Why Pay Attention to Infrared?

On one hand, Infrared is currently executing its points program phase, and there will be airdrops in the future.

On the other hand, on the surface, Infrared is part of the LSD (Liquid Staking Derivatives) sector. However, Infrared differs from existing LSD projects like Lido.

💠 Berachain's POL Proof

As the liquidity infrastructure of the Berachain ecosystem, the differentiation designed by Berachain is one of the fundamental reasons why Infrared stands out.

🔷 Dual Token Model Separates Security and Incentives

◆ Dual Token Model: Berachain uses a dual token model, $BERA + $BGT.

$BERA, like other tokens, supports transfers, trading, etc. However, $BGT is non-transferable and non-tradable.

$BGT is a governance token, and its monetization model involves burning $BGT at a 1:1 ratio to exchange for $BERA. Conversely, $BERA cannot be exchanged for or purchased with $BGT.

◆ Security: The top 69 validators stake $BERA as a security guarantee. At the same time, they earn GAS fees ($BERA), ecosystem shares (various ecosystem tokens), and fixed block rewards ($BGT) as cost compensation and basic income.

◆ Incentives: Validators and users delegate $BGT to validators to earn Boost rewards. This portion of the rewards primarily incentivizes validators and users to provide liquidity to Berachain.

◆ Security Separation: If a validator encounters issues, a portion of their staked $BERA may be deducted. However, this will not affect the $BGT delegated by users.

🔷 Liquidity Compounding

◆ Ways to Earn $BGT

› Validators earn fixed block rewards during their work, which are distributed in $BGT.

› Delegating $BGT to validators earns Boost rewards, which are also distributed in $BGT.

› Adding liquidity in permitted DEXs earns LP tokens. Staking these LP tokens can yield $BGT rewards.

◆ Liquidity Compounding

First, in the Berachain ecosystem, adding liquidity to DEXs can earn transaction fee income from the trading pool.

Second, staking the corresponding LP tokens can yield $BGT income.

Third, delegating $BGT to validators can earn additional delegation income, including Boost rewards from Berachain blocks, validator voting rewards, and dividends from ecosystem Dapps.

This is the liquidity triple compounding of the Berachain ecosystem, which enhances the capital utilization in the Berachain ecosystem, distinguishing it from the coin-generating model of POS consensus.

💠 Pol-vaults + $iBGT Optimize User Participation Process

🔷 Risks and Complexity of Native POL

◆ Risks Faced by Native POL Users

In the POS model, users can participate in mining by purchasing and staking public chain coins, bearing only the risks associated with the volatility of the public chain coins. Additionally, users can reduce this risk at any time by buying and selling public chain coins.

In the native POL model, since $BGT is non-tradable and non-transferable, users must first add LP and then stake LP tokens to earn $BGT. While users enjoy triple liquidity compounding, they also bear the dual risks of impermanent loss and price volatility of LP assets.

Moreover, users cannot reduce short-term risks through flexible buying and selling of $BGT. They must either give up $BGT, burn it, and exchange for $BERA, or continue to hold $BGT.

◆ Complexity of User Participation in Native POL

On the other hand, when users choose validators for delegation, they need to analyze the overall situation of each validator and frequently monitor and adjust their delegation targets. For example, if a validator reduces their staked $BERA, it decreases the probability of that validator earning rewards. Similarly, if too much $BGT is delegated to a validator, it may reduce the Boost rewards allocated to users. This presents users with challenges in terms of choice complexity and timeliness.

🔷 Pol-vaults + $iBGT Optimize User Participation Process

◆ More Flexible Two-Stage Process

Infrared has keenly identified these pain points for users and launched the Pol-vaults + $iBGT model.

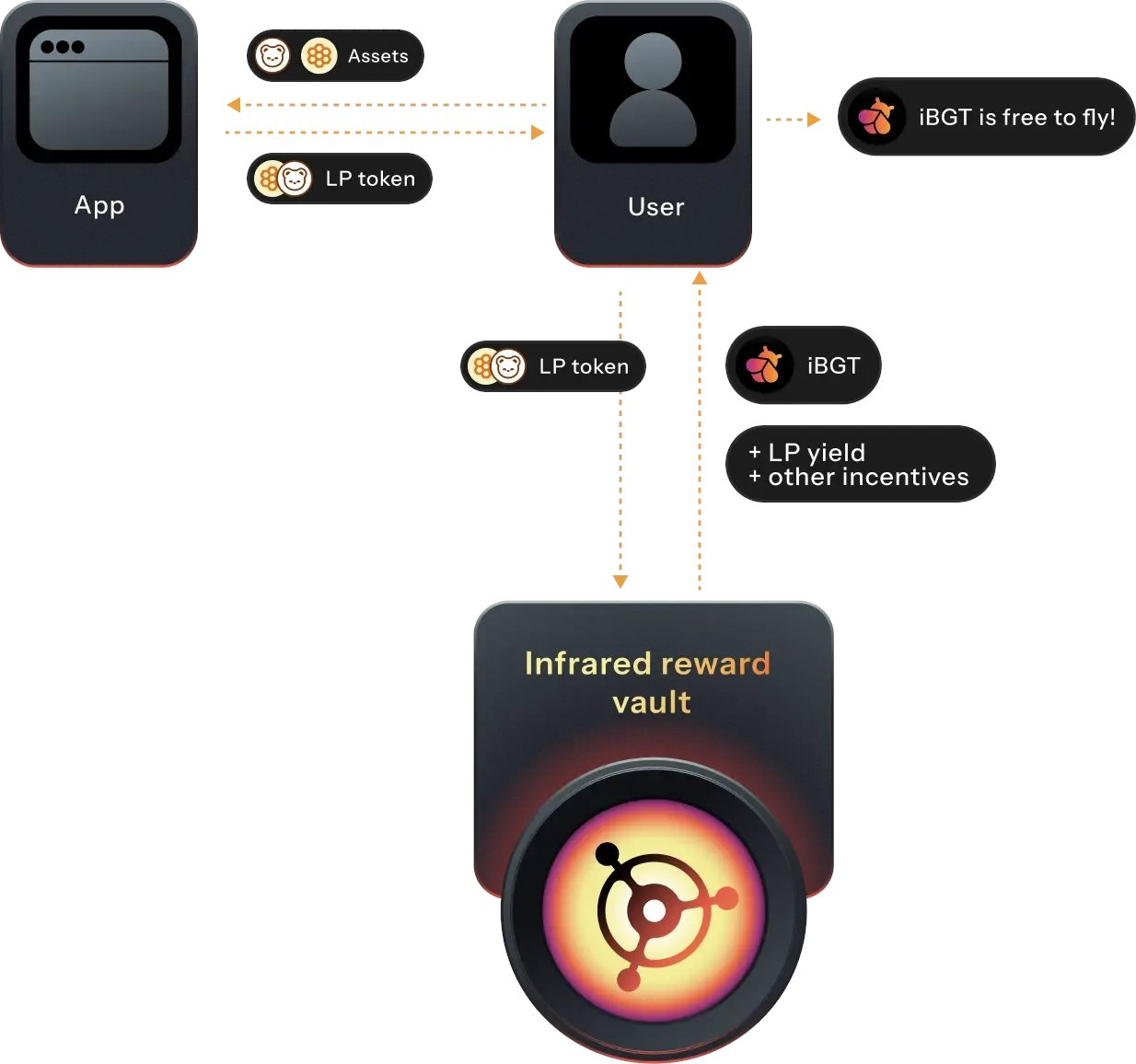

Users deposit LP tokens into Infrared's Pol-vaults, where the Infrared protocol deposits the LP tokens into Berachain's native POL. After earning $BGT, corresponding $iBGT is issued, and the rewards users receive in Infrared's Pol-vaults are not $BGT, but $iBGT.

