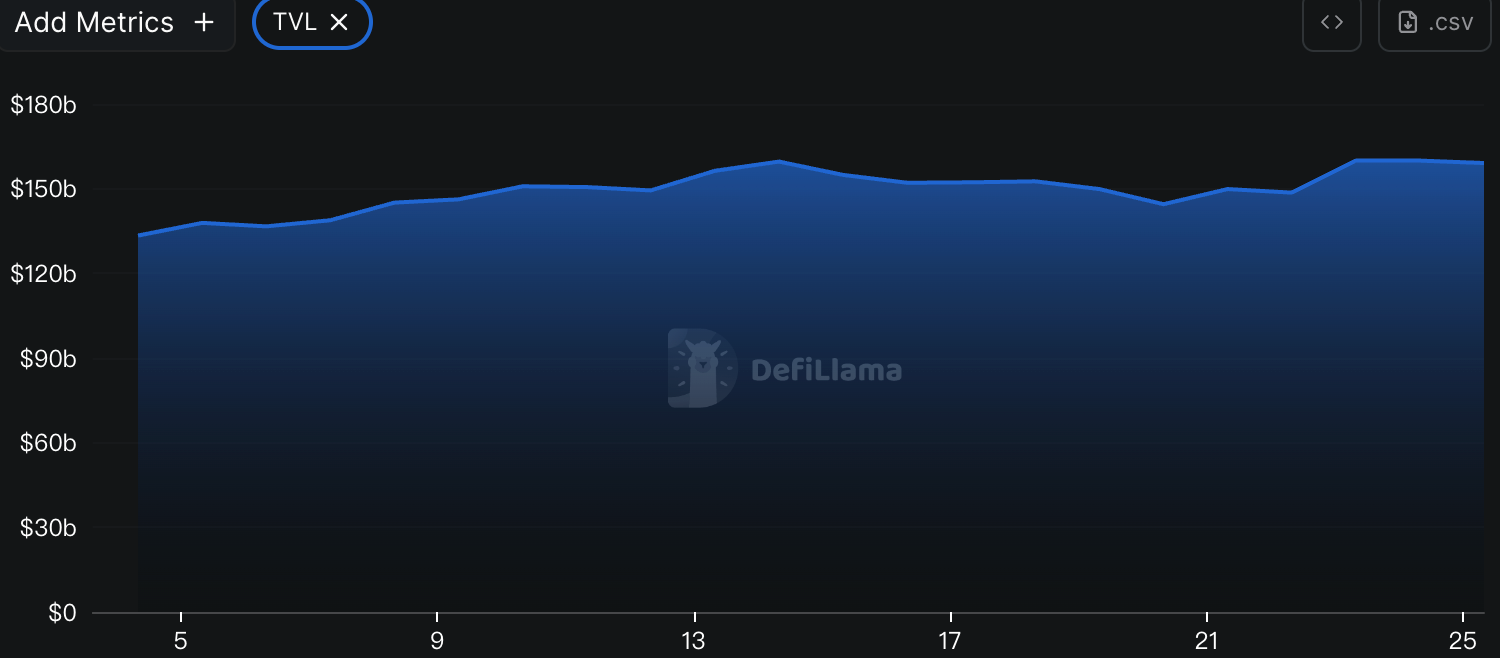

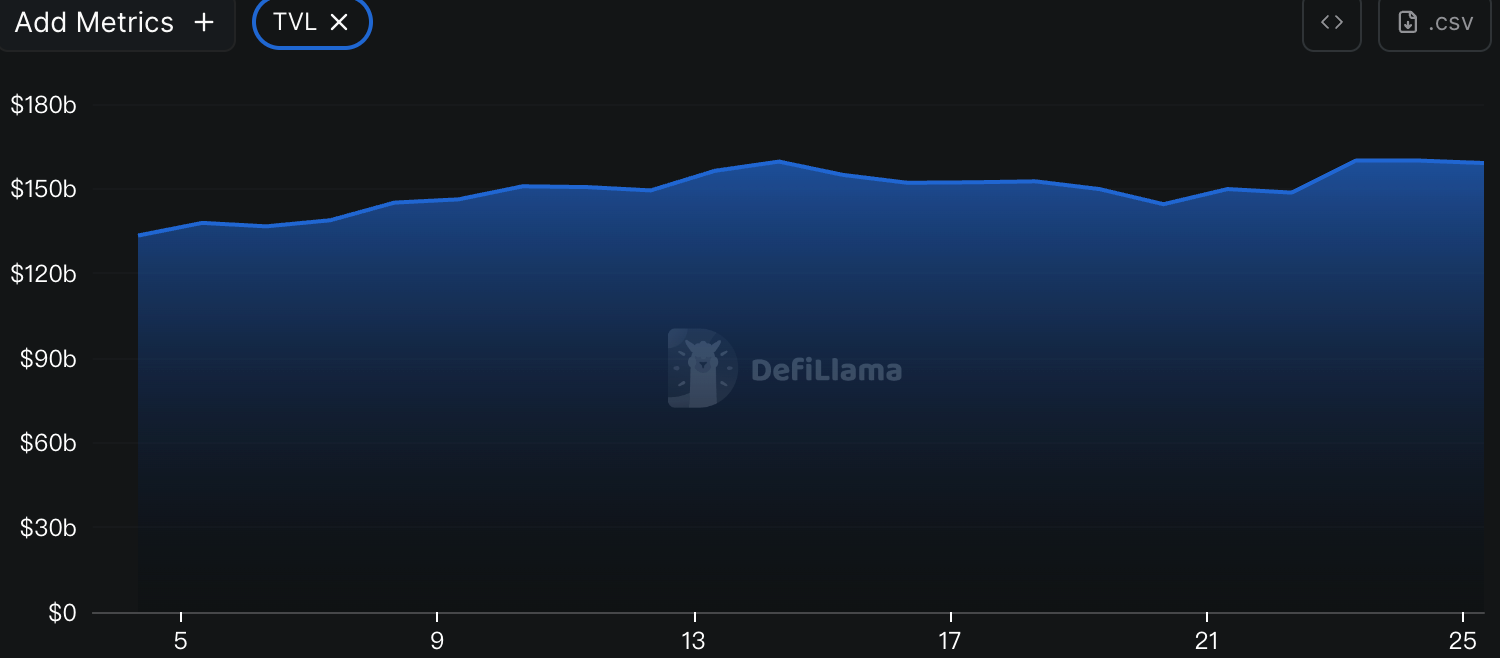

According to DeFiLlama, the total TVL of DeFi this week is $159 billion, up from $154.4 billion last week, an increase of approximately 2.98%. By public chain, the top three chains by TVL are Ethereum at 60.36%; Solana at 7.14%; and Bitcoin at 4.98%.

