Original author: Lao Lu (@Luyaoyuan1), Crypto OG

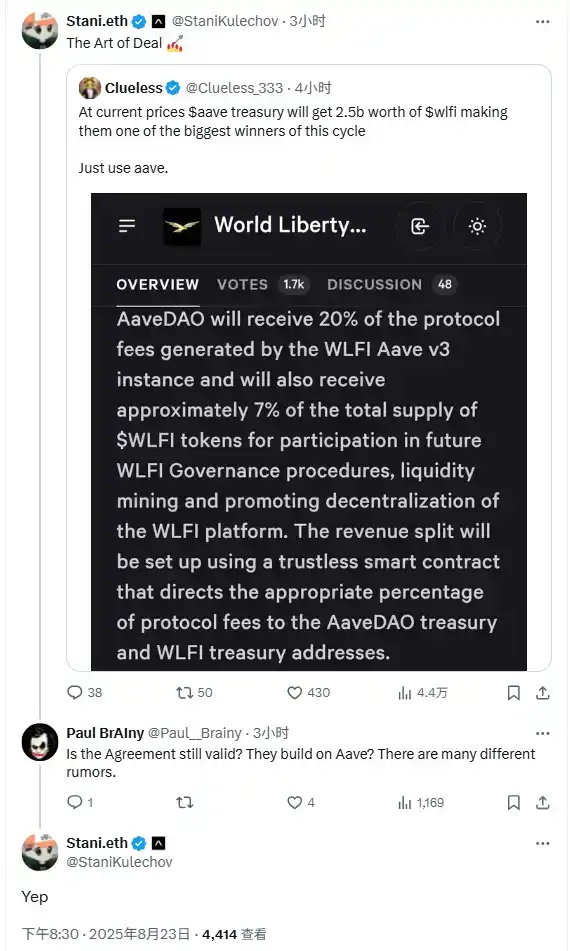

Editor's Note: Last weekend (August 24), a disagreement arose between Aave and the WLFI team regarding "Aave should receive 7% of the total supply of WLFI tokens," leading to significant fluctuations in the price of AAVE tokens. The dispute originated from a proposal released by the WLFI team in December 2024 to "launch an Aave V3 instance on the Ethereum mainnet," which was approved. The proposal indicated that Aave would serve as a lending ecosystem partner for WLFI, and WLFI would adopt reserve factor parameter designs consistent with the Aave mainnet in its Aave v3 instance. As part of the collaboration, AaveDAO would enjoy 20% of the protocol fees generated by this instance and would be allocated approximately 7% of the total supply of WLFI tokens, which are intended for participation in WLFI's subsequent governance, providing liquidity incentives, and promoting the decentralization of its platform.

However, the situation took a dramatic turn recently. Last night, a Twitter user suspected to be a member of the WLFI Wallet team, @0xDylan_, tweeted to deny the association of the proposal stating "Aave will receive 7% of the total WLFI tokens." In response, Aave founder Stani.eth quickly pointed out that the proposal was written and submitted by the WLFI team and was legally voted on by Aave DAO, attaching the original proposal link as evidence.

It is worth noting that this is not the first time Aave has been embroiled in such controversies. There have been several instances where project parties have sought reputational endorsement through "cooperation" or "proposals" with Aave, only to fail to fulfill their promises. These events expose deeper issues: while DAO governance proposals have a certain degree of binding significance, when one party in the collaboration is highly centralized and refuses to fulfill the proposal, can on-chain governance be effectively executed? In the absence of clear support from traditional legal frameworks, how can DeFi projects break through the trust dilemma of "gentlemen's agreements" and establish more reliable cooperative execution mechanisms? This has become a real challenge facing Aave and the entire DeFi sector.

Crypto OG @Luyaoyuan1 also wrote related tweets, recounting Aave's past experiences of being "duped." The following is the content of the tweets:

In April 2021, Polygon (market cap about $4 billion) offered $40 million worth of 1% MATIC to incentivize Aave (then with a market cap of about $6.5 billion). For AAVE at that time, it was merely a bonus; the mainnet data was growing rapidly, and countless L2s were extending olive branches. However, for the relatively barren DeFi ecosystem of Polygon, it was a timely help.

In the Swap field: Uniswap did not officially deploy to Polygon until December 2021, during which QuickSwap dominated.

In the lending field: Many protocols emerged on Polygon that forked mainnet lending products, but their security was concerning, with numerous attacks like those on EZLend.

The $40M incentive led to over $1 billion in TVL, with Matic skyrocketing from $0.4 to $2.6 by December 2021. While this was not entirely due to Aave, the impact was undoubtedly profound. The valuation logic of that era was more "naive"—capital accumulation determined valuation; with fresh capital, there was active money. Unlike now, where $1 billion in TVL is commonplace, the collaboration between Polygon and Aave has long been viewed as a classic example of a win-win between public chains and applications, serving as a template for others to follow.

Fast forward to December 2024, a heated debate arose over whether to place $1.3 billion in assets from Polygon's cross-chain bridge in Morpho or Aave. Polygon hesitated, while Aave expressed the risks of such a move and responded firmly. Aave adjusted the parameters of the Polygon lending platform, setting the LTV to 0, meaning that no matter how much was deposited, borrowing would be impossible, freezing liquidity, and even considering exiting Polygon. Ultimately, Polygon chose neither side, maintaining the status quo of funds on the bridge, and Aave has since remained highly cautious towards Polygon.

As for Morpho, its story is quite dramatic. Initially just a rate optimization layer for Aave/Compound, it later independently launched Morpho Blue, rapidly expanding with strong business development capabilities and competing for market share, becoming Aave's most significant competitor. Their strategy was to persuade various on-chain capital providers to migrate liquidity to Morpho, thus competing directly with Aave.

The above stories inevitably raise several questions:

Did Polygon have to choose to cooperate with Aave? Could Polygon's ecosystem have launched so quickly without AAVE? Or would it have faced frequent security incidents and gone unnoticed?

What exactly do Morpho's actions constitute? Is this market innovation or "biting the hand that fed it"?

In the face of interests, does Polygon still remember the timely help from back then, or has it long forgotten that kindness?

Aave's story continues, and similar scenarios are replaying between WLFI and Aave. They borrowed influence and gained endorsement; how will both parties develop moving forward? I will revisit this in two years.

Are you afraid of products from Dough Finance? How do relationships between projects compare to those between people?

(The above content is based solely on publicly available information and does not involve any positions or interests. Readers are advised to make their own judgments and assess risks.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。