On August 12, 2025, in a federal court in Manhattan, New York, Do Kwon, dressed in a yellow prison uniform, slowly stood up.

Years of fleeing and imprisonment have made his once round face much thinner, and his hairstyle has become the uniform buzz cut of prisoners. Those eyes that once sparkled in front of the camera now only show fatigue.

This 33-year-old South Korean man, once a darling of the crypto world, is now the central figure in the largest financial fraud case in history.

In a courtroom sketch, Do Kwon bowed his head, gripping his hands tightly. He pleaded guilty, stating, "In 2021, I made false and misleading statements regarding the re-pegging of TerraUSD. What I did was wrong, and I want to apologize for my actions."

Now, he faces long-term imprisonment and hefty fines, but for the hundreds of thousands of investors who lost $40 billion because of him, this is far from enough.

Time is the cruelest judge; it not only changed Do Kwon's appearance but also completely destroyed everything he once had.

Prosecutor Damian Williams stated outside the court that this guilty plea is "an important milestone in the enforcement of cryptocurrency fraud cases." However, the word "milestone" sounds too cold; it cannot rebuild those shattered families, comfort the elderly who have lost everything, nor save the young people who chose to end their lives.

From elite schools in Seoul to Stanford, from skyscrapers in Singapore to a dilapidated prison in Montenegro, Do Kwon's life trajectory resembles a parabola, rising rapidly, then falling swiftly, ultimately shattering into pieces.

The Birth of a Genius

From Seoul to Silicon Valley

On September 6, 1991, Do Hyeong Kwon let out his first cry in a hospital in Seoul, and no one anticipated that this baby would become one of the most controversial figures in global financial history 30 years later.

He was born into a typical middle-class Korean family, with a father who was an engineer and a mother who was a teacher. This combination represents a reverence for knowledge and a desire for success in Korean society. South Korea is a country deeply troubled by educational anxiety, where children are caught up in competition from kindergarten. Do Kwon displayed intelligence beyond his peers from a young age, with a particular talent for mathematics, as if numbers would automatically arrange themselves into the most elegant answers before him.

He attended Daewon Foreign Language High School in Seoul, one of the most elite schools in Korea. Here, the smartest students from across the country spent the most critical three years of their lives. According to his classmates, Do Kwon was always the first to finish his homework and the one most eager to challenge the teacher's views. His intelligence was evident, but even more apparent was his confidence. This confidence, while perhaps charming in the adolescent school environment, also sowed the seeds for future tragedy.

At that age, he already believed he was different, convinced that he was destined for greatness. High school Do Kwon was like a star accumulating energy, waiting to burst forth with dazzling brilliance on a larger stage. That stage was Stanford, across the ocean.

In 2010, 19-year-old Do Kwon boarded a flight to the United States. For a young Korean, gaining admission to Stanford University meant a complete transformation of life. Stanford, located in the heart of Silicon Valley, is the birthplace of countless tech legends.

The computer courses were not difficult for Do Kwon; what truly fascinated him was the entrepreneurial atmosphere that permeated the campus. Here, every student dreamed of becoming the next Steve Jobs or Mark Zuckerberg, and every idea could potentially turn into the next world-changing product. Silicon Valley has a unique magic that makes people believe technology can solve all problems and convinces young people that they can disrupt the world. Do Kwon was deeply influenced by this culture.

At that time, Bitcoin had just emerged, and the perceptive Do Kwon began to delve into blockchain technology, reading Satoshi Nakamoto's white paper and participating in related project developments. While his classmates were anxious about finding jobs, Do Kwon was already contemplating how to redefine money itself with technology. In his view, the traditional financial system was outdated and inefficient, while blockchain technology represented the future.

His time at Stanford shaped Do Kwon's worldview. Here, he learned to think about problems in the language of technology and to view the world through the eyes of an entrepreneur. More importantly, he established a belief: he was here to change the world.

In 2015, Do Kwon graduated from Stanford University, no longer the naive boy from Seoul. He had transformed into a confident young man, a dreamer who believed he could create miracles. His resume boasted a Bachelor’s degree in Computer Science from Stanford, and his heart burned with the ambition to change the world.

The Entrepreneurial Journey

Returning to Korea, Do Kwon faced a choice: to join a large company like Samsung and live a stable and respectable life like most of his classmates, or to embark on a risky entrepreneurial path. For a young man who had been immersed in a culture of entrepreneurship at Stanford, the answer was clear.

In 2016, 25-year-old Do Kwon founded Anyfi, his first entrepreneurial attempt. He hoped to use blockchain technology to allow users to share their WiFi networks and earn token rewards. In his view, traditional telecom operators were monopolists, and Anyfi could break this monopoly through technology, enabling ordinary people to benefit from network infrastructure.

