Author: Liang Xinjun

Organizer: RPC Cat Friends Association

Since everyone is up early on the weekend, I will try not to waste your time. A hot topic recently has been the changes in the ecosystem of investment, financing, and wealth management following the introduction of compliance policies for stablecoins. This is very important, and I hope the content shared today will be worthwhile for everyone.

I will mainly discuss four points:

Future Certainty Tracks: I believe there are certain tracks that can provide very certain high-growth opportunities in the next seven to ten years.

Impact of Stablecoin Policies and RWA: After the introduction of stablecoin policies, what changes will occur in asset forms, especially how Real World Assets (RWA) will evolve and what new functionalities can be developed.

Six Investment Strategies for Crypto Assets: How should we assess the value of crypto assets? There is a logical basis for it, rather than it being purely speculative.

Technical Issues: Finally, if everyone is interested, we can discuss some traditional technical issues, such as energy consumption.

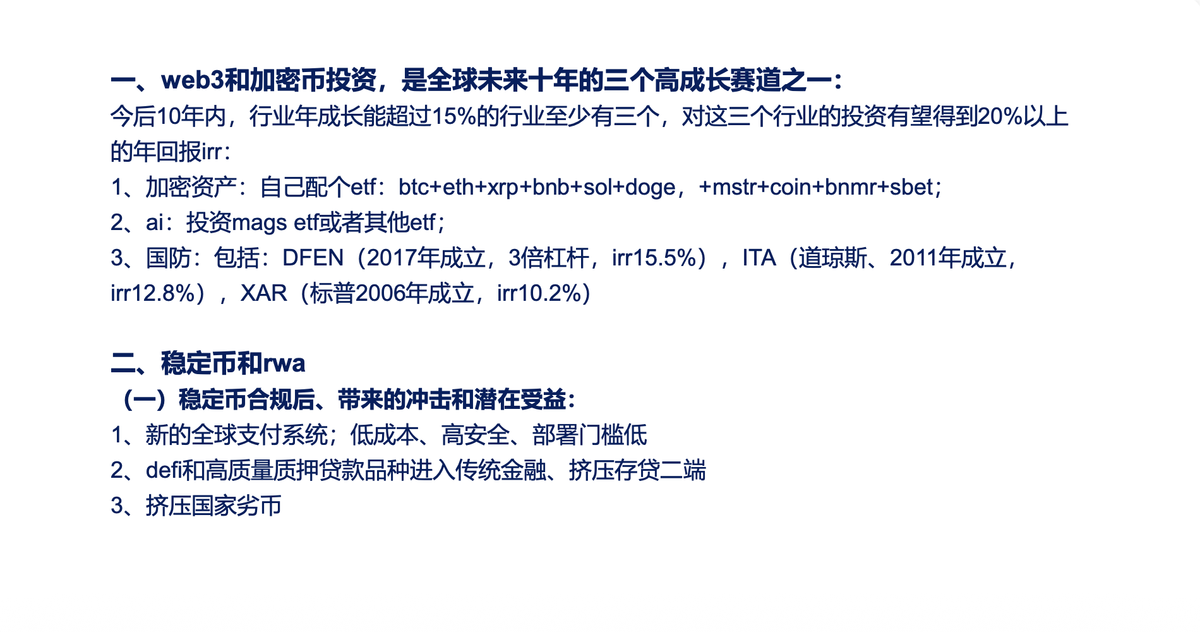

I. Three High-Growth Tracks for the Next Decade

Looking to the future, which industries or regions can achieve a scale (GMV or GDP) with an annual growth rate of 10-14%? As long as you invest in industry leaders, finding a project with an internal rate of return (IRR) of around 20% is very easy.

Currently, I believe there are at least three areas that can achieve such high growth, one of which is the Web3 crypto industry.

The first very certain track is AI. In the United States, investment in AI infrastructure exceeded investment in real estate office buildings last year. It is foreseeable that in the next seven to eight years, continuous investment in the AI field will grow by about 40% annually, and its entire economic scale can maintain growth of over 15% each year. In such an industry, if you can find leading companies to invest in, achieving a return of 20% will be very easy.

- Investment Methods in AI: There is currently no very good AI ETF, but I believe many will be launched soon. At present, you can directly purchase investment portfolios related to Mag 7 (Magnificent Seven). For example, some product structures may mix U.S. Treasury bonds with the top seven U.S. AI concept stocks. This type of portfolio has achieved an IRR of about 38% since its inception, and even if it does not reach 38% in the future, achieving over 20% will also be very easy. I suggest directly purchasing the beta of the industry, which is the average growth of the industry; this is already good enough, and there is no need to deliberately seek alpha.

