Tom Lee (Thomas Lee) has become the recognized new champion of Ethereum, buying 1.5 million ETH in 50 days, transforming Ethereum from a doomsday vehicle into "the next decade still depends on him." Meanwhile, Solana, which last year boldly proclaimed "to take down Ethereum," has lost its previous momentum. In this wave of cryptocurrency and stock, the community has realized, "Solana also needs its own Tom Lee."

The SOL/ETH exchange rate continues to decline.

So who is Solana's Tom Lee?

Rhythm BlockBeats has highlighted six candidates from the community, each possessing unique skills, even the early SOL promoter Raoul Pal did not make the list.

Ultimately, our top choice is Anthony Scaramucci.

This Wall Street's most steadfast Solana Maxi holds absolute influence in both crypto and Wall Street, and more importantly, he has an unabashed enthusiasm for Solana.

Let's take a look at why Anthony Scaramucci stands out from a list that includes Kyle Samani (founder of Multicoin) and Chamath Palihapitiya (top Silicon Valley investor).

Anthony Scaramucci

Anthony Scaramucci can be considered one of Wall Street's most steadfast Solana Maxis. He was a Goldman Sachs investment banker and later founded the hedge fund SkyBridge Capital in 2005, becoming known for his brief tenure as White House Communications Director (1 mooch, 11 days). He gathers Wall Street leaders by hosting the annual SALT summit, accumulating a deep network in the financial circle. As a seasoned fund manager, Scaramucci is bold in embracing emerging assets, often investing against the trend during market downturns, making him one of Wall Street's visionary investment representatives. In recent years, he has actively engaged in the crypto space, reallocating part of SkyBridge's capital to Bitcoin, Ethereum, Solana, and others, and personally advocating for the crypto industry, enhancing his visibility in the crypto community. Besides his network, he also has a YouTube channel with 170,000 subscribers, giving him considerable influence in terms of dissemination.

Compared to other "candidates," Scaramucci's stance on Solana appears more resolute. At the Solana Breakpoint conference in September 2024, he stated, "I hope the tokenization of financial assets happens on Solana because I hold a large amount of Solana, and I believe this will ultimately happen." He revealed on the spot that he is a Solana holder and predicted that Solana would lead the global financial market's tokenization wave. Previously, in May 2024, Scaramucci tweeted, "We will see a Solana ETF." He firmly believes that after Bitcoin and Ethereum, Solana is likely to be the next crypto asset approved for a U.S. ETF, and this "prophecy" was realized on July 2 of this year.

At the DigiAssets summit in June 2025, he reiterated the slogan "SOL Will Flip ETH," emphasizing that this is not a denial of Ethereum but rather that he "understands Solana's story better." While many cryptocurrency and stock companies and traditional institutions began to make a big push for Ethereum, he still insisted that Solana is the Ethereum killer, showcasing his strong confidence in Solana's prospects.

Scaramucci has repeatedly emphasized his Solana holdings in public. As of early 2025, SkyBridge held up to nine-digit dollar amounts of Bitcoin and Solana on its balance sheet and set up a crypto portfolio fund of about $300 million for clients, which he stated also included Avalanche, Polkadot, etc. Although the report did not specify the holdings of each token, he indicated that Solana is a crucial component.