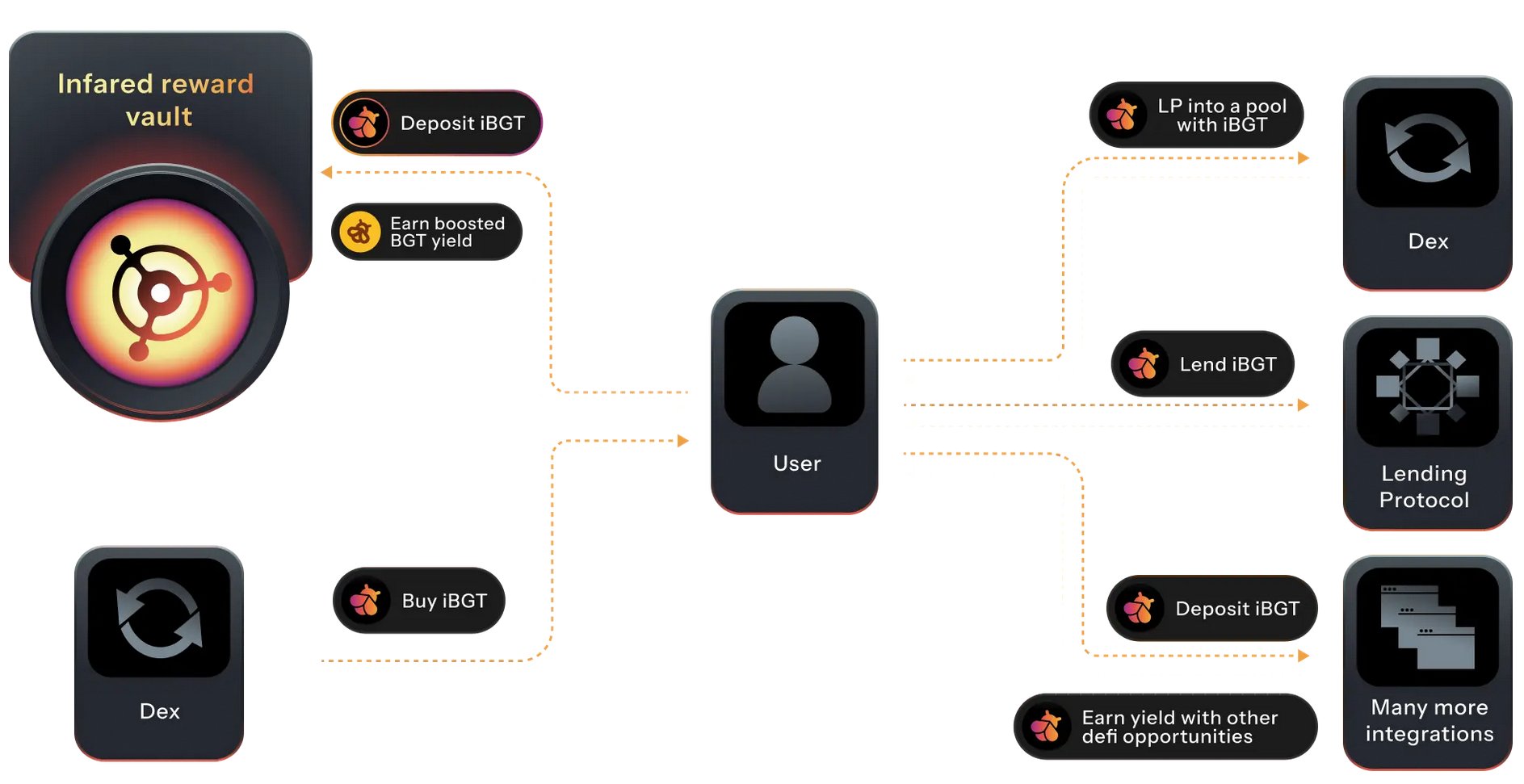

Compared to the non-tradable and non-transferable $BGT, $iBGT offers strong flexibility, allowing trading on DEXs and transfers between wallets.

Users can separate the two stages of participating in LP and delegating to validators. In the first stage, users can deposit LP tokens to earn $iBGT.

In the second stage, users stake $iBGT to earn Boost delegation rewards from delegating $BGT.

Users can choose:

› To participate only in the first stage. For example, when bearish, use WBTC + WETH to add LP and sell the $iBGT mined from LP.

› To participate only in the second stage. For example, when bullish, directly buy or borrow $iBGT and stake it. (Earning $iBGT through the first stage with equivalent LP may be slower).

› Of course, users can also participate continuously in both stages.

In summary, the separation of the two stages provides users with ample flexibility, allowing them to better formulate their yield and risk strategies.

◆ Liquidity Delegation Agency Service

The income from staking $iBGT for users comes from the underlying $BGT delegated to validators, generating delegation income.

In native POL, users need to personally choose validators for delegation. However, when staking $iBGT, the Infrared protocol selects validators and executes the delegation.

The Infrared protocol can monitor the status and data of Berachain validators in real-time, allowing it to delegate $BGT to the most suitable validators.

Essentially, this provides users with a liquidity delegation agency service. On one hand, it greatly simplifies the user participation process. On the other hand, it maximizes users' delegation income.