The project gained some attention and investment in its early stages. Do Kwon began to frequently appear at tech events in Korea, introducing his project and ideas. His speeches were passionate, and his vision sounded exciting. Under those flashing lights, Do Kwon enjoyed the aura of a startup star. However, reality soon dealt him a heavy blow. The Anyfi project faced numerous challenges, and the existing infrastructure was far from mature enough to support such a complex application. The gap between technological ideals and commercial realities was much larger than Do Kwon had imagined.

By the end of 2017, Anyfi declared failure. For any entrepreneur, this would be an incredibly painful experience; failure is bitter, causing one to question their abilities and reflect on their decisions. But Do Kwon did not think this way. In his view, the failure of Anyfi was due to timing; the market was not yet ready to accept such an advanced concept, and investors lacked the foresight to support such a project.

This mindset in psychology is called "self-serving bias," where people tend to attribute success to internal factors (like their own abilities) and failure to external factors (like bad luck).

For Do Kwon, "self-serving bias" not only prevented him from learning lessons from failure but also boosted his confidence. He began to shift his focus to the emerging field of decentralized finance, particularly stablecoins. In his view, this was an opportunity to "redefine money itself," a chance to leave a mark in history.

In January 2018, a new company emerged in Singapore—Terraform Labs.

The co-founders of this company were Do Kwon and Daniel Shin, two young men who graduated from top universities, both passionate about blockchain technology and believing they could change the world.

Choosing Singapore as their headquarters was a shrewd decision. This city-state is not only a financial center in Asia, with a well-developed financial infrastructure and an international talent pool, but it also adopts a relatively open regulatory attitude towards blockchain technology. Singapore encourages innovation and simplifies regulations, providing an ideal growth environment for startups like Terraform Labs.