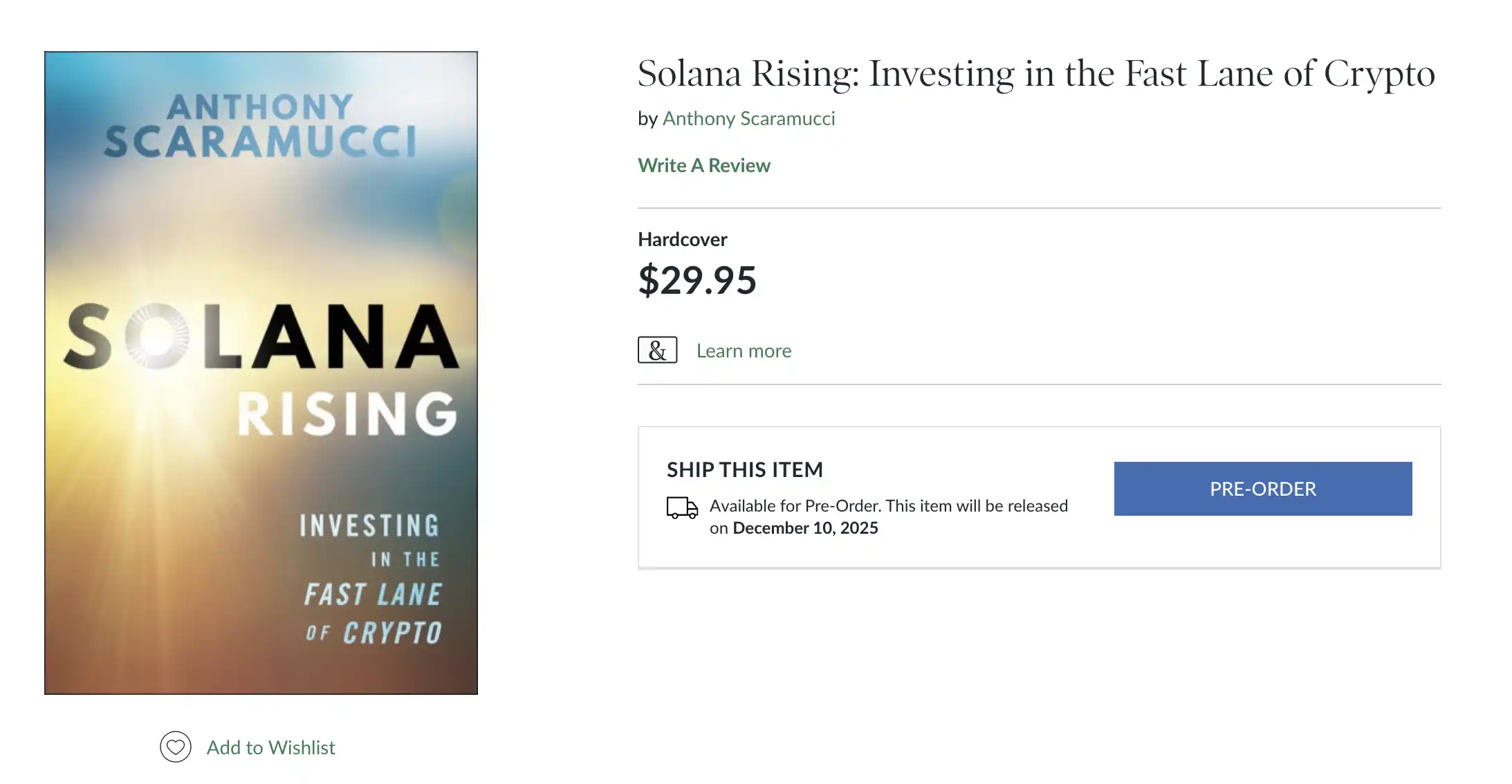

As the saying goes, "the butt decides the brain," he also wrote a book about his holdings titled Solana Rising, which is planned for release in the second half of this year. The target audience is those newcomers to traditional finance learning to allocate crypto assets, covering discussions from significant investors and players betting heavily on Solana, as well as an introduction to Solana and its role in cryptocurrency investment portfolios.

Scaramucci's overall view of Solana can be summarized as "highly bullish, long-term layout." He is extroverted and talkative, adept at packaging grand narratives, and tends to express optimistic expectations in straightforward and exaggerated terms. His style is sometimes seen as Degen or market hype, but it is precisely this that successfully attracts attention and gathers focus.

With a background in Wall Street and a passion for crypto, Scaramucci can articulate Solana's selling points in a language that mainstream investors understand. He discusses how tokenization can reduce financial costs and how Solana addresses trust overhead, transforming technical advantages into investment logic. Overall, he is one of the few who can hold sway in both traditional finance and the crypto sphere. With this cross-border influence and his unabashed enthusiasm for Solana, Scaramucci is increasingly seen as one of the spokespersons for the Solana ecosystem.

Michael Edward Novogratz

Michael Edward Novogratz is a former macro trader at Goldman Sachs, a partner at Fortress Investment Group, and the founder and CEO of Galaxy Digital, regarded as one of Wall Street's earliest and most heavyweight crypto adopters. His career spans traditional hedge funds and digital asset investments, known for his bold bets on emerging markets and high-volatility assets.