From on-chain data, in terms of trading volume, all chains except Ethereum (-1.42%) and TON (-22%) saw increases, with Solana leading the way (+55.63%), followed by Sui (+38.44%), BNB Chain (+25.06%), and Aptos (+5.33%). Overall, transaction fees are declining, with Ethereum and TON seeing the largest decreases (-50%), while Solana (-16.75%), Sui (-0.18%), and Aptos (-5.65%) saw slight declines, and BNB remained flat. In terms of daily active addresses, BNB (-13.39%) and Aptos (-4.56%) decreased, while the others increased, with Aptos (+36.61%) and Solana (+11.68%) performing notably. In terms of TVL, TON, Sui, and Aptos saw slight declines (around -2%), while Ethereum (+2.61%), Solana (+6.06%), and BNB (+4.61%) continued to grow.

New project highlights: 01 Exchange is a decentralized trading platform aimed at providing an efficient and secure trading experience for cryptocurrency traders. StableStock is a decentralized on-chain stock asset platform that aims to combine traditional finance (TradFi) with decentralized finance (DeFi), offering a digital stock trading method settled in stablecoins. Legion is a decentralized on-chain fundraising platform designed to enable retail investors to fairly participate in the financing of early-stage projects through a compliant regulatory framework and investor credibility system.

Table of Contents

Key Points

Table of Contents

I. Market Overview

Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-Chain Data

Stablecoin Market Cap and Issuance

II. This Week's Hot Money Trends

Top Five VC Coins and Meme Coins by Growth This Week

New Project Insights

III. New Industry Dynamics

Major Industry Events This Week

Major Upcoming Events Next Week

Important Investments and Financing from Last Week

IV. Reference Links

I. Market Overview

- Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

The total market capitalization of global cryptocurrencies is $4.17 trillion, up from $4.08 trillion last week, representing a 2.2% increase this week.

Data Source: cryptorank

Data as of August 24, 2025

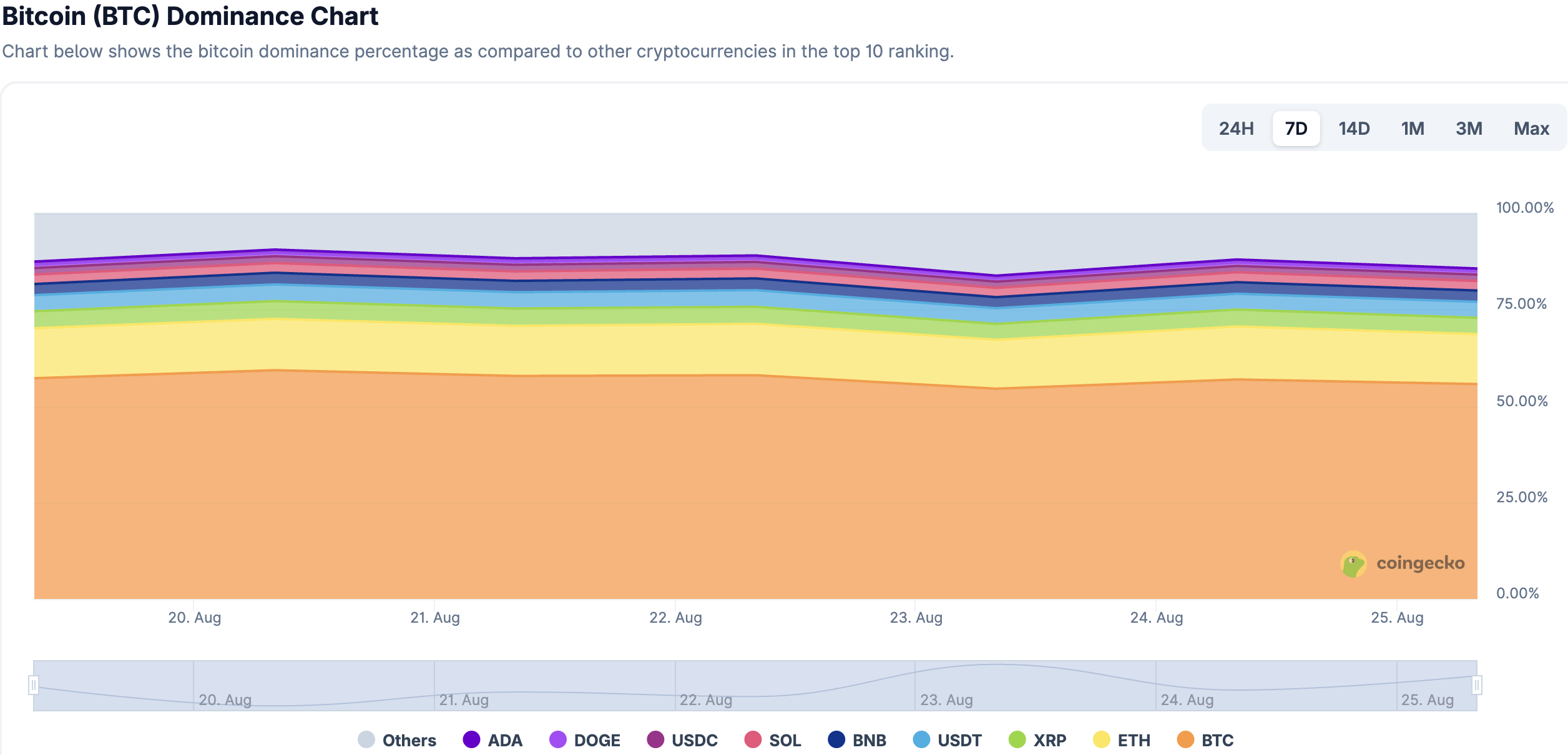

As of the time of writing, the market cap of Bitcoin is $2.24 trillion, accounting for 53.7% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $274.9 billion, accounting for 6.59% of the total cryptocurrency market cap.