The second certain track is crypto assets. After the recent compliance legislation, the amount of funds flowing into this industry will be enormous each year. For example, MicroStrategy may soon enter the Nasdaq and S&P indices, which means that passive funds tracking these indices will need to increase their allocation to its stock. Overall, in the next decade, it will be very easy to see an annual average growth of over 15% in assets flowing into the crypto industry. Conversely, once it integrates into the financial system, the industry growth it brings can also easily reach 15% annually. Therefore, selecting leading institutions or assets in this industry for investment to achieve an IRR of around 20% is also very easy, which is equivalent to doubling your investment in about three to three and a half years. If you put an asset in for 12 to 14 years, it could become 16 times or even 32 times, and you hardly need to think about it.

The third track is defense. Although the certainty is not as strong as the first two, I believe the potential is very large. Since the start of the Russia-Ukraine war in 2022, countries have been desperately increasing military spending. The biggest change this year is that Trump successfully persuaded the EU and NATO countries to raise defense spending to 2-5% of GDP, even higher than the U.S. Japan and other countries are also consciously increasing their budgets. Last year, global defense spending grew by 14% year-on-year, and I believe we will see at least 14% growth for the next seven to eight years.

Defense spending is different from AI infrastructure investment; once AI infrastructure is invested in, it can still be used the following year. However, defense items are consumable, such as ammunition having an expiration date and aircraft having a limited lifespan. Once war breaks out, consumption occurs at a rapid pace. Several tons of shells can be used up in just five minutes. Therefore, this supplementary demand is very continuous and fast. Investing in defense is also a very good choice, and you can pay attention to U.S. military ETFs, such as ITA, RPA, PPA, etc. Among them, PPA is a three-times leveraged ETF. I usually advise against using leverage, but if you have no allocation in this field at all, it makes sense to allocate a little to a leveraged ETF to increase your weight.

In summary, these three sectors will provide very good returns in the next seven to ten years.

II. Impact of Stablecoin Compliance and RWA

What impact will stablecoin compliance in the U.S. bring?

First, it will give rise to a brand new global payment system. U.S. compliance will "force" all licensed institutions engaged in U.S. dollar financial business to accept crypto assets. Recent new policies even prohibit banks from discriminating against customers who hold or operate crypto assets; refusing to provide services to them is considered illegal. This new payment system has the following characteristics:

- Extremely low cost: I experienced transferring using the Ethereum main chain recently, and regardless of the amount, the transaction fee is only a few cents. If using a Layer 2 network, one dollar can support about ten thousand transactions, with costs nearly zero.

- Very fast arrival: Transferring stablecoins takes at most two to three minutes; transferring Ethereum can take as little as one to two minutes.

- Extremely high security: Its security level is equal to or even higher than traditional financial security levels. Traditional finance relies on the SWIFT system; I have seen cases where friends transferred over 5 million dollars from Europe to Singapore, and the funds disappeared for a month. Ultimately, it took several days of work from three lawyers for the money to suddenly appear. However, in the Web3 world, whether a transaction is received can be publicly verified on the blockchain, making it impossible to deny.

- Extremely low deployment threshold: Traditional institutions need to open accounts with Visa or Mastercard, deposit several million dollars as collateral, and each branch must apply separately and install servers, paying monthly fees. In contrast, a company wanting to introduce a stablecoin payment system only needs a mobile phone, with almost zero deployment threshold.

Second, high-quality DeFi products will enter traditional finance.

- High-quality staking deposits: Many people are familiar with Yu'ebao, which has an annual interest rate of 2-3%. In the Web3 world, there is a T+1 demand deposit with a safety level of 99.99%, which can expect to yield 3.5% to 8% annual returns in dollars. This will attract a large amount of capital out of traditional banks or money market funds.

- High-quality staking loans: Banks will eventually notice a very high-quality loan project in Web3. Web3 loans can offer interest rates of 8% to 12%, with high liquidity assets like Bitcoin and Ethereum (with daily liquidity of 20-40 billion dollars) as collateral, and the collateralization ratio is very low; for example, a $10,000 asset can only borrow $4,700 to $6,000.

DeFi provides three layers of protection for funders, making it extremely safe:

Over-collateralization and automatic liquidation: For example, with $10,000 in collateral borrowing $5,000, when the collateral price drops to $8,000, the smart contract will automatically liquidate, repaying the loan principal, making it difficult for the borrower to incur losses.

Bad debt reserve: 10% of the interest income from each loan goes into a bad debt reserve pool. For example, if the loan interest is 8%, then 0.8% will be set aside as a bad debt reserve. This is equivalent to accounting for 40% of the interest spread (assuming the spread is 2%) as a bad debt reserve, which no traditional bank can achieve.

Deposit insurance mechanism: If the collateral and bad debt reserve are insufficient to cover losses (i.e., liquidation), the losses will be proportionally shared among all deposit users in the pool at the moment of liquidation, akin to a deposit insurance. Participation and exit from DeFi products are very free; interest starts accruing the next second, and you can withdraw the next second without needing third-party approval or complex KYC. In contrast, traditional banks take months or even over a year to handle default loans through court litigation and auctioning collateral, during which the value of the collateral (such as real estate) may further decline. In contrast, the liquidation of crypto asset collateral is completed instantaneously through smart contracts.