🔷 Ecosystem Data

◆ Pol-vaults Data

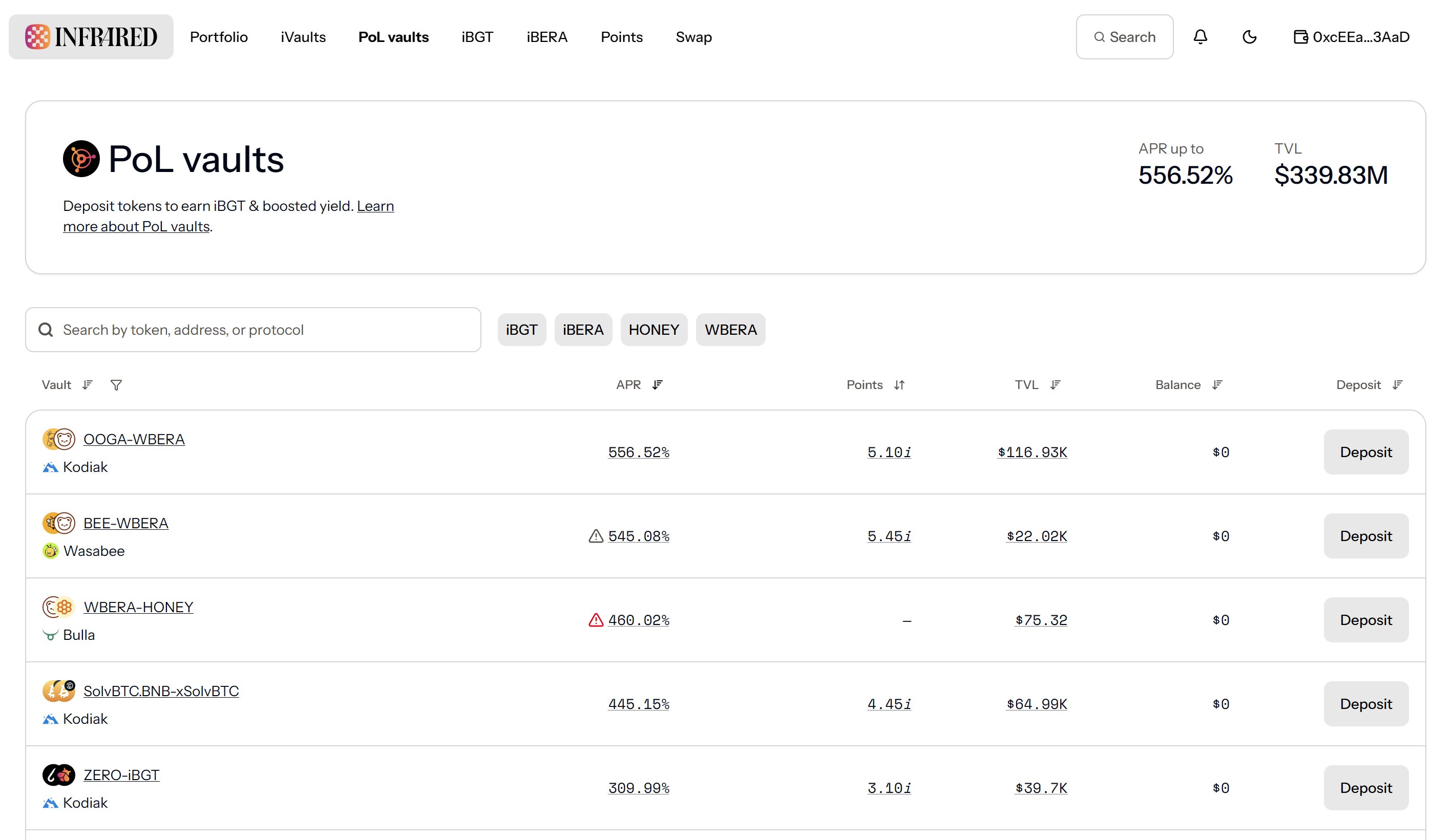

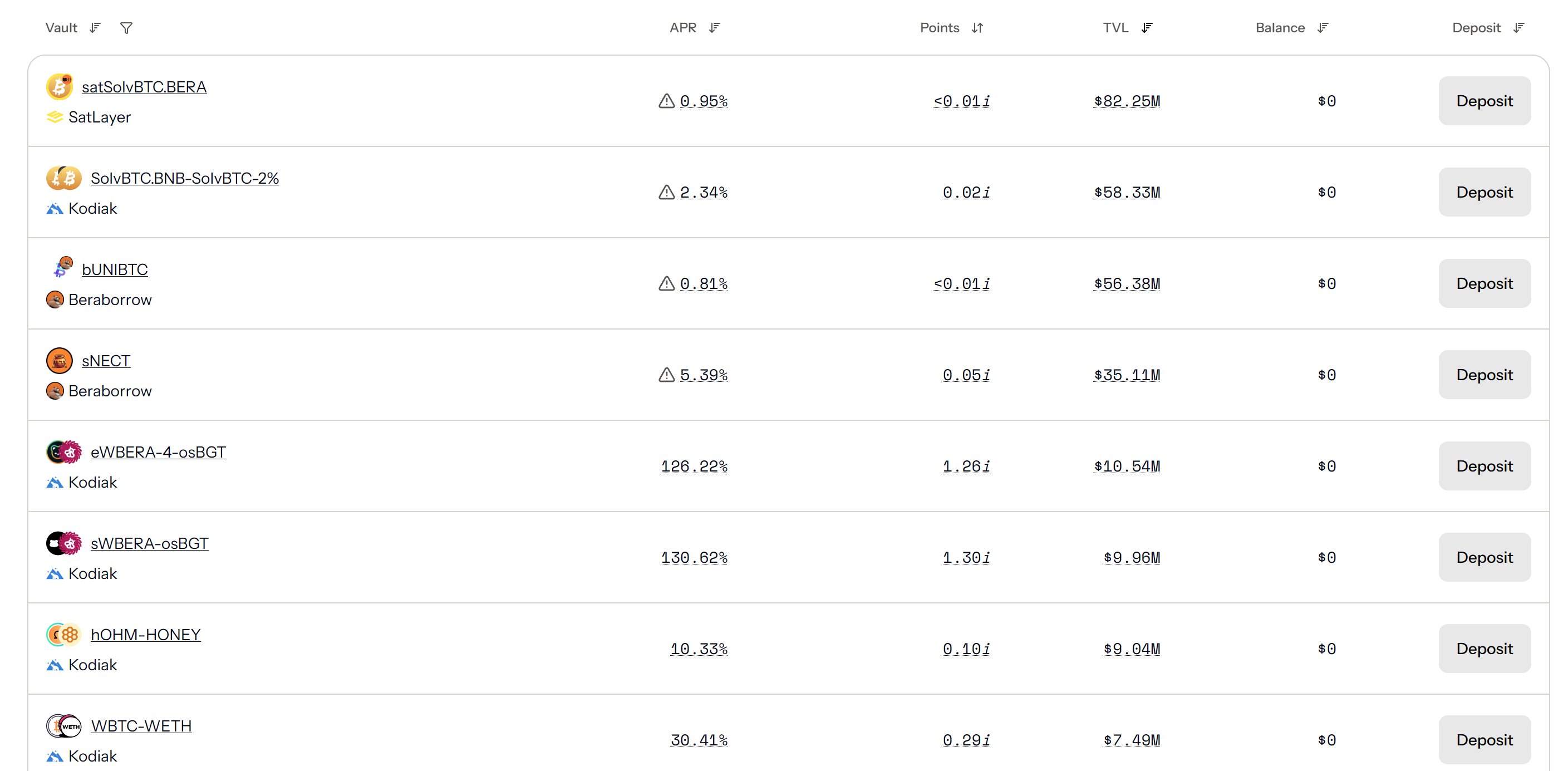

Currently, the total TVL of Pol-vaults is close to $340 million, with the highest APR exceeding 500%.

The highest TVL is for the cross-chain satSolvBTC to Berachain, with a TVL exceeding $80 million. This shows that Infrared's Pol-vaults also support non-LP single currency liquidity.

Additionally, liquidity for non-Berachain native assets is also supported. For example, the LP for the WBTC-WETH trading pair has a TVL exceeding $7 million, with an annualized yield of 30%.