Data Source: coingeck

Data as of August 24, 2025

- Fear Index

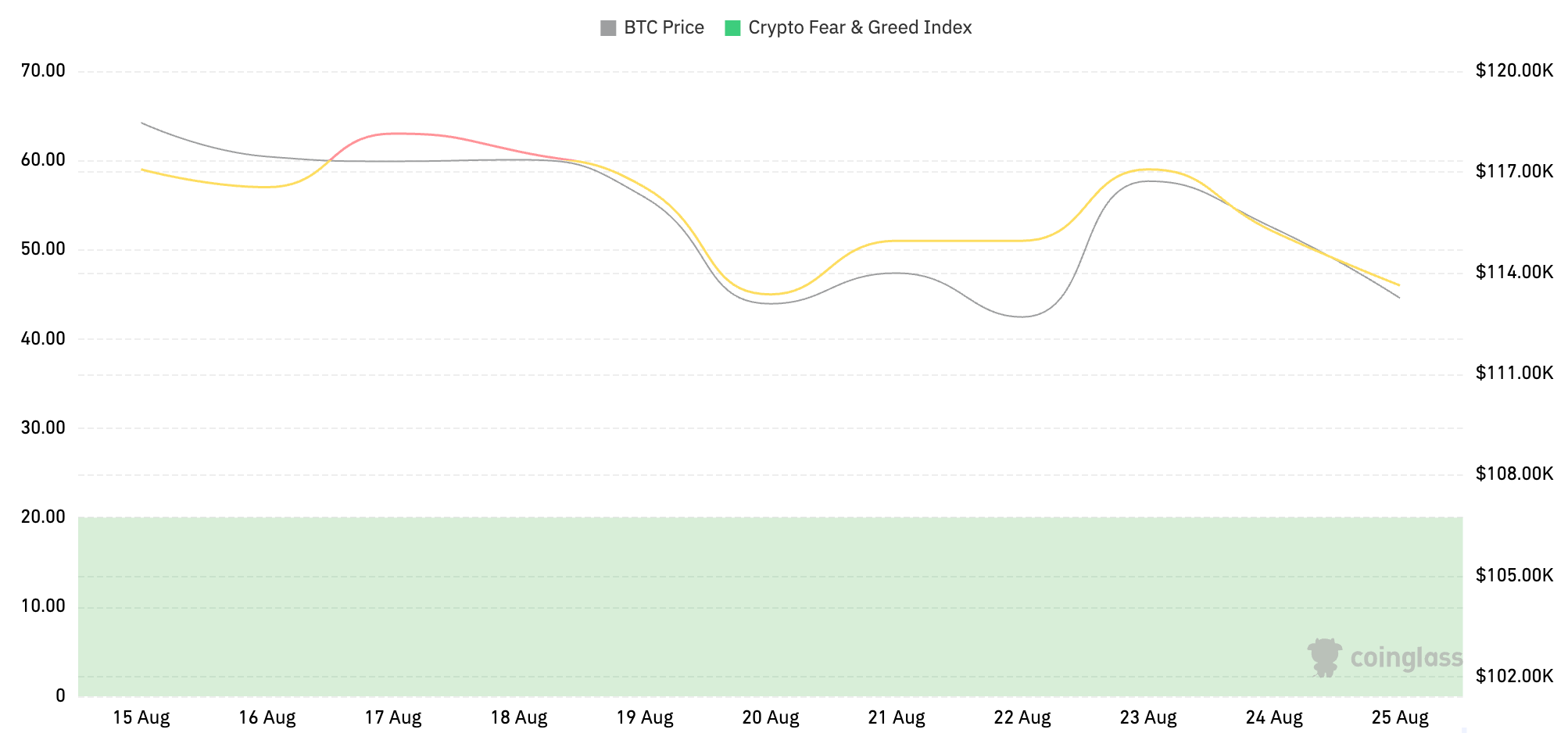

The cryptocurrency fear index is 46, indicating a neutral sentiment.

