Recently, both the US stock market and the cryptocurrency market have experienced a sharp correction. Just as ETH broke its historical high and market sentiment was once caught in a FOMO frenzy, the price suddenly plummeted. Within just a few days, ETH fell below $4,100 from its peak, with a maximum correction of nearly 20%, leaving investors caught off guard by the drastic shift in sentiment. Optimistic expectations were quickly overshadowed by pessimism, and the market began to question: what is the true reason behind this decline? Does it signify the end of the bull market, or is it a healthy adjustment?

High valuations lead to natural corrections and risk aversion

The recent correction is not coincidental but rather a natural reaction from investors under high valuations. Since April of this year, the Nasdaq index has soared, with a cumulative increase of over 40%, largely driven by AI and tech stocks, most of which have risen over 80%. Such a rapid increase has made market sentiment highly sensitive, where any uncertainty could trigger a flight of sensitive capital.

Against this backdrop, the uncertainty surrounding corporate earnings reports and Federal Reserve Chairman Powell's upcoming speech at the Jackson Hole "Global Central Bank Annual Meeting" has led to a shift towards risk aversion. Investors are eager to gauge the resilience of US consumer spending through the performance of the retail sector to determine if it can withstand the impacts of inflation and trade friction. Any slight adjustment in Powell's wording regarding monetary policy could influence capital expectations for future interest rate paths. This "high-altitude chill" market state has made investors particularly cautious at elevated levels.

As a result, there has been a noticeable rotation of capital: some profits have been taken from tech stocks and shifted into defensive sectors. Industries such as consumer staples, utilities, and real estate have strengthened against the trend, highlighting their risk-averse characteristics. In other words, this round of adjustment resembles a "deep breath" for the market—after a significant rise, capital is seeking a new equilibrium.

However, if this decline is merely a natural response to valuations and sentiment, the doubts surrounding the AI bubble have truly made the market "tense."

OpenAI CEO Sam Altman publicly compared the current AI frenzy to the dot-com bubble of the past. He pointed out, "When a bubble occurs, smart people become overly excited about the core of a truth." Although Altman remains optimistic about the long-term value of AI, he candidly stated that "some investors will face significant losses," undoubtedly dousing cold water on the exuberant market. Meanwhile, a research report from MIT indicated that despite companies investing as much as $30-40 billion in generative AI, 95% of them have yet to see any commercial returns. This conclusion strikes at the core logic of AI investment—massive profitability conversion is still a long way off. In the long run, Altman stated that AI will follow a path similar to the development of the internet, "after several notable bubble bursts, ultimately achieving lasting transformation."

Altman's warning, combined with MIT's research, has caused market sentiment to swiftly shift from "passion" to "caution." This is also a significant reason for the simultaneous and substantial adjustments in tech stocks and crypto assets within a short period.

The inevitability of interest rate cuts faces challenges: the Fed adopts a hawkish stance, and the market closely watches Powell

The Federal Reserve's meeting minutes released on August 20 also sent hawkish signals. At the July meeting, nearly all decision-makers supported "not cutting rates for now," with only two dissenting. The minutes reflect a divergence within the Fed regarding inflation and employment risks: most officials believe the risks of rising inflation are greater, while a minority emphasize the more prominent threat of weak employment. Additionally, several officials mentioned that the impact of tariffs on prices has not yet fully manifested, and it will take more time for their effects to be reflected in consumer goods and service prices. There is currently insufficient evidence to suggest that inflation has peaked. Data indicates that the core PCE price index may rise to 2.9% this month and continue to climb in the coming months, persistently deviating from the Fed's 2% target.

In terms of economic outlook, some officials expect US economic activity to remain robust, while others anticipate that the low growth trend from the first half of the year will continue into the second half. Overall, there is a divergence among Fed officials regarding the outlook, but they unanimously agree that it is too early to cut rates recklessly.