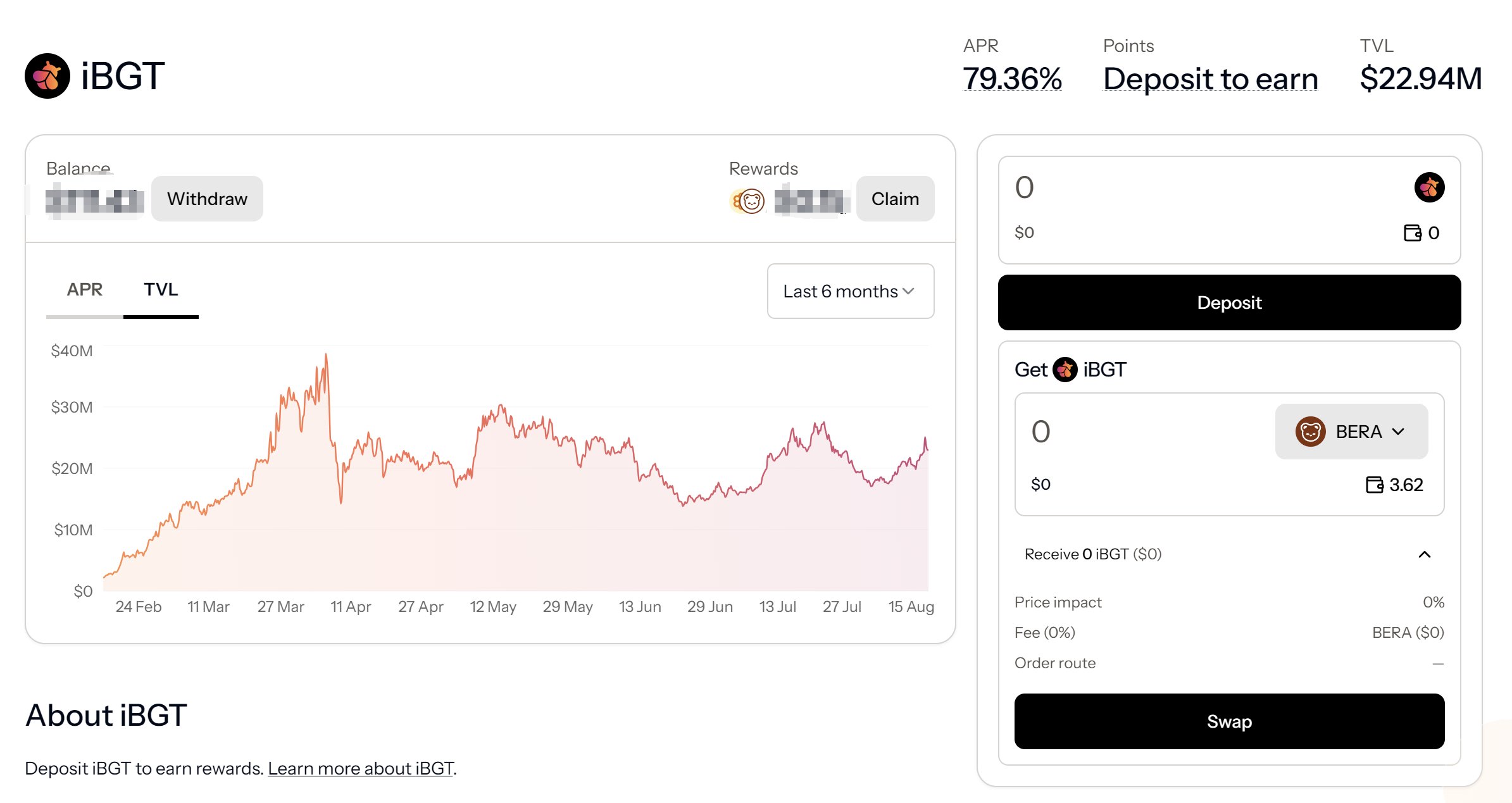

◆ $iBGT Data

Since its launch six months ago, the TVL of $iBGT has generally been between $15 million and $30 million, with the current TVL at $22.94 million and an APR of 79.36%.

💠 $iBERA Participates in Validator Role

🔷 Automatic Compounding of Staking Income

Users staking $BERA in Infrared can earn $iBERA. Infrared uses these $BERA as validator stakes, and the validator income generated on this basis is distributed to $iBERA holders.

Holders of $iBERA indirectly participate in the role of Berachain validators. Users can earn validator income, including miner fees and additional incentives, and may even include MEV income.

The staking income of $iBERA is automatically compounded, requiring no manual operation from users; the staking income will continue to be staked automatically. Therefore, the income from $iBERA is reflected in the appreciation of $iBERA / $BERA.

$iBERA is the product most similar to Lido. (The difference is that Lido can infinitely increase validator nodes as ETH staking increases, while $iBERA can earn income from a maximum of 69 validator nodes.)

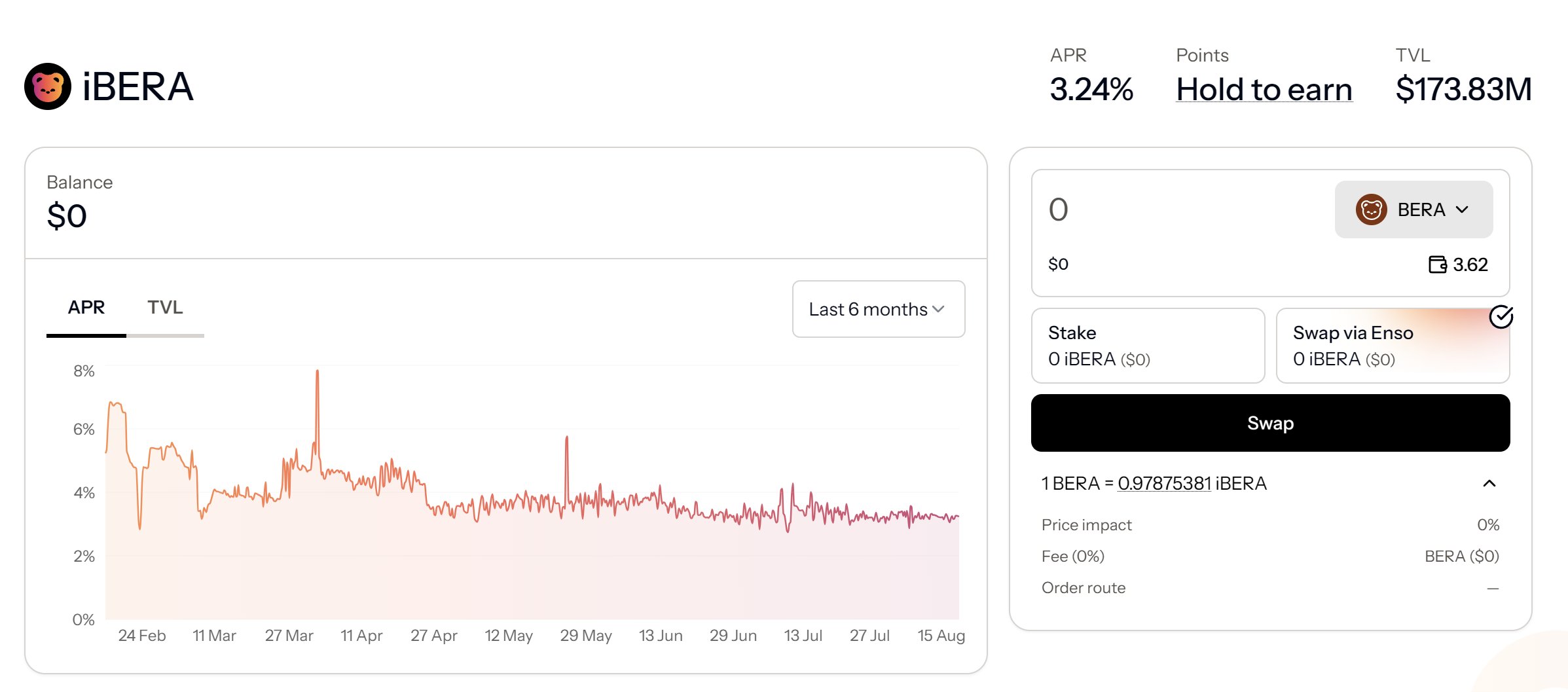

🔷 $iBERA Ecosystem Data

In the second half of 2025, the TVL of $iBERA is expected to stabilize, with the current TVL at $174 million and an APR of 3.24%.

