Author: Tuo Luo Finance

The market is indeed perplexing. Just as Bitcoin reached a new high, it quickly fell by nearly $10,000 within four days, with a potential for further decline. Ethereum, the recent star, also faced a setback, dropping from $4,788 back below $4,300 after a strong upward trend was abruptly halted. The altcoin market, which is more sensitive to volatility, was once again drained, with most tokens falling over 15%, cooling off the eager altcoin sector.

The reasons for rising prices are often hard to grasp, but when it comes to declines, there is usually some news behind it.

In fact, since the beginning of this year, the key factor determining market direction has been U.S. monetary policy. This year, the expectations for regulation have been well reflected in the crypto market: rising interest rate cut expectations lead to market upswings, while declining expectations result in market downturns. In this context, whether to cut rates, by how much, and how to do it have become the most pressing questions for market observers.

Looking back at the topic of interest rate cuts, it has become a political drama in the U.S.

The tightening cycle has lasted for three years in the U.S., showing significant results. Regardless of external complaints, the fact is that inflation is gradually becoming controllable. Although Biden's direct cash distribution to improve household balance sheets posed challenges to inflation, it indeed facilitated a soft landing for the U.S. economy by shifting debt from households to the government.

However, the tightening cycle, which was expected to end this year, was disrupted by Trump's trade war. The Federal Reserve found itself in a dilemma: on one hand, it faced the dual challenge of shrinking GDP and high inflation; on the other hand, it was necessary to retain redundancy to respond to the president's subsequent policies. Thus, a confrontational dynamic between Trump and the Federal Reserve was established.

In this context, Trump expressed his frustration on social media, claiming that the Federal Reserve was too late in cutting rates, threatening to oust Powell, and even sought to place his own people in the Fed, showcasing a "succession plan." Powell, under pressure, stood his ground, asserting, "He has no right to fire me," emphasizing that CPI and inflation are the core determinants.

Since data is the core, Trump also focused on it. In August, he fired the head of the Bureau of Labor Statistics, Erica McEntyre, claiming that official data was deliberately manipulated to favor Biden. At the beginning of that month, the employment data released by the Bureau showed that non-farm employment in the U.S. only increased by 73,000 jobs in July, far below the previous expectation of 102,000, significantly increasing the likelihood of recession. On August 11, Trump nominated conservative economist Anthony from the Heritage Foundation to head the Bureau of Labor Statistics, unsurprisingly, the new nominee is an opponent of Biden.

Changing the head of data statistics and nominating Federal Reserve Governor Miran, while repeatedly calling for Powell's resignation, clearly indicates Trump's urgency for interest rate cuts. This urgency is understandable; for Trump, cutting rates is not just an economic issue but also a political one. The tightening cycle affects stock market performance and also impacts the cryptocurrency market, which is a cash cow. Coupled with the effects of tariffs, Trump urgently needs to boost confidence to improve his approval ratings and resolve conflicts with residents, making it a reasonable approach for him.

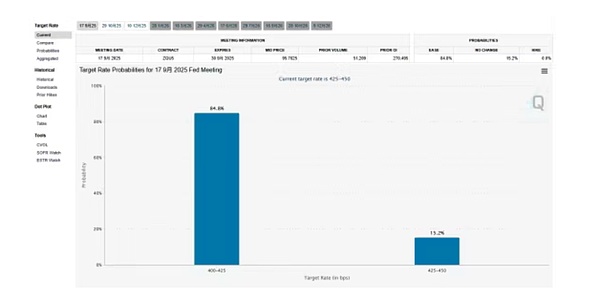

This round of turmoil has indeed served a purpose. The once solid Federal Reserve is now showing signs of increasing division. Since July, Federal Reserve Governors Christopher Waller and Michelle Bowman voted against maintaining interest rates, advocating for an immediate cut of 25 basis points, marking the first time in over 30 years that two governors voted against the same proposal. Recently, San Francisco Fed President Mary Daly and Chicago Fed President Goolsbee both stated that there should be no hasty rate cuts. The emergence of these divisions actually reflects that the possibility of rate cuts is gradually increasing. By August, with the release of disappointing employment data from the Labor Department, investors had greater expectations for rate cuts. CME data showed that after rising to 92.1%, the expectation for a rate cut in September stabilized at 84.8%. In other words, although there are still variables, the market has largely reached a consensus on a rate cut in September.

Returning to the market, on August 14, influenced by favorable pension news and rising rate cut expectations, Bitcoin surged, successfully reaching a historic high of $125,000, while ETH saw an even larger increase due to institutional buying, hitting a peak of $4,788. Given the almost certain rate cut, why did the market decline afterward?

The reason lies in expectations. Although the probability of a rate cut in September has increased, the frequency of cuts for the year has decreased from three to two due to the unexpectedly high PPI index in July, and the expected cut amount has dropped from 100 basis points to 50 basis points, with even pessimistic views suggesting 25 basis points, directly impacting investors significantly. It is worth noting that despite both being influenced by macro expectations, the U.S. stock market has shown more resilience with limited declines, while the crypto market is more sensitive to risk information, exhibiting a weaker characteristic.

This Friday, the Jackson Hole central bank annual meeting will be held in Wyoming as scheduled, where Federal Reserve Chairman Powell will make important statements regarding the economic outlook. This meeting is highly anticipated by the market because Powell has revealed significant information at this event multiple times. Three years ago, Powell warned that fighting inflation would bring pain, leading to a surge in short-term yields; at last year's meeting, he hinted at preparing to lower rates from a twenty-year high, causing a sharp drop in two-year yields. In September, the Federal Reserve began its rate cut cycle, with the first cut being 50 basis points. Although the market expects that next month's rate cut will not be overturned, under the current tense emotions and political games, whether the situation will change remains uncertain. As a result, capital is also inclined to take a risk-averse stance.

