Author: Lawyer Liu Zhengyao

Introduction

The judicial disposal of virtual currencies involved in cases is no longer a niche business; more and more people are aware of, understand, and even begin to participate in this business. Especially since the Beijing Municipal Public Security Bureau's Legal Affairs Division officially announced the judicial disposal of virtual currencies involved in cases this year, there has been a noticeable increase in judicial disposal work across the country in the second half of the year.

In fact, helping judicial authorities to liquidate frozen and seized virtual currencies has been done since around 2018. However, at that time, there was no "9.24 Notice" (Notice on Further Preventing and Disposing of Risks from Virtual Currency Trading Speculation) prohibiting any entity from engaging in the exchange of virtual currencies and fiat currencies in mainland China, so domestic over-the-counter (OTC) traders could assist judicial authorities in converting the involved virtual currencies into fiat currency.

However, since the "9.24 Notice," no entity is allowed to engage in the exchange of virtual currencies and fiat currencies in mainland China. Therefore, faced with the "accumulated" virtual currencies, judicial authorities found themselves at a loss. Some disposal companies began to construct a joint disposal model combining domestic and overseas methods (the author first saw the introduction of this model in a paper by Suzhou Economic Investigation Team Leader Di Kechun); of course, there are other models in practice, including the most primitive model of directly liquidating in mainland China (although the "9.24 Notice" classifies engaging in the exchange of virtual currencies and fiat currencies in mainland China as illegal financial activity).

On August 8, an article titled "How to Turn Virtual Currency into Cash? Lucheng Court Solves the 'Digital Liquidation' Execution Difficulty" was published on Wenzhou News Network, introducing a model used by the Lucheng District Court in Wenzhou City for the disposal and liquidation of involved virtual currencies. The author refers to it as the "Wenzhou Model."

I. Background Introduction

According to the article, in a criminal case involving virtual currency adjudicated by the Lucheng District Court in Wenzhou City, the defendant Liu used illegal means to transfer tens of thousands of virtual currencies from victims including Yang. After the criminal judgment took effect, the court's execution bureau found that it was impossible to directly liquidate the involved virtual currencies into fiat currency within the country.

The court's execution officers contacted the Cybersecurity Team of the Lucheng Public Security Bureau, "to study the disposal plan in accordance with the latest deployment requirements from the Supreme Court and the Ministry of Public Security regarding the exploration of the disposal of criminal case-related virtual currencies." The Lucheng Public Security Bureau contacted the Third Research Institute of the Ministry of Public Security, which helped select a mature professional disposal agency and signed a disposal agreement.

Ultimately, the disposal of the involved virtual currencies was completed through a licensed exchange. After deducting handling fees, the remaining liquidated funds were transferred through an independent account of the public security to the court's special account for involved funds. A total of 6,000 USDT, 2,700 TRX, and 0.8 BNB were liquidated for approximately 50,000 RMB.

(Image source: Wenzhou News Network, website as seen in the screenshot)

II. Analysis of the "Wenzhou Model"

According to the news report, the general outline of the "Wenzhou Model" is as follows: after the court's trial of the criminal case is concluded, the case is transferred to the court's execution bureau for enforcement. The execution bureau then contacts the local public security agency's cybersecurity team. At this point, it is unclear whether the involved virtual currencies are still held by the public security agency or have been transferred to the court's execution bureau; based on my practical experience, they are likely still held by the public security agency.

(Image source: Wenzhou News Network)

The local public security bureau's cybersecurity team, through the Third Research Institute (hereinafter referred to as "the Third Institute"), selects a professional disposal company and signs a disposal agreement. The disposal company then relies on a licensed exchange to complete the liquidation. After deducting disposal fees, the disposal funds are first transferred to the public security agency's account, and then from the public security account to the court's special account for involved funds.

We can see that unlike the previous "Beijing Stock Exchange Model," where the First Institute of the Ministry of Public Security provided technical support, the Wenzhou Model seems to directly commission the Third Institute, which then selects the disposal company. If the article's description aligns with objective facts, the role of the Third Institute here is equivalent to that of an intermediary.

The author checked the official website of the Third Institute, which is positioned as an applied research institution directly under the Ministry of Public Security.

(Image source: Introduction from the official website of the Third Institute of the Ministry of Public Security)

The news report also mentioned that after the Third Institute selected the disposal company, the commissioning agency and the disposal company signed a commissioning agreement, but it did not specify whether it was the court or the public security that signed the agreement with the disposal company. My personal judgment is that it was the public security that signed it, as the final disposal funds were first transferred to the public security account and then to the court account. Logically, the disposal company would have signed a contract with the public security before transferring the disposal funds to the public security's account.

Lastly, the Wenzhou Model also relies on licensed exchanges for disposal and liquidation overseas. It is not particularly clear whether this "licensed exchange" refers to a virtual currency exchange or another licensed institution.

III. Introduction to Judicial Disposal Business Models

Since June of this year, I, along with Director Luo Wenlong of my team, have shared the defense and judicial disposal practices of criminal cases involving virtual currencies at various venues, including the headquarters and multiple branches of Zhiheng Law Firm and industry seminars on virtual currencies.