Data Source: coinglass

Data as of August 24, 2025

- ETF Inflow and Outflow Data

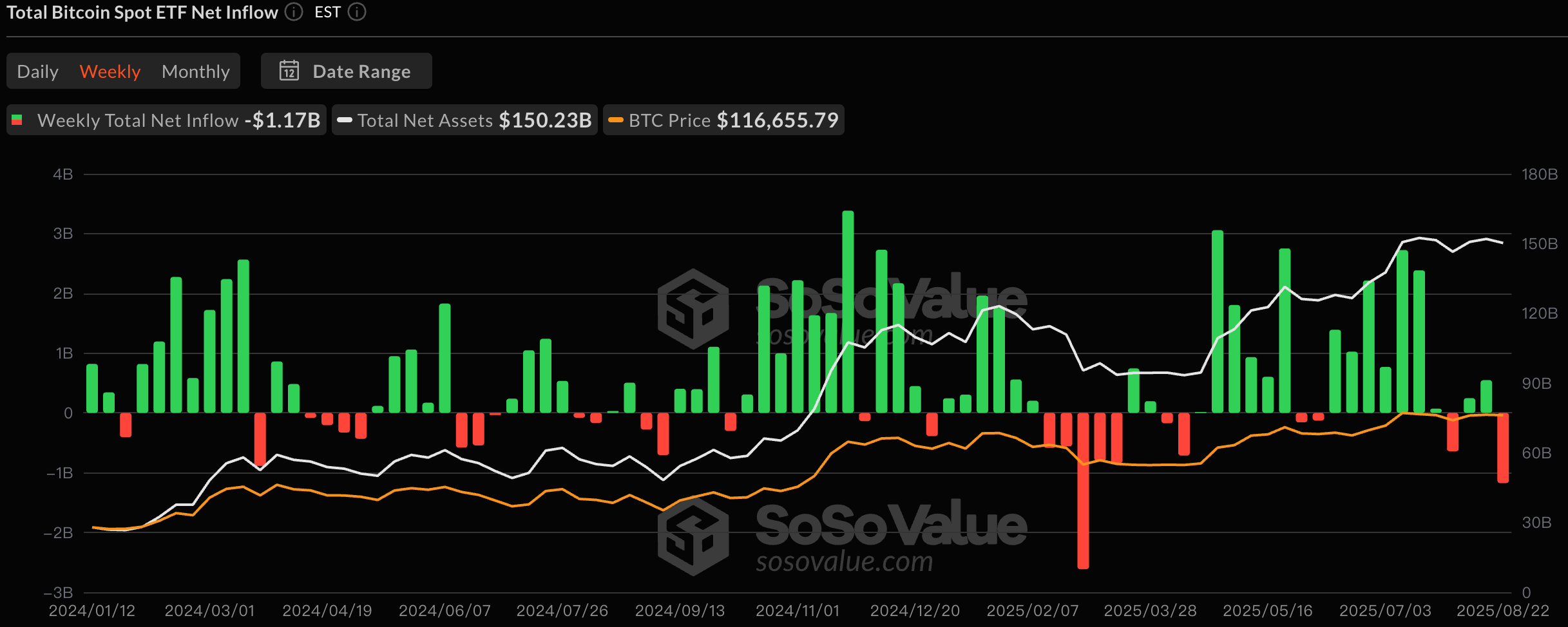

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $53.8 billion, with a net outflow of $1.17 billion this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $12.43 billion, with a net outflow of $578 million this week.

Data Source: sosovalue

Data as of August 24, 2025

- ETH/BTC and ETH/USD Exchange Rates

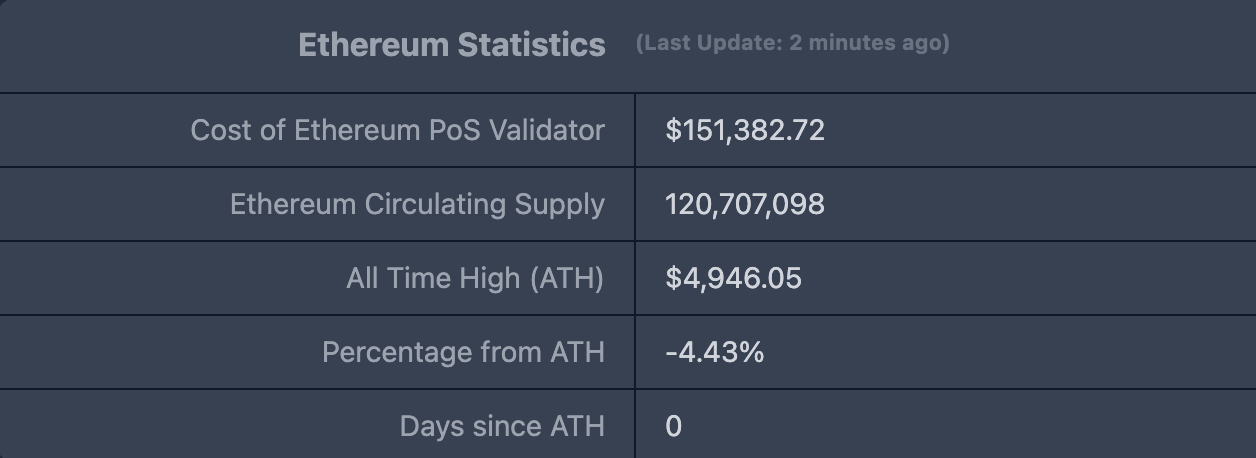

ETHUSD: Current price $4,733.00, historical highest price $4,878.26, down approximately 4.43% from the highest price.

ETHBTC: Currently at 0.041843, historical highest at 0.1238.

Data Source: ratiogang

Data as of August 24, 2025

- Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $159 billion, up from $154.4 billion last week, an increase of approximately 2.98%.

Data Source: defillama

Data as of August 24, 2025

By public chain, the top three chains by TVL are Ethereum, accounting for 60.36%; Solana, accounting for 7.14%; and Bitcoin, accounting for 4.98%.

Data Source: CoinW Research Institute, defillama

Data as of August 24, 2025

- On-Chain Data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily trading volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of August 24, 2025

Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. In terms of daily trading volume, this week only Ethereum (-1.42%) and TON (-22%) saw declines, while the other chains increased. Solana had the largest increase at 55.63%, followed by Sui (+38.44%), BNB Chain (+25.06%), and Aptos (+5.33%). In terms of transaction fees, BNB Chain remained flat compared to last week; Sui (-0.18%) and Aptos (-5.65%) saw slight declines; Ethereum and TON chains decreased by 50%; Solana chain decreased by 16.75%.

Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. In terms of daily active addresses, this week only BNB Chain and Aptos saw declines of 13.39% and 4.56%, respectively, while the other chains increased. Aptos and Solana increased by 36.61% and 11.68%, respectively; the other chains increased by TON (+6.08%) and Ethereum (+1.53%). In terms of TVL, TON (-2%), Sui (-2%), and Aptos (-2.44%) saw slight declines, while the other public chains saw slight increases, including Ethereum, Solana, and BNB Chain, which grew by 2.61%, 6.06%, and 4.61%, respectively.