In addition to rate cuts, Treasury Secretary Scott Bessenet also poured cold water on the market. Back in March, to fulfill campaign promises, Trump issued an executive order designating Bitcoin as a strategic reserve asset, mainly involving existing Bitcoin, but proposed to purchase more Bitcoin in a budget-neutral manner. Although it was budget-neutral, under the broader context of the U.S. planning to establish a sovereign wealth fund, the market still held expectations that the sovereign fund would enter the Bitcoin market, becoming another significant price support. Unfortunately, just recently, Bessenet stated in an interview with Fox Business News that the U.S. government would not make new Bitcoin purchases but would use $15 billion to $20 billion worth of seized Bitcoin to fill that reserve, which comes from criminal or civil asset forfeiture processes or as compensation for fines.

This news disappointed the crypto market, causing a short-term drop in Bitcoin. Interestingly, just a few hours later, Bessenet himself expressed goodwill towards crypto on the X platform, suggesting that the Bitcoin seized by the U.S. government would become the basis for strategic reserves, while the Treasury Department promised to explore "budget-neutral" paths to acquire more Bitcoin. Although the attitude softened quickly, the market still planted seeds of doubt. It is worth noting that, based solely on his superficial attitude, the politicization of the crypto space should not be underestimated, as it is enough to allow the Treasury Secretary to make a complete turnaround.

Additionally, this adjustment is also due to leveraged liquidation. Before the new highs of Bitcoin and Ethereum, market FOMO continued to escalate, with bullish sentiment prevailing. Even as funding rates increased, the long leverage in the market was significantly higher than short leverage, and the disparity in long and short forces could lead to greater chain reactions. If prices show a one-sided trend, the impact will continue to spread. On August 14, the market liquidated over $1.02 billion in derivative positions, with long positions reaching $872 million, while shorts were only $145 million. The ongoing battle between the two sides, according to Coinglass data, indicates that if Bitcoin breaks through $117,000, the cumulative short liquidation intensity on mainstream CEXs will reach $558 million. Conversely, if Bitcoin falls below $113,000, the cumulative long liquidation intensity will reach $690 million.

Overall, the crypto market, which originally had limited upward momentum, entered an adjustment phase after the accumulation of the aforementioned factors. Currently, Bitcoin has dropped from a high of $124,400 to $114,700, a decline of 7.79%, while ETH has also fallen from $4,788 to $4,234, a drop of 11.57%.

Although the market has returned to an adjustment phase, there is no need for excessive panic regarding market direction. In terms of trading volume, during Bitcoin's four consecutive days of decline, both trading volume and turnover rate did not significantly increase, indicating strong reluctance among sellers to part with their assets. From a price support perspective, according to @Phyrex_Ni's data, Bitcoin's price support has completed six jumps, and currently, the open interest at the $117,000 level exceeds 750,000 coins. High open interest solidifies Bitcoin's price foundation; of course, high open interest also means high risk. However, given the attributes of current holders, unless there is a significant downward trend, even if temporarily breached, holders are unlikely to easily release their positions. From the external environment, whether it is the anticipated rate cuts, regulatory openness, or increased holdings by giants, all reflect that the market is still developing positively.

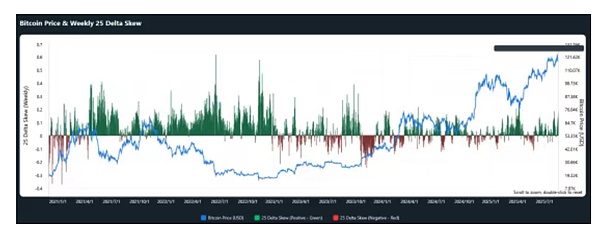

In reality, under the unchanged external environment, the current sharp drop in BTC largely stems from the market's long-short divergence after reaching new highs, with bullish and bearish sentiments converging, making emotional changes particularly evident with any slight disturbance. From the options market perspective, the current BTC 25 Delta Skew is basically close to the state at the end of March and early April, indicating that there is indeed some bearish sentiment in the market.

Compared to Bitcoin, Ethereum may face even bigger issues. Although the ETF data performance is very impressive, with Ethereum spot ETFs seeing a net inflow of $2.85 billion last week, setting a historical high, there is still considerable selling pressure from the staking queue. As of the time of writing, the number of validators exiting the Ethereum blockchain has reached 860,286 ETH, also a historical high, while only 290,541 ETH are waiting to enter the staking queue. This means that the number of investors waiting to exit for profit is increasing, and ETH may soon face significant market selling pressure, which will intensify as ETH prices decline.

Rationally speaking, given the key node of the central bank annual meeting this week, the market's directional choice will likely align with this timing. Currently, there are no clear negative news, and although there is an objective trend of correction technically, most technical analysts believe that the support level is at $112,000. However, before Friday, if the market remains in a relatively optimistic scenario, it is unlikely to see uncontrollable declines, and more likely to remain in a volatile trend. ETH's price capacity is somewhat weaker, and from the CME gap perspective, the recent ETH CME gap is between $4,100 and $4,200, with a certain probability of being filled this week or even further declining.

Therefore, for ordinary investors, the old adage still holds true: hedging is the key.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。