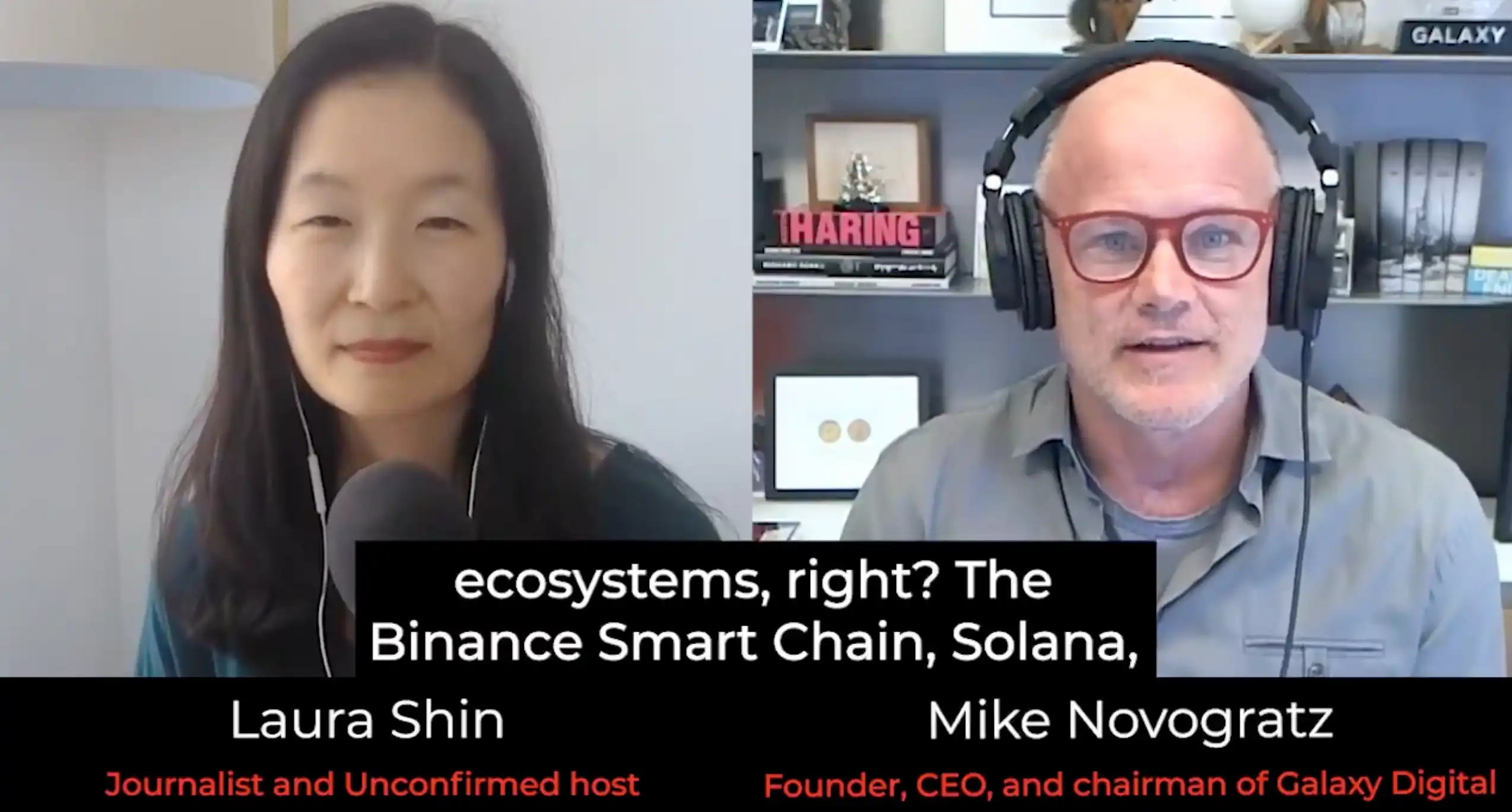

Since 2013, Novogratz has actively invested in core assets like Bitcoin and Ethereum, playing a "bridge" role between crypto and institutional funds across multiple cycles, including the recent Ethereum DAT craze among listed companies, where he played a significant role as an over-the-counter platform. As a macro investor, Novogratz's view of Solana is somewhat similar to Raoul Pal's, focusing on the macro liquidity and institutional adoption trends. He believes that the next round of growth in crypto assets hinges on the on-chain and tokenization of real-world assets (RWA), and Solana's technical architecture (high TPS, low latency, stable fees) enables it to meet the stringent speed and cost requirements of institutions.

Novogratz has deep Wall Street connections and media exposure, and Galaxy Digital is one of the few publicly listed crypto financial companies in both the U.S. and Canada, giving his voice a strong signaling effect. He often promotes crypto concepts in concise and straightforward language on traditional media like CNBC and Bloomberg. His style combines the steadiness of old-school Wall Street with the aggressiveness of crypto pioneers, often blending personal investment views with Galaxy's market data, making his statements both persuasive and strategically guiding. In promoting Solana's potential, Novogratz's advantage lies in his ability to pitch Solana to traditional finance using "institutional language," complementing Scaramucci's capital network and Samani's crypto-native advocacy.

Novo's Luna tattoo before the Luna crash; on the other arm is a tattoo of BTC.

But whether Novo will seriously stand up for Solana ultimately depends on whether the stakes are worth it for him. Novo has also gained considerable profits from Solana in various ways. In September 2023, the FTX Estate commissioned Galaxy Digital to handle the sale, hedging, and staking of up to $3.4 billion in cryptocurrency assets during FTX's bankruptcy, a significant portion of which was SOL (FTX acquired approximately 60 million SOL tokens between August 2020 and May 2021). The sale of SOL was divided into multiple auctions; in March 2024, the first auction sold 25 to 30 million locked Solana tokens at a price of $64 each, a 60% discount from the market price. Galaxy Trading set up a special purpose fund to acquire these tokens, financing approximately $620 million. In the second auction, 1.8 million SOL tokens were sold at prices ranging from $95 to $110, with a price reduction of 15% to 26%. Galaxy participated in both auctions, acting as both "referee" and "player," which sparked discussions in the community.