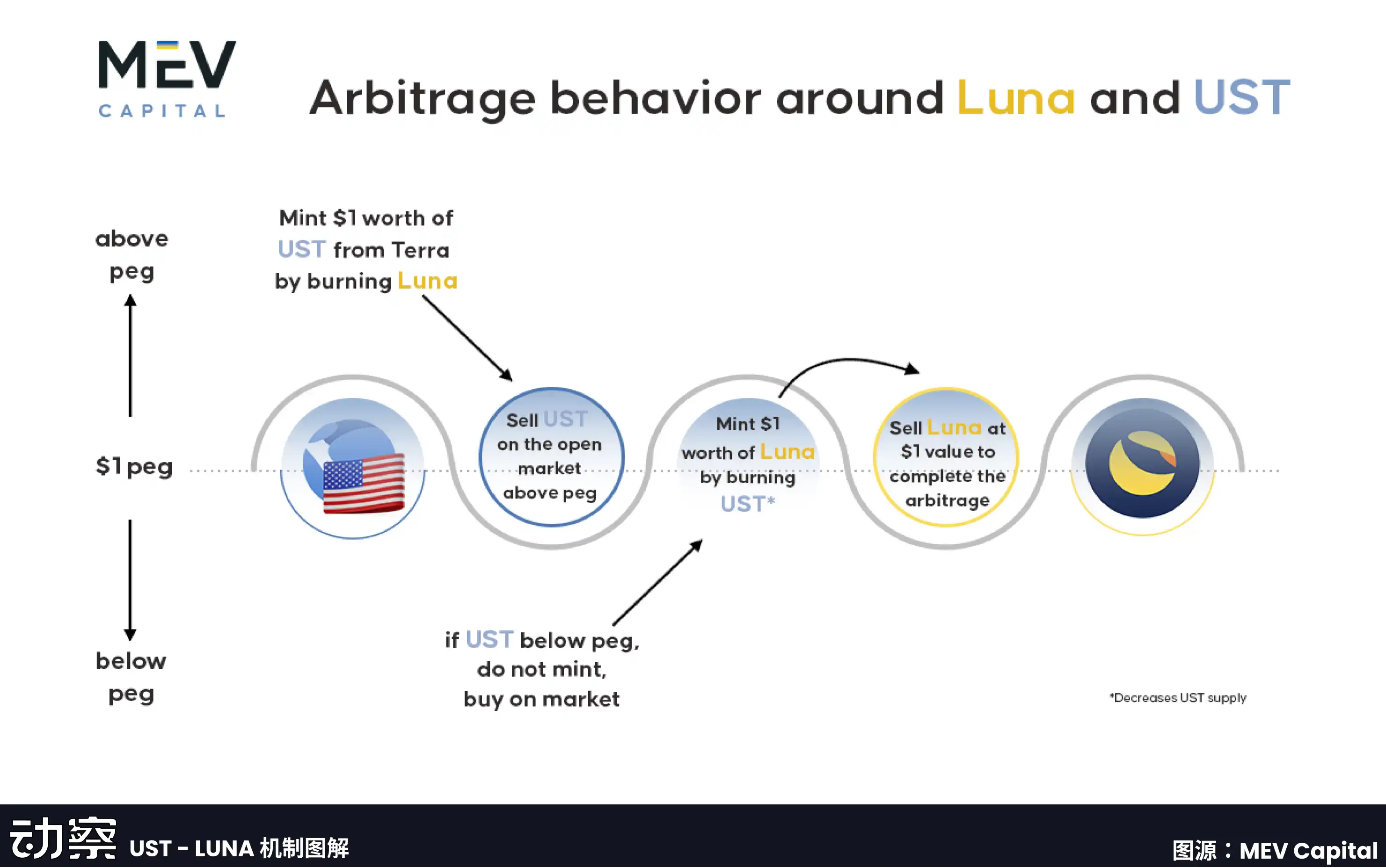

Their core idea sounded simple: to create an algorithmic stablecoin system that combines the decentralized characteristics of Bitcoin with the stability of the US dollar. This system consists of two tokens: TerraUSD (UST), a stablecoin aimed at maintaining a 1:1 exchange rate with the US dollar; and Luna, a governance token used to maintain the system's stability.

The relationship between the two is like a seesaw: when the price of UST is above $1, the system mints more UST and burns Luna, thereby increasing the supply of UST and lowering its price; when the price of UST is below $1, the system burns UST and mints Luna, thereby reducing the supply of UST and raising its price.

This mechanism does not require bank deposits or government bonds as reserves, relying entirely on the market and algorithms to maintain stability.

Do Kwon likened this system to "the gravitational system of the digital world," claiming it was a revolution in the history of currency. In his view, traditional stablecoins are like balloons tied with strings, while UST is like a planet with its own gravity, capable of naturally maintaining a stable orbit.

Do Kwon demonstrated exceptional persuasive ability during the fundraising process. He could explain complex technical concepts in clear and concise language and paint a grand and enticing vision. More importantly, he could convince investors that he was the one who could realize this vision. In August 2018, Terraform Labs completed a $32 million seed round of financing, with investors including Binance Labs, Polychain Capital, and Coinbase Ventures. These investments not only provided financial support but also gave the project authoritative endorsement.

In April 2019, the Terra blockchain officially launched. This day held special significance for Do Kwon, marking his transformation from a failed entrepreneur to a leader with the potential to change the world.

At the same time, Terraform Labs began to build an ecosystem around Terra. They launched the Terra Station wallet, allowing users to conveniently store and transfer Terra tokens. They partnered with e-commerce platforms in Korea, enabling users to shop using Terra tokens. They also began developing various decentralized applications to increase the demand for UST.

By the end of 2020, the Terra ecosystem had begun to take shape. The market capitalization of UST reached hundreds of millions of dollars, and the price of Luna was steadily rising. More importantly, an increasing number of users began to utilize various services offered by Terra. In the cryptocurrency community, Do Kwon was hailed as a pioneer of algorithmic stablecoins, and the Terra project was regarded as one of the most promising projects in the DeFi space.

In such an environment, Do Kwon and his Terra empire continued to expand rapidly, moving towards greater success and deeper abysses.

A Tower Built on the Ground

Gold and Dross

2021 was a watershed year for Do Kwon.

