The CertiK "2025 Skynet RWA Security Report" has been released. The report points out that RWA tokenization is rapidly reshaping the landscape of blockchain finance. By mid-2025, the RWA market size is expected to exceed $26 billion, achieving a fivefold increase compared to approximately $5 billion in 2022, making it one of the most dynamic segments of the digital asset ecosystem. RWA is becoming a key bridge connecting traditional finance (TradFi) and decentralized finance (DeFi), but at the same time, its security threats are presenting new characteristics.

The CertiK "2025 Skynet RWA Security Report" has been released. The report points out that RWA tokenization is rapidly reshaping the landscape of blockchain finance. By mid-2025, the RWA market size is expected to exceed $26 billion, achieving a fivefold increase compared to approximately $5 billion in 2022, making it one of the most dynamic segments of the digital asset ecosystem. RWA is becoming a key bridge connecting traditional finance (TradFi) and decentralized finance (DeFi), but at the same time, its security threats are presenting new characteristics.

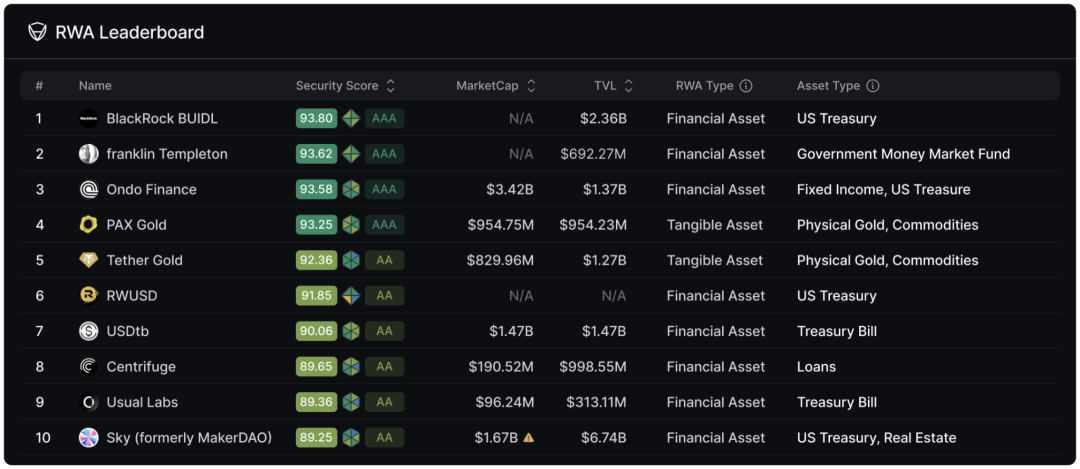

Skynet RWA Rankings

The report announced the Skynet RWA rankings, with the top ten projects in the first half of 2025 being: BlackRock BUIDL, Franklin Templeton On-Chain Fund, Ondo Finance, Paxos Gold, Tether Gold, Binance RWUSD, Ethena USDtb, Centrifuge, Usual, and SKY (MakerDAO RWA Vaults). These projects cover various sub-sectors such as government bonds, gold, stablecoins, and accounts receivable, representing the diverse development directions of the RWA ecosystem.

The report announced the Skynet RWA rankings, with the top ten projects in the first half of 2025 being: BlackRock BUIDL, Franklin Templeton On-Chain Fund, Ondo Finance, Paxos Gold, Tether Gold, Binance RWUSD, Ethena USDtb, Centrifuge, Usual, and SKY (MakerDAO RWA Vaults). These projects cover various sub-sectors such as government bonds, gold, stablecoins, and accounts receivable, representing the diverse development directions of the RWA ecosystem.

These protocols demonstrate the highest standards in the RWA industry through compliant legal frameworks, transparent reserve proof, and institutional-grade security measures. Their practices in compliance, transparency, and risk management are setting new benchmarks for the entire industry.

