Today's condition is still not good. I didn't go to the hospital because my cough during the day wasn't very severe, but at night, the cough became very serious. I really need to go to the hospital tomorrow, so I am submitting today's homework early. First of all, I closed my long position with a small profit, very minimal, but at least there is some profit. I will write in detail about the reason for closing when I do my review tomorrow. Overall, I do not believe that Powell's speech today was dovish.

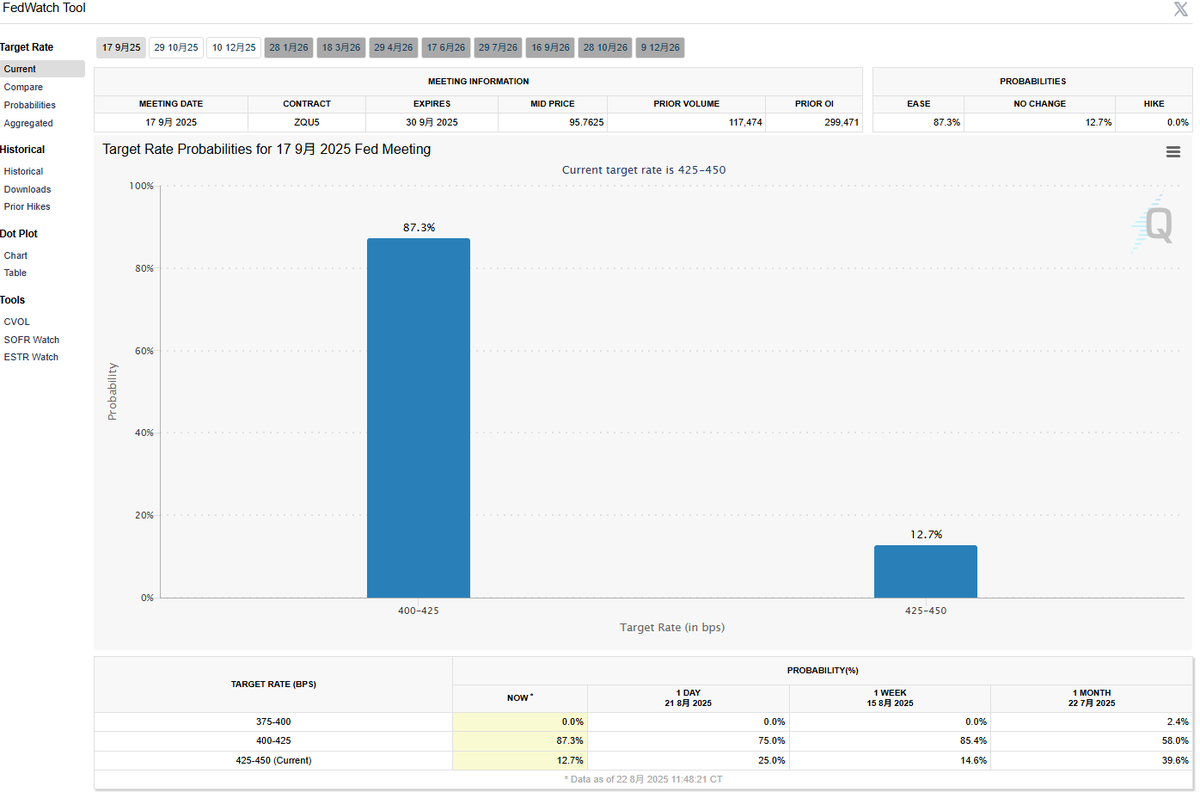

Although Powell's speech did increase the probability of a rate cut in September (which has now retreated to 87%), the premise is that Powell believes the U.S. economy will experience a downturn, and there may even be a short-term or slight recession. The economic issues started last week with the labor data bringing a downturn. This week's decline, while partly due to concerns about a September rate cut, is also due to worries about economic downturns, such as retail data.

Today, Powell emphasized multiple times that inflation is currently still controllable. Although the impact of tariffs is uncertain, the path of declining inflation is still visible. However, the biggest risk is that inflation declines while the labor market is also declining. At the beginning, Powell mentioned that the risk of declining inflation has weakened, but the unemployment rate has increased by one percentage point, a development that historically only occurs during recessions.

He also mentioned that although the labor market is in a balanced state, it is a strange balance because both situations are clearly slowing down, and the labor supply-demand relationship has become abnormal, with the risk of job losses increasing. He also talked about the slowdown in GDP in the first half of the year, so I personally feel that Powell is worried that the U.S. economy may encounter problems, and the market is judging the increased probability of a September rate cut based on this situation.

Of course, this does not mean that economic risks will definitely occur, but the market will come to understand it. Once the market reinterprets Powell's words, it should realize that the current rate cut is to balance the potential economic recession. Especially since the market rose quite high today, there is a possibility of a pullback, so I closed my position. Holding onto positions is too uncomfortable, so I won't gamble for now; I will wait until I am more certain.

