Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

This column aims to cover low-risk yield strategies primarily based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risks can never be completely eliminated), to help users who wish to gradually increase their capital through U-based financial management find more ideal earning opportunities.

Past Records

Lazy Financial Management Guide | Katana, Agora Double Dipping; Huma 2.0 Reopens (July 16);

New Opportunities

Binance Increases USDC Subsidy - Launches Borrowing Discounts

Following the announcement of a one-month USDC deposit subsidy activity (see the August 12 article for details here), Binance last week announced a limited-time borrowing discount for USDC.

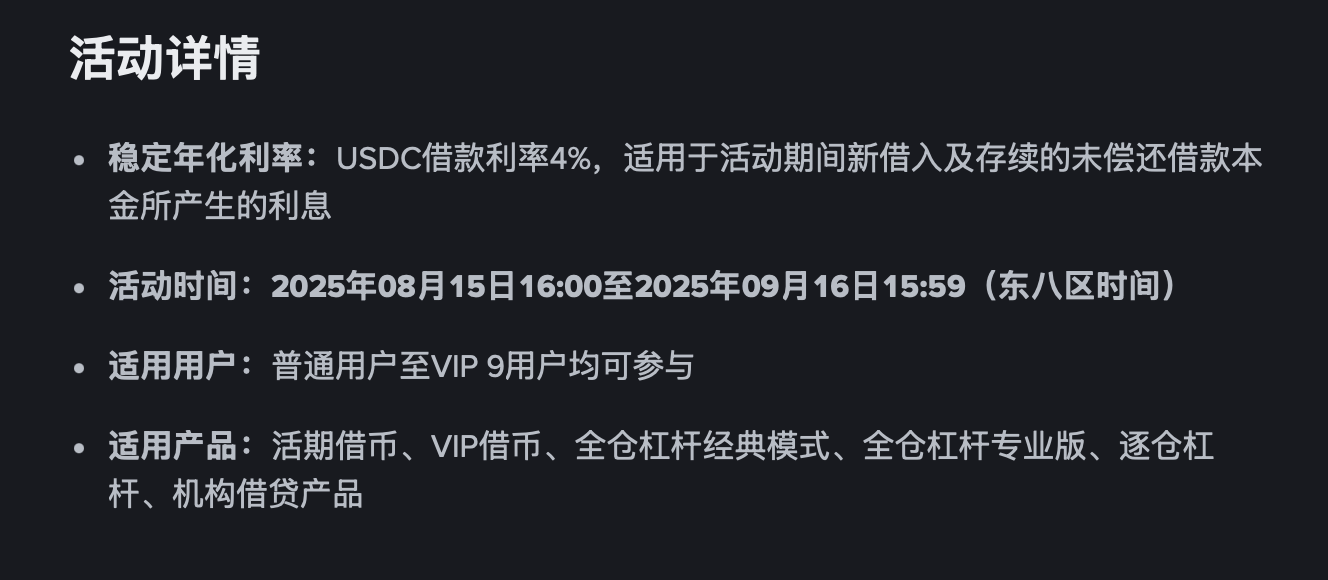

Specifically, during the activity period (UTC time from August 15, 2025, 16:00 to September 16, 15:59), users can enjoy a fixed annualized interest rate of 4% on the USDC borrowing balance newly borrowed or held through Binance leverage or Binance staking. Since the current annualized interest rate for USDC deposits after subsidies is about 12%, this means users can collateralize other assets, borrow USDC, and then deposit it into a flexible financial product for an arbitrage yield of about 8%.

OpenEden Confirms Airdrop Ratio

On August 14, the RWA tokenization platform OpenEden announced the launch of the token EDEN.

According to the official announcement, 7.50% of EDEN will be distributed through airdrops to participants in the points activity Bills Campaign, and the airdrop shares will be fully unlocked upon claiming, but OpenEden will introduce a lock-up reward mechanism to incentivize long-term holders. More details are expected to be announced on September 15.

Currently, OpenEden's points activity is still ongoing, and users can check the specific yield rates and points rates for various schemes such as deposits and LP on the official website (link: https://portal.openeden.com), I personally recommend providing cUSDO LP in Pendle (5x points), providing cUSDO-USDC LP in Curve (10x points), and depositing cUSDO in Upshift (12x points), among other schemes.

