Abstract

- According to data released by the Cryptorank Dashboard on August 5, 2025, the Web 3 industry completed a total of 132 financing rounds in July 2025, with a total financing amount of $3.68 billion, continuing the strong capital enthusiasm.

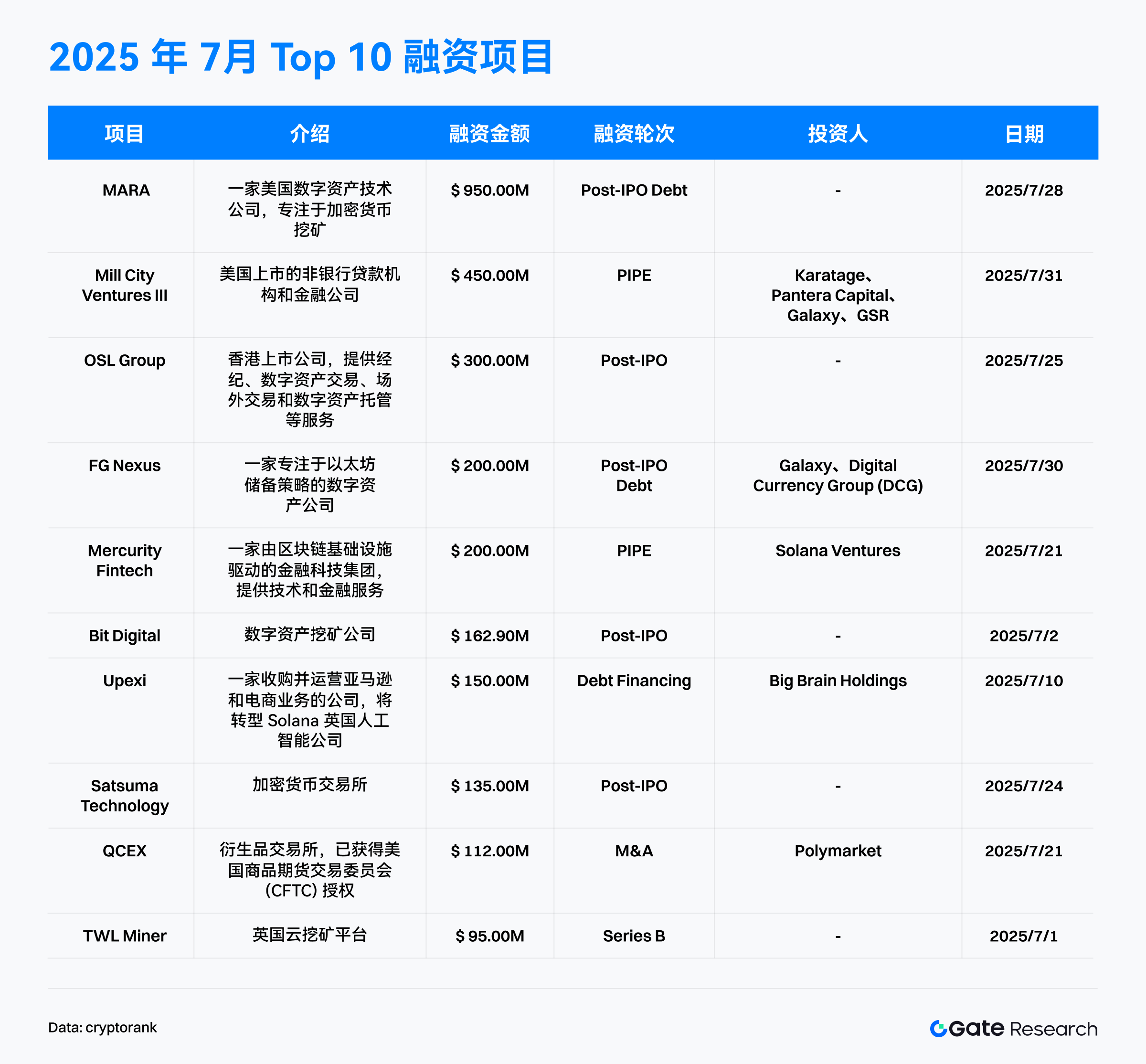

- From the perspective of the Top 10 financing projects, there is a clear trend of "head concentration" and "institutionalization" in the financing landscape. Traditional financial paths such as Post-IPO and PIPE (Private Investment in Public Equity) are gradually becoming mainstream financing methods, marking the deepening integration of Web 3 with traditional capital markets.

- Many projects have explicitly stated that part of the financing funds will be used to purchase mainstream crypto assets such as BTC, ETH, and SOL as treasury reserves, a trend that is gradually becoming the new normal in the industry.