The Double-Edged Sword of RWA Growth and Security Risks

RWA tokenization unleashes tremendous value potential, bringing efficiency and transparency to the financial system. However, the security risks associated with these assets far exceed traditional smart contract vulnerabilities, encompassing issues such as oracle manipulation, custodian and counterparty risks, unenforceable legal frameworks, and false reserve proofs.

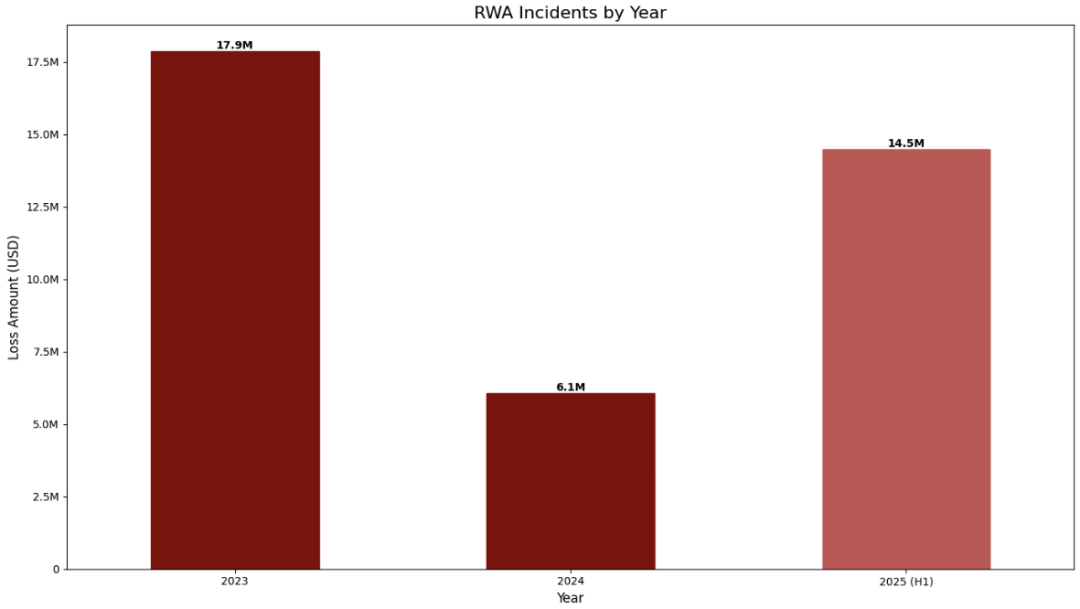

Historical RWA Incident Loss Amounts

On the other hand, the threat landscape of RWA has undergone significant changes over the past two years. In the first half of 2025, losses from RWA-related security incidents reached as high as $14.6 million, compared to only $6 million in 2024. More notably, the sources of risk have fundamentally changed: the main threats in 2023 and 2024 came from off-chain credit defaults, such as borrowers failing to perform; while in 2025, losses were almost entirely due to on-chain and operational vulnerabilities.

This shift indicates that the security landscape of RWA is undergoing a profound evolution, with the focus of risk gradually shifting from off-chain financial defaults to on-chain technical vulnerabilities and operational management errors.