Currently, in addition to the domestic + overseas joint disposal model, there are actually various models running in parallel as shown in the diagram below. Some places even still adopt the most primitive model of domestic OTC buying coins from public security for disposal.

IV. Conclusion

Few judicial activities can provoke as much controversy as the judicial disposal of virtual currencies, both theoretically and practically. This is closely related to the overall regulatory policies on virtual currencies in mainland China, regarding a technology that regulators dislike but cannot completely ban (yes, in the author's view, the entire virtual currency is merely a facade, with new technologies represented by blockchain behind it). Rather than blocking it, it is better to guide it.

After the passage of the Genius Act in the United States, Hong Kong has also attempted to open up Web3 to a certain extent, such as through a Hong Kong-style model for the issuance of stablecoins. This reflects the different political systems' attitudes toward this emerging phenomenon of virtual currencies.

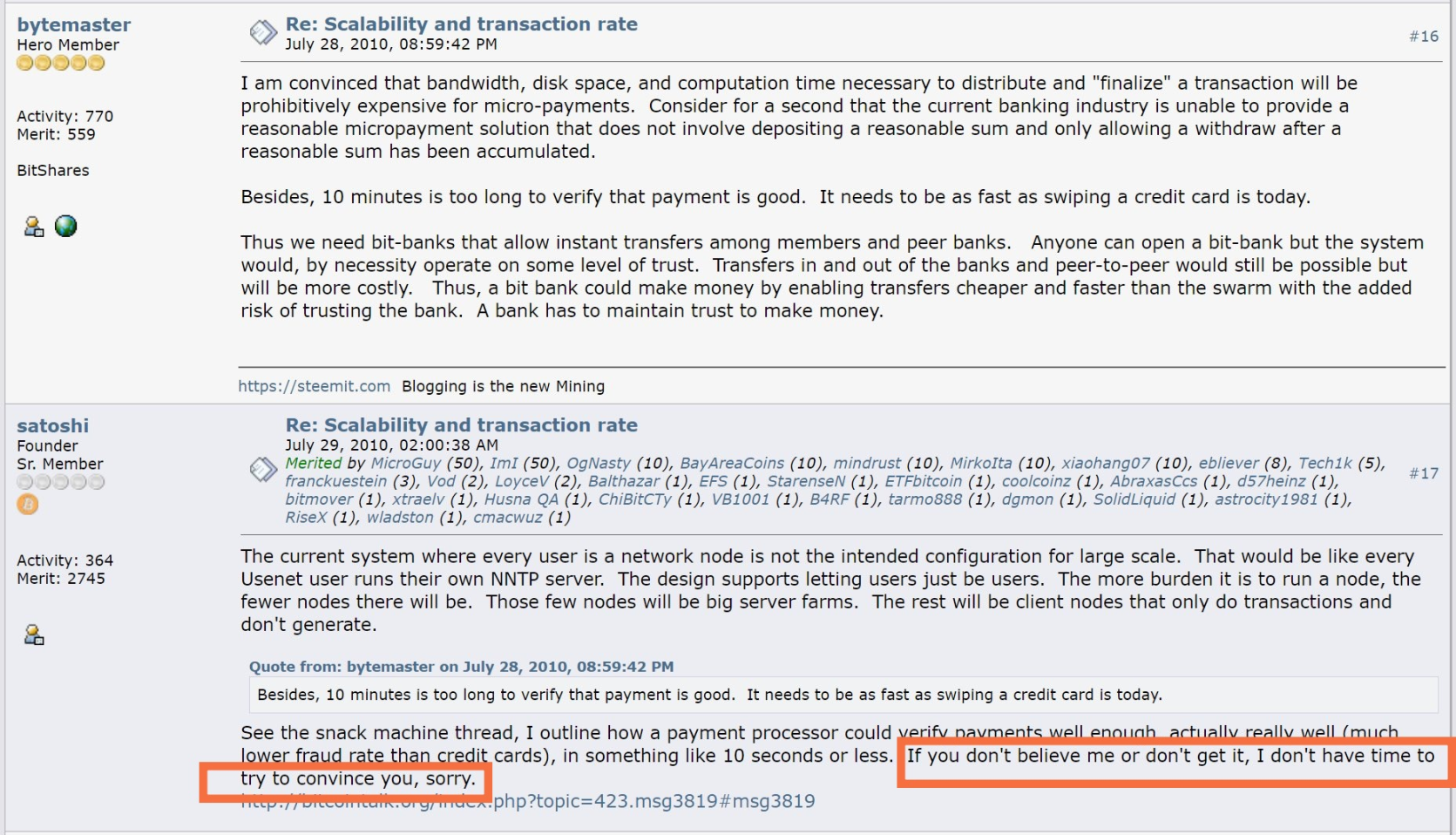

Satoshi Nakamoto once replied in an email: "If you don't believe me or don't understand me, I don't have time to convince you, sorry."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。