💠 iVault Advanced Strategies

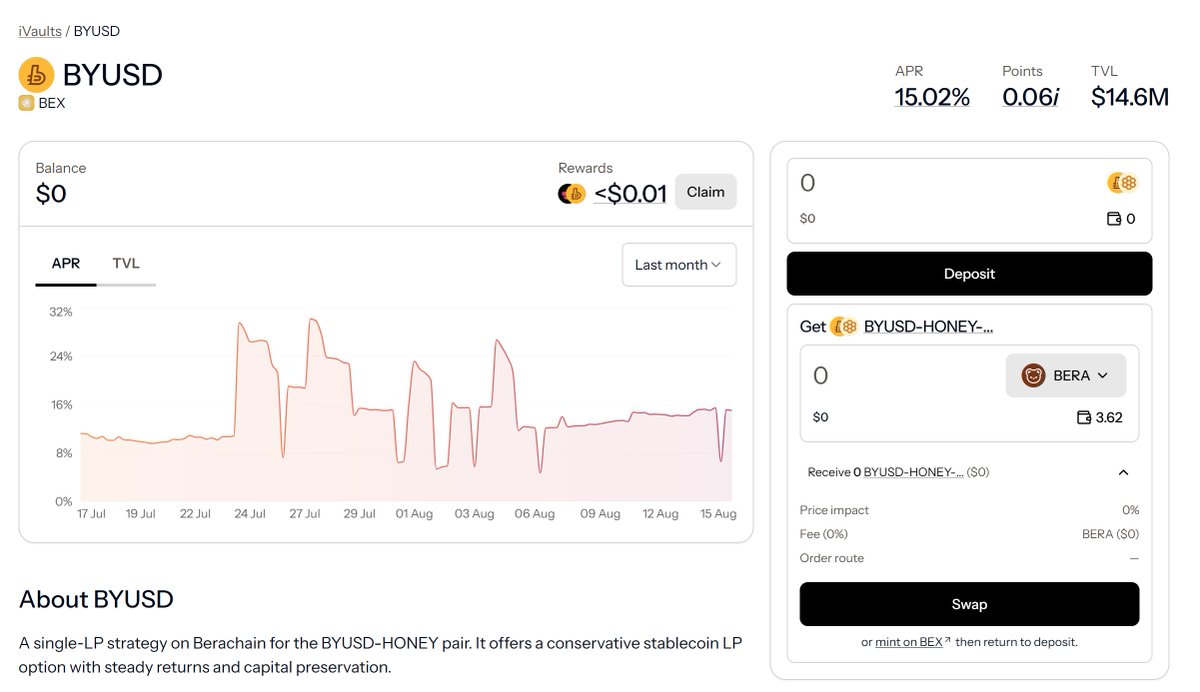

In late July, Infrared launched the iVault advanced strategy product.

The first product of iVault is BYUSD, where users can deposit LP from the BYUSD-HONEY stablecoin trading pair to earn $iBGT and more. Possible sources of income include Berachain's POL, BEX, and additional incentives.

Since the launch of BYUSD less than a month ago, the current TVL has reached $14.6 million, with an APR of 15.02%.

💠 More Products from Infrared

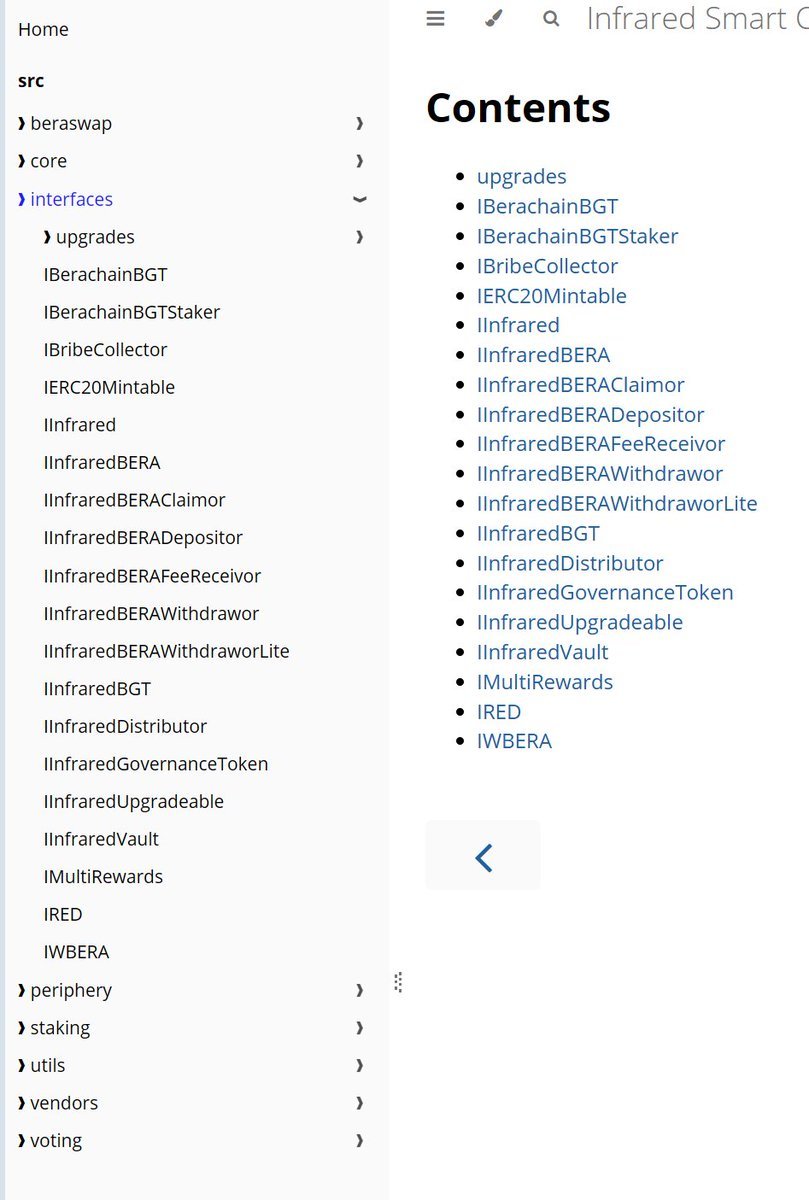

🔷 For Developers

In addition to the products aimed at ordinary users mentioned above, Infrared also offers many products for developers, such as various API tools.

Additionally, Infrared provides a function set for developers to offer extra incentives to validators, thereby guiding validator behavior (as long as it does not harm the Berachain ecosystem).

Infrared also provides automated tools for collecting and staking $iBGT, allowing developers to collect and stake $iBGT more timely, thereby increasing yields.

🔷 New Version in Iteration

At the end of July, Infrared released the introduction of version 1.7, marking the seventh upgrade of Infrared, which includes four major updates:

First, the $iBGT auction system. The $BGT rewards for staking $iBGT will no longer be directly converted to $wBERA at a 1:1 ratio but will be minted as $iBGT and auctioned for $wBERA. This is to maintain the price of $iBGT/$BERA in line with market supply and demand.

Second, the update of the reward form for $iBERA. $iBERA will still automatically compound, but when the $iBERA/$BERA premium reaches 1.2 or higher, the rewards will be retained as $iBGT instead of being converted to $BERA for reinvestment.

Third, the dynamic minting fee for $iBGT. When minting $iBGT based on $BGT, a dynamic minting price will be used. When the $iBGT/$BGT price is high, a higher minting fee will be applied; when the $iBGT/$BGT price is low, a lower minting fee will be used to balance the $iBGT/$BGT price.

Fourth, a temporary restriction on the redemption of $iBGT. When the $iBGT/$BGT price drops below 1.0, the redemption of $iBGT will be temporarily restricted to stabilize the $iBGT/$BGT price.

The main motivation for this update is to strengthen the price balance of $iBGT/$BGT and $iBGT/$BERA, aligning with market supply and demand while avoiding excessive volatility.

💠 Security

As a financial protocol, security is always a top priority.