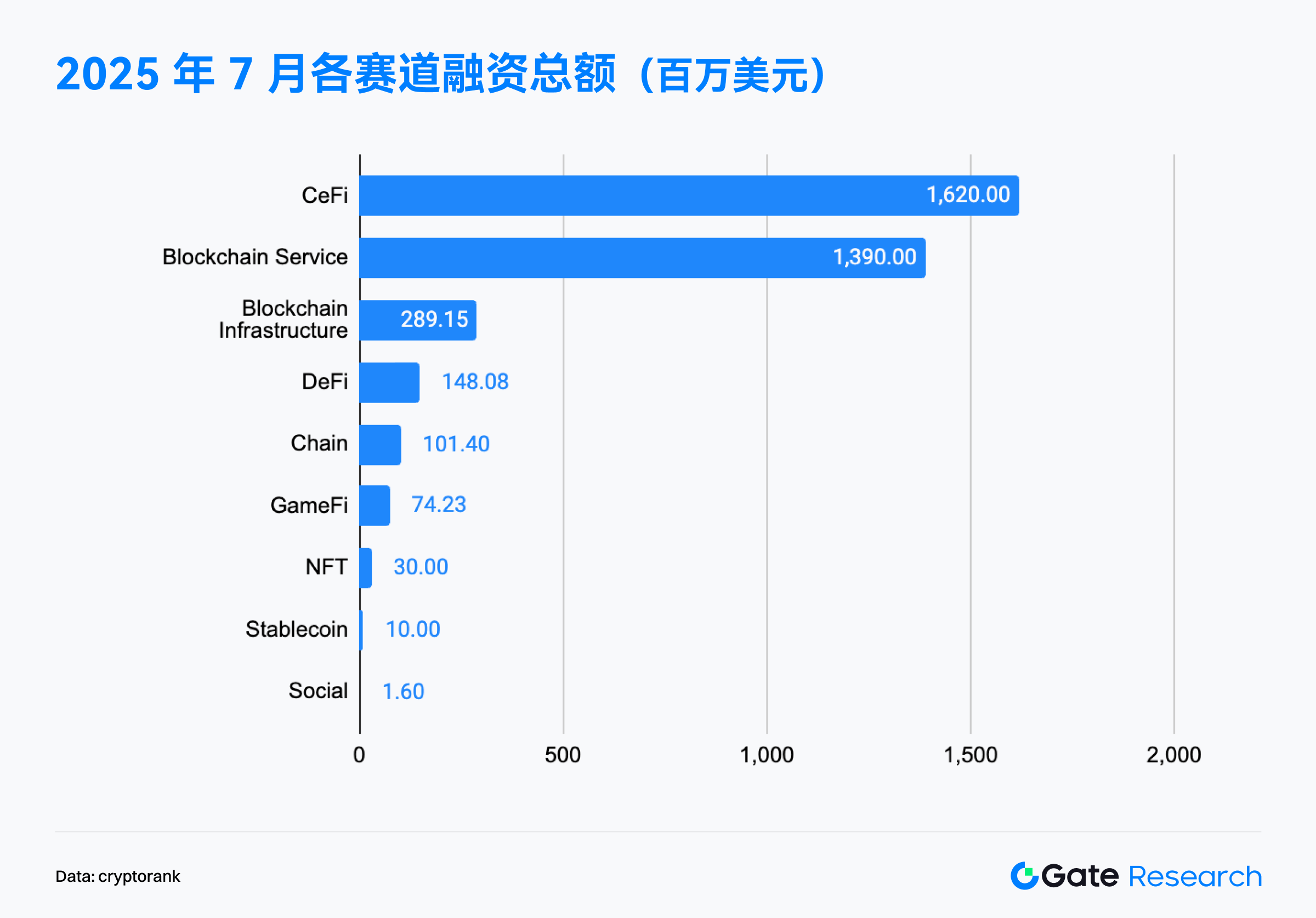

- Financing is mainly concentrated in CeFi ($1.62 billion) and blockchain services ($1.4 billion), showing a structural trend of "infrastructure first, service-oriented, and application differentiation"; capital continues to bet on centralized service platforms that have commercial closed-loop capabilities and can bridge Web 2 and Web 3.

