Author: Thejaswini M A

Translation: Block unicorn

Preface

Arthur Hayes travels with a suitcase full of stuffed animals.

The 40-year-old cryptocurrency billionaire has collected over 100 stuffed toys, named each one, and brings them along to celebrate milestones. In his apartment in Miami—where he served six months of house arrest—visitors can see rows of stuffed animals, displayed like in a childhood bedroom: there are yellow-green starfish, foxes, armadillos, giraffes, elephants, octopuses, snakes, and even a personified cabbage.

For someone who created the financial tools that now dominate cryptocurrency trading, this might seem a bit odd. But Hayes has never been one to follow the conventional path.

In 2013, Bitcoin traders faced a problem that was both silly and mathematically intriguing.

Every month, their futures contracts would expire, forcing them to constantly adjust their positions, like playing some sort of expensive financial Sisyphus simulator.

Rolling contracts, paying fees, endlessly repeating, gradually transferring all funds to the exchange through trading costs.

Arthur Hayes, a derivatives trader, had spent his career at Deutsche Bank and Citigroup studying how to profit from the fact that markets are held together by mathematical tape. He saw this situation and came up with an idea that can only be described as extremely expensive.

"What if time didn’t exist?"

Not in a philosophical sense—Hayes wasn’t having an existential crisis about the nature of time’s reality.

He wondered what would happen if a perpetual futures contract could be created, eliminating the monthly fee extraction ritual that was slowly bankrupting every Bitcoin trader on Earth.

The answer made him a giant in the cryptocurrency space, creating the financial tool that now supports most cryptocurrency trading, but also ultimately facing federal criminal charges for building this tool without proper licensing.

This story illustrates what happens when someone applies traditional financial engineering to a market designed by computer programmers who view regulation as merely a synonym for "suggestion."

Early Life and Education

Hayes grew up in Detroit in the 1980s, with parents who worked at General Motors and understood that education was the only reliable way to escape the cyclical booms and busts of the auto industry. They moved to Buffalo so he could attend Nichols School—a preparatory school where rich kids learned Latin and poor students learned how to network with the wealthy.

He excelled academically, ranking second in his class, while also being a member of the school’s lacrosse team. After bouncing between the University of Hong Kong and the Wharton School, he graduated in 2008 with degrees in economics and finance, just in time for the real-time collapse of the global financial system.

He didn’t stay in New York to reflect on whether Wall Street fundamentally broke after the crisis; instead, he moved to Hong Kong. This was a prescient decision, as in Hong Kong, you could trade exotic derivatives without anyone raising sharp questions about systemic risk.

Learning the Language of Derivatives

As a broke intern, Hayes turned food delivery into a profitable business, charging colleagues a markup on each order and earning hundreds of dollars a week. When recruiters visited Wharton, he took them to nightclubs in Philadelphia, leaving a strong impression. His work attire was legendary—at a "Casual Friday" event, he wore a tight pink polo shirt, acid-wash jeans, and bright yellow sneakers, prompting a department head to ask, "Who is that guy?" This led to the cancellation of "Casual Friday" events.

In 2008, Deutsche Bank hired Hayes as an equity derivatives trader in its Hong Kong office. There, he became fascinated by the complex mathematics of derivatives—financial instruments whose value derives from underlying assets.

His expertise was in delta-one trading and ETFs—essentially the "plumbing" of finance. While not glamorous, it was crucial; if you knew how to connect the pipes, you could profit.

After learning how to make money from price discrepancies that existed for about seventeen seconds for three years, he jumped to Citigroup in 2011. In 2013, when banking regulators decided the fun was over, Hayes was laid off, allowing him to discover Bitcoin at a time when it desperately needed people who understood how financial plumbing actually worked.

In 2013, Bitcoin was traded on exchanges built by developers who understood blockchain protocols but had never heard of margin requirements. Hayes saw a 24/7 operation with no circuit breakers, no central authority, and certainly no complex risk management. It was either the future of finance or a complex way to lose money quickly; Hayes believed these two possibilities were not mutually exclusive.

The infrastructure was rudimentary, but the mechanics were captivating, and the underlying mechanisms of the Bitcoin market fascinated Hayes. This market urgently needed the kind of financial engineering he had learned in traditional finance.

Building BitMEX

Hayes collaborated with mathematician Ben Delo and Samuel Reed, who truly understood how cryptocurrencies worked. In January 2014, they began building BitMEX—a Bitcoin commercial exchange, claiming to be "the best peer-to-peer trading platform," competing with exchanges that were characterized by "barely functioning."