🔷 Open Source

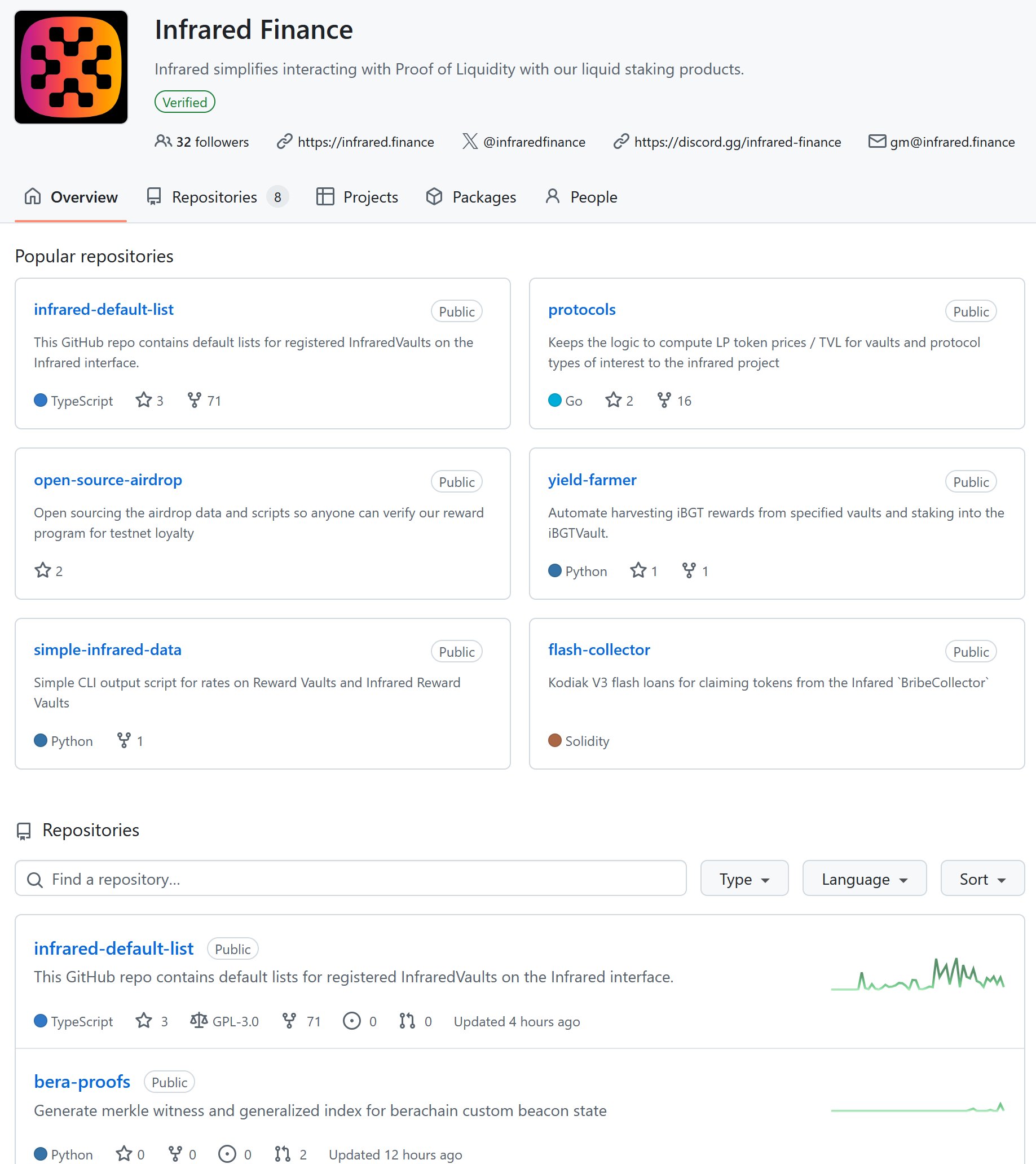

First, Infrared's code is open source, with the most recent update occurring 4 hours ago, 12 hours ago…

🔷 Code Security Audits

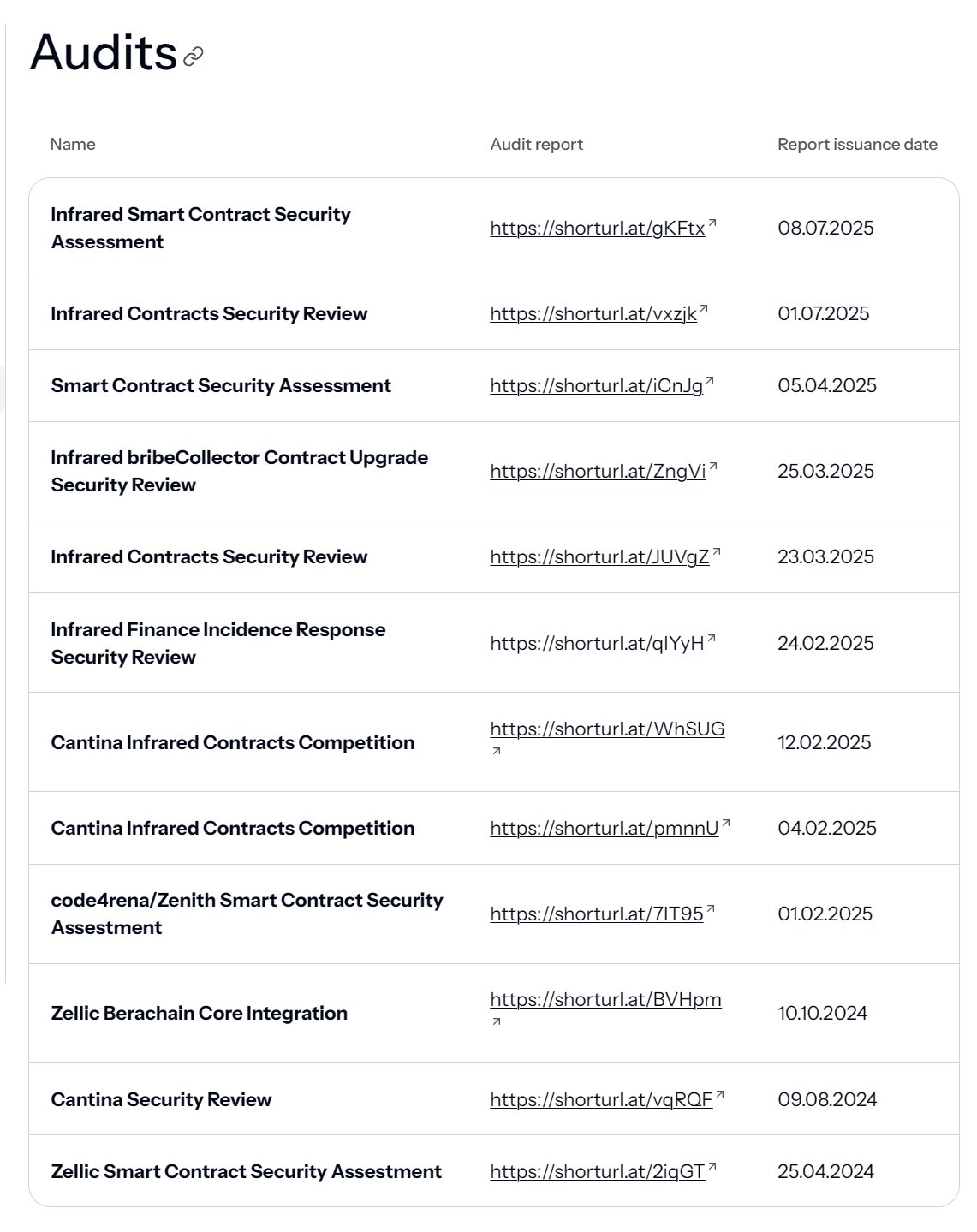

Second, from April 2024 to the present, Zellic, Zenith, Cantina, and Spearbit have conducted a total of 12 security reviews on Infrared, including code audits, security assessments, and security competitions.

The two most recent audit reports were released in July 2025, with the auditing firms being Cantina and Zenith.

The audit report from July 1 found 0 critical risks, 1 high risk (all resolved), 4 medium risks (all resolved), 5 low risks (3 resolved), and 15 informational risks (4 resolved).

