Written by: J1N, Techub News

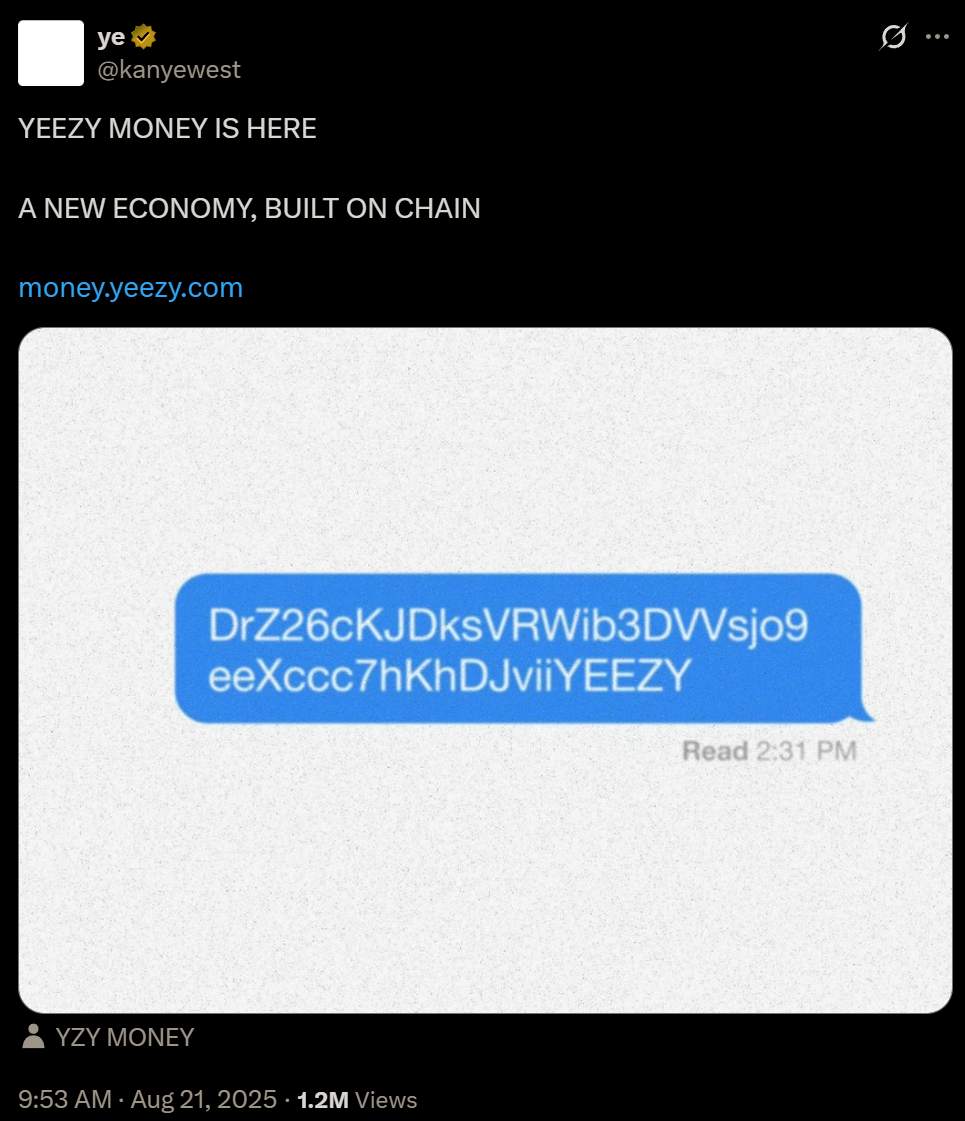

Famous singer Kanye West (Ye) has officially launched the cryptocurrency project YZY Money and its token YZY. The project team claims that YZY is issued on Solana and employs a random contract mechanism to prevent front-running. The team's share will be released through locking and phased unlocking, and payments can be made using Ye Pay and YZY Card. After its launch, YZY's market capitalization surpassed $3 billion within just one hour, with an increase of up to 1414.8%. BitMEX co-founder Arthur Hayes even called out to Kanye on social media, stating that he had bought YZY and jokingly said, "Please don't rug me." As of the writing, GMGN market data shows that YZY has dropped to $0.97, with a decline of 70% within 2 hours.

Unlike previous celebrity token launches, Ye has introduced YZY Money, Ye Pay, and YZY Card this time, seemingly aligning with the Trump family's WLFI to add so-called application scenarios to the token. More notably, the official documentation for YZY Money includes a "class action waiver" clause, explicitly requiring users to waive their rights to join class action lawsuits and bear related legal costs. This rare clause indicates that the YZY project has considered potential legal risks from the outset, attempting to safeguard the project with a systematic "defense mechanism."

Behind this seemingly tight layout and comprehensive application scenarios…

Lookonchain tweeted that although Kanye has officially announced the launch of YZY, the liquidity pool only contains YZY itself and does not include USDC. This means that developers can flexibly manipulate YZY by continuously adding or removing liquidity, which is quite similar to the previous LIBRA project. Several insider wallets clearly positioned themselves in advance, with one address starting with 6MNWV8 even attempting to purchase YZY a day early. On the launch day, that wallet bought 1.29 million YZY at a price of $0.35 each using 450,611 USDC, and then sold 1.04 million of them for $1.39 million, leaving about 249,907 YZY (worth approximately $600,000), with initial profits exceeding $1.5 million.

The project's apparent "fair token distribution" hides the reality of capital and information asymmetry manipulation. Like previous celebrity token launches, it has devolved into a race for retail investors. In fact, if we look at Kanye's past methods, we wouldn't be surprised by these operations.

As early as February this year, Kanye West revealed on X platform that someone was willing to pay $2 million for him to promote a Memecoin, intending to use his influence to scam fans. He not only firmly rejected the offer but also publicly shared the chat records, stating that he "would not issue a token" and would only work on products he liked and understood. He criticized tokens as being akin to sneaker speculation, essentially deceiving young fans.

However, things quickly reversed. Weeks later, media reported that Kanye was preparing his own cryptocurrency YZY, with a distribution plan showing he would receive 70% of the shares and bind the token to the Yeezy brand as a payment tool. Shortly after, he announced on Twitter that he would launch an official meme coin, even hinting at a token named "Swasticoin." Meanwhile, Kanye's account behavior became increasingly erratic: he frequently retweeted tweets from Zhao Changpeng and then suddenly unfollowed him, instead following other fund founders; most of his tweets were deleted, leaving only a few related to Zhao Changpeng. These unusual actions led the public to suspect that his account might have been taken over by someone else, with rumors suggesting he might have sold the account's publishing rights to the BarkMeta team for $20 million. Although Kanye later denied this, the controversy did not dissipate.

In fact, this is not the first time Kanye has "flip-flopped" in the crypto space. As early as 2021, he sold music works and merchandise through NFTs, only to later publicly deny NFTs, claiming he wanted to focus on real-world creations. However, just a few months later, he applied for trademarks related to the metaverse and NFTs, even deleting his previous denial statements. Such vacillation makes it difficult for the public to gauge his true stance, significantly damaging his credibility among fans.

Considering the above cases, similar to Jay Chou's "Jay Chou Bear" NFT, Shawn Yue's zombie NFT, or NBA celebrity Shaquille O'Neal's DAO project Astrals, these celebrities once led a speculative frenzy but almost without exception ended in failure. History has shown us: regardless of how high the individual's popularity or how novel the theme, these celebrity-led token or NFT initiatives are destined to struggle to achieve long-term value, resembling more of a short-term "fan economy harvesting" capital game.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。