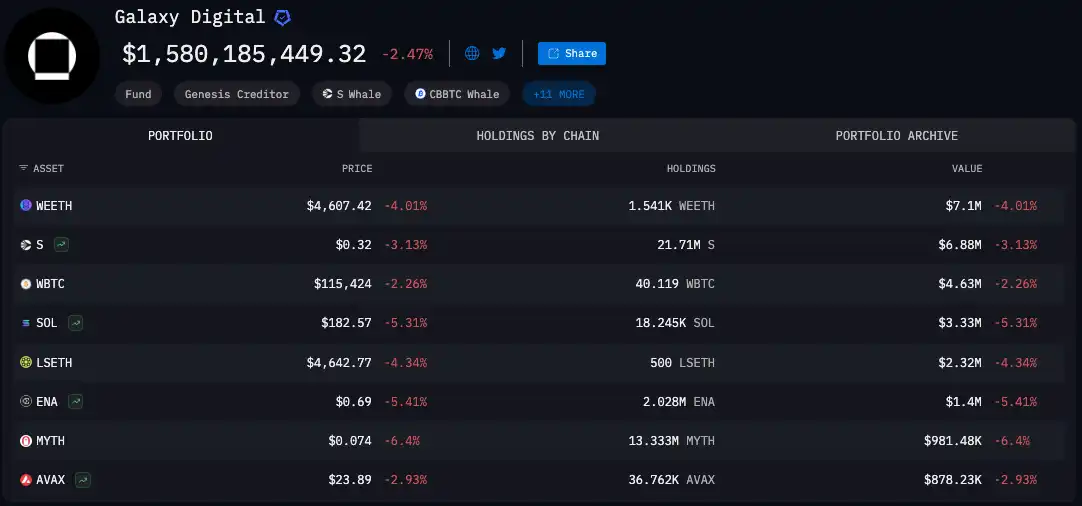

Investors will need to pay Galaxy a 1% management fee, and returns will be generated through staking, with just one transaction bringing in millions of dollars in profits. However, this is not all; the company’s financial report released on March 31, 2024, showed that Galaxy Digital invested $104.1 million in its Crypto Vol fund, which included acquiring Solana from FTX assets. This implies that Galaxy itself may have invested at least tens of millions of dollars in this transaction, and if priced at $64, this investment has more than tripled since then. According to Arkm's data, Galaxy Digital's main wallet currently holds $3.3 million in SOL, and on-chain analysis shows it holds a total of 151,196 SOL, valued at $25 million. Additionally, with tens of millions of dollars in SOL "missing" after being transferred to centralized exchanges, along with other holding addresses, the actual amount held may far exceed this figure.

In addition, Galaxy was one of the first institutions to participate in SOL's ETF. As early as April, Galaxy collaborated with CIGlobalAsset to launch the CI Galaxy Solana ETF (SOLX) on the Toronto Stock Exchange. In June, it partnered with Invesco to submit an application to the SEC for a U.S. listed ETF, and on the 14th of this month, it received a response from the SEC, which acknowledged the submission of Invesco Galaxy's spot Solana ETF application.

Although Galaxy Digital's main source of profit still comes from over-the-counter trading of ETH and BTC, Novo currently discusses Ethereum and BTC more in public forums. However, Galaxy's SOL holdings are quite impressive, coupled with recent frequent activities. With both motivation and influence, if Novo is willing to convey "faith" in a "crazy call" style like Tom Lee, his influence on Wall Street should be comparable to anyone on the list.

Kyle Samani

Mike Dudas, co-founder of The Block, cast his vote for Kyle Samani, who is the co-founder and managing partner of the emerging crypto venture capital firm Multicoin Capital. As an entrepreneur from the 80s (formerly an engineer), Samani quickly rose to prominence in the crypto investment world due to his deep insights into blockchain technology trends.

In terms of closeness to Solana, Samani is undoubtedly one of the biggest bulls among the candidates. His firm, Multicoin Capital, began investing in Solana during its seed round in 2018 and added $20 million in the A round in 2019. At its peak in 2021, Kyle Samani disclosed on X that they held SOL worth "nine figures" (at least $1 billion) across multiple funds. This could account for 8-12% of Solana's circulating supply. He was among the first to bet on Solana when others doubted its feasibility, earning super high returns for the fund. The successful investment in Solana made Samani famous, and Multicoin grew to become one of the top crypto funds. Although not from a traditional Wall Street background, Samani has established influence in the emerging financial circle through his investment achievements.

