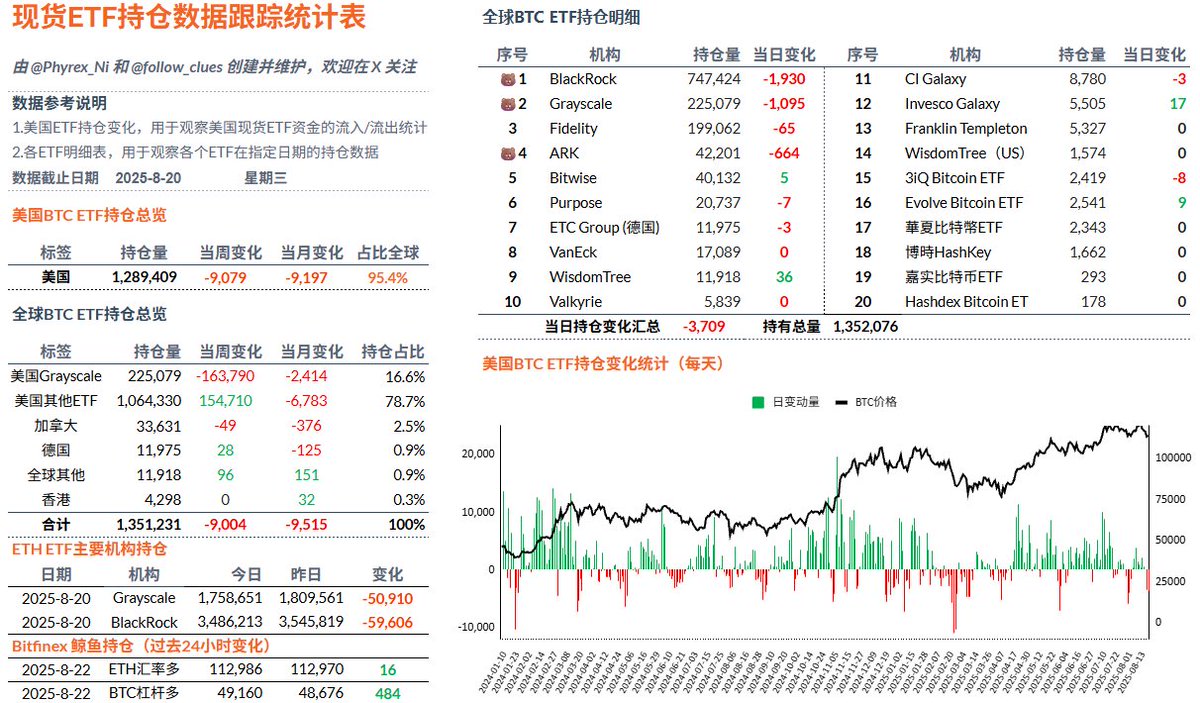

On Wednesday, the data for the $BTC spot ETF was slightly worse, with BlackRock, Grayscale, and Fidelity all experiencing varying degrees of reductions in their holdings. Although the total amount is not significant, it reflects the current market sentiment. Due to the pessimistic expectations regarding interest rate cuts in September and the U.S. economy, the market has begun to gradually define the likelihood of no rate cuts in September.

Especially from a funding perspective, we have been saying that the purchasing power intensity of Bitcoin itself is insufficient, and now the selling has increased, leading to greater market pressure. The initial game will still depend on Powell's speech on Friday; we will see the market's reaction afterward.

However, I personally estimate that Powell may not provide a clear monetary policy path and will still focus on data.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。