The audit report from July 8 found 0 critical risks, 0 high risks, 2 medium risks (all resolved), 9 low risks (8 resolved), and 4 informational risks (2 resolved).

💠 Relationship Between Infrared and Berachain

Infrared has a close cooperative relationship with Berachain, but they belong to two different teams.

First, these two projects complement each other.

🔷 Berachain Provides the Foundation for Infrared's Innovation

Berachain's POL consensus innovation provides the foundation for Infrared's innovation. $iBera is a liquidity product similar to Lido. However, POL Vault + $iBGT is an innovation generated based on the POL consensus.

🔷 Infrared Improves Liquidity in the Berachain Ecosystem

First, Infrared issues $iBGT based on $BGT, and $iBGT is tradable and transferable, thus adding vitality to the liquidity of the Berachain ecosystem.

Second, Infrared has not yet issued tokens and is currently in the points program phase, which can attract more funds to participate in the ecosystem, thereby increasing liquidity for Berachain.

Third, Infrared has designed more liquidity products based on Berachain, adding more ways to engage with the Berachain ecosystem.

🔷 Infrared Approaching Monopoly on Berachain Liquidity

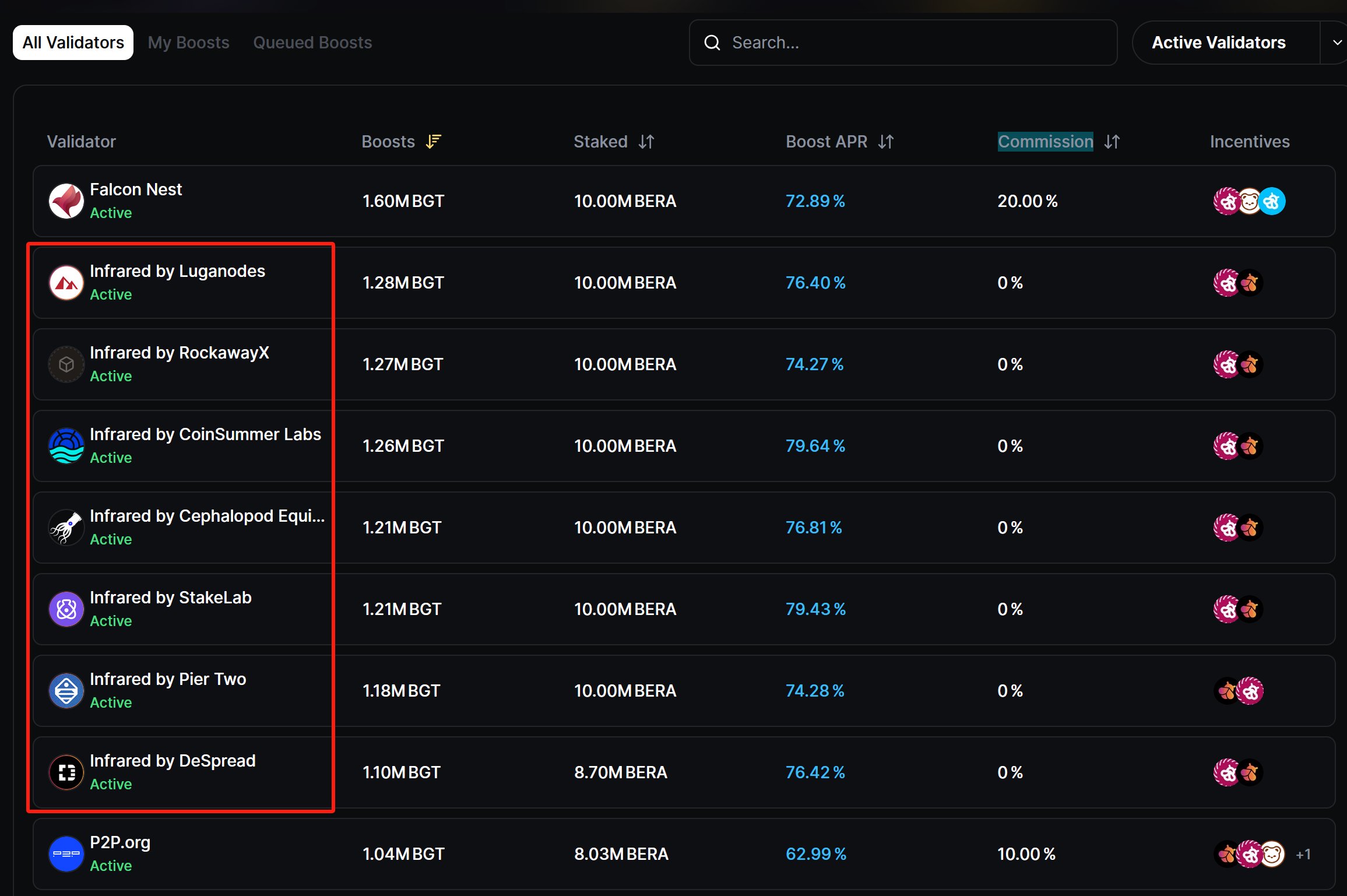

According to Berahub, among the validators with the highest number of Boosts, almost all are occupied by Infrared's nodes.

