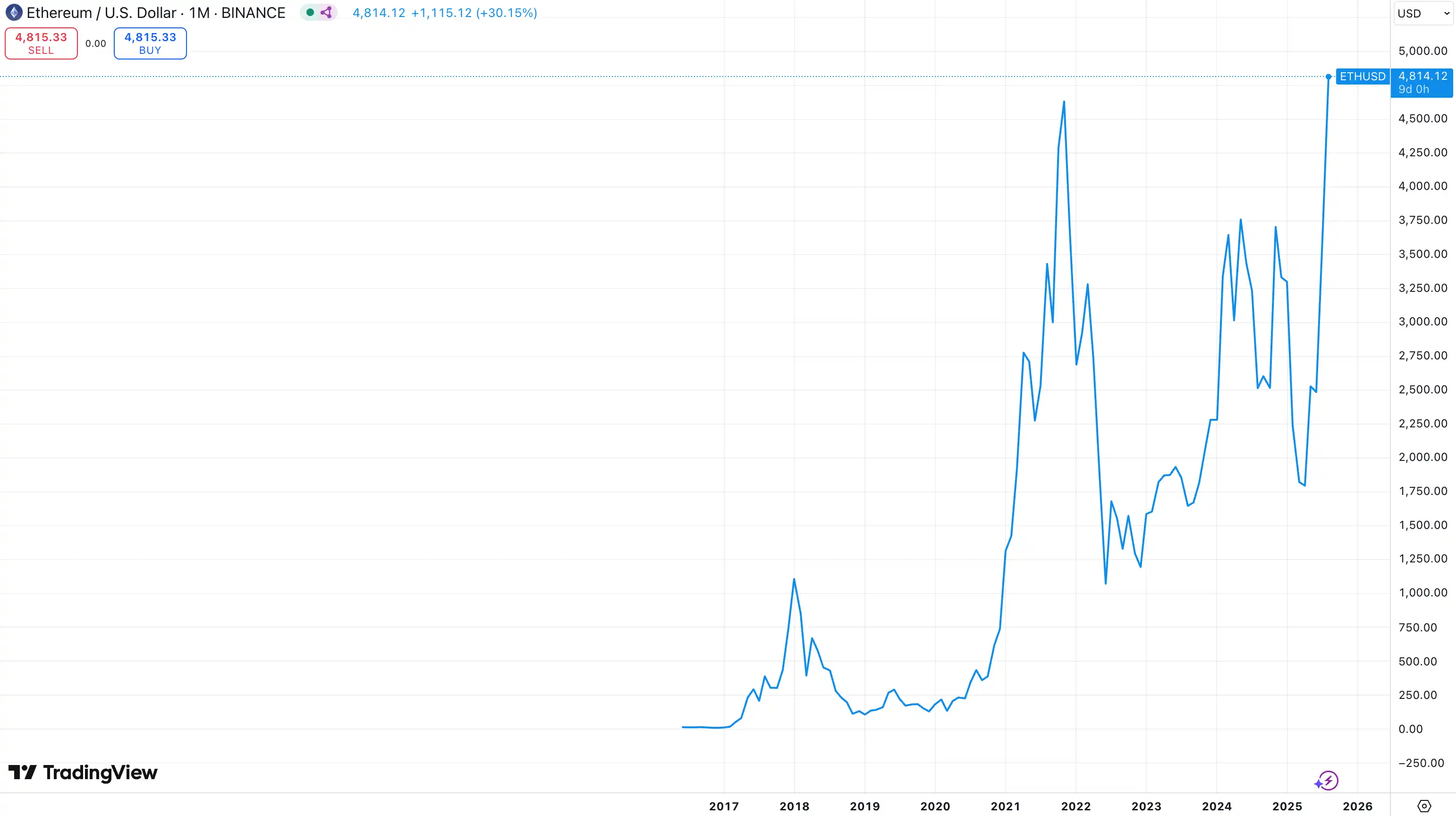

After 1384 days, Ethereum has finally reached a new price high in this cycle.

On August 23, following a significant "dovish" speech by Federal Reserve Chairman Jerome Powell the night before, expectations for a rate cut in September surged, leading to a broad increase in dollar assets. A few hours later, Ethereum surged by 14% to reach $4887, setting a new all-time high in its 11-year history, with a market capitalization exceeding $586 billion, ranking 25th among global tech companies, surpassing well-known firms like Mastercard and Netflix.