The three founders each had their strengths: Hayes was well-versed in market structure and derivatives, Delo could build complex trading engines, and Reed was knowledgeable about cryptocurrency technology.

BitMEX officially launched trading on November 24, 2014, focusing on Bitcoin derivatives. After months of careful development and stress testing, the timing was perfect. At launch, the founders were scattered around the globe—Hayes and Delo in Hong Kong, while Reed participated remotely from his honeymoon in Croatia.

Early products included leveraged Bitcoin contracts and dual-currency futures, allowing traders to express their views on Bitcoin prices without holding the underlying asset. These complex tools required an understanding of margin, clearing mechanisms, and cross-currency hedging.

But Hayes and his team were just getting started.

On May 13, 2016, BitMEX launched the unprecedented XBTUSD perpetual swap contract. This was a never-ending type of futures contract, where funding payments between long and short positions kept the contract price stable relative to the spot price of Bitcoin. The perpetual swap offered up to 100x leverage and settled in Bitcoin cash.

Traditional futures expire monthly, forcing traders to constantly roll positions and pay fees, falling into an absurd cycle. Hayes borrowed the funding mechanism from the forex market and applied it to Bitcoin futures. The contracts had no expiration date but maintained a link to the spot Bitcoin price through funding fees between long and short positions. When the contract price was above the spot, longs paid shorts; when below, shorts paid longs. The market thus self-corrected.

This eliminated expiration dates, reduced trading costs, and created such a practical tool that every cryptocurrency exchange immediately followed suit. Today, perpetual swaps account for the majority of global cryptocurrency trading volume. Hayes effectively solved the time problem, at least in the realm of derivatives contracts.

Explosive Growth and Regulatory Scrutiny

BitMEX's XBTUSD contract quickly became the deepest Bitcoin derivatives market in the world. The exchange's complex risk management, professional-grade tools, and high leverage attracted both traditional finance and crypto-native traders.

By 2018, BitMEX's daily notional trading volume exceeded $1 billion. The exchange moved into the 45th floor of the Cheung Kong Center in Hong Kong—one of the city's most expensive office buildings. In August 2018, BitMEX went offline for scheduled maintenance, and the Bitcoin price immediately surged 4%, adding $10 billion in market capitalization to the entire crypto market.

BitMEX nominally prohibited U.S. customers, but critics argued that these restrictions were easily circumvented. The exchange's influence on Bitcoin prices drew the attention of academics, regulators, and politicians, who were just beginning to understand the cryptocurrency market.

In July 2019, economist Nouriel Roubini released a report suggesting that BitMEX was involved in "systemic illegal activities," claiming it allowed excessive risk-taking and could profit from customer liquidations. These allegations triggered regulatory investigations and congressional hearings on the structure of the crypto market.

By the end of 2019, daily trading volume in Bitcoin derivatives reached $5 billion to $10 billion, more than ten times the spot Bitcoin trading volume. BitMEX captured a significant share of this activity, making Hayes and his partners central figures in the global crypto market.

On October 1, 2020, things took a sharp turn. The U.S. Commodity Futures Trading Commission (CFTC) filed a civil lawsuit, and the U.S. Department of Justice (DOJ) announced criminal charges, claiming BitMEX operated as an unregistered futures commission merchant while servicing U.S. customers and ignored anti-money laundering requirements. Prosecutors alleged that Hayes and his partners willfully disregarded compliance requirements while earning hundreds of millions in profits.

That day, Hayes resigned as CEO. Reed was arrested in Massachusetts. Hayes and Delo were listed as "fugitives," a term used by the DOJ meaning "we know where you are, but we haven't caught you yet."

The legal proceedings lasted two years, during which Hayes found he had a knack for writing about markets and monetary policy. His "Crypto Trader Digest" became essential reading for understanding the connections between macroeconomics, Federal Reserve policy, and cryptocurrency prices. He built a framework explaining why central bank decisions inevitably pushed people toward Bitcoin.

In August 2021, BitMEX agreed to pay $100 million to settle civil charges. On February 24, 2022, Hayes pleaded guilty to charges of willfully failing to establish an anti-money laundering program. On May 20, 2022, he was sentenced to six months of home confinement, two years of probation, and a $10 million fine.