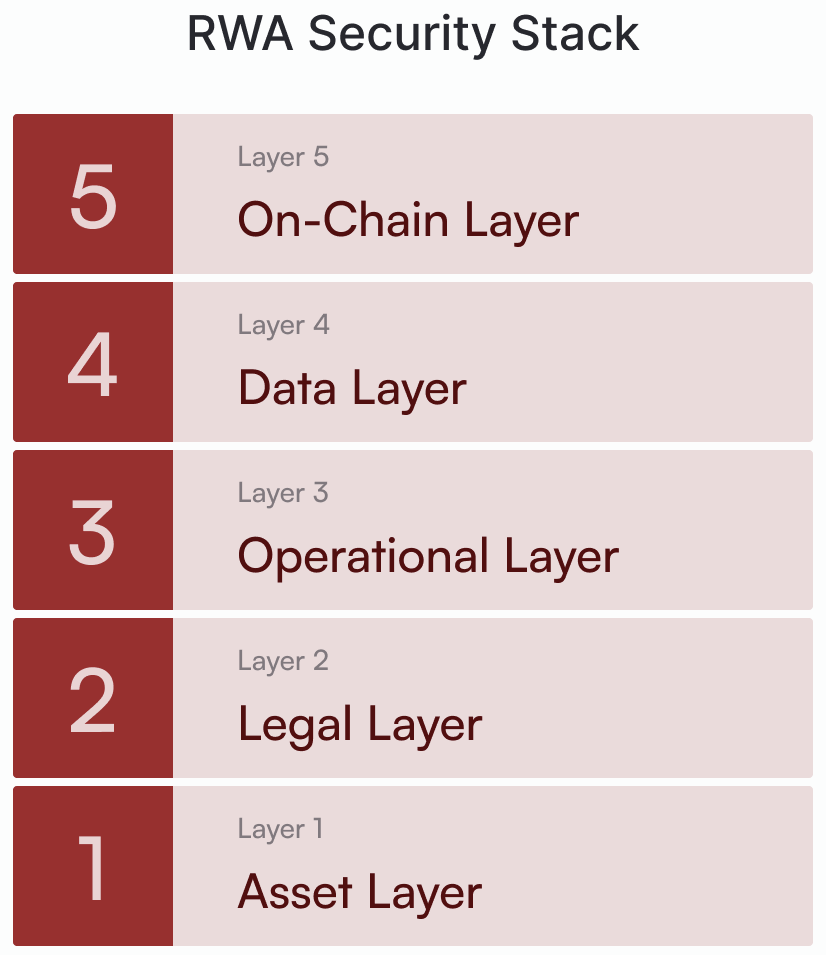

"Five-Layer Security Stack" and Skynet Scoring Framework

RWA Security Stack Framework

To help the market systematically identify and manage risks, CertiK proposed a "Five-Layer Security Stack" model in the report, covering five levels: asset, legal, operational, data, and on-chain, forming a full-stack security assessment method from oracle security, reserve proof to compliance and governance mechanisms.