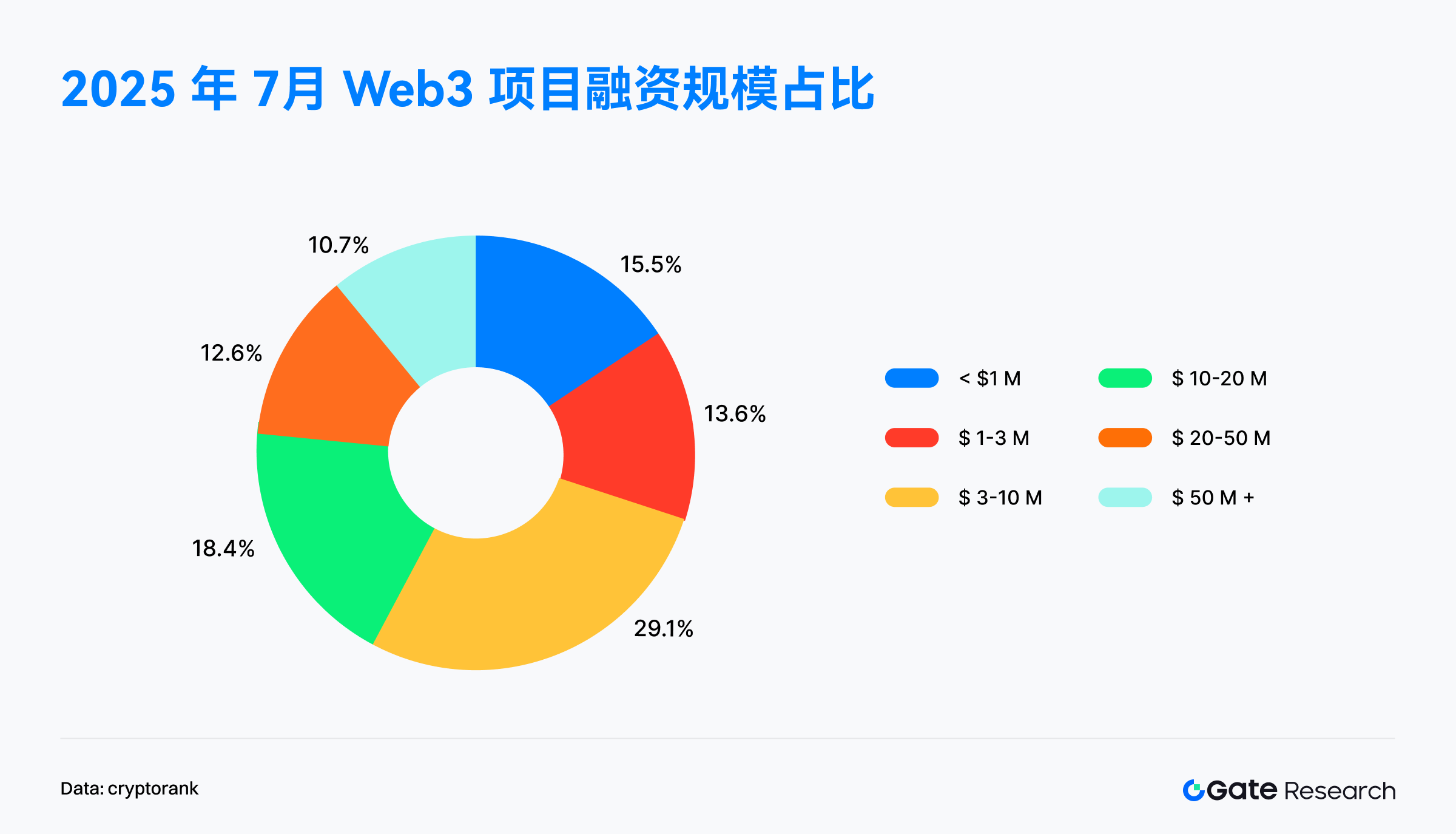

- In terms of financing scale, early-stage projects inject vitality into the ecosystem, while leading projects build confidence, but the most concentrated capital is still in growth projects between $3 million and $20 million, accounting for as much as 47.5%. These projects are mostly in the late stage of product-market fit (PMF) and on the verge of expansion, making them the current investment focus.