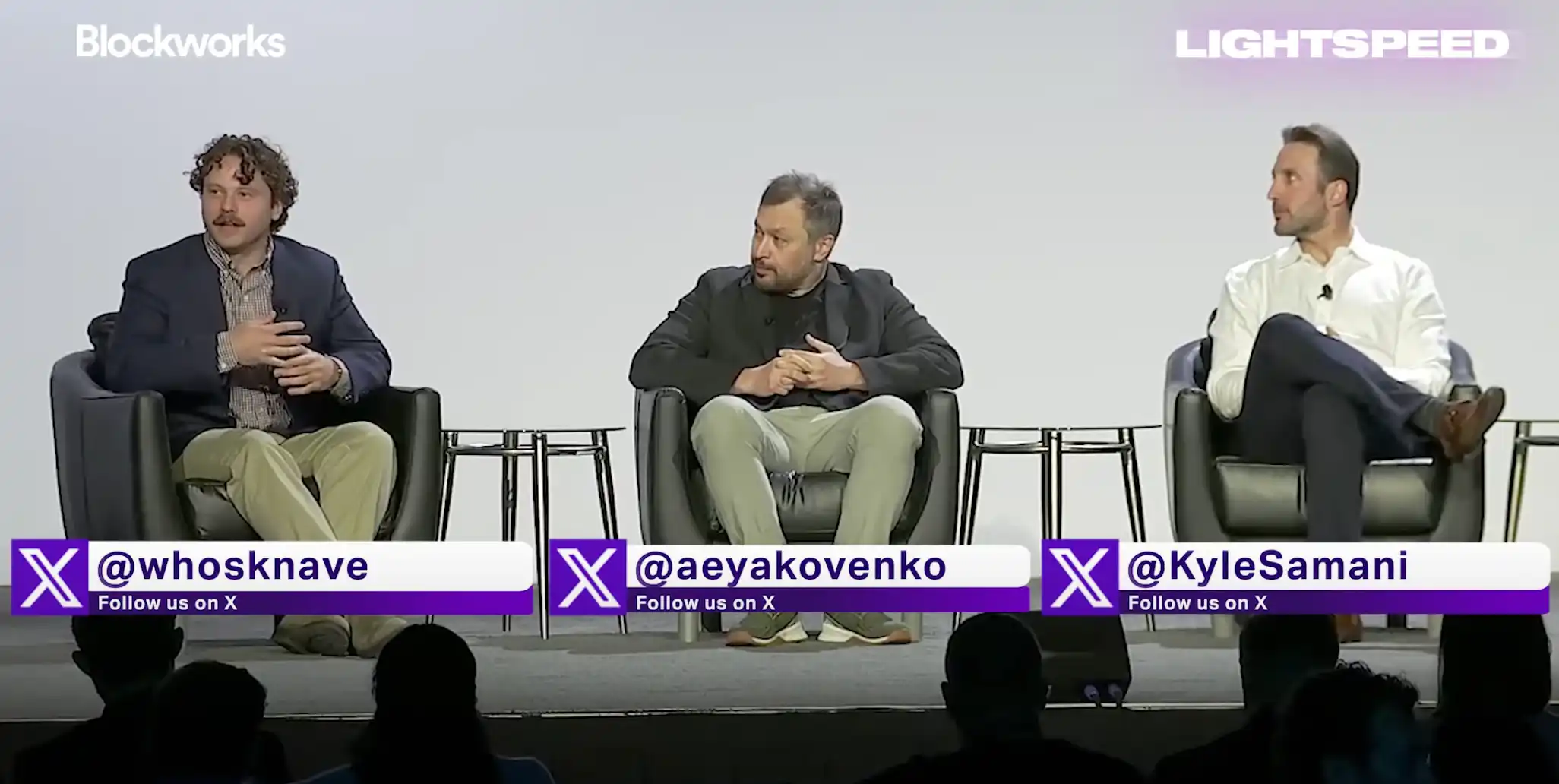

Solana founder Toly discusses the development of Solana with Samani, source: Lightspeed

As an early investor in Solana, Samani has almost become one of the spokespersons for Solana projects. Multicoin has invested not only in Solana but also in a series of Solana ecosystem projects, including Jito, Drift, solscan, Dialect, Helium, and more. In June 2025, he stated in an interview with Coinage, "In the past, people thought Ethereum was unshakeable, but Solana is on an inevitable path to disrupt Ethereum." He bluntly pointed out that the Ethereum development team "missed the opportunity to solve scalability, leading to skyrocketing fees and poor user experience," forcing users to switch. He believes Solana seized this opportunity to become the biggest beneficiary.

At various summits in recent years, Samani has painted a grand vision for Solana, believing it can support an internet-scale capital market (ICM) for trading real assets like stocks and bonds on-chain. He stated, "If global assets gradually move on-chain, the crypto market cap could grow from $3 trillion to $50 trillion in the next decade," and Solana has the potential to play a key role in this leap. Therefore, he is not afraid of short-term volatility and has consistently over-allocated SOL, which has made Multicoin's investment style appear more "Degen."

Samani is rational yet passionate; he speaks with data and facts but is unabashedly optimistic about promising projects, which is somewhat similar to Tom Lee. However, Samani primarily operates within the crypto investment circle and developer community, sharing his views through blogs, podcasts, and industry summits. Due to his lack of a Wall Street background, traditional media exposure, and cross-industry celebrity effect, Samani's influence in the public or traditional finance circles is limited. Nevertheless, his enthusiasm and investment in Solana make him one of the most important advocates and thought leaders in the Solana ecosystem.

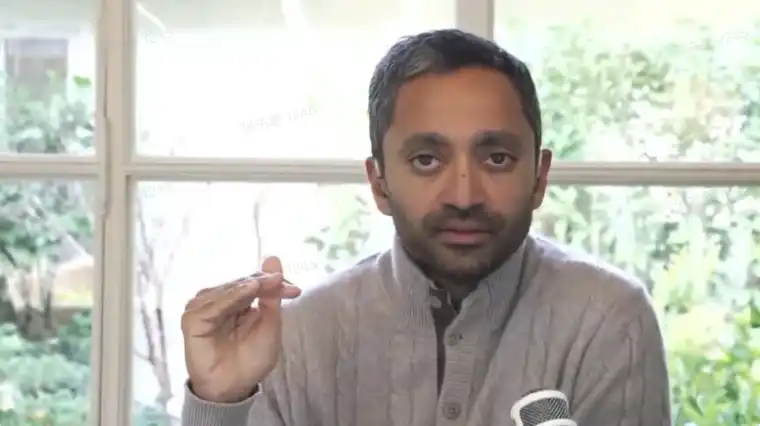

Chamath Palihapitiya

Jon Charbonneau, co-founder of DBR Crypto, proposed a rather controversial figure, Chamath Palihapitiya, stating, "once you see it you can't unsee it." He believes that if Palihapitiya stands up for Solana, the price of SOL could easily break $1,000.

Chamath Palihapitiya is a well-known venture capitalist and entrepreneur in Silicon Valley. He accumulated wealth as an executive at Facebook and later founded the investment firm Social Capital, becoming a prominent figure in the new generation of finance through a series of unique investments (such as early investments in Bitcoin and promoting multiple SPAC listings). He is known as the "King of SPACs" and has frequently made headlines in financial media. In Wall Street and the tech world, Chamath is known for his independent thinking and willingness to challenge the status quo, often sharing insights on market trends in his popular podcast "All-In," influencing many listeners. His financial connections span Silicon Valley and Wall Street, and his innovative and aggressive investment style has garnered a large following.