Third, squeezing out the fiat currencies of inferior countries. For countries with high inflation rates and volatile currencies, people will be more inclined to use stablecoins. Due to the U.S.'s long-arm jurisdiction, any bank wishing to use the dollar system cannot refuse cryptocurrencies. This means that ordinary users in these countries will automatically gain access to stablecoins, leading to a large outflow of their local fiat currencies, exchanged for more stable dollar stablecoins.

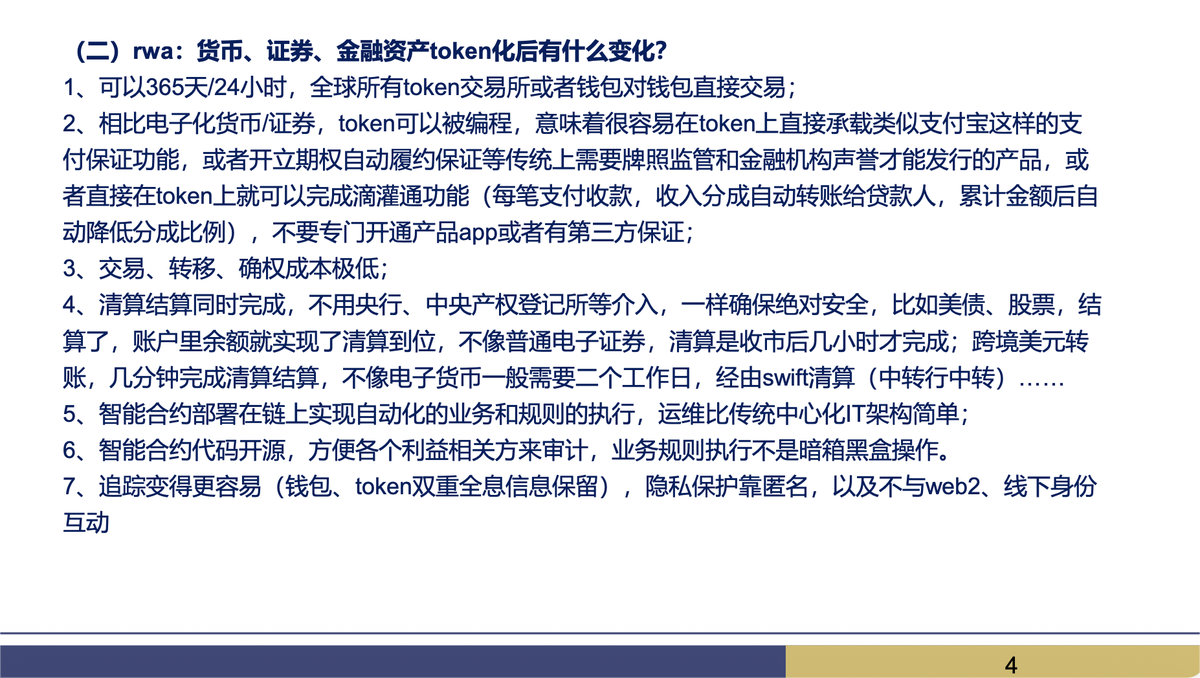

RWA: Programmable Currency and Assets

After stablecoin compliance, the dollar is not just a dollar; it has transformed into a programmable digital currency. This transformation is not limited to currency; securities and financial assets will also undergo several core changes after RWA (Real World Asset tokenization):

365 days, 24 hours global P2P trading: Once assets are tokenized, they can be traded peer-to-peer globally at any time, even without going through an exchange as an intermediary. I can directly send my Tesla stock token to your wallet, and you send me stablecoins, and the transaction is complete. The role of exchanges shifts from being an "indispensable" link to a "service provider" that offers liquidity and convenience.

Programmability brings infinite possibilities:

a. Smart contracts enable complex functions: Third-party guaranteed transactions like those on Alipay can be achieved in Web3 through a simple smart contract, without needing a centralized platform.

b. Democratization of financial derivatives issuance: Anyone can issue derivatives like options. Smart contracts will automatically verify and freeze the underlying assets (like stock tokens) of the issuer and the funds of the buyer, ensuring contract execution without the need for licensed financial institutions and consuming their capital.