Layer 2 Related Data

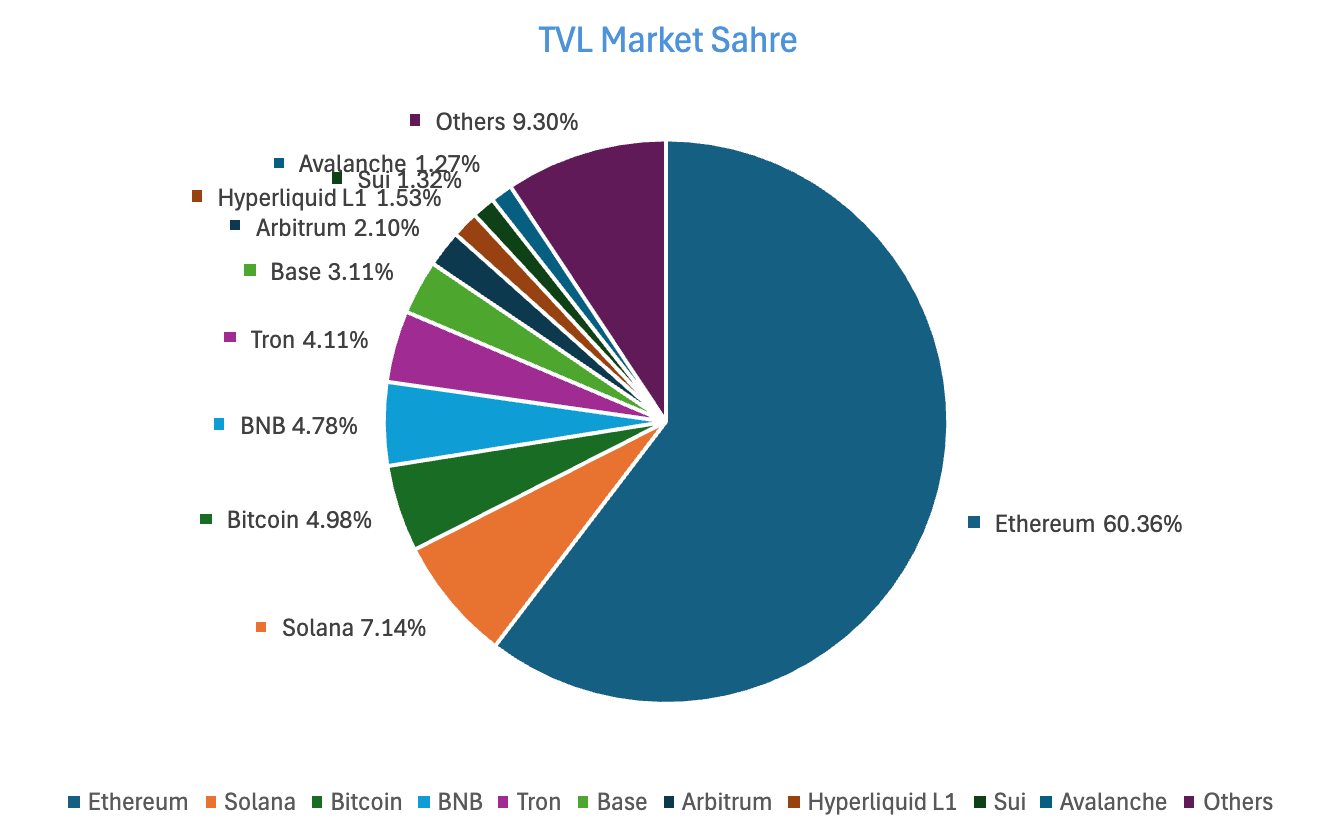

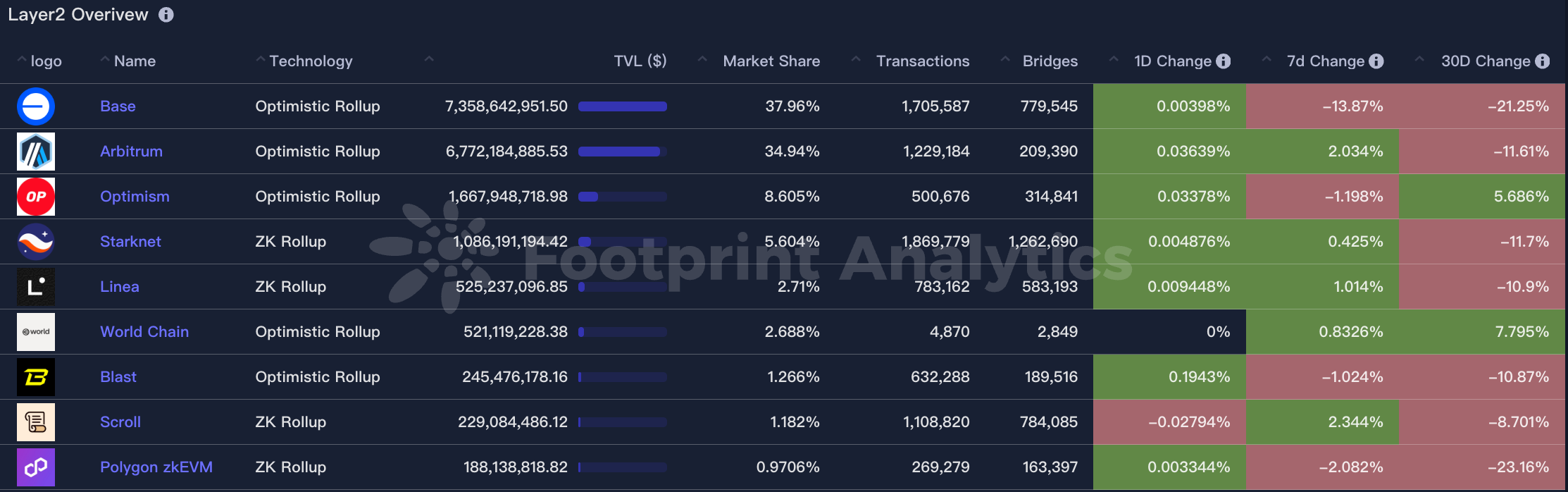

According to L2Beat, the total TVL of Ethereum Layer 2 is $45.19 billion, with an overall increase of 1.04% compared to last week ($44.72 billion).