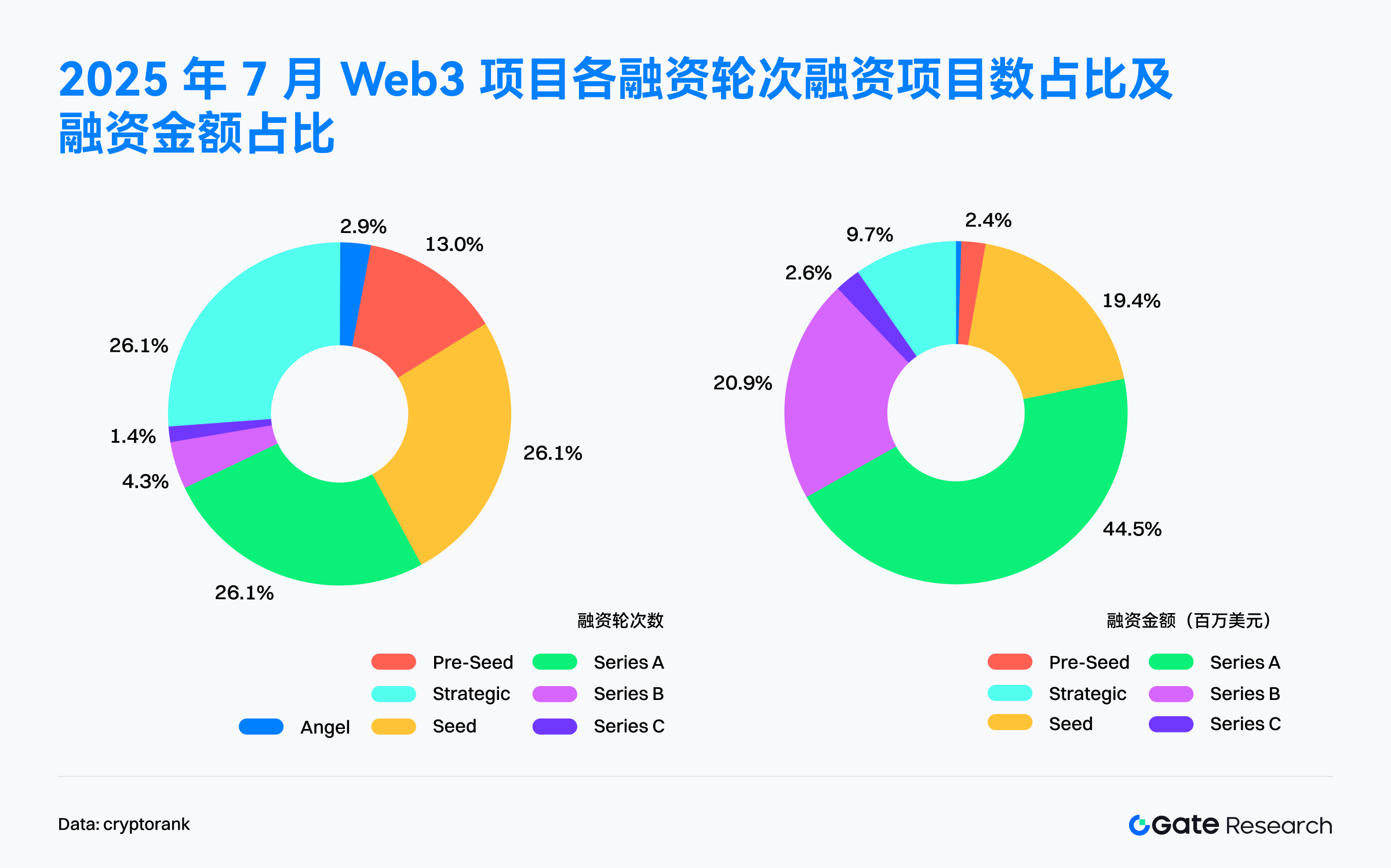

- From the perspective of financing rounds, the growth stage rounds are the most active, with Series A financing dominating, accounting for 44.4% of the total financing amount. Capital is shifting from "story-driven" to "growth validation," giving significant attention to projects with clear market paths, mature technology, and commercialization capabilities.

- At the institutional investment level, Colosseum ranked as the most active institution in July with 9 investments.

Financing Overview

According to data released by Cryptorank on August 5, 2025, the Web 3 industry completed a total of 132 financing rounds in July 2025, with a total financing amount of $3.68 billion【1】. It should be noted that due to statistical criteria, this amount differs from the total financing amount obtained by summing individual amounts (approximately $3.77 billion); to maintain consistency in the analysis data, this article uniformly adopts the original statistical data provided by the Cryptorank Dashboard.

Compared to 119 financing rounds and $5.14 billion in June 2025, the number of financing rounds in July increased by 10.92% month-on-month, but the total amount decreased by 28.4%. This phenomenon of "increased volume and decreased price" is mainly due to several large financings in June, particularly prominent in the fields of compliant financial services, expansion of listed companies, and deep integration with traditional finance. Among them, Circle topped the list with $1.1 billion in IPO financing, with 5 financings exceeding $400 million; while in July, there were only 2 financings exceeding $400 million, the highest being MARA's $900 million post-IPO financing obtained on July 28, which was also lower than the highest level of the previous month.

Looking back at the annual trend, the financing enthusiasm at the beginning of 2025 briefly receded, maintaining in the range of $1-1.2 billion in January and February. However, starting in March, the market rapidly heated up, with financing exceeding $5 billion in March and reaching a two-year high of $5.17 billion in June, showing characteristics of "centralization, high amounts, and institutionalization," indicating that the market is gradually maturing.

Although the financing amount in July has adjusted, it remains at a high level, with financing activity continuing to increase, reflecting that market enthusiasm is undiminished and investment confidence is solid. The Web 3 industry is entering a new stage of accelerated capital allocation and structural development.

The Top 10 financing projects in the Web 3 industry in July 2025 show a clear trend of "head concentration" and "institutionalization" in the financing structure. The total amount of financing in the top ten this month reached $2.75 billion, with individual financing amounts generally at the billion-dollar level, significantly driving the overall financing amount. Among them, MARA ranked first with $950 million in post-IPO convertible bond financing, demonstrating the strong financing capability of crypto mining companies in the capital market; followed by Mill City Ventures III, which obtained $450 million in PIPE private placement, with funds to be used to establish a treasury for Sui, reflecting the continued attention and deep participation of traditional financial institutions in public chain ecosystems【2】.

From the perspective of financing rounds and methods, Post-IPO and PIPE (private placement) have become mainstream, accounting for over 60% of the projects, especially concentrated in the CeFi and blockchain services sectors, indicating that listed or pre-listed companies remain favored targets for capital, and also showing that Web 3 is continuously integrating with traditional financial markets. Several projects have also explicitly stated that financing funds will be used to purchase mainstream crypto assets (such as BTC, ETH, SOL), indicating that crypto assets are becoming an important component of corporate financial reserves, reflecting confidence in the long-term value of crypto assets.

In addition, this month saw a large financing deal involving an acquisition (QCEX being acquired by Polymarket) and a traditional Series B financing (TWL Miner obtaining $95 million), injecting new variables and growth momentum into the market.

Overall, the Web 3 financing market in July presents strong capital injection, high concentration, and a preference for mainstream asset allocation, indicating that the industry is entering a mature stage led by top projects with a stable funding structure.