ETH historical price chart; Source: TradingView

If Bitcoin completed its transition from a retail asset to an institutional asset in the last cycle, then Ethereum's new high may signify its entry into its own "sovereign narrative moment." Wall Street's Ethereum "call master" Tom Lee likened this strategic positioning to a "sovereign call option"—when Ethereum is widely adopted by global financial and AI infrastructure, companies holding significant stakes will be in a unique position.

Sean McNulty, head of derivatives trading for Asia-Pacific at digital asset brokerage FalconX Ltd, stated that funds are flowing from Bitcoin to Ethereum, constituting a "huge positive sentiment shift driven by strong spot ETF inflows, increasing corporate financial adoption, and broader tailwinds for stablecoins."

This statement succinctly summarizes why Ethereum is reaching new highs at this time. Its delay was not an absence but a waiting period—waiting for sentiment and capital, policy and technology to converge at the same moment. Now, that moment has finally arrived. For Ethereum, this is not just a price leap but a narrative switch.

Increased Rate Cut Expectations

The shift in the macro environment has become a key driving force behind Ethereum's breakthrough to new highs. As the U.S. job market continues to weaken and core inflation gradually declines, market bets on a rate cut by the Federal Reserve this year have significantly increased.

Behind this trend are signals released by Federal Reserve officials in recent statements. Powell rarely acknowledged at the Jackson Hole central bank annual meeting that "the risk balance is changing"—inflation risks still exist, but the pressure from deteriorating employment is rising rapidly. Under this dual pressure, the focus of monetary policy is shifting from "maintaining high interest rates" to "moderate easing."

The market reacted quickly, with CME's "FedWatch" tool showing that the probability of a 25 basis point rate cut in September is approaching 90%. For risk assets, this not only means lower funding costs and improved liquidity but also represents the emergence of a policy turning point. Coupled with institutional buying and Ethereum's own narrative switch, this new high for ETH is seen by many traders as a cyclical turning point, rather than just a technical breakthrough.

Public Companies Buying Up!