Data Source: L2Beat

Data as of August 24, 2025

Base and Arbitrum occupy the top positions with market shares of 37.96% and 34.94%, respectively. Base's market share has slightly decreased over the past week, while Arbitrum has seen an increase.

Data Source: footprint

Data as of August 24, 2025

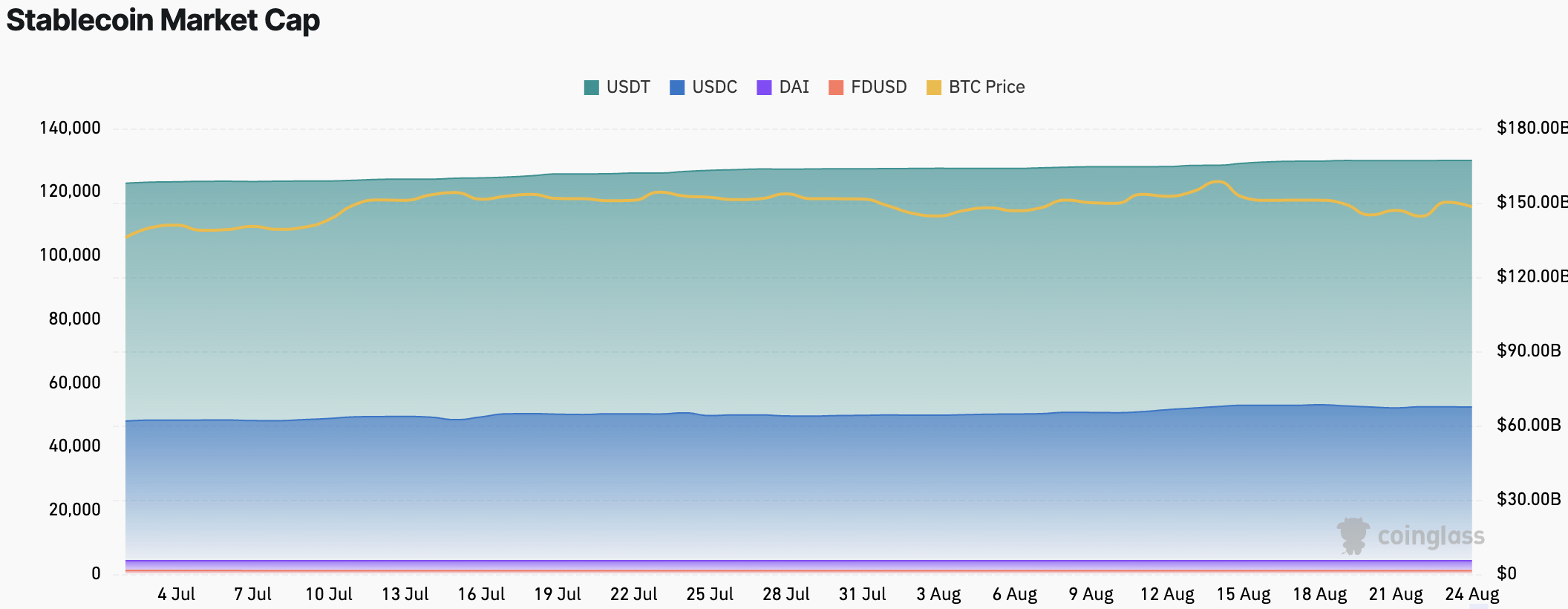

- Stablecoin Market Cap and Issuance

According to Coinglass data, the total market capitalization of stablecoins is $274.9 billion, with USDT's market cap at $167.1 billion, accounting for 60.78% of the total stablecoin market cap; followed by USDC with a market cap of $67.5 billion, accounting for 24.55% of the total stablecoin market cap; and DAI with a market cap of $5.37 billion, accounting for 1.95% of the total stablecoin market cap.