According to the Cryptorank Dashboard data, the Web 3 financing in July 2025 shows a trend of "strong institutions, compliance emphasis, and infrastructure focus," with funds highly concentrated in CeFi and blockchain services, with the total financing amount of these two sectors accounting for over 70% of the total for the month. This pattern reflects the high recognition of capital for platforms that connect traditional finance with the crypto world, providing both compliance and usability.

CeFi sector ($1.62 billion) continues to be strong, driven by multiple PIPE, Post-IPO, and acquisition transactions, showing significant characteristics of institutional dominance and head concentration in financing. Exchanges, custody, and crypto asset management platforms remain key areas for capital allocation, seen as the core entry points for traditional users and large-scale capital entering Web 3.

At the same time, the blockchain services sector continues to highlight its value, attracting nearly $1.4 billion in investment. This sector is viewed as the "water seller" of the Web 3 ecosystem, covering B-end basic services such as API interfaces, data analysis, node services, and security audits. As the complexity of Web 3 increases, capital is optimistic about specialized, efficient developer and enterprise-level tools, believing they will be key to driving industry maturity and large-scale adoption.

In contrast, while blockchain infrastructure ($289 million) and Chain ($101 million) have lower total financing amounts, they show that investors still value the long-term potential of underlying technologies, continuously investing to address key issues such as scalability, security, and interoperability, laying a solid foundation for the entire ecosystem.

Compared to the hot infrastructure and centralized platforms, the financing enthusiasm for decentralized applications (dApps) is relatively subdued and differentiated:

- DeFi received approximately $148 million in financing, accounting for only 4%. After experiencing high enthusiasm and risks in the early market, attitudes have become cautious, with funds more inclined to support projects with sustainable business models and strong risk control capabilities.

- GameFi and NFT combined received only about $104 million in financing, indicating that these two previously hyped sectors have entered a cooling period, with capital focusing more on actual user experience and sustainable economic models.

- The Social sector received only $1.6 million, reflecting ongoing challenges in user growth and commercialization pathways.

- The stablecoin sector, although only receiving $10 million in financing, is regaining capital attention due to the gradual clarification of stablecoin regulatory policies, and related application ecosystems are beginning to take shape.

Overall, the financing trend in the Web 3 market in July 2025 highlights a clear pattern: infrastructure first, service-oriented, and application differentiation. Capital is concentrating on centralized service platforms with commercial closed-loop capabilities that can bridge Web 2 and Web 3, while continuously supplying "ammunition" for infrastructure improvement. Although decentralized applications aimed at the C-end still hold potential, capital enthusiasm has clearly cooled, entering a phase of rational selection. This marks the transition of the Web 3 market from the early "experimental phase" to a more mature commercialization development cycle.

According to the financing data of 103 Web 3 projects disclosed in July 2025, the overall financing market's investment focus is gradually shifting towards the mid-growth stage, favoring projects with clear growth paths and implementation capabilities.

Among them, medium-sized projects with financing amounts between $3 million and $10 million are the most active, accounting for as much as 29%, typically corresponding to Series A or B rounds, indicating that a large number of Web 3 projects have crossed the product/market fit (PMF) stage and are seeking funds to expand their teams and ecosystems. Capital shows the strongest interest in this stage.

Further analysis shows that the combined proportion of the $3-10 million and $10-20 million ranges reaches 47.5%, fully reflecting that the current market's main theme is "investing for growth." Investors are more inclined to increase their stakes in projects that have shown potential and preliminary validation of their business models, aiming to help them establish competitive barriers and sprint for leading positions in their sectors.

At the same time, large financings exceeding $20 million remain active, accounting for over 22% (including projects over $50 million). Most of this funding flows to leading CeFi companies, listed companies, or acquisition projects, highlighting capital's high recognition of leading enterprises and directions deeply integrated with traditional finance.

In contrast, early-stage financings below $1 million account for 15.5%, and the $1-3 million range is 13.6%, indicating that although the market is becoming more rational, the financing difficulty for startup projects has increased, but new teams and innovative ideas continue to emerge, providing momentum for the long-term healthy development of the ecosystem.

In summary, the Web 3 financing market in July 2025 presents a typical "olive-shaped" structure: small at both ends, large in the middle. Early innovative projects inject vitality into the ecosystem, leading projects build market confidence, while the true capital core is concentrated on growth projects between $3 million and $20 million. Investment logic is also shifting from "telling stories" to "competing for growth," with capital increasingly favoring teams that have taken shape and possess sustainable business models and expansion potential.

According to the financing data of 67 Web 3 projects disclosed in July 2025, the financing activities exhibit a typical structural characteristic of "active growth rounds, with capital highly concentrated in Series A":

- In terms of the number of rounds, Seed, Series A, and Strategic rounds are the most active, accounting for 26.1% respectively, indicating that the market maintains enthusiasm for early exploration and ecological collaboration, while also keeping a high level of attention on projects entering the growth phase with validation capabilities.

- In terms of fund distribution, Series A rounds dominate, absorbing 44.4% of the total financing for the month, showing that capital is concentrating its "main battlefield" on projects that have completed product-market fit (PMF) and possess rapid expansion potential. Series B rounds also account for 20.9%, with A and B rounds combined exceeding 65%, clearly indicating that capital preferences are shifting towards mid to late-stage mature projects.