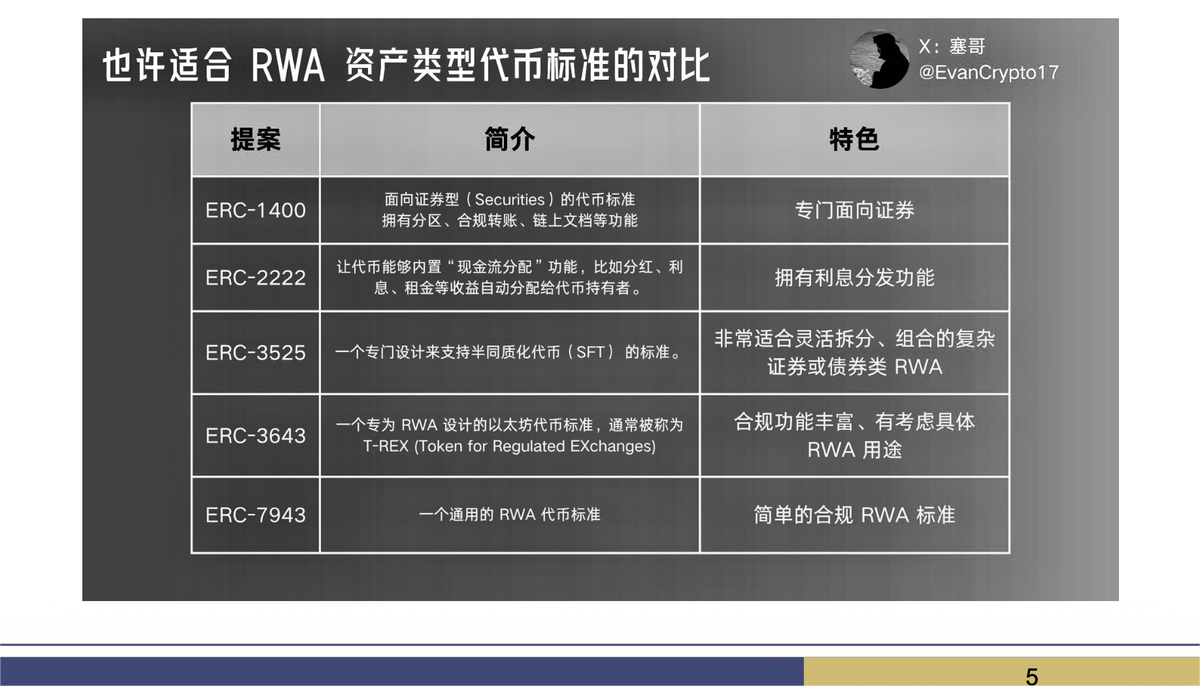

c. Automated cash flow distribution: Some complex business models, such as "street vendor loans" (loaning to small merchants and automatically taking a proportion of their income for repayment), can be easily realized using tokens and smart contracts (for example, with token standards like ERC-404). This makes granular investment in assets possible; for instance, instead of buying a large REIT, you can directly invest in the parking lot token of a building you favor and automatically share in every parking fee income.

Extremely Low Transaction, Confirmation, and Settlement Costs: The costs of asset transfer and ownership confirmation are extremely low. Most importantly, settlement and clearing are completed simultaneously. In traditional finance, when you buy stocks, it is merely "settlement"; the numbers on the account change, but the actual transfer of ownership ("clearing") is completed only after the exchange closes. Cross-border remittances take two days due to the clearing process. However, in Web3, settlement and clearing are integrated; when you see money in your wallet, it is genuinely in your wallet.

Automation and Low Operating Costs: Smart contracts are classic AI agents, but they function like Lego blocks, with each contract completing a specific function, and when combined, they can accomplish complex automated business processes. Deployed on the blockchain, they can exist perpetually, and their operating costs are extremely low, requiring neither high-performance computers nor top-tier AI architects.

Transparency and Trust: The code of smart contracts is open-source, allowing anyone to audit it. A project's cash flow and profitability can be viewed in real-time, eliminating the need to rely on delayed audit reports from auditors, thereby establishing a high level of trust.

Simplified KYC and Reduced Crime: Stablecoin compliance will bridge traditional financial accounts and crypto wallets, linking a large amount of real-name information with wallet addresses. Although there are many anonymous accounts in Web3, as soon as a transaction is linked to a real-name account, its anonymity can be easily broken. All transactions on the blockchain are traceable, and each token carries a "watermark" of all wallet addresses it has passed through, making fund tracking very easy. Criminals attempting to launder money through mixers are finding it increasingly difficult, as funds that have gone through mixers are now highly suspect. Stablecoins can be categorized into several types:

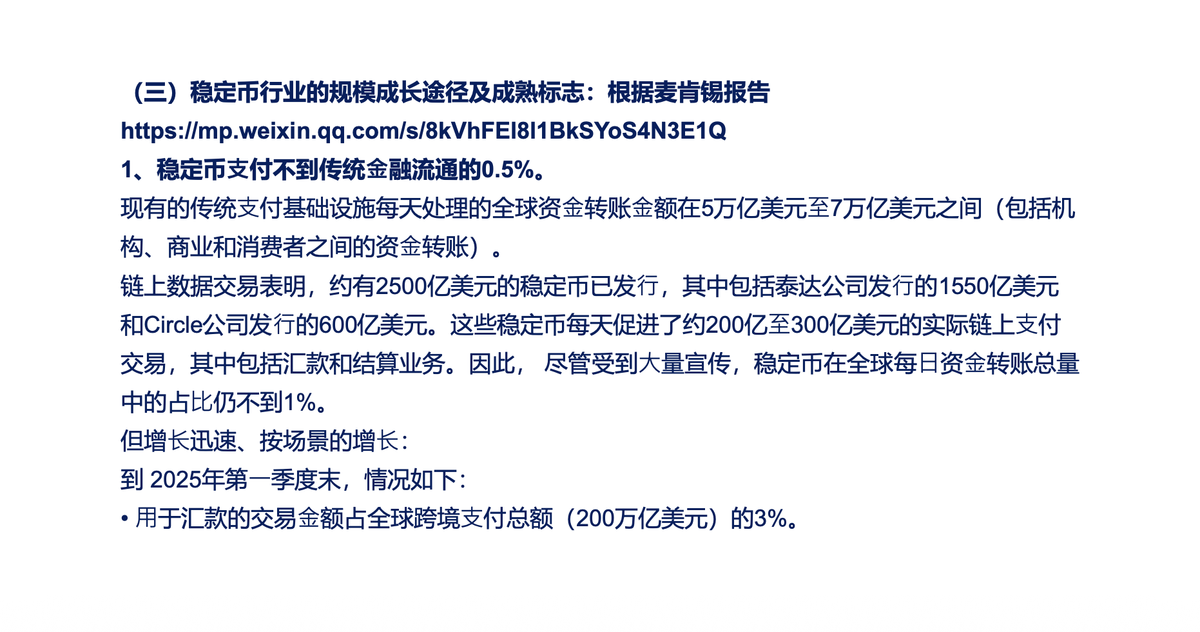

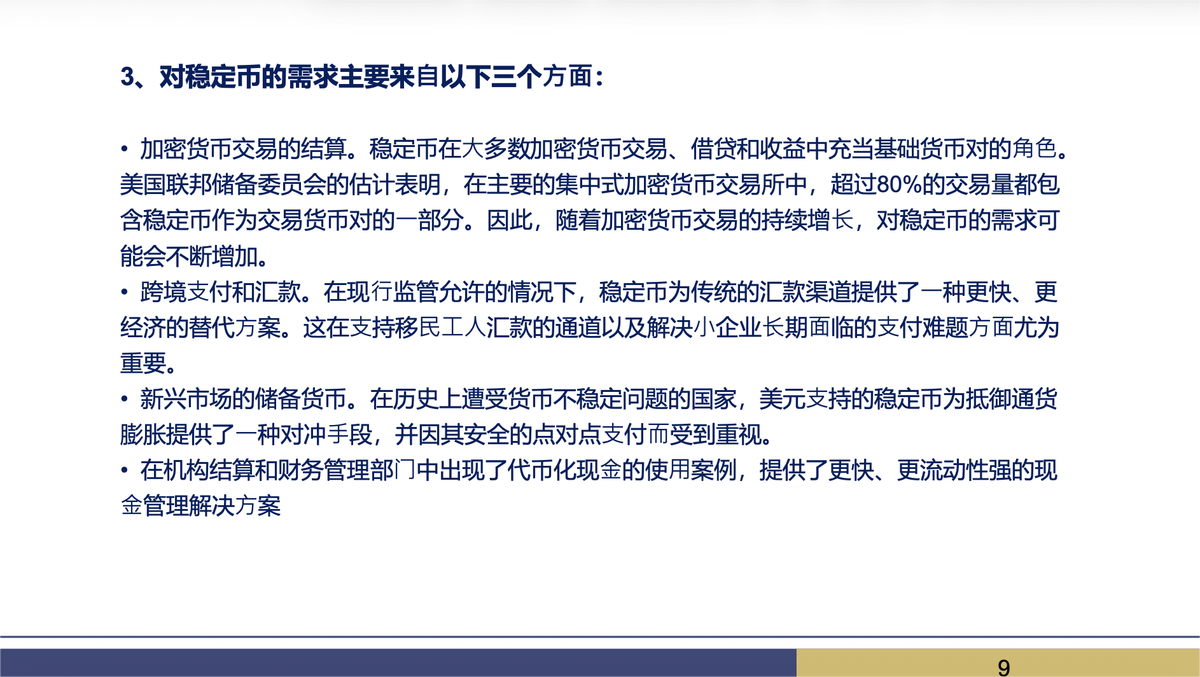

III. Market Size and the Future of Stablecoins

According to McKinsey's report, the current scale of stablecoins used for payments is still very small, less than 0.5% of traditional finance, but it will grow very quickly, especially in the fields of cross-border remittances (which already account for 3% of the global total) and capital market transactions. Currently, 74% of cryptocurrency transactions are completed using stablecoins.

Stablecoins can be categorized into several types:

Central Bank Digital Currency (CBDC): I believe this carries significant risks because the "high-energy currency" issued by central banks has a "money multiplier" effect, and directly issuing digital currency may lead to uncontrolled multipliers, interfering with monetary policy.

Asset-Backed Stablecoins: One type is backed by fiat currency/government bonds, such as USDC, which is subject to strict regulation, with each stablecoin backed by a dollar in cash or short-term government bonds, making it very safe. Another type is backed by crypto assets, such as DAI, which is generated through over-collateralization of Bitcoin, Ethereum, etc., with an automatic liquidation mechanism to ensure its value stability.