Data Source: CoinW Research Institute, Coinglass

Data as of August 24, 2025

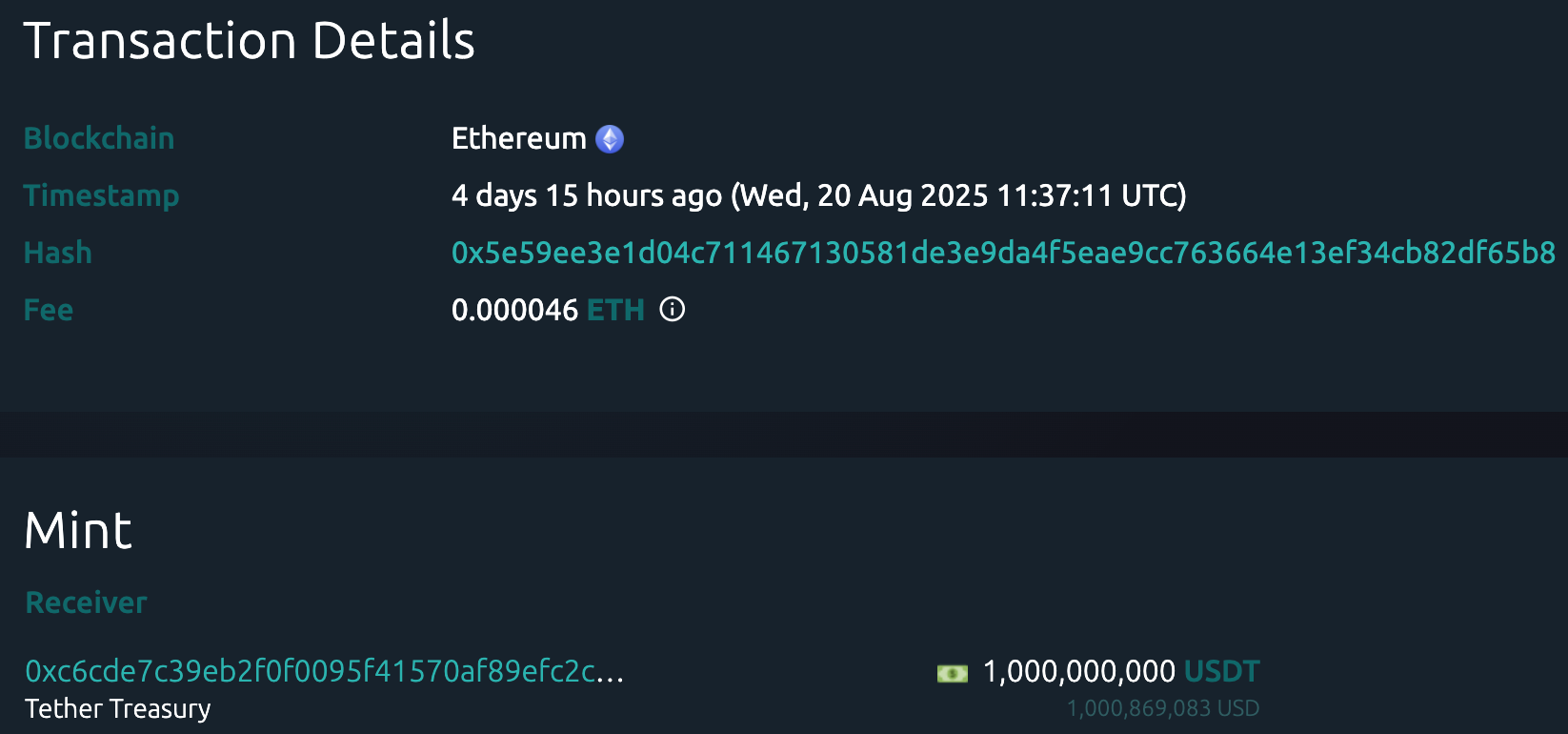

According to Whale Alert data, this week the USDC Treasury issued a total of 1.782 billion USDC, and the Tether Treasury issued a total of 1.06 billion USDT this week. The total issuance of stablecoins this week was 2.842 billion, a decrease of 27.95% compared to last week's total issuance of 3.945 billion.

Data Source: Whale Alert

Data as of August 24, 2025

II. This Week's Hot Money Trends

- Top Five VC Coins and Meme Coins by Growth This Week

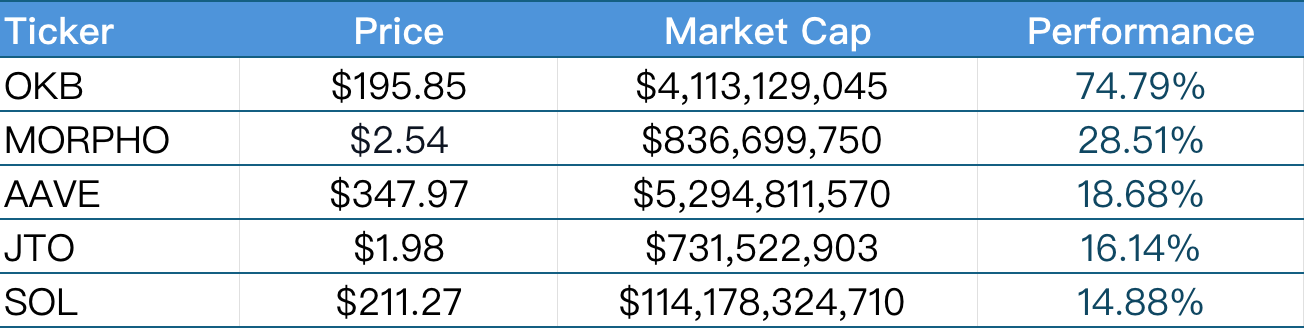

Top five VC coins by growth in the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of August 24, 2025

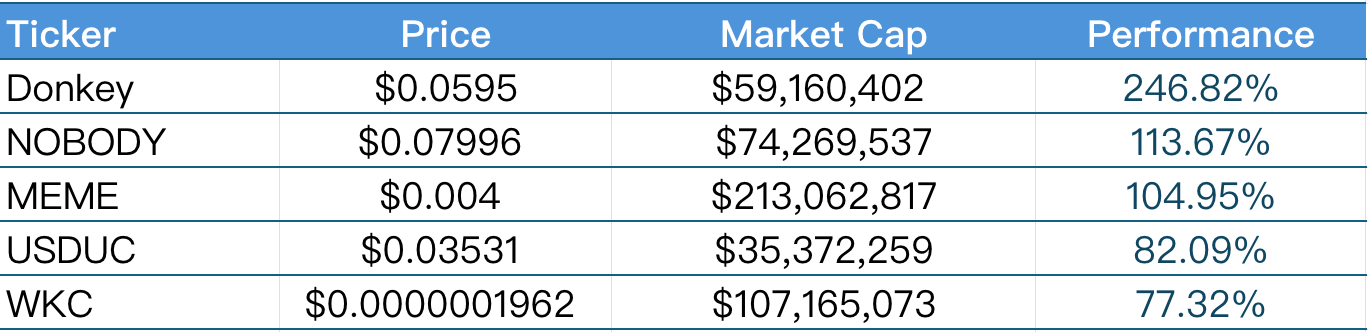

Top five Meme coins by growth in the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of August 24, 2025

- New Project Insights

01 Exchange (o1.exchange) is a decentralized trading platform aimed at providing an efficient and secure trading experience for cryptocurrency traders. The platform combines AI-driven market analysis, self-custody wallets, and anti-MEV (Maximum Extractable Value) protection mechanisms to ensure users enjoy a smooth experience similar to centralized exchanges in a decentralized environment.

StableStock is a decentralized on-chain stock asset platform that aims to combine traditional finance (TradFi) with decentralized finance (DeFi), offering a digital stock trading method settled in stablecoins. The platform includes three core modules: StableBroker (supporting stock purchases with stablecoins), StableVault (tokenizing stock assets for on-chain applications), and StableSwap (enabling low-slippage exchanges between different tokens).