During the legal proceedings, Hayes became one of the most insightful commentators in the cryptocurrency space. His analyses of Federal Reserve policy and Bitcoin price dynamics influenced traders' and institutions' views of cryptocurrency as a macro asset. He proposed the concept of "NakaDollar"—a synthetic dollar created by combining long Bitcoin positions with short perpetual contracts, effectively creating dollar exposure without traditional banking infrastructure.

Hayes also actively advocated for Bitcoin as a hedge against currency devaluation.

"Our way of transferring currency is shifting from an analog society to a digital society, which will bring about tremendous disruption," Hayes observed. "I see the opportunity in Bitcoin and cryptocurrencies to create a company that can benefit from this massive transformation."

On March 27, 2025, President Trump pardoned Hayes and his BitMEX co-founders, officially ending this chapter of his life as a defendant. By this time, Hayes had begun his post-BitMEX career as the Chief Investment Officer of the family office fund Maelstrom, which invests in venture capital, liquidity trading strategies, and crypto infrastructure.

The fund supports Bitcoin development by providing grants of $50,000 to $150,000 to Bitcoin developers, reflecting Hayes' belief in the need for sustainable funding for open-source development. The Maelstrom website explains: "Bitcoin is the cornerstone asset of the crypto space, and unlike other crypto projects, Bitcoin has never raised funds for technological development through issuance."

Recent Market Dynamics

Hayes' current investment strategy reflects his macro outlook. In August 2025, he made headlines for purchasing over $15 million in cryptocurrency within five days, focusing on investments in Ethereum and DeFi tokens rather than Bitcoin. His purchases included 1,750 ETH ($7.43 million) and significant holdings in HYPE, ENA, and LDO tokens. This allocation reflects his belief that certain altcoins can benefit from market trends, such as institutional interest in ETH, the growing popularity of stablecoins, and protocols that earn profits by filling specific market gaps.

Hayes is also a staunch supporter of Ethena (ENA), a synthetic dollar protocol based on the derivatives concept he pioneered at BitMEX. In August 2025, he purchased 3.1 million ENA tokens worth $2.48 million, becoming one of the largest individual holders of the project. Hayes views Ethena as the next evolutionary stage of the NakaDollar concept, utilizing derivatives to create dollar-pegged assets without traditional banking infrastructure. This investment indicates Hayes' bet on a new generation of projects redefining how synthetic assets operate using perpetual swaps and funding mechanisms.