Algorithmic Stablecoins: These have basically been eliminated from the market.

Yield-Generating Stablecoins: Although current legislation prohibits stablecoins from generating yields, tokenized money market funds are an excellent alternative. They tokenize traditional money market fund shares, which can be split down to $1, providing high stability while generating returns for holders (currently around 3.4%-4.1%).

Predictions for the growth of stablecoin demand:

The current total market capitalization of stablecoins is approximately $260 billion. I conservatively estimate that it will reach $800 billion in a year (about three times), and easily reach $2 trillion in about three years. Consider this: over $200 billion in stablecoins supports nearly $4.5 trillion in the crypto asset industry (about 20 times leverage), so how large of a market size can $2 trillion in stablecoins support? The expansion of this industry is visible.

IV. Six Strategies for Investing in Crypto Assets

From the perspective of a traditional investor, I will share six strategies for analyzing crypto assets.

Strategy 1: Build Your Own Crypto ETF

Since I am optimistic about the systemic growth of the entire industry (fiat inflow + asset inflow), the simplest way is to buy the entire market and build your own ETF.

Currently, the total market capitalization of the entire crypto market is about $4.5 trillion (excluding stablecoins).

BTC (including its mapped assets like WBTC) accounts for about 60-64%.

ETH accounts for about 14-15%.

Together, they account for over 75%.

Adding XRP (about 4%), BNB (about 3%), SOL (about 3%), and DOGE (about 1%), these six coins together cover 86% of the total market capitalization.

Additionally, allocate two stocks: MicroStrategy (about 3%) and Coinbase (about 2%).

Thus, 6 coins + 2 stocks already capture 91% of the market share. You can rebalance every two to three months based on market capitalization changes.

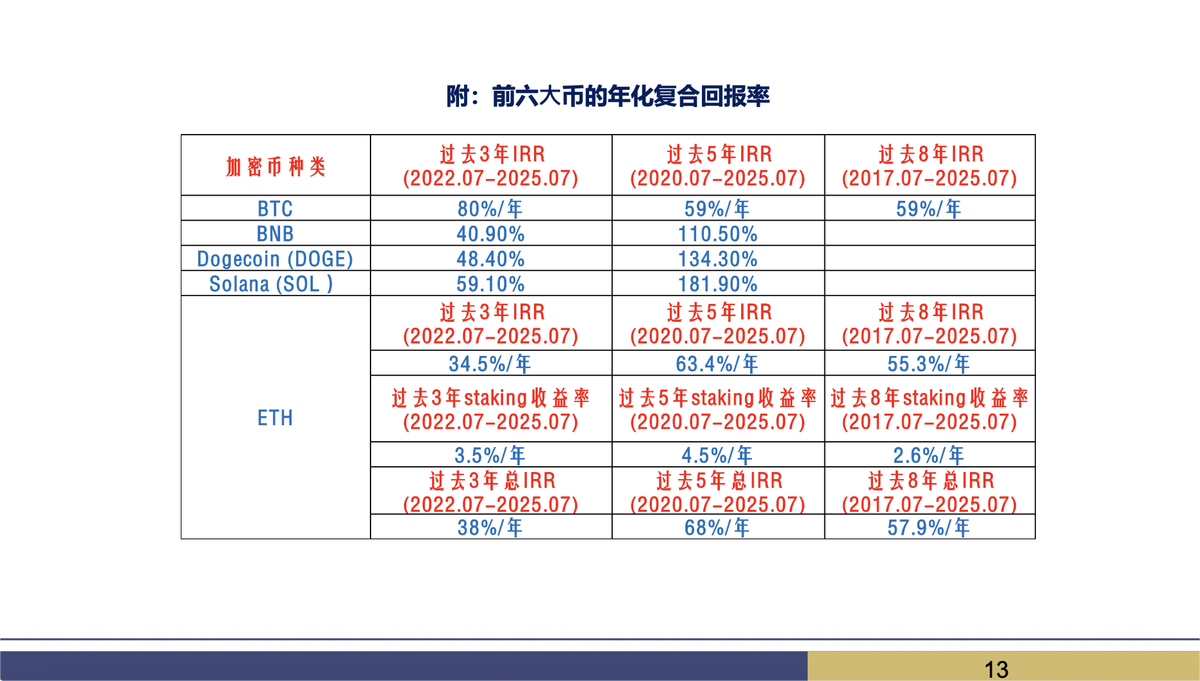

Historically, whether at the peak three years ago or buying in five or eight years ago, the annualized IRR of mainstream assets like Bitcoin and Ethereum has exceeded 50% (an 80% IRR means doubling in 11 months). Even if future returns are halved, the likelihood of achieving annual returns in the 20% range is still very high. History also proves that the vast majority of small coins find it difficult to outperform these leaders.

Strategy 2: Long-Term Thinking, Analyze Profit Models

When investing in an asset, it is essential to understand how it makes money, its cash flow, and whether its business model is reliable.