Legion is a decentralized on-chain fundraising platform designed to enable retail investors to fairly participate in the financing of early-stage projects through a compliant regulatory framework and investor credibility system. Legion introduces the "Legion Score" mechanism, which comprehensively assesses investors' social activity, investment behavior, and community contributions, reducing the risk of bots and Sybil attacks. Project teams can customize investment amounts, whitelists, discounts, and other strategies based on this credibility data, thereby building a valuable supporter community.

III. New Industry Dynamics

- Major Industry Events This Week

On August 20, Mitosis opened registration for its genesis airdrop, which will last until August 26. Users can check their airdrop eligibility through the official airdrop query website. Airdrop claims are expected to open before September 10 and will last for a week, during which users can choose to receive directly or stake for 180 days to obtain additional airdrop shares. Previously, the Mitosis Foundation announced the MITO token economics on August 17, with a total supply of 1 billion tokens, of which 10% is allocated for the genesis airdrop, while the rest is distributed to the ecosystem, team, investors, foundation, and other incentive mechanisms.

On August 20, CyberKongz officially announced the issuance of a new token KONG, which will fully replace the original token BANANA. The total supply of KONG is 1 billion tokens, and it will only be issued on the Ethereum mainnet. BANANA holders can exchange KONG at a ratio of 1:25 during the token generation event (TGE). As part of the issuance, 2% of the total KONG supply will be airdropped to the Ethereum NFT community, with specific airdrop details to be announced later.

On August 18, Rice AI ($RICE) successfully completed its token generation event (TGE) and conducted its initial public offering (IDO) on the PancakeSwap platform on the same day. A total of 200 million $RICE tokens were offered in this issuance, with 2% (i.e., 40 million tokens) sold through TGE at a subscription price of approximately $0.036. Rice AI also plans to airdrop a total of 140 million $RICE tokens to stakers of $FLOKI and $TOKEN, distributed in 8 rounds, with the first round starting at 10:00 AM (UTC) on August 21, 2025. The airdrop amount will be calculated based on factors such as staking amount, staking duration, and staking commitment period.

On August 21, AriaAI ($ARIA) successfully completed its token generation event (TGE) and launched its initial public offering (IDO). The total issuance is 1 billion $ARIA tokens, of which 51% will be distributed to community users through airdrops. Users must confirm their airdrop eligibility within the specified time; otherwise, it will be considered forfeited. AriaAI also provides an airdrop query tool to help users check their airdrop eligibility and plans to launch more airdrops and reward mechanisms in the future to encourage community participation.

- Major Upcoming Events Next Week

The CAMP airdrop eligibility query function went live on August 22. Users must complete registration by 11:59 AM Beijing time on August 26 and connect using the same wallet that participated in the Camp ecosystem (including the Summit Series testnet) to verify eligibility. A registration fee of 0.0025 ETH is required to complete registration, which covers the cost of gas-free claims on the Camp mainnet; no additional fees will be charged when claiming the airdrop.

Boundless (ZKC) will conduct its initial public offering (IDO) from August 25 to September 1, 2025, with 50% of the tokens unlocking at the token generation event (TGE) and the remaining 50% unlocking later. Community users can improve their airdrop eligibility by completing tasks, engaging in social media interactions, joining Discord, minting NFTs, etc. Additionally, Boundless has launched the "Boundless Berry NFT" airdrop event, where users can mint NFTs by paying a small gas fee to gain future airdrop opportunities.

Lombard ($BARD) plans to conduct its initial public offering (IDO) from August 26 to September 2, 2025, with a target fundraising amount of $6.75 million, and 1.5% of the total token supply will be distributed through this public offering. The sale will take place on the Buidlpad platform, and participants must complete KYC verification. The token generation event (TGE) is expected to occur on September 4, 2025, with all tokens unlocking at TGE, and there will be no lock-up period. Lombard is a decentralized finance (DeFi) protocol aimed at bringing Bitcoin into the DeFi ecosystem through its Babylon protocol.

- Important Investments and Financing from Last Week

IVIX announced the completion of a $60 million Series B financing round, led by OG Venture Partners (OGVP), with participation from Insight Partners, Citi Ventures, Team8, Disruptive AI, Cardumen Capital, and Cerca. The funds will primarily be used to accelerate research and development capabilities, focusing on financial crime detection in complex crypto networks, anonymous blockchain transactions, and high-frequency trading. IVIX is a blockchain-based Web3 compliance project focused on combating financial crime and narrowing the tax gap using transparent data tracking and decentralized compliance solutions. August 18, 2024. (August 18, 2025)

DigiFT announced the completion of a new round of strategic financing of $25 million, led by Japan's largest financial group, SBI Holdings, with participation from Mirana Ventures, Offchain Labs (Arbitrum), Yunqi Capital, and several global fintech executives. The funds will be used to expand tokenized products, enhance RWA secondary market liquidity, broaden on-chain application scenarios, and build compliant smart contract infrastructure. DigiFT is an Ethereum-based on-chain RWA compliant exchange founded by a team with backgrounds from Goldman Sachs, UBS, Citigroup, and Morgan Stanley, aiming to provide blockchain-based security token issuance and AMM continuous liquidity trading services for asset issuers and investors. (August 21, 2025)

Irys announced the completion of a $10 million Series A financing round, led by CoinFund, with participation from Hypersphere, Tykhe Ventures, Varrock Ventures, Breed VC, Echo Group, Amber Group, and WAGMI Ventures, bringing the total financing amount to $20 million. Irys (formerly Bundlr Network) is a Layer-1 data chain designed for AI, achieving data programmability through a low-cost storage layer and a high-performance, EVM-compatible execution layer, IrysVM. (August 21, 2025)

IV. Reference Links

StableStock: https://www.stablestock.finance/

LEGION: https://legion.cc/

IVIX: https://www.ivix.ai/

DigiFT: https://www.digift.sg/

Irys: https://irys.xyz/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。