In contrast, early-stage financing (Angel, Pre-Seed) has a certain number, accounting for nearly 16%, but the total financing amount accounts for less than 3% of the total, reflecting that the "high-frequency small amount" early investment strategy continues, with rising investment thresholds and stricter screening for quality projects.

Additionally, while the number of projects in the Strategic round is on par with Seed and A rounds, the financing amount only accounts for 9.7%, indicating that this type of financing is more inclined towards small investments for ecological collaboration and resource complementarity, rather than mainstream capital investment directions.

Although most projects have clearly marked financing rounds, the "Undisclosed" rounds still occupy a significant proportion. This also includes a large number of PIPE (Private Investment in Public Equity) and Post-IPO (post-listing financing) financing methods commonly seen in traditional financial markets, reflecting that Web 3 projects are gradually integrating deeply with traditional capital mechanisms. At the same time, several undisclosed round financing projects have explicitly stated that the raised funds will be used to purchase mainstream crypto assets such as BTC, ETH, and SOL as treasury reserves. This type of "financial allocation" financing has not been included in the regular round statistics by the Cryptorank Dashboard but is becoming a new trend.

Overall, the Web 3 financing market in July 2025 shows a clear trend of "growth rounds dominating, with deepening institutional paths." Capital is no longer blindly chasing early narratives but is heavily betting on projects with market validation, compliance pathways, and commercial closed-loop capabilities, especially mid to late-stage teams in Series A to B. Meanwhile, traditional financial tools represented by PIPE and Post-IPO are accelerating their integration into the Web 3 ecosystem, and the behavior of projects allocating financing funds to crypto assets also reflects that their financial structure and strategy are moving towards diversification and maturity.

According to data released by Cryptorank on August 5, 2025, Colosseum ranked as the most active Web 3 investment institution in July with 9 investments, demonstrating its high-frequency engagement and broad coverage in early project layouts. Following closely are Coinbase Ventures (7 investments) and Animoca Brands (5 investments), continuing their roles as strategic investors in the industry, focusing on infrastructure development and content ecosystem expansion.

From the perspective of investment rounds, multiple institutions such as Amber Group, Susquehanna International Group (SIG), CoinFund, and Faction participated in several leading investments, reflecting their strong dominance in project valuation, resource introduction, and ecological collaboration. Among them, institutions like SIG and Amber Group, with traditional financial backgrounds, are gradually playing a key accelerator role in the Web 3 field.

Overall, the leading capital in the current market remains active, with emerging capital and traditional capital accelerating their integration. The frequent intersection of traditional financial institutions and crypto-native funds in the early investment stage is jointly driving the Web 3 ecosystem towards a more mature and refined capital operation model.

Key Financing Projects in July

Delabs Games

Introduction: Delabs Games is a studio focused on Web 3 game development, founded in 2021 by former Nexon executive James Joonmo Kwon. Since its establishment, the team has continuously developed multiple blockchain game products, including "Rumble Racing Star," "Space Frontier," and "Metabolts," aiming to build a Web 3 gaming experience that combines fun and playability from scratch.【3】

On July 21, Delabs Games announced the completion of $5.2 million in Series A financing, led by Hashed, bringing its total financing to $17.2 million.【4】

Investors/Angel Investors: Hashed, TON Ventures, Kilo Fund, IVC, Taisu Ventures, Arche Fund (Coin 98), Yield Guild Games (YGG), Everyrealm, Jets Capital, etc.

Highlights:

- Delabs aims to break the centralized limitations of traditional games, combining blockchain technology to give players ownership of game assets, and reducing development barriers through the generative AI platform Verse 8, supporting users and creators in building multiplayer game scenarios through natural language prompts, promoting community-driven content co-creation and economic cycles.

- The first game, "Boxing Star X," has validated the feasibility of the "light social + Web 3" game business model, with monthly revenue exceeding $300,000 and ARPPU reaching over $200, with global user numbers approaching 2 million. The game recently ranked seventh in DappRadar's global game rankings, surpassing well-known projects like "Axie Infinity." The next game, "Ragnarok," has not yet been released, but pre-registration has exceeded 100,000, with increasing market attention.

- The team has a "golden background" in the integration of Web 2 and Web 3: Founder James Joonmo Kwon previously served as CEO of Nexon, leading the development of phenomenon-level games like "MapleStory" and "Dungeon Fighter Online"; Co-CEO JC Kim is a co-founder of Planetarium, deeply engaged in the blockchain gaming ecosystem, promoting the integration of traditional games and crypto technology. Its strong lineup of investors includes NFT influencer Dingaling, digital asset fund Grail, game accelerator Liquid X, and YGG co-founders, providing the team with a robust ecological resource network.

Gaia Labs

Introduction: Gaia is a decentralized artificial intelligence network aimed at redefining the construction, distribution, and ownership of intelligence. Its peer-to-peer infrastructure allows anyone to run AI models and agents on a global network composed of independent nodes, ensuring the system's transparency, privacy, and resilience. Gaia Labs is the team responsible for the initial development of the Gaia network.【5】

On July 23, Gaia Labs announced the completion of a total of $20 million in seed and Series A financing, led by ByteTrade, SIG Capital (Susquehanna), and Mirana, Mantle Eco Fund.【6】

Investors: ByteTrade, SIG Capital (Susquehanna), Mirana, Mantle Eco Fund, EVM Capital, Taisu Ventures, NGC Ventures, Selini Capital, Presto, Stake Capital, FactBlock, G 20, Amber, Cogitent Ventures, Paper Ventures, Republic Crypto, Outlier Ventures, MoonPay, BitGo, SpiderCrypto, Consensys Mesh, etc.