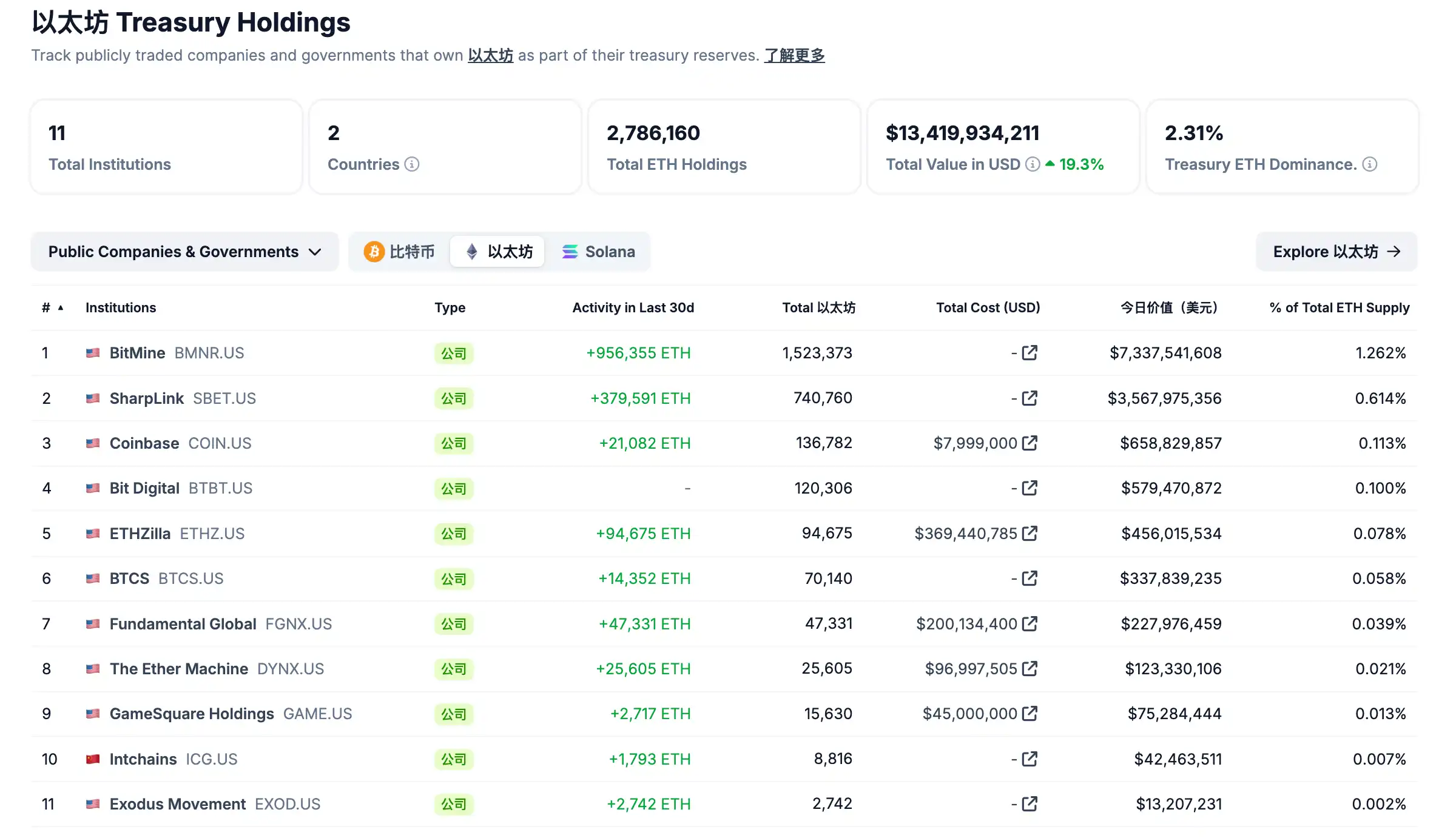

If there is any change in Ethereum's fundamentals this cycle, the biggest difference is that it has attracted U.S. public companies similar to Bitcoin's MicroStrategy.

On May 27, 2025, Nasdaq-listed company SharpLink Gaming announced a major strategic move, reaching a $425 million financing agreement through a private investment in public equity (PIPE), planning to use the net proceeds to purchase Ethereum and make ETH its primary reserve asset. Notably, the lead investor in this transaction was Ethereum infrastructure development company Consensys Software Inc.

Related: "Ethereum's 'Strategy Moment'? SharpLink Gaming Bets $425 Million on ETH Reserves"

Since then, enterprises and small public companies have increased their Ethereum allocations, with more and more Ethereum treasury companies becoming the vanguard of this upward trend. As of August 2025, according to CoinGecko data, there are currently 17 companies/institutions holding 1,749,490 ETH, valued at approximately $7.5 billion. Bitmine has acquired 833,000 ETH within a month, accounting for nearly 1% of the global total supply, solidifying its position as the "largest publicly listed ETH treasury company."

The logic behind this is that holding ETH not only allows for potential appreciation but also generates over 3% in native yield through PoS staking, creating long-term sustainable financial returns. This is different from Bitcoin treasury strategies that rely solely on price speculation; it is closer to operating as an infrastructure asset, combining capital appreciation with cash flow. On August 10, Ethereum co-founder and Consensys CEO Joe Lubin stated, "Treasury companies may drive ETH's market cap to surpass BTC within a year."

Geoffrey Kendrick, global head of digital asset research at Standard Chartered Bank, stated that Ethereum treasury companies are now "very worthwhile investments," and are more attractive to investors compared to U.S. spot Ethereum ETFs. The net asset value (NAV) multiple of Ethereum treasury companies—market cap divided by the value of held ETH—has "started to normalize" and is expected to remain above 1, making it a better investment target than U.S. spot ETH ETFs.

Kendrick pointed out that since June, Ethereum fund management companies have purchased 1.6% of all circulating ETH, comparable to the purchasing speed of ETH ETFs during the same period. By August 15, according to strategicethreserve data, the total ETH holdings of Ethereum treasury companies and ETFs exceeded 10 million, accounting for about 8.3% of the current total supply.