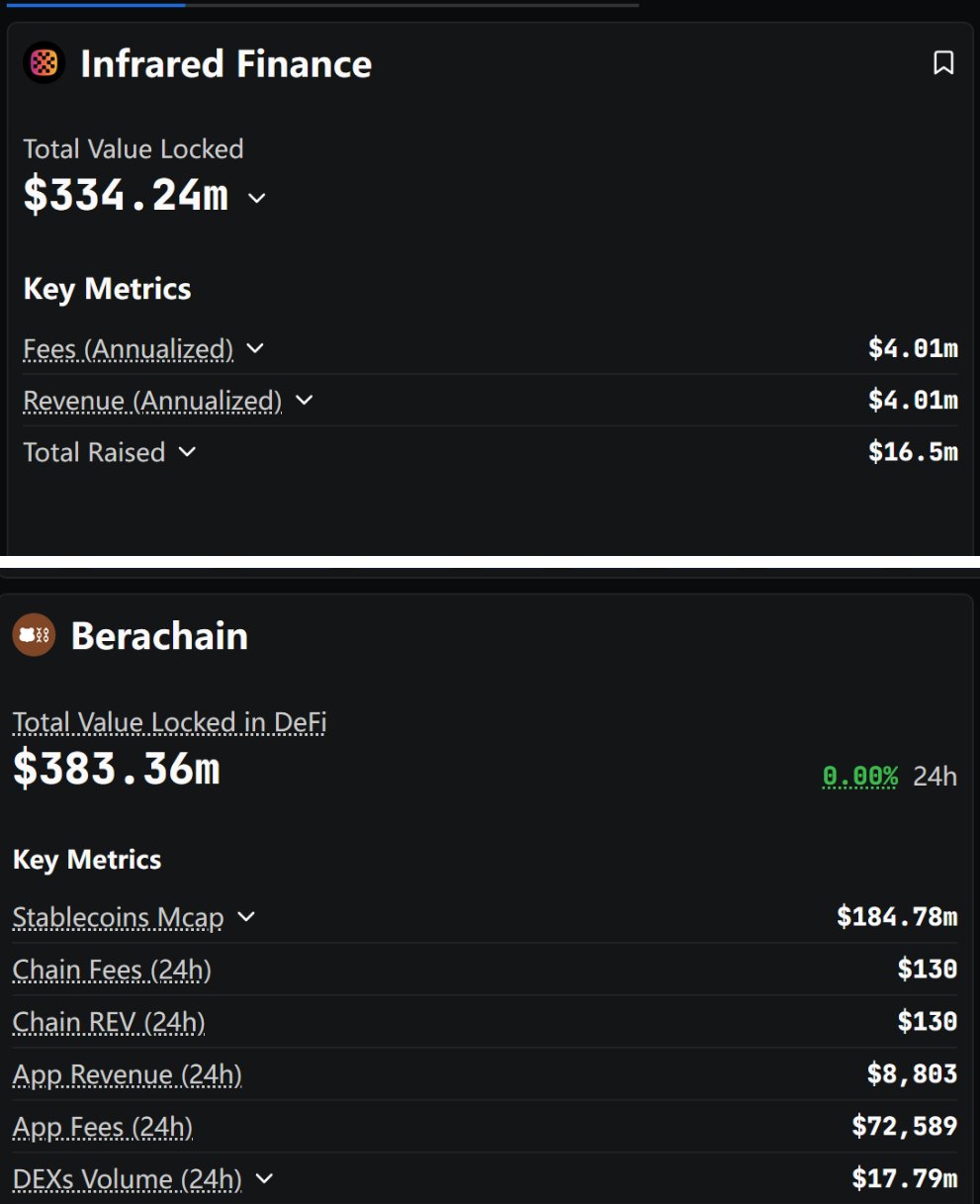

According to Infrared's official website, the total TVL of the platform has reached $533 million. Defillama uses different metrics, reporting Infrared's TVL at $334 million, while the total TVL of the Berachain ecosystem, using the same metrics, is $383 million.

This set of data indicates that Infrared provides almost all of the liquidity for Berachain.

In contrast, Lido accounts for 40.74% of Ethereum's liquidity, Kamino accounts for 24.45% of Solana's liquidity, and Pancake accounts for 26.51% of BSC's liquidity… Echo may account for slightly more of Aptos's liquidity, at only 34.89%.

Infrared holds a near-monopoly position in the liquidity of the Berachain ecosystem.

Especially with the application of $iBGT, the underlying corresponding $BGT is actually within the Infrared protocol. Users trading $iBGT in swaps do not immediately affect the destruction of $BGT. When a significant number of users sell $iBGT, Infrared may then destroy $BGT. Therefore, Infrared becomes an important factor influencing the supply of $BGT.

According to Berascan, the total supply of $BGT is 19,930,102, while the total supply of $iBGT is 14,451,374, accounting for 72.51% of the total $BGT supply.

To some extent, Infrared has almost become the central bank of $BGT.

💠 Possibility of Infrared Expanding Beyond Berachain

There may be a subtle relationship between Berachain and Infrared. This subtle relationship could give Infrared potential future competitiveness.

This competitiveness may drive Infrared to develop beyond the Berachain ecosystem.

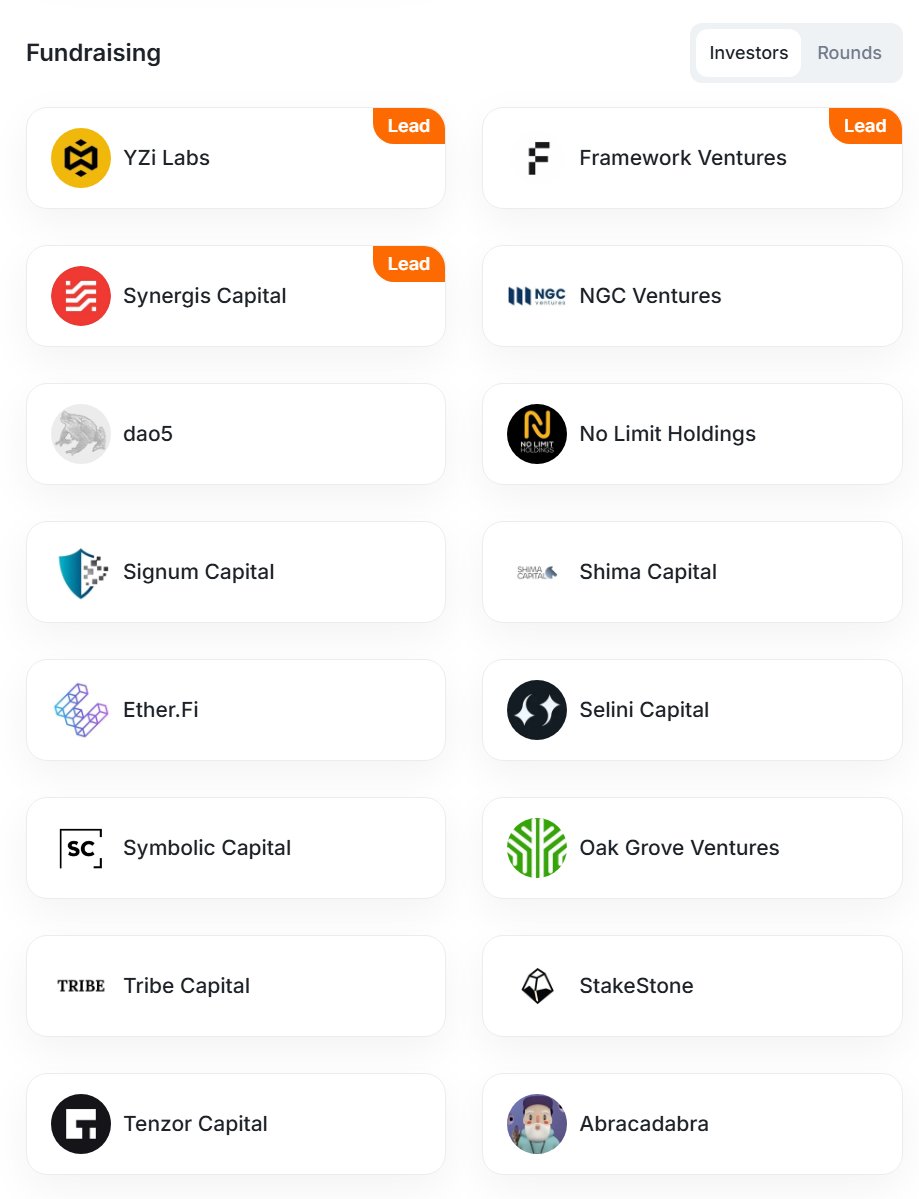

In fact, both Infrared and Berachain's leading investment institutions include Framework. However, Infrared's leading investment institutions also include Binance (YZi) and Synergis. The investment institutions outside the leading investors also differ. This means that Infrared may gain resources and support beyond the Berachain ecosystem.

💠 In Conclusion

Infrared has innovated more liquidity products based on the Berachain ecosystem. Among them:

POL-vault + $iBGT is the first liquidity product of its kind in the entire network, with the advantage that users can flexibly participate in LP mining and validator delegation in stages. The earnings from POL-vault are primarily in $iBGT, while the earnings from staking $iBGT are primarily in $wBERA + $HONEY.

$iBERA is a liquidity product similar to Lido, with the advantage of automatic compounding. After staking $BERA once, holding $iBERA is sufficient. The earnings from $iBERA are reflected in the premium of $iBERA/$BERA.

$iVault is a high-level liquidity product, with the first product being BYUSD (LP for the BYUSD-HONEY trading pair). Its advantage lies in the stablecoin-stablecoin trading pair, which carries very low risk. The earnings from BYUSD are primarily in $BYUSD + $iBGT + $wBYUSD.

All profitable products can increase points, which can be redeemed for airdrops in the future. Additionally, there are several products aimed at developers, and more designs to balance the $iBGT/$BGT price are being updated.

What makes Infrared special is that its innovative liquidity products are different from existing LSD products; and it is rare for a liquidity protocol like Infrared to almost monopolize an ecosystem.

Infrared's innovative capabilities, relationship with Berachain, and financing background may indicate greater potential for Infrared, even the possibility of expanding beyond the Berachain ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。