Highlights:

- Gaia is building a globally leading decentralized AI inference network, with its core architecture based on a distributed node system, deploying a large number of independently operating AI nodes globally to create an open, transparent, and resilient intelligent network. Official data shows that the Gaia network currently has over 700,000 active nodes, executing over 17 trillion AI inference tasks, with nodes distributed across thousands of application chains and blockchain ecosystems, supported by over 1 million independent wallets.

- The node mechanism is a technical highlight of the Gaia network. Each node can host AI models and independently execute inference tasks, with node operators able to choose to run nodes on local devices, GPU servers, or even personal computers. Gaia Labs has integrated various mainstream open-source large language models (LLMs) as the "core models" of the network, including Meta's LLaMA series, Google's Gemma/CodeGemma, Microsoft's Phi series, and Alibaba's Qwen model, providing a diverse and high-performance model foundation for the AI network.

- One of the key applications of the network is the Gaia AI Phone, an AI-native smartphone that Gaia Labs plans to launch. This high-performance terminal, built on Galaxy S 25 Edge hardware, differs from other "AI phones" on the market in that all AI models and agents run locally on the device's chip. It does not rely on cloud computing or upload user data, fundamentally ensuring data ownership and privacy security.

- In terms of security and trust, the Gaia network introduces a "verifiable inference" mechanism to ensure the reliability of AI computation results through node staking and other methods. At the same time, Gaia Labs continues to improve the developer toolchain, providing an open AI agent framework and SDK, aiming to allow developers to easily develop and deploy AI applications on Gaia, just like using WordPress.

Syntetika

Introduction: Syntetika is a decentralized platform that supports the tokenization and trading of various assets. The platform covers yield-generating crypto products, tokenized stocks of private companies (including unlisted firms), and digital representations of real-world assets (RWA).【7】

On July 17, Hilbert Group announced that its tokenization platform and decentralized exchange Syntetika completed a $2.5 million seed round financing. 【8】

Investors: Russell Thompson, Chief Investment Officer of Hilbert Group; John Lilic, Hilbert advisor and head of Nordark; Alex Berto, co-founder of Aave and Allez Labs, and venture capitalist.

Highlights:

- Syntetika focuses on issuing and trading tokenized assets that comply with regulatory requirements, integrating blockchain infrastructure with regulatory compliance mechanisms. The platform introduces Galactica's zero-knowledge KYC (zkKYC) system, ensuring user privacy while achieving enterprise-level audit capabilities, creating a decentralized and compliant digital asset ecosystem. Its vision is to simplify the issuance, trading, and management processes of on-chain assets, enhancing the efficiency and security of traditional assets circulating on-chain.

- Syntetika builds a tokenized asset issuance platform for institutions by integrating DeFi traffic and structured asset design capabilities. The first product is a tokenized version of Hilbert Group's Bitcoin yield strategy, allowing users to earn additional income while holding BTC. Leveraging Hilbert's expertise in quantitative finance, Syntetika aims to provide structured on-chain yield products for both institutional and individual users.

- The platform has established a strategic advisory board, including members such as Max Rabinovitch, Chief Strategy Officer of Chiliz; Vladimir Maslyakov, CTO of Blum; Chirdeep Chhabra, former head of tokenization at Citigroup; and John Lilic, advisor at Polygon, providing rich industry resources and strategic guidance for the platform's development.

Blockskye

Introduction: Blockskye is a blockchain-based corporate travel and payment platform designed to simplify booking, expense tracking, and reconciliation processes. By integrating with KAYAK for Business and PwC systems, the platform eliminates intermediaries and pays suppliers directly through its Blockskye Pay system. 【9】

On July 17, Blockskye announced the completion of $15.8 million in Series C financing, led by Blockchange. This round of financing will be used to expand into European, Latin American, and Asian markets and develop real-time payment products based on stablecoins. 【10】

Investors/Angel Investors: Blockchange, United Airlines Ventures, Lightspeed Faction, KSV Global, Lasagna, Litquidity Ventures, Longbrook Ventures, TFJ Capital, etc.

Highlights:

- Blockskye utilizes blockchain technology to streamline corporate travel processes, supporting flight bookings, expense management, and payment settlement, bypassing traditional intermediaries like travel agencies and credit card networks, and directly connecting with suppliers such as airlines. Current clients include PwC, TripAdvisor, and Diageo. With the new round of financing, the company plans to expand to more Fortune 500 companies and accelerate its growth in European, Latin American, and Asian markets.

- Blockskye's real-time ownership tracking feature significantly optimizes resource allocation, helping agencies reduce spending by 84% and recover millions of dollars in unused tickets. The company claims that the platform can help businesses reduce overall travel costs by approximately 14.5%.