XRP (Ripple): I do not understand its profit model. Its connection to the banking system is merely historical and unrelated to the functionality of Ripple itself. However, as the third-largest asset by market capitalization, it can be allocated as part of an index component.

ETH (Ethereum): The profit model is very clear. It is the dominant smart contract platform (50-60% of on-chain activity), and all DeFi (over 90%), stablecoins (over 84%), RWA, and other economic activities require ETH as gas fees. The larger the stablecoin scale and the broader the DeFi applications, the more value ETH captures.

BNB (Binance Coin): The profit model is very direct and quantifiable.

○ Profit Buyback and Burn: Binance uses part of its profits each quarter to buy back and burn BNB, creating deflation. The amount used for buybacks each year is about $4-5 billion.

○ "New Listing" Profit Sharing: Users holding BNB can participate in new coin launches on the Launchpad, sharing in the token airdrops of new projects, which distributes about $7-9 billion in value to BNB holders each year.

An asset with a market capitalization of less than $100 billion has a clear mechanism for returning substantial value to holders each year, which represents a very reliable investment logic. A good economic model must clearly explain how value is created and how it is distributed between shareholders and token holders.

Strategy 3: Data Asset Thinking, Analyze User Value

For those "internet" projects that are not yet profitable, you can measure them using data asset logic. Core indicators include:

- User count (active wallet addresses)

- Daily Active Users/Monthly Active Users (DAU/MAU)

- User Spending Power (GMV)

- Total Value Locked (TVL)

For example, wallets with spending power in Web3 may only account for a small portion of the total, and 99% of these high-value users are concentrated on the BNB chain. Ethereum's smart contract market share has dropped from over 90% to over 60%, which is one reason for its underperformance compared to competitors like Solana. Solana's growth has benefited from attracting a large number of young users through meme coins. You can use this set of data indicators to measure the value of various DeFi protocols like Uniswap and Aave.

