Wednesday wasn't particularly fresh, but the assignments are still quite difficult to write. The main issue is that the market's decline without clear information often represents a pessimistic outlook for the future. This has been the case for two consecutive days, with not only $BTC declining but also the U.S. stock market showing a downward trend. Currently, the market's pessimistic expectations mainly revolve around the possibility of interest rate cuts in September and whether the U.S. economy is entering a downturn.

In the early hours, the Federal Reserve released the minutes from the July meeting, which did not contain any significant data and were similar to what Powell had discussed. Out of the nine voting members, seven agreed to maintain the current rates, while only Bowman and Waller supported a rate cut. Currently, the only additional member publicly supporting a rate cut is Williams, while many other voting members remain hesitant.

After reading Nick's interpretation of the minutes, he believes that the adjustment of the August non-farm payroll data marks a turning point for the Federal Reserve. Due to the significant downward revision of labor data, more voting members may keep an open attitude towards a rate cut in September. Trump also targeted another conservative voting member, Cook, today, which I find completely unsurprising, as Trump hopes to increase support for a rate cut as much as possible before the September meeting. This is also a way to set an example.

Looking at Bitcoin's data, today's volatility has increased, not just in terms of decline; there have been signs of a rebound in both the Asian and U.S. time zones. However, BTC's rebound is somewhat weak, while $ETH's rebound is much stronger, with ETH directly recovering the losses from yesterday. Investor sentiment is clearly leaning more towards ETH.

This aligns with what we have been explaining all along: the stability of BTC's price is due to fewer sellers, not because of strong buying power, while the rise in ETH's price is a result of actual user purchases.

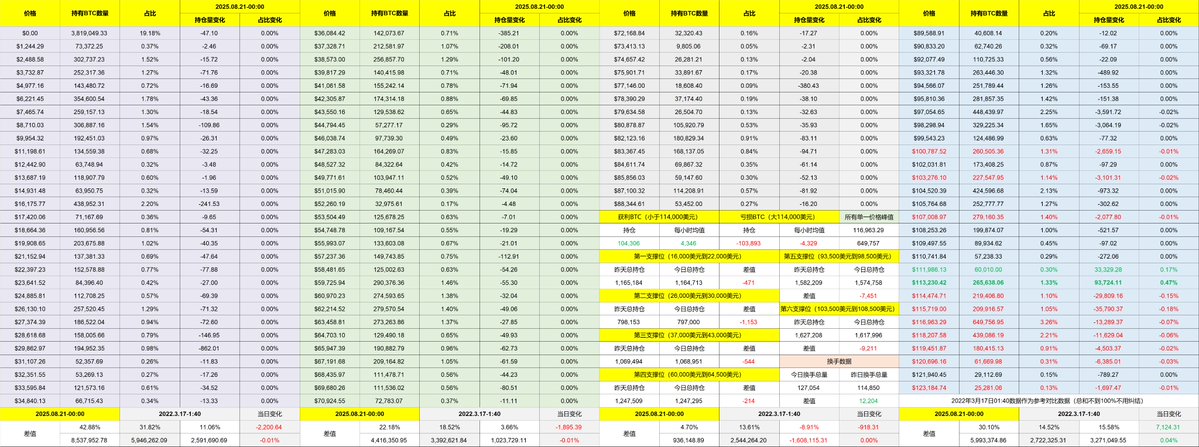

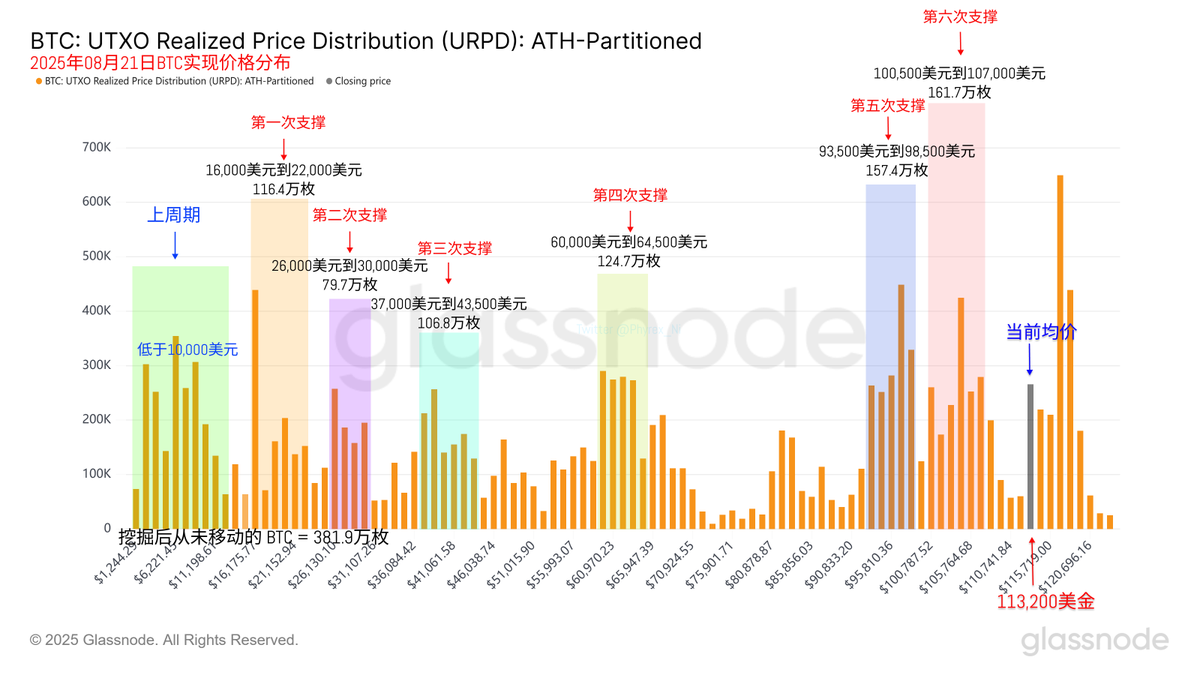

Currently, BTC's support remains very solid, and there is no trend indicating a break below support levels. As mentioned in today's weekly report, the expected bottom support price for BTC should be around $112,000. In fact, today's lowest price reached $112,200 before starting to rebound. Of course, this is all based on expectations before the Jackson Hole meeting, and the subsequent trend will depend on Powell's speech at that time.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。