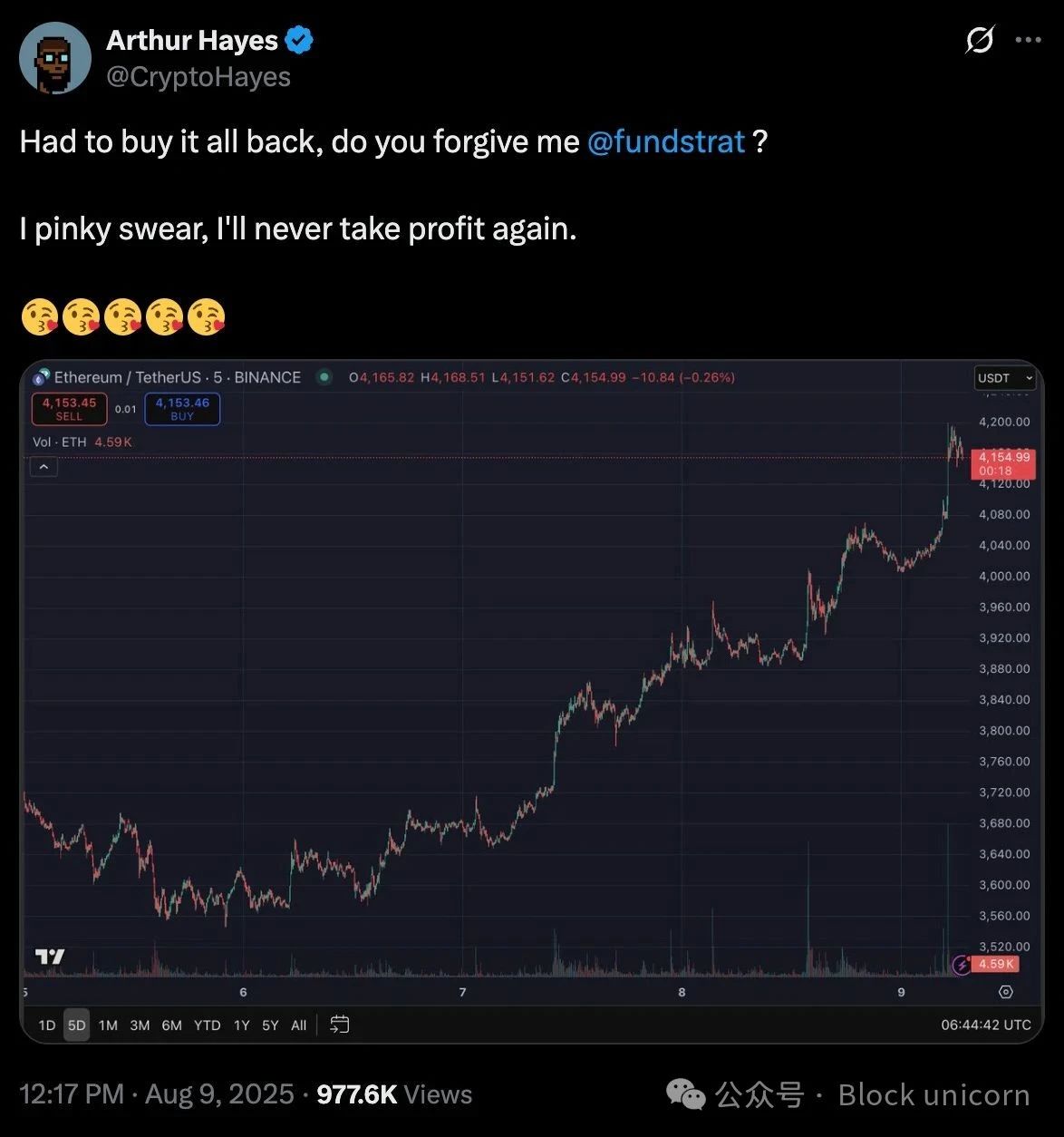

Earlier that month, citing macroeconomic concerns, he sold $8.32 million worth of Ethereum when the price approached $3,500. When ETH rebounded above $4,150, he bought back in and admitted on social media, "I had to buy it all back. I swear, I will never take profits again."

Hayes' current macro argument focuses on what he believes to be the Federal Reserve's inevitable money printing. He argues that structural issues, including housing market pressures, demographic changes, and capital outflows, will force policymakers to inject about $9 trillion into the financial system. He stated, "If you don't print money, the system will collapse," emphasizing the debt burdens of entities like Fannie Mae and Freddie Mac.

If this scenario unfolds, Hayes predicts that Bitcoin could reach $250,000 by the end of 2025 as investors seek alternatives to depreciating fiat currencies. He also believes Bitcoin could reach $1 million by 2028, based on his conviction that the current monetary system is unsustainable and that Bitcoin is the most viable store of value alternative.

Perpetual swaps have fundamentally changed the way cryptocurrencies are traded by providing tools that eliminate many frictions present in early derivatives markets.

By 2025, even mainstream platforms like Robinhood and Coinbase are launching their own perpetual products, while new exchanges like Hyperliquid are building entire businesses around Hayes' original innovations.

The regulatory framework spawned by the BitMEX case has also shaped industry standards. Proper anti-money laundering programs, customer verification, and regulatory registration have become basic requirements for exchanges serving the global market.

At 40, Hayes occupies a unique position in the cryptocurrency ecosystem. He is old enough to remember traditional finance before Bitcoin emerged; his experience is rich enough to build the infrastructure that defines cryptocurrency trading; and his practical experience is substantial enough to navigate rapid success and serious legal consequences.

His story illustrates that sustained success in the crypto space requires an understanding of both technology and regulation, innovation and compliance. The success of perpetual swaps is not only due to their technical elegance but also because they solve real problems for traders while operating within existing legal frameworks—at least until those frameworks catch up with innovation.

Reflecting on the BitMEX experience, Hayes said, "We didn't need to ask for permission to build this platform; what other industry allows three guys to try to create an exchange with daily trading volumes in the billions?"

This statement captures the opportunity and responsibility of building financial infrastructure in a rapidly changing regulatory environment.

Today, Hayes continues to analyze the market and make concentrated investments based on his macro outlook, with his influence extending beyond individual trades or investments. Through his writing, investments, and ongoing engagement in the crypto market, he remains one of the most thoughtful voices in an industry that often prioritizes hype over analysis.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。