However, Palihapitiya is not actually well-received by the community, and one of the reasons he is controversial on this topic is due to a conversation he had in the 50th episode of All-In in 2021, where he jokingly discussed buying Solana tokens at a discount and considering cashing out with co-host David Sacks. This conversation was edited and circulated, leading some to accuse them of profiting from the downturn as venture capitalists. In response, Chamath clarified this year that he did not sell Solana at a high price, stating that accusations of him "dumping Solana on retail investors" are unfounded, saying, "If that were the case, those who bought would be making a fortune now" (referring to Solana's subsequent price surge).

All IN Podcast Episode 50 discussing investment philosophy with David Sacks

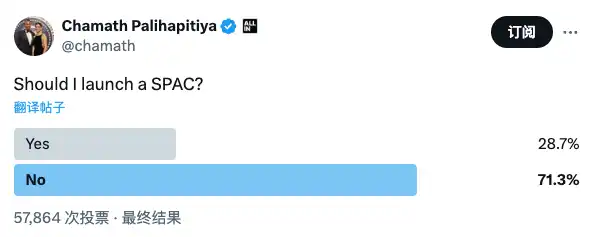

The argument that Palihapitiya is "manipulating the market to profit at the expense of others" is not unfounded. Since 2020, Palihapitiya has managed dozens of SPACs, including Virgin Galactic, Opendoor Technologies, Clover Health, and SoFi Technologies. However, most investors have found it difficult to make money from the projects he has managed. Calculations show that if someone invested $100 in all of his SPAC projects, they would have lost over 70% by now. After receiving a significant number of "NO" votes on X, he famously commented in his comment section, "No crying in the casino!!" Some community members speculate that with the trend of "crypto stock companies," Palihapitiya might be looking to leverage his Wall Street connections to shell out a public company for the listing of "some crypto token," but this remains unverified.

On August 19, 2025, Chamath Palihapitiya finally revealed that he is launching a SPAC called "AMERICAN EXCEPTIONALISM" to raise $250 million. The investment targets not only include the DeFi sector of blockchain but also primarily encompass energy production, AI, and defense. The prospectus mentions that DeFi will completely revolutionize various financial products, including international payments, smart contracts, and supply chain transparency. Therefore, his investment inclination in cryptocurrencies may mainly focus on these types that have tangible connections.

Palihapitiya's investment philosophy has always been long-term and fundamentals-oriented. He stated in 2021 that he held a significant portion of his net worth in Bitcoin, believing in its macro-hedging properties. Similarly, he emphasizes network effects and practicality in his views on public blockchain tracks. For Chamath to fully endorse Solana, it needs to prove that it can break through Ethereum's moat in decentralization and security, which he may still be weighing.

With over a million followers on social media and podcast listeners, "All-In" keeps him in the spotlight. He excels at explaining complex financial issues in layman's terms, with a humorous yet sharp style, attracting a large following of young investors. His charisma lies in his combination of candor and rationality, being able to make bold predictions (such as early predictions that Bitcoin would reach $200k) while also being straightforward during unfavorable situations (such as stating "crypto is dead in the U.S.").

This style makes his words both compelling and controversial. He mainly shares his views through podcasts and the X platform, rarely endorsing specific projects, and more often commenting from an industry-wide perspective. Therefore, while Palihapitiya's prominence in the financial world is unquestionable, in terms of being a "spokesperson for Solana," both his channel and personal accounts have seen a decrease in discussions about the cryptocurrency industry, focusing more on AI-related topics. Thus, it is unlikely that he will become a flagbearer for any single cryptocurrency other than BTC; he seems more inclined to be a behind-the-scenes capital driver rather than a front-facing evangelist.

