Original | @Moomsxxx

Compiled | Odaily Planet Daily (@OdailyChina)

Translator| Ding Dong (@XiaMiPP)

Recently, the native token MNT of the Layer 2 public chain Mantle has surged from a low of $0.5 in early July to a high of $1.4, an increase of nearly 200%, before retreating to $1.27, making it a leader in the L2 sector. What forces are driving the rapid rise of MNT?

Crypto practitioner @Moomsxxx recently posted a message providing a noteworthy perspective for the market: MNT will be deeply integrated into the core business of Bybit, the world's second-largest centralized exchange, which may bring significant market demand for MNT. This article combines trading volume, transaction fees, and future integration plans to model the potential annual buying pressure for MNT, as compiled by Odaily Planet Daily.

Project Introduction

Mantle Network is a high-performance Ethereum Layer 2 network that employs a modular architecture, combining Optimistic Rollup with EigenLayer's data availability layer (EigenDA) to achieve low costs, high throughput, and fast transaction confirmations, while relying on Ethereum's security for solid protection.

Mantle was initially initiated by BitDAO and completed a brand merger through the BIP-21 proposal in May 2023, upgrading BitDAO to the Mantle ecosystem, with the token transitioning from BIT to MNT. Early supporters include Bybit, Peter Thiel, Pantera Capital, and others.

The relationship between Mantle and Bybit began during the BitDAO period, with Bybit providing funding and strategic support as a major backer. Although Mantle has now independently developed into a Layer 2 ecosystem, the two maintain close ties in terms of funding, ecological cooperation, and market promotion.

The Mantle project has a treasury of approximately $2.6 billion (as of December 2024), with assets including MNT, BIT, ETH, USDC, and USDT. According to the latest data disclosed on July 30, the total holdings of ETH and mETH amount to 101,867 coins, valued at approximately $388 million, including ETH (4,454 coins), mETH (77,218 coins), and ETH in MI 4 (20,195 coins).

Latest Developments of Mantle

This week, Mantle announced one of the most significant news items of the year: The MNT token will be integrated into Bybit's core business, Bybit being the world's second-largest centralized exchange (CEX).

Based on this, I built a model predicting that the annual average buying pressure for MNT could reach nine figures.

Background

Bybit is the second-largest CEX globally by spot trading volume and ranks third by derivatives trading volume (data source: @coingecko).

Recently, Bybit's co-CEO and head of spot business joined Mantle as a core contributor, further strengthening the connection between the exchange and the Mantle ecosystem.

This move aligns closely with Mantle's strategy to promote the integration of DeFi and TradFi, such as launching @URNeobank and increasing focus on real-world assets (RWA). At the same time, Mantle plans to directly embed MNT into Bybit's core products.

The core of this significant news is the deep integration of MNT into Bybit's core business, accompanied by the addition of key team members.

Currently, MNT has been integrated into:

- Bybit Launchpool projects

- Bybit structured products

- Bybit OTC portal

Future planned integrations include:

- Using MNT to pay for discounted trading fees

- Obtaining VIP level qualifications through MNT

- Trading pairs priced in MNT

- Many more applications

Using MNT to pay fees and upgrade VIP levels will become important practical uses for the token—almost an ideal application scenario for the token.

It is worth noting that Bybit's average daily trading volume over the past year has exceeded $30 billion.