Hyperbeat Raises $5.2 Million

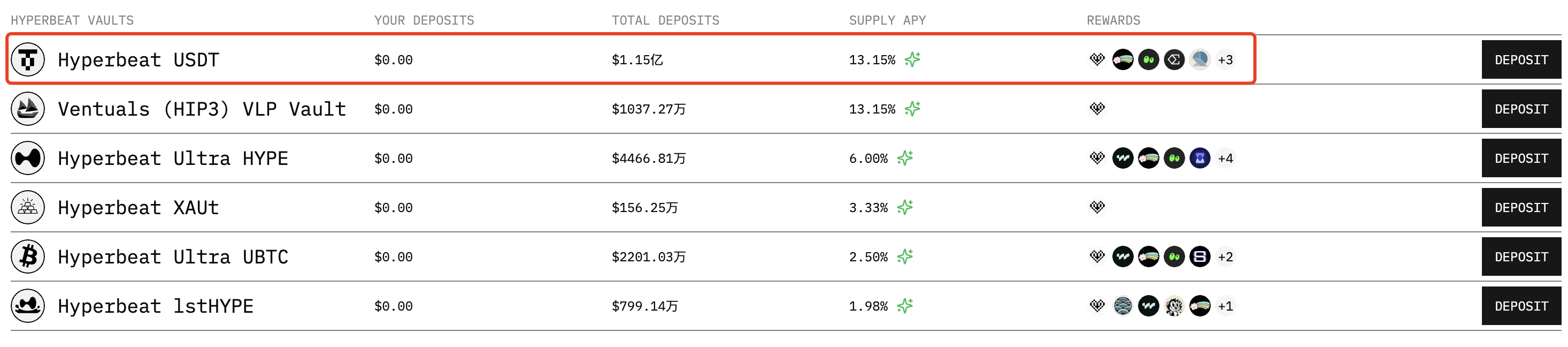

On August 15, Hyperliquid's ecosystem-native yield protocol Hyperbeat completed an oversubscribed seed round financing of $5.2 million, led by ether.fi Ventures and Electric Capital, with participation from Coinbase Ventures, Chapter One, Selini, Maelstrom, Anchorage Digital, and supporters from the HyperCollective community.

Currently, Hyperbeat has launched several yield pools, and I personally recommend directly depositing into the Hyperbeat USDT pool (link: https://app.hyperbeat.org), where you can earn 13.15% APY while also gaining points for projects like Hyperbeat, Hypurrfi, Hyperswap, Ethena, Resolv, Felix, Hyperlend, Theo, etc.

AI Concept Stablecoin USD.AI Raises $13 Million

On August 14, the stablecoin protocol USD.AI, which provides credit for AI, completed a $13 million Series A financing round, led by Framework Ventures, with participation from Bullish, Dragonfly, Arbitrum, and others. USD.AI, developed by Permian Labs, uses graphics processing unit (GPU) hardware as collateral to issue loans to AI companies. The on-chain system includes a dollar-pegged token USDai and a yield-bearing token sUSDai supported by income-generating computing assets.

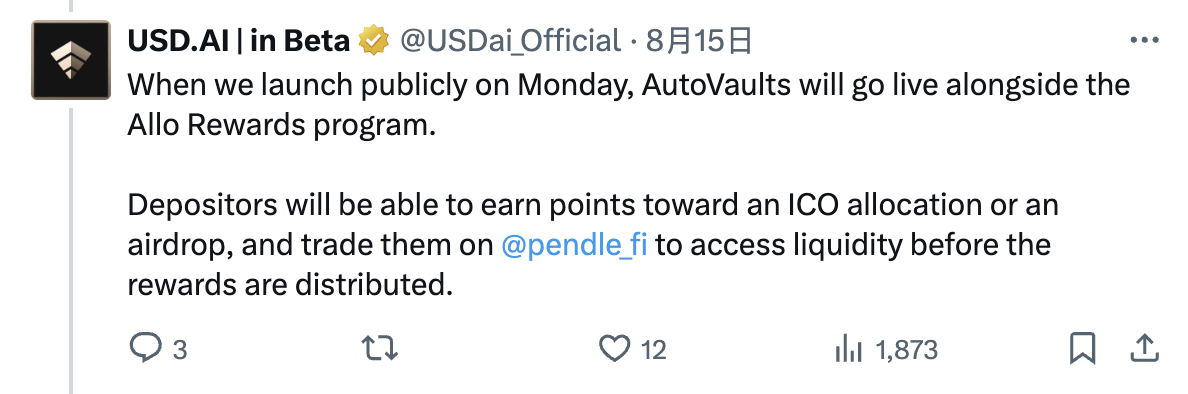

According to USD.AI's official announcement, the project's AutoVaults deposit pool will go live on Arbitrum on Monday, at which point Pendle will also provide support. Deposit users will not only earn yields but also receive points, which will be used for IC0 quotas or airdrops.

I know that "AI stablecoin" sounds somewhat abstract, but given the decent background of the investors and the project's early stage, I still recommend participating with controlled funds once the pool opens.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。