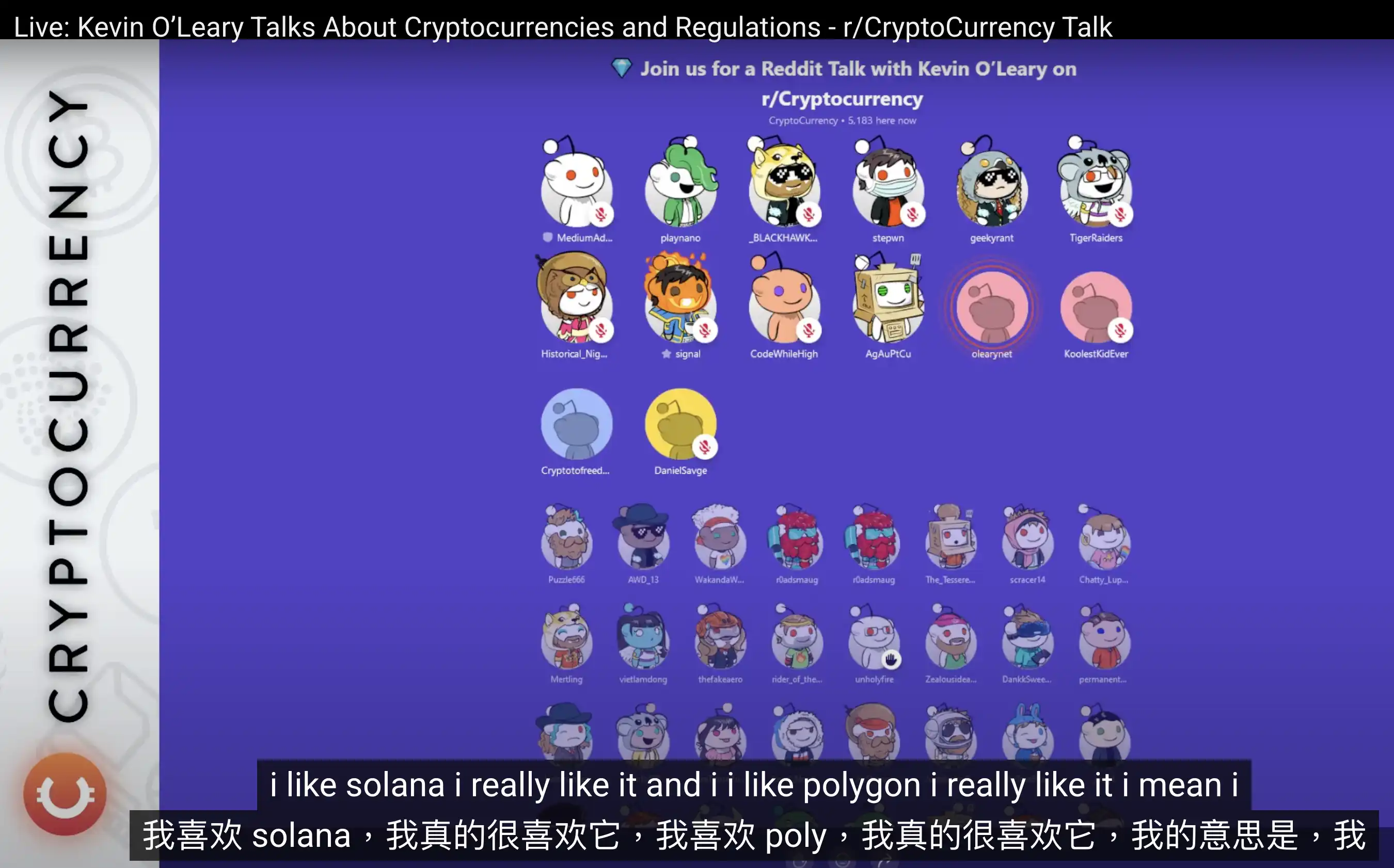

Kevin O'Leary

Kevin O'Leary is a Canadian businessman and investment celebrity, widely known for being a judge on the reality show "Shark Tank." He founded an educational software company in his early years and successfully sold it, subsequently building a broad influence through television, earning the nickname "Mr. Wonderful." As a television personality, O'Leary's communicative influence primarily operates through mainstream financial media (such as CNBC), personal social platforms, and participation in industry conferences. He is straightforward and pragmatic, unafraid to speak about risks and opportunities, and has openly admitted to making mistakes and losing money in investments, but each failure has made him more cautious. This "candor + experiential rationality" style gives him appeal among retail investors. In the crypto space, O'Leary plays the role of a "rational bull," supporting crypto innovation without blindly chasing highs, focusing more on long-term value and regulatory compliance. This stable image lends a degree of credibility to his words in the eyes of traditional finance professionals.

O'Leary was initially skeptical about cryptocurrencies but has since become an advocate for crypto investments, allocating about 11% of his personal investment portfolio to digital assets. In a July 2024 interview with CoinDesk, he mentioned that he holds various cryptocurrencies for diversification and candidly stated, "Solana looks like it has good momentum right now." O'Leary's overall view of Solana is cautiously optimistic, with a focus on compliance. He has repeatedly emphasized that the crypto market needs clear regulations to attract mainstream capital. In his view, Bitcoin and Ethereum have "settled" and most institutions have accepted them; if new chains like Solana can prove their value within a regulatory framework, they will likely share in the growth dividends of digital assets.

This is not the first time he has been bullish on Solana; his connection to Solana dates back to his collaboration with SBF. In 2021, he became a paid spokesperson for FTX, earning about $15 million from this relationship, which included equity, tokens in the FTX wallet, and tax compensation. Additionally, he personally invested in FTX equity, amounting to about a million dollars. It can be said that during that time, he enjoyed a wonderful "honeymoon period" with the FTX ecosystem and Solana.

Just a month before the FTX collapse in 2022, the r/CryptoCurrency subreddit held a public meeting inviting O'Leary. In his communication with community members, he mentioned that he believed Solana's processing speed far exceeded that of Ethereum, which would provide many possibilities for "financial institution adoption." After meeting the Solana team, he considered them to be among the smartest people he had encountered in his years in the software industry. He views crypto as "productivity software," similar to investing in Microsoft or Google, and believes that the success of each project depends on the strength of the technology team behind it.

Looking back, after the FTX collapse, when O'Leary was accused of "misleading investors" during a hearing, he did not disparage SBF to save himself (even though he personally lost millions of dollars). He stated that more data was needed to prove his point and mentioned that the "shareholder dispute" between SBF and CZ ultimately led to the collapse of his funding chain. At the end of that hearing, he maintained his belief in the development of the cryptocurrency sector, stating, "The collapse of FTX will not stop venture capital from pursuing the next unicorn. If there is a glimmer of hope in this chaos, it is that the crypto industry will finally receive the long-awaited regulation."