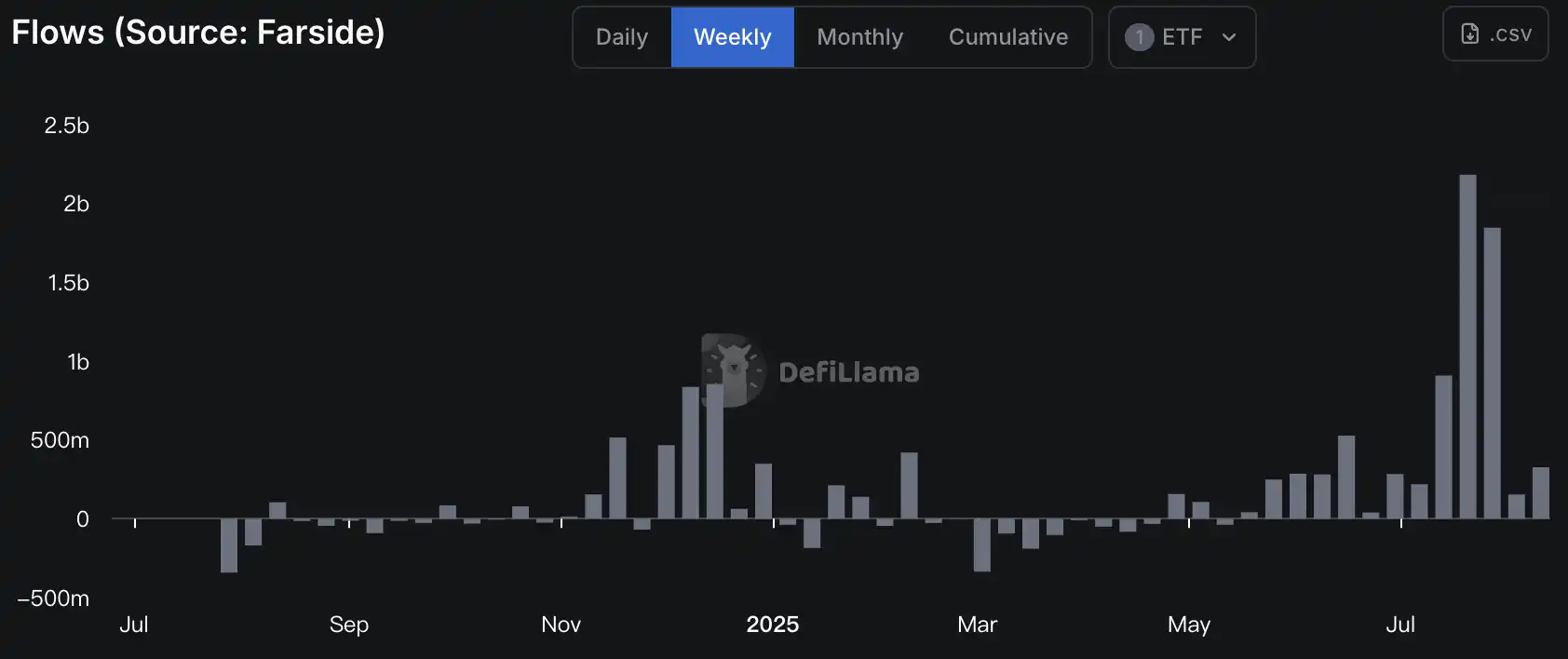

Ethereum ETF Inflows Exceed Bitcoin

Ethereum spot ETFs have finally seen a surge in net inflows over the past year. According to Farside data, cumulative inflows since July 4 have exceeded $2 billion, quietly attracting $8.7 billion in the first full operating year, with AUM reaching $15.6 billion. This sustained institutional buying has built a stable buying wall for the market.

A more significant recent signal is that the amount of ETH purchased by ETFs has surpassed that of Bitcoin.

On August 8, the total inflow for ETH ETFs was $461 million, while BTC only saw $404 million. BlackRock purchased $250 million in ETH, Fidelity bought $130 million in ETH, and Grayscale acquired $60 million in ETH.

Unprecedented Policy Benefits

On the narrative level, Ethereum's policy tailwinds are not just verbal commitments but are gradually transforming into institutional support.

The most direct change comes from the clearer compliance path for ETH staking—regulatory agencies in some U.S. states have begun to recognize the accounting treatment of staking income under a licensed framework, meaning institutions can disclose staking-related income more transparently in their financial reports.

At the same time, the successful advancement of a series of stablecoin bills has also provided growth expectations for large stablecoins issued based on ETH (such as USDC, USDT), with core terms requiring reserve transparency, on-chain verifiability, and interstate payment interoperability, which will directly strengthen Ethereum's central position in the stablecoin issuance and settlement network.

More strategically, the "Project Crypto" plan, jointly led by the SEC and the Treasury Department, is adjusting the regulatory framework from a previously defensive stance to encouraging innovation in DeFi and blockchain financial products. Under this policy tilt, Ethereum, with its absolute advantages in DeFi TVL (approximately 59.5% of the total) and stablecoin trading volume (about 50%), naturally becomes the primary beneficiary of the dividends.

The mild policy shift not only reduces concerns for institutional investors but also opens the door for long-term funds such as pensions and insurance funds to enter the market.

On August 7, 2025, an event destined to leave a significant mark in U.S. financial history quietly occurred. Trump signed an executive order allowing U.S. retirement savings accounts (401(k)) to officially invest in "alternative assets," including cryptocurrencies, private equity, and real estate. From then on, an asset class that had been marginalized by the mainstream financial system was officially written into the nearly $9 trillion U.S. retirement plan.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。