Bybit Fee → MNT Demand Model

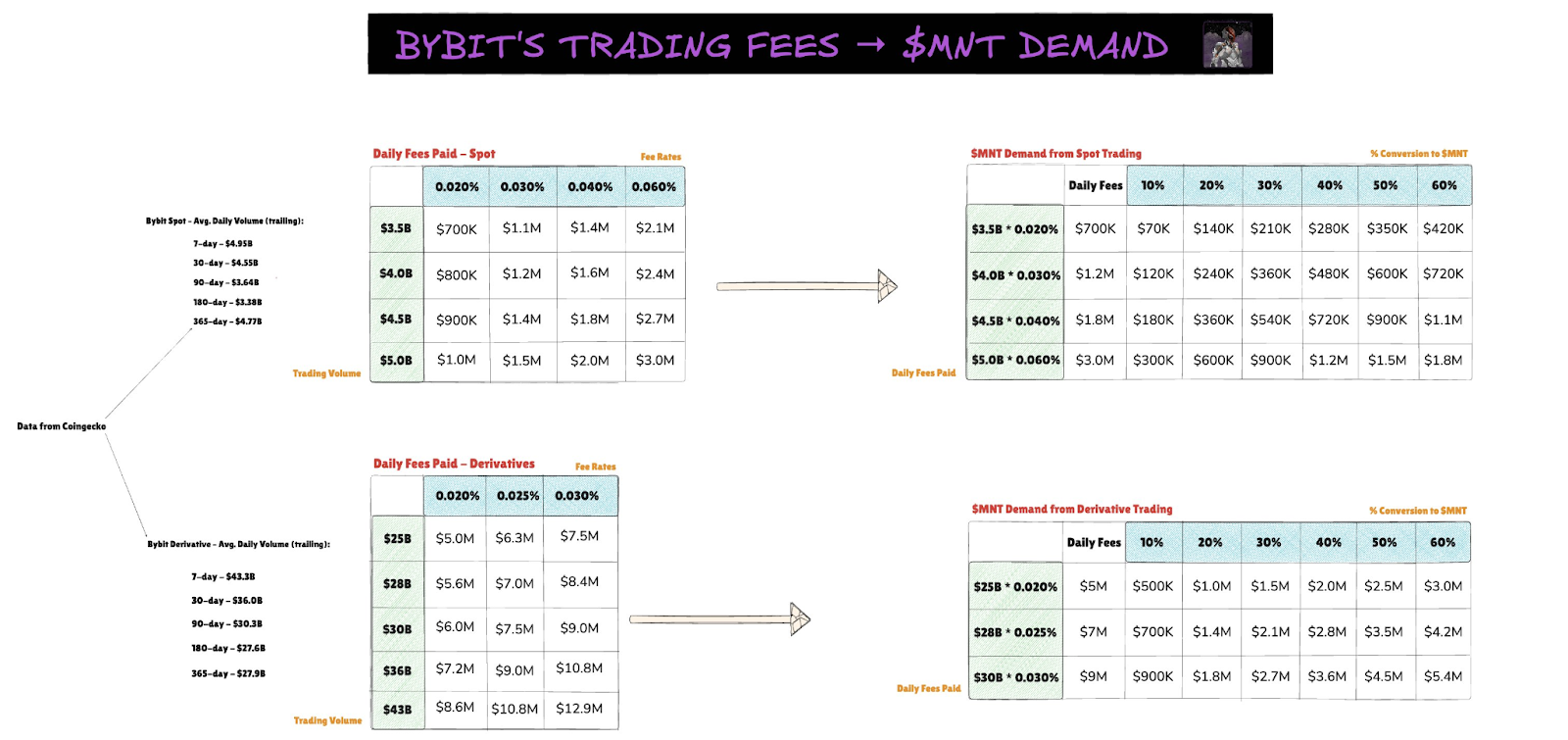

To quantify the potential buying pressure, we established a simple model to calculate the demand for MNT based on the conversion of spot and derivatives fees:

Trading Volume Assumptions

- Spot: Based on Bybit's historical average over the past year, approximately $3.5 to $5 billion daily

- Derivatives: Approximately $25 to $43 billion daily, consistent with the historical average over the past year

Effective Rates (Basis Points)

Bybit's fees vary by trading pair category, user level, and market-making/taker methods. I used a weighted average for calculations:

- Derivatives: 0.020% / 0.025% / 0.030%

- Spot: 0.020% / 0.030% / 0.040% / 0.060%

Model Calculation Method

- Daily Fees: Calculate daily fees (in USD) for each [trading volume × fee rate] combination.

- MNT Buying Pressure: Use median trading volume/median fee rate as a baseline and apply 10–60% conversion rate scenarios to estimate daily MNT demand.

Model Results

Conservative Scenario

- Daily Demand: $570,000

- Annual Demand: $20.8 million

Even if only 10% of the fees flow to MNT, the daily demand would be $570,000, with annual demand exceeding $200 million.

Neutral Scenario

- Daily Demand: $2.46 million

- Annual Demand: $89.8 million

Under neutral assumptions, approximately 30% of the fees flow to MNT, with daily demand close to $2.46 million and annual demand nearing $900 million.

Optimistic Scenario

- Daily Demand: $7.2 million

- Annual Demand: $2.6 billion

In a very optimistic scenario, about 60% of the fees flow to MNT, with daily demand at $7.2 million and annual demand reaching $2.6 billion.

Of course, these figures are based on assumptions and rough estimates, but the trend is very clear: The addition of Bybit executives to Mantle, the launch of Neobank, and the integration of MNT into the world's second-largest CEX are all significant catalysts for the ecosystem and the token.

From a fundamental and data perspective, the outlook for MNT is worth paying attention to, as its potential value is reflected not only in price fluctuations but also in the sustainability of ecological integration and practical applications.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。