Today's homework is still not complicated. Compared to last Friday's closing, the price of $BTC has dropped by $2,500 over the weekend, while $ETH has only fallen by less than $30. Recently, there has been almost daily discussion about the differences between BTC and ETH. As long as ETH still has a significant amount of buying power in the primary and secondary ETF markets, shorting ETH may be a thankless task, while Bitcoin is likely to be a precursor to the U.S. stock market.

The reasons for the decline over the weekend have been discussed many times. The market has begun to reflect on Powell's speech from Friday, with interest rate cuts and economic recession being more likely to excite investors. However, after a day, expectations for a rate cut in September have returned to around 84%. The current market hopes for a rate cut from the Federal Reserve while also worrying that such a cut is due to an economic downturn.

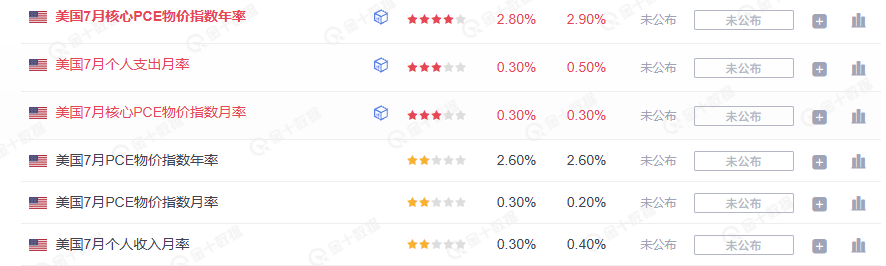

On Monday, there are two key time points: one is the morning CME opening to gauge the thoughts of Asian investors, and the other is the evening opening of the U.S. stock market to see what American investors think. The most important data next week should be the core PCE on Friday, which currently seems likely to fall within the market's expected range. Therefore, if there is a continued decline on Monday, I might consider going long.

Additionally, several Federal Reserve officials will be giving speeches next week, which could provide insights into who supports which side. Currently, the support from Trump's camp should be three people: Waller, Bowman, and Williams.

Looking back at Bitcoin's data, the turnover rate on Sunday was still very low. Although the continuous price decline did not trigger panic among investors, it is worth noting that it was the weekend, and due to insufficient liquidity, even a small amount of selling could lead to significant price fluctuations. As mentioned earlier, it all depends on Monday. However, neither BTC nor ETH should experience a gap; we mainly need to see more investors' thoughts after a weekend.

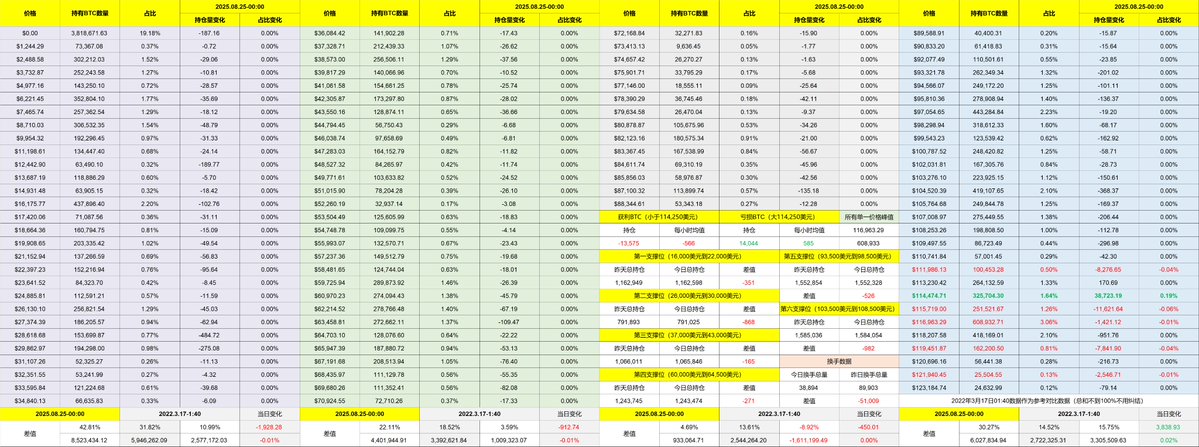

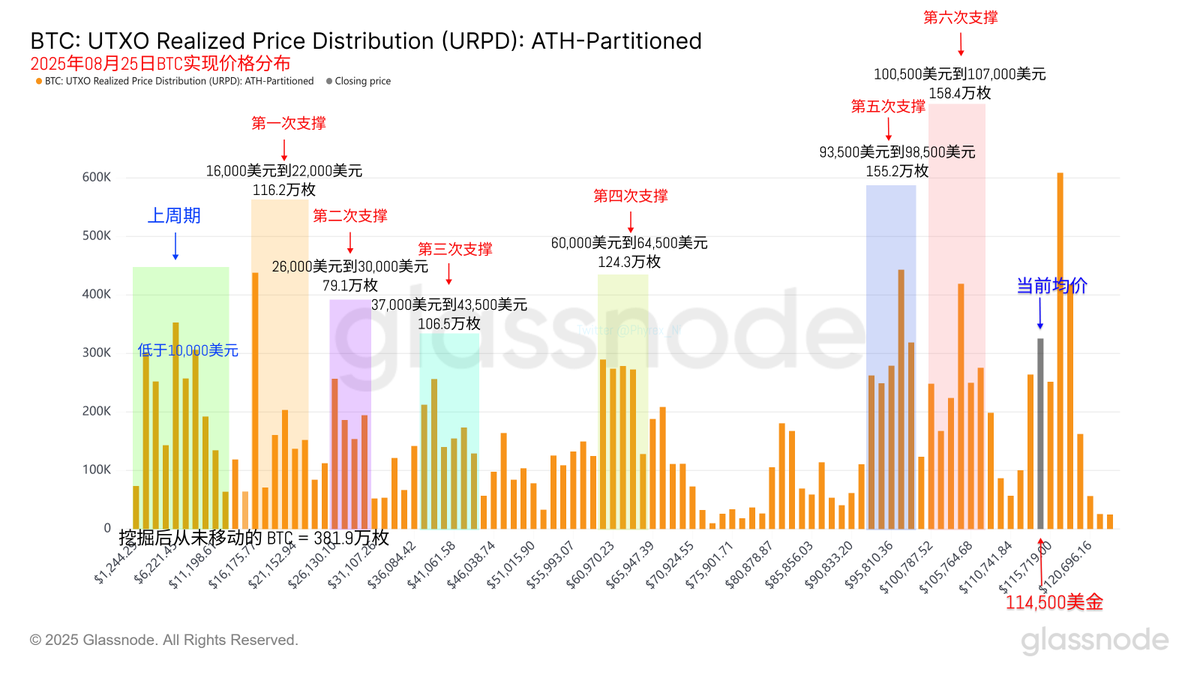

The seventh support level has begun to take shape and should be marked next week, likely between $113,000 and $118,000. There are already quite a few accumulated chips.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。