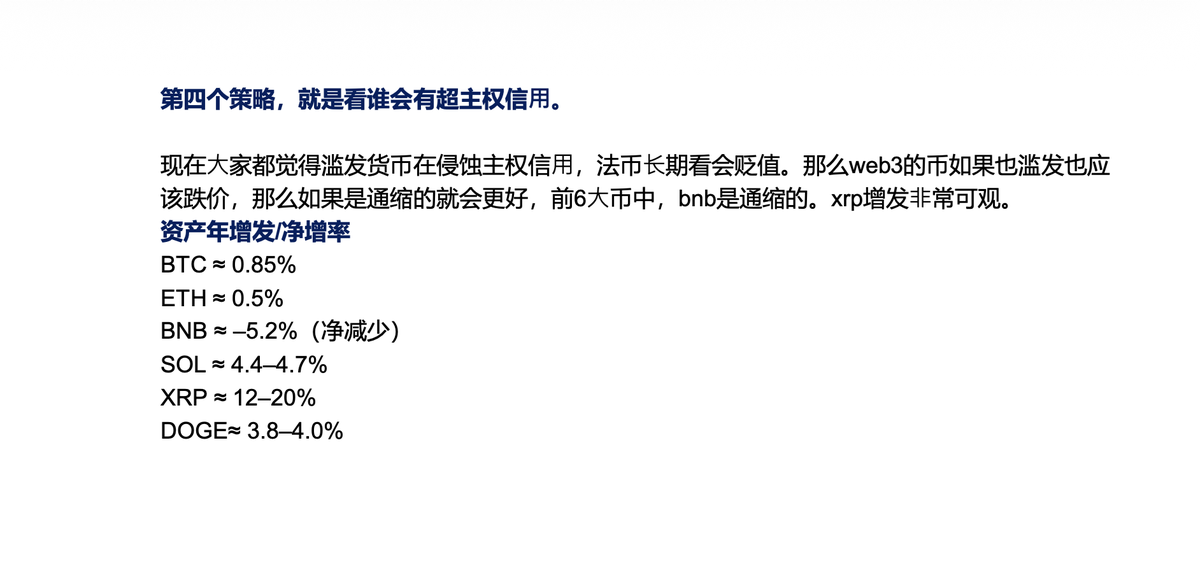

Strategy 4: Seek Supranational Credit

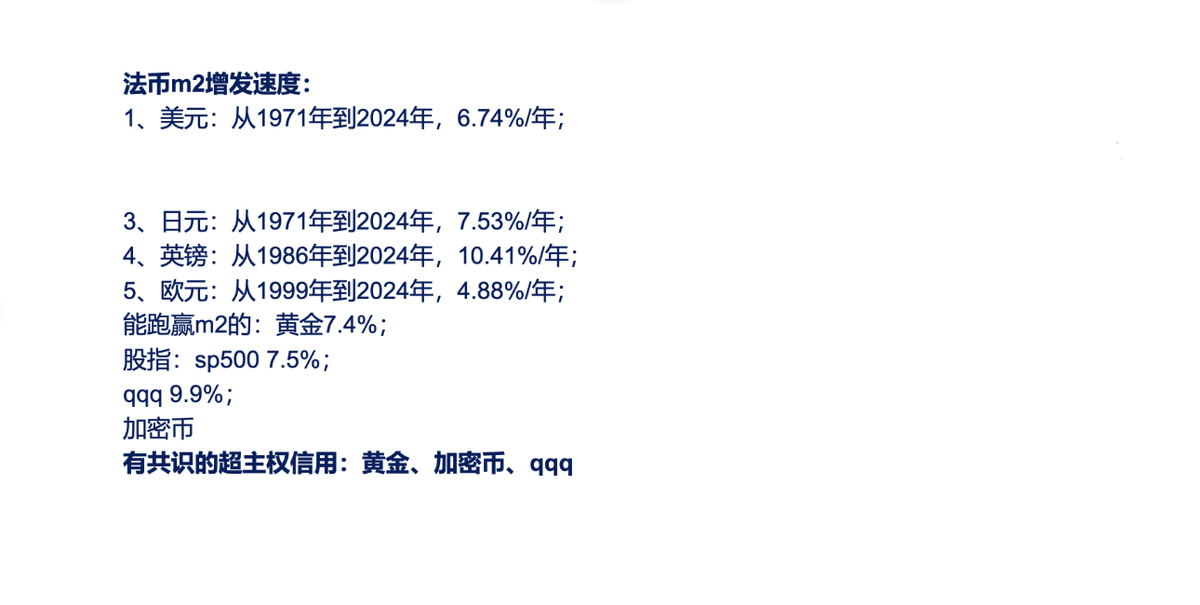

All sovereign fiat currencies are continuously being overissued and devalued. Over the past few decades, the annual increase in the U.S. dollar M2 has averaged 6.7%.

In contrast, the issuance rates of mainstream crypto assets are extremely low:

- BTC: Annual inflation of 0.85% (will halve to 0.425% in the future)

- ETH: Annual inflation of about 0.13% - 0.5%

- BNB: Negative inflation (continuous burning)

- SOL: 4.4% - 4.7%

- XRP: 12% - 20% (this is a dangerous signal)

Using gold's annual production rate of 1.8% as a benchmark, BTC, ETH, and BNB are all deflationary assets. Therefore, if you are concerned about sovereign credit (including U.S. Treasury bonds), the only trustworthy value storage tools on Earth are: gold, certain crypto assets (BTC/ETH), and stocks of global high-tech companies (like QQQ).

Another layer of meaning for supranational credit is resistance to censorship and attacks from public authorities. The FTX token FTT went to zero because its founder was arrested and the exchange was shut down. However, you cannot shut down Bitcoin or Ethereum in the same way because they are sufficiently decentralized (Bitcoin has about 6 million nodes, and Ethereum has 1 million validators). In contrast, some chains that are not sufficiently decentralized could theoretically be shut down.

Strategy 5: Integration with AI

In the future world, AI will not just be a tool for humans. In the next 3-5 years, the number of AI users, whether in content creation, consumption, or economic activities, will catch up to or even exceed that of humans.

So the question arises, how can AI conduct value transfer and asset confirmation? It cannot do so through traditional bank KYC. Web3 is the infrastructure for AI to engage in economic activities. Therefore, public chains that provide a friendly environment for AI users and AI agents will have tremendous growth potential in the future. Currently, coins that claim to be "AI concepts" are merely speculative, but truly great projects that serve the AI ecosystem will undoubtedly emerge in the future.

Strategy 6: Analyze User Profiles

The future belongs to the youth, who are anti-establishment and pursue trends. The future of a brand or asset depends on its ability to capture the hearts of young people.

- BTC User Profile: 42 years old, views it as digital gold, a value investor, tends to hold long-term. It is important to emphasize the "coin-based" mindset, where the investment goal is to increase the number of coins held, rather than the fluctuations in fiat currency value.

- ETH User Profile: 35 years old, a skilled DeFi player.

- SOL User Profile: 28 years old, primarily engages in NFTs and blockchain games.

- DOGE User Profile: 26 years old, enjoys meme culture.

The conclusion is that assets with a larger and younger user base have greater potential for the future. Therefore, you cannot completely ignore meme coins like Dogecoin.

Conclusion: The Myth of Energy Consumption

Finally, let me clarify that the criticism regarding the massive energy consumption of cryptocurrencies is outdated. That was aimed at Bitcoin's PoW (Proof of Work) mechanism. The situation has completely changed with the shift to PoS (Proof of Stake).

Ethereum (PoS) has a total annual energy consumption of about 1% of PayPal's, yet it processes nearly a quarter of PayPal's transaction volume. More importantly, the energy consumption growth of PoS chains is almost uncorrelated with transaction volume growth; a tenfold increase in transaction volume may only result in a twofold increase in energy consumption.

Web3 not only has low energy consumption itself, but the economic efficiency improvements it brings (such as accelerating capital flow and reducing idle funds) will further save resources for society as a whole. Therefore, from a global perspective, it is a more efficient and greener technology.

That concludes my sharing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。