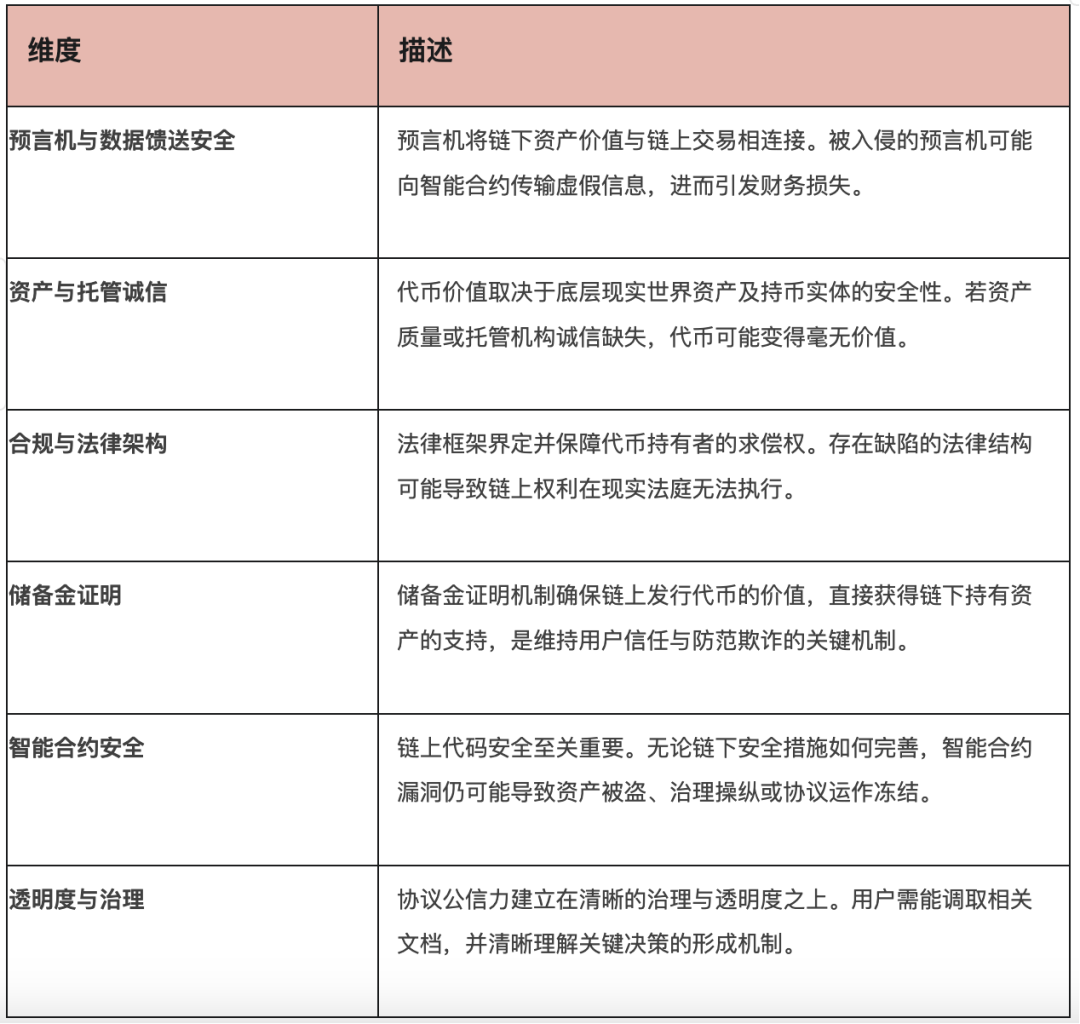

Based on the five-layer security stack, CertiK launched the Skynet RWA security scoring framework, which comprehensively assesses risks across six dimensions, including asset, legal, operational, and smart contracts. The Skynet security framework is built on the core risk dimensions of RWA, with each dimension corresponding to its potential impact on the overall security and stability of RWA protocols. This structure ensures that key off-chain components representing the latest significant risk vectors receive appropriate weight in the final assessment.

RWA Security Scoring Framework

RWA Security Scoring Framework

Outlook: From $26 Billion to Trillion-Dollar Market

The report also summarizes three core trends in the RWA field:

- U.S. Treasury Products Dominate the Market: The tokenized U.S. Treasury market has grown by 400% year-on-year, becoming the "gateway asset" for RWA.

- Integration of Yields and Stablecoins: Emerging stablecoins will directly distribute U.S. Treasury interest to users, reshaping the stablecoin landscape.

- Deep Participation of Traditional Financial Giants: The involvement of institutions like BlackRock and Franklin Templeton has raised compliance and transparency standards, accelerating the mainstreaming of the industry.

By mid-2025, the total market value of RWA is expected to exceed $26 billion, with continued rapid growth anticipated in the future. Boston Consulting Group predicts that by 2030, up to $16 trillion in assets could be tokenized globally.

In conclusion, CertiK emphasizes that RWA security has become a key proposition for the healthy development of the entire Web 3 ecosystem. A transparent and systematic security assessment framework will help investors, institutions, and regulators make more robust decisions in the future trillion-dollar market.

Conclusion

As the world's largest Web 3.0 security company, CertiK possesses deep industry insights and has long provided various security event analyses, security guidelines, and annual and quarterly security reports, conveying critical security information to the industry. We welcome you to visit the Skynet platform (skynet.certik.com) for more stablecoin ratings and on-chain security updates.

We invite everyone to click here to read the complete "2025 Skynet RWA Security Report" for a more comprehensive analysis, insights, and recommendations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。