After that, although Solana's price experienced a sharp decline, the team behind Solana managed to bring it back into the spotlight, suggesting that O'Leary's investment vision was quite accurate. However, his investment logic focuses on diversifying risk by holding multiple excellent projects simultaneously to avoid betting on a single token. He openly admits that in his investment career, "winners compensate for losers," so in the crypto space, he also casts a wide net to increase his odds. His support for Solana is more presented as part of his investment portfolio rather than as a dedicated spokesperson for Solana.

But "the butt decides the brain," and with the shift in policy direction and Solana's development, it remains to be seen whether O'Leary will double down on Solana in his investment portfolio, thereby connecting Solana to the "cognitive storm" of traditional finance.

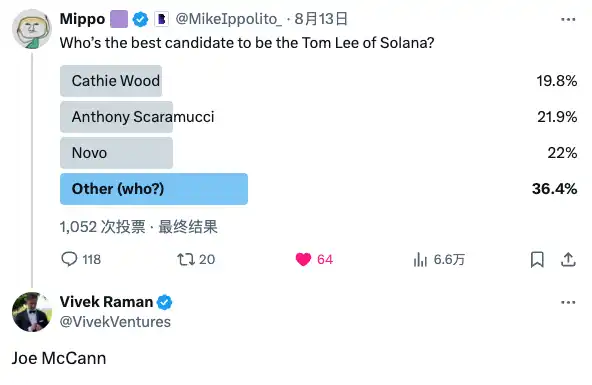

Joe McCann

Former JPMorgan trader Vivek Raman believes that this candidate should be Joe McCann, and in fact, many people share this view.

Joe McCann is the founder, CEO, and Chief Investment Officer of the crypto hedge fund Asymmetric, which has received support from well-known institutions such as Andreessen Horowitz, Chris Dixon, Circle, as well as the founders of Solana and Multicoin. McCann has over 24 years of experience on Wall Street and in Silicon Valley, having served as a senior director in Microsoft's cloud and AI division (focusing on mergers and acquisitions and startups), worked on crypto system trading at Passport Capital, and founded NodeSource (a Node.js company). He has served as an advisor to several blockchain companies (such as Zebec in the Solana ecosystem), is active in global blockchain summits, and frequently promotes emerging technologies to mainstream audiences.

McCann can be considered the most steadfast bull for Solana among the candidates. He has publicly stated that he is a "die-hard fan" of Solana, buying as much SOL as possible in the $8–$11 range during the market downturn from 2021 to 2022. Like Kyle Samani, he believes that Ethereum is currently in an "identity crisis," with its supercomputer positioning being replaced by Solana, which is why he holds "0 ETH" in his fund. McCann emphasizes Solana's technological and cultural advantages, believing that Solana's architecture offers high throughput and low fees, and that its early integration into mainstream culture, combined with the trend towards compliance, keeps him highly optimistic about Solana.

Joe McCann discusses traditional IPO issues and blockchain value discovery with Dragonfly co-founder Haseeb during the Pumpfun ICO.

To deeply invest in Solana, McCann has also promoted a series of practical projects. In mid-2025, he proposed establishing a Solana digital asset treasury company named Accelerate, planning to raise $1.5 billion through SPAC financing, and he would serve as co-founder and CEO. However, the SPAC deal was terminated in August 2025. Previously, Asymmetric had publicly reported significant losses due to heavy investments in Solana, with the fund losing nearly 80% in the first half of 2025. McCann offered LPs the option to exit or roll their capital into specific illiquid investments (i.e., the Solana treasury).

Despite this, he continues to increase his involvement in the Solana ecosystem, such as early investments in BONK that yielded substantial returns, and investments in Solana infrastructure projects like Syndica, Light Protocol, and Ranger. Overall, McCann is one of the few individuals who can exert influence in both traditional finance and the crypto space. He possesses a Wall Street background and a professional analytical perspective while actively promoting Solana, making him one of the important spokespersons for the Solana ecosystem.

Who is most likely to become Solana's representative promoter?

In summary, based on the actual situation, Anthony Scaramucci is the most likely candidate to represent Solana. He holds a considerable amount of "SOL Bag" and continues to be bullish on Solana while having Wall Street resources and media exposure. Although Joe McCann's enthusiasm and investment in Solana are equally strong, his recognition on Wall Street and among the general public is not as high as Scaramucci's. Other candidates are somewhat lacking in holdings, popularity, or public image. Novogratz holds a significant amount of Solana assets, and his Galaxy Digital is about to launch a Solana ETF, but the platform's factors may be more neutral, currently focusing more on Bitcoin and Ethereum. Kyle Samani is very optimistic but lacks a traditional finance background, identifying more as an emerging investor. While Palihapitiya and O'Leary have influence, they have not taken sustained actions to lead Solana.

Looking ahead, who will ultimately raise the "Solana flag"? It is likely to be more than one person. Just as Tom Lee has a group of Ethereum believers supporting him to advance the entire Ethereum ecosystem, Solana also needs representatives from multiple dimensions, and the community strength behind Solana, which has risen from the lows, may be stronger than imagined.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。