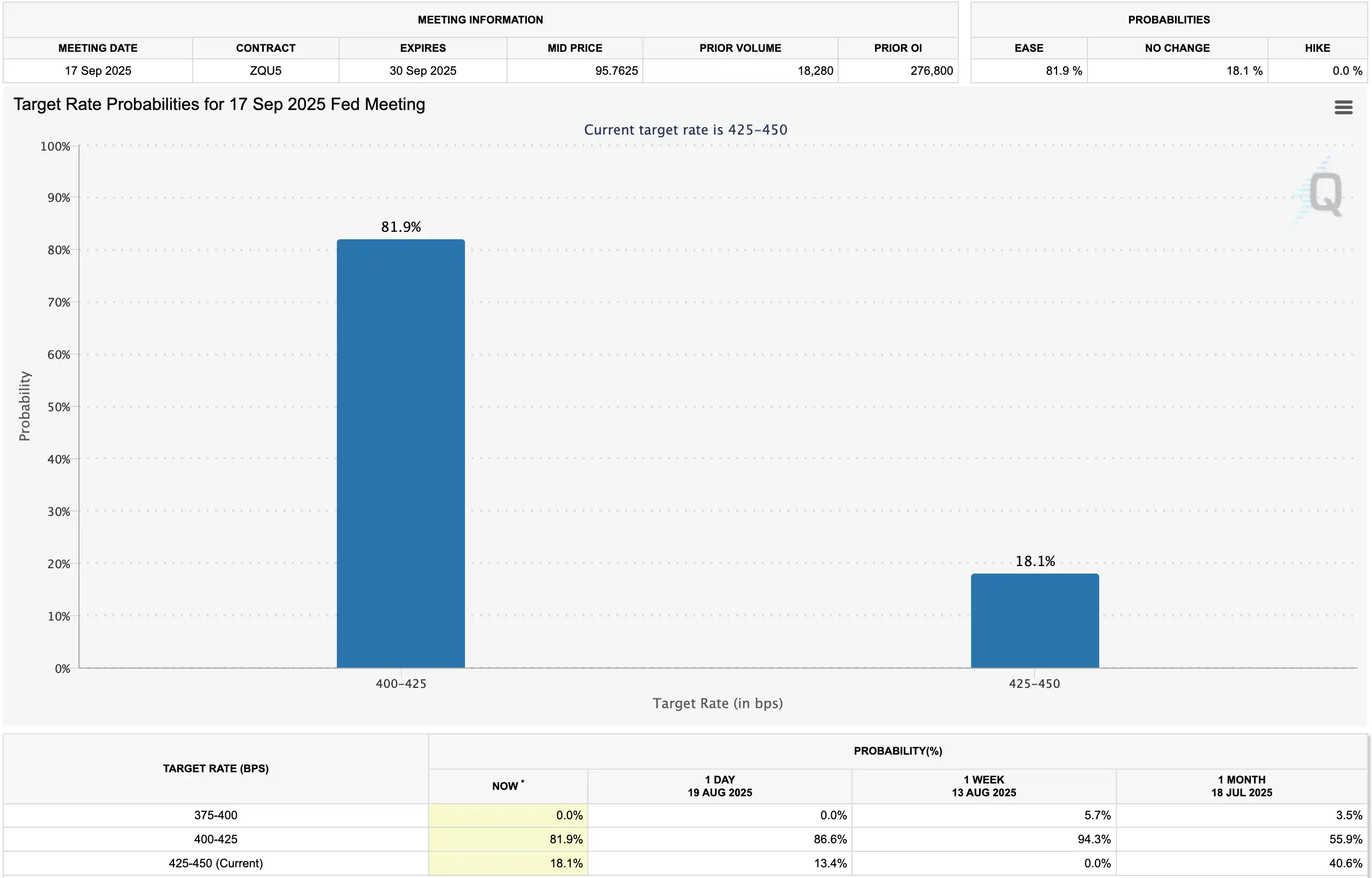

Market focus is gradually shifting to this Friday, when Fed Chairman Powell will speak at the Jackson Hole "Global Central Bank Annual Meeting." Evercore analyst Julian Emanuel pointed out that Powell may "indirectly signal a 25 basis point rate cut in September," and his stance will remain "neutral" rather than purely accommodative, which could trigger a market correction of 7% to 15% in the short term. The latest data shows that the probability of a 25 basis point rate cut in September has dropped from 94.3% a week ago to 81.9%. Although it remains the mainstream expectation, confidence has been shaken.

Morgan Stanley believes that the core task of Powell's speech is to break the market's reliance on the "inevitability of rate cuts" and regain control of policy. Morgan Stanley expects Powell to continue emphasizing inflation risks, clearly ruling out the possibility of a significant 50 basis point cut while leaving room for a moderate 25 basis point cut. Nomura anticipates that Powell will not provide a "clear commitment" on Friday; Bank of America even expects him to maintain a hawkish stance, countering the market's expectations for easing. This uncertainty is also a reason for capital withdrawal and market decline, as investors await a clear "signal."

Summary

Although this decline has been fierce, it is largely a short-term correction in a high market rather than a signal of the end of the bull market. The latest holdings of Berkshire Hathaway, led by Buffett, seem to convey an intriguing signal: in anticipation of peak interest rates falling, Berkshire is increasing its investment in the interest rate-sensitive housing sector. According to the latest disclosed 13F filings, the company established a new position in D.R. Horton, one of the largest residential builders in the US, in the second quarter and increased its stake in another leading builder, Lennar. Against the backdrop of expectations for Fed rate cuts, the housing sector and its upstream and downstream industries have begun to show signs of strengthening, and the market is re-pricing this long-suppressed sector due to high interest rates.

Similarly, in the crypto market, the arrival of a loosening cycle combined with treasury strategies continuously buying ETH and other altcoins, along with multiple mentions of stablecoins in the Fed's meeting minutes, has created an unprecedented favorable combination. This adjustment can be seen less as a turning point in the bull market and more as a risk-averse reaction to short-term uncertainties under high valuations. Once sentiment stabilizes, capital is likely to shift back to offense, driving a new upward cycle. In other words, this resembles a "deep breath" at the peak rather than the "final chapter" of a bull market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。