- Blockskye is launching a new generation of payment products, featuring a stablecoin-based transaction settlement mechanism. Unlike traditional corporate payment systems that rely on batch processing, Blockskye achieves real-time settlement at the transaction level, ensuring transparent, controllable, and delay-free cash flow, bringing structural changes to corporate payment systems. Blockskye is not limited to "adding chains" to credit card or invoice systems but is committed to fundamentally reconstructing corporate travel and payment infrastructure, creating a truly data-synchronized, smart contract-driven full-stack travel operating system.

Limitless

Introduction: Limitless is a decentralized prediction market platform where users can bet on real-world events, with a mechanism similar to binary options. The platform generates daily markets based on publicly available price data, with a structure close to zero-day-to-expiration (0 DTE) options, providing a high-frequency, short-cycle trading experience to help users capture rapidly changing market opportunities. 【11】

On July 1, Limitless announced the completion of $4 million in strategic financing, bringing the total financing amount to $7 million. 【12】

Investors: Coinbase Ventures, 1 confirmation, Maelstrom, Collider, Node Capital, Paper Ventures, Public Works, Punk DAO, WAGMI Ventures, etc.

Highlights:

- Limitless combines order book trading with innovative liquidity mechanisms to provide an efficient and flexible trading experience. The platform designs a dual order book system (Yes/No) for each market, supporting market orders and limit orders; it enhances capital utilization efficiency through share merging and splitting mechanisms; and establishes a daily USDC reward program to incentivize liquidity providers (LPs) to place orders near the midpoint price, narrowing the bid-ask spread. Market outcomes are provided by the Pyth Network oracle, and the platform also opens APIs and smart contract interfaces for developers to integrate and use.

- Limitless has grown to become the largest prediction market on the Base chain, with total contract betting exceeding $250 million. Users can predict the price movements of specific assets over the next few minutes, hours, or days, providing a simple, accessible high-frequency trading method that significantly lowers the participation threshold.

- Limitless has launched a user incentive points program in preparation for its token generation event (TGE). Users can accumulate points through trading, providing liquidity, and inviting friends to participate on the platform, with a chance to receive future token airdrops. As one of the first prediction market platforms to reward early users with a token mechanism, Limitless is attracting a large number of core users to participate actively.

Summary

In July 2025, the total financing amount in the Web 3 industry reached $3.68 billion, with a total of 132 financing rounds completed, indicating sustained capital enthusiasm. This month's financing shows a trend of "head consolidation" and "institutionalization," with traditional financial paths such as Post-IPO and PIPE increasingly becoming mainstream, marking a deep integration of Web 3 with traditional capital markets. Notably, more and more projects are using financing funds to purchase mainstream crypto assets as treasury reserves. Funds are primarily flowing into CeFi ($1.62 billion) and blockchain services ($1.4 billion), highlighting a structural trend of "infrastructure first, service-oriented," while application layer financing remains relatively subdued. The market focus is shifting towards the mid-growth stage, with projects in the $3 million to $20 million range accounting for as much as 47.5%, and Series A financing being the most active, indicating that capital is shifting from "story-driven" to "growth validation," with investments becoming more precise and strategic.

The key financing projects this month further confirm the trend of the Web 3 market moving towards maturity and diversification. Delabs Games showcases breakthroughs in user experience and business models in Web 3 gaming, emphasizing player ownership and AI empowerment. Gaia Labs represents the rise of decentralized AI infrastructure, connecting the real world through innovative applications like AI phones. The financing of Syntetika and Blockskye highlights the immense potential of tokenized assets (RWA) and blockchain in enterprise applications (such as travel payments), as well as the emphasis on compliance and real-time settlement. Limitless, as a prediction market, reflects the ongoing focus on innovation in on-chain financial tools and user incentives. Overall, the Web 3 financing market is entering a more mature commercialization development cycle led by top projects.

References:

- Cryptorank, https://cryptorank.io/funding-analytics

- Cryptorank, https://cryptorank.io/funding-rounds

- Delabs Games, https://delabs.gg/

- GamesBeat, https://gamesbeat.com/with-5-2 m-series-a-delabs-games-levels-up-web 3-ambitions/

- Gaia, https://www.gaianet.ai/

- Gaia, https://www.gaianet.ai/blog/gaia-labs-raises-20 m-series-a/

- Syntetika, https://syntetika.io/

- Hilbert Group, https://hilbert.group/en/hilbert-group-closes-heavily-oversubscribed-seed-round-for-syntetika-tokenisation-and-decentralised-trading-platform/

- Blockskye, https://www.blockskye.com/

- The Block, https://www.theblock.co/post/363173/blockskye-funding-blockchain-corporate-travel

- Limitless, https://limitless.exchange/simple/markets/59

- Cointelegraph, https://cointelegraph.com/press-releases/limitless-raise-4 m-strategic-funding-launch-points-ahead-of-tge

Gate Research Institute is a comprehensive blockchain and cryptocurrency research platform that provides readers with in-depth content, including technical analysis, hot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risks, and users are advised to conduct independent research and fully understand the nature of the assets and products they are purchasing before making any investment decisions. Gate is not responsible for any losses or damages resulting from such investment decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。