Of course, it is also possible that I am wrong; it's hard to say, but being cautious is good. After all, I haven't lost money. If the market's sentiment can stabilize, then opportunities will still arise, and I still won't short.

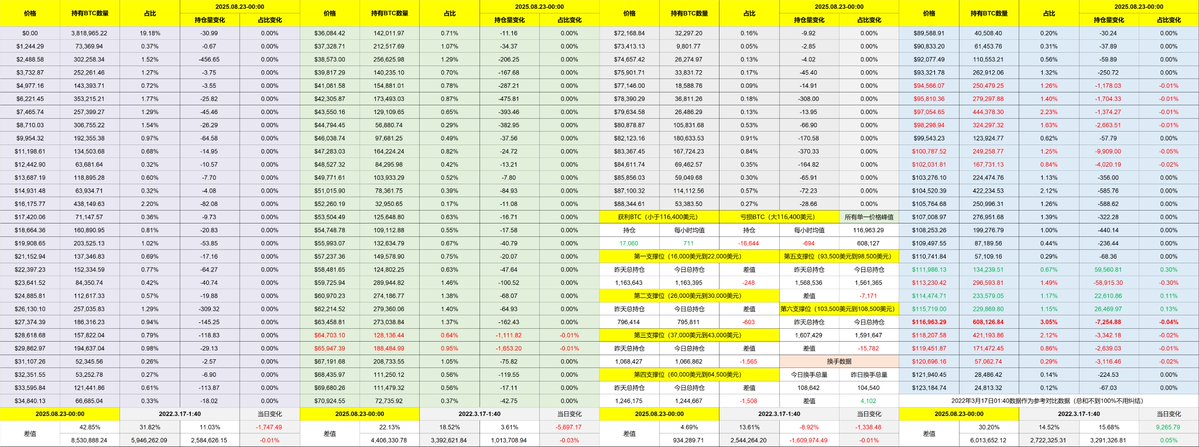

Looking back at Bitcoin's data, today's price fluctuated significantly, and the turnover rate saw a slight increase. Investors who bought the dip in the last two days have noticeably exited. Investor sentiment remains relatively stable; after all, the selling of $BTC is still not much, and today's increase is already quite good. The key is to see how American investors react next Monday.

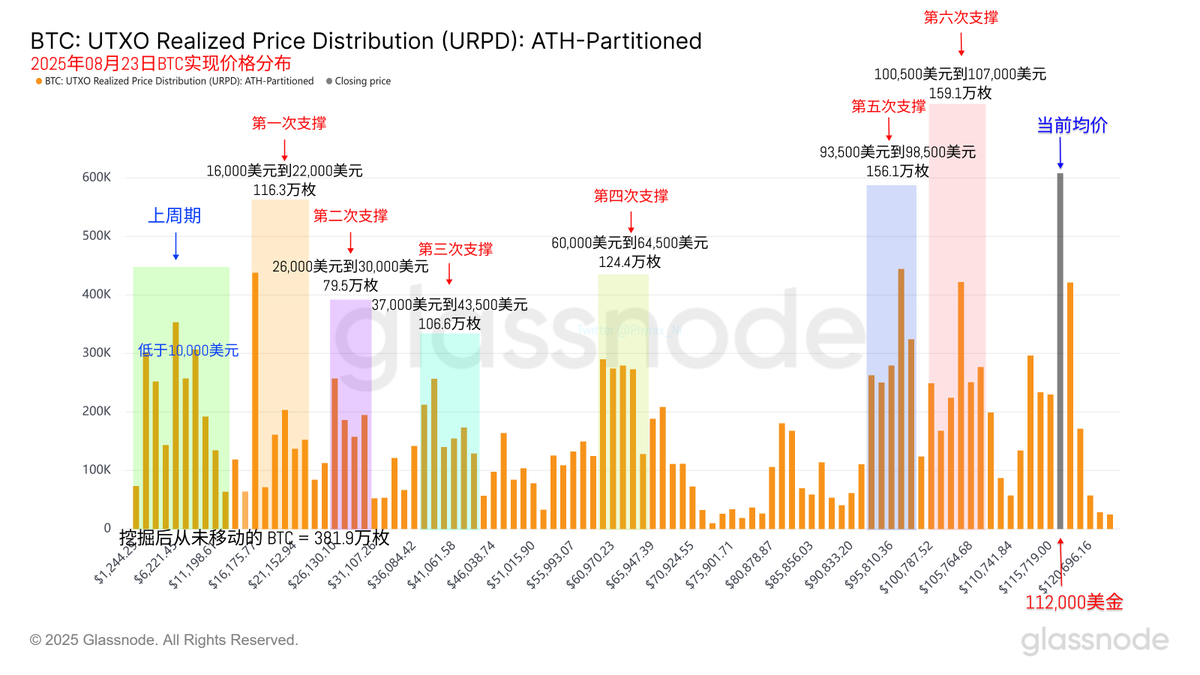

Support is still quite good, and no problems have been found. $112,000 is indeed a relatively good consensus area, and this position was stable before Powell's speech. The seventh bottoming range may be gradually forming, which is a good thing.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。