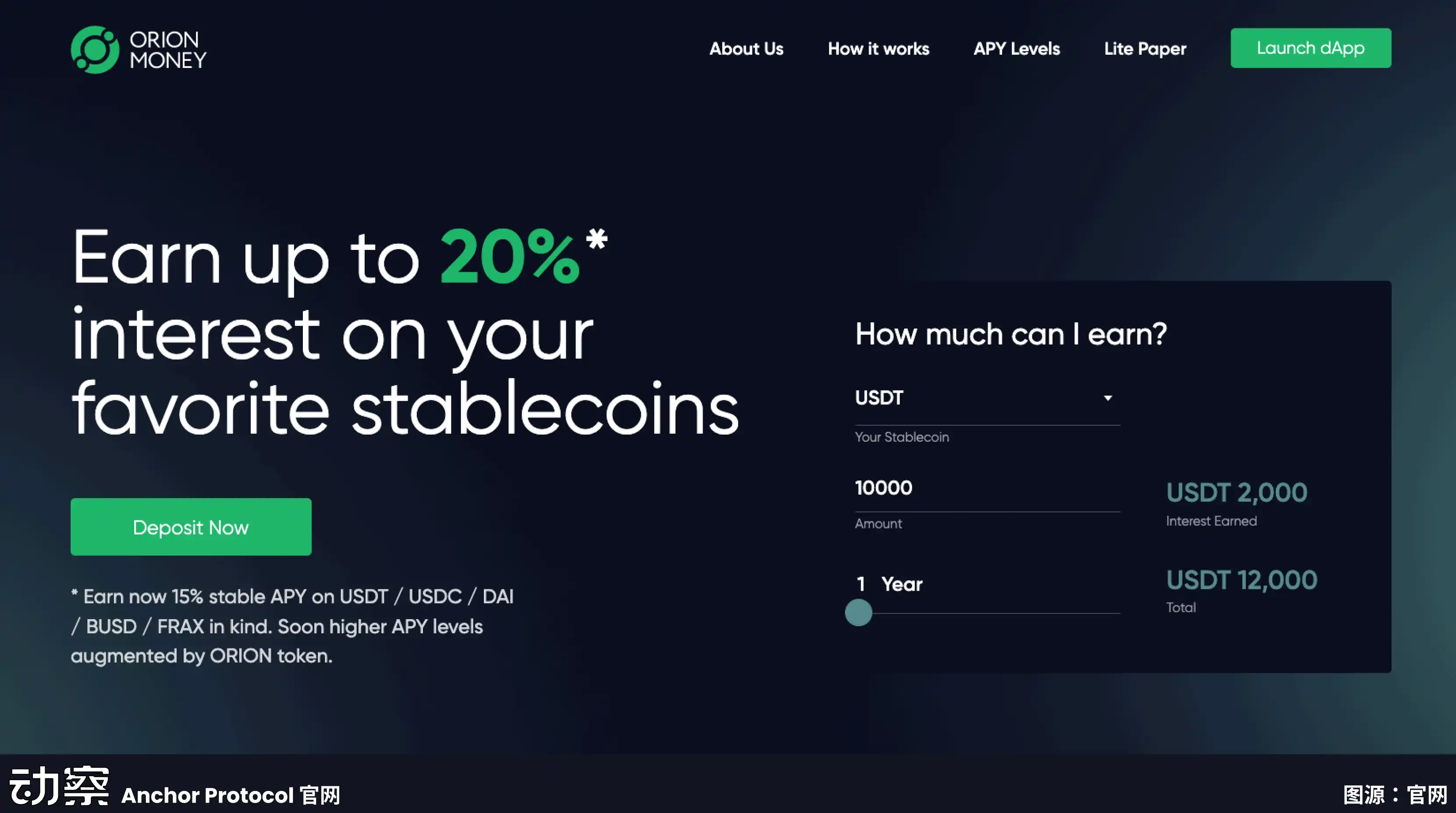

That year, he launched Anchor Protocol, a lending protocol that promised a 20% annual yield on UST deposits. In the traditional financial world, such a yield is unimaginable; even the most aggressive hedge funds struggle to sustain such high returns.

In Do Kwon's vision, Anchor Protocol was the core engine of the Terra ecosystem. The high yield would attract a massive influx of funds, increasing the demand for UST, driving up the price of Luna, and creating a positive feedback loop.

However, this logic had a fatal flaw.

A 20% yield requires real economic activity to support it; to maintain this promise, Anchor Protocol needed approximately $6 million in subsidies every day. These subsidies primarily came from the Luna Foundation Guard (LFG), a foundation controlled by Terraform Labs.

In other words, the high yield of Anchor Protocol was essentially a Ponzi scheme, using new investors' money to pay returns to old investors. But Do Kwon never described it that way. In his speeches, Anchor Protocol was the "future of decentralized finance," the "terminator of traditional banking."

By early 2022, the TVL of Anchor Protocol exceeded $14 billion, making it one of the largest DeFi protocols at the time. Investors from around the world flocked to invest their funds. The enthusiasm and trust of these investors intoxicated Do Kwon. He began to believe that he had truly created a miracle, that he had really found the Holy Grail of the financial world.

At the same time, Do Kwon also launched Mirror Protocol, a synthetic asset platform. In public promotions, this platform was described as "completely decentralized," with no individual or entity able to unilaterally control the protocol. But the reality was different; according to later investigations by the SEC, Do Kwon actually maintained secret control over Mirror Protocol. He could unilaterally modify protocol parameters, decide which synthetic assets to add or remove, and even pause the entire protocol's operation.

An even more serious fraud was Chai. Starting in 2019, Do Kwon claimed on various occasions that Chai used the Terra chain to process transactions, with transaction volumes reaching "billions of dollars." This claim was written into the Pitch Deck, used in media interviews, and served as important evidence of Terra's practical applications. Investors were indeed persuaded by these figures; after all, most blockchain projects were merely concepts, while Terra seemed to have real applications.

According to the SEC's investigation, this was also false.

The transactions on the Chai platform were actually processed through traditional financial networks, unrelated to the Terra chain. Do Kwon and the executives of Terraform Labs were fully aware of this fact but continued to make misleading statements to investors. This was deliberate fraud, but in Do Kwon's view, as long as he could attract more investment and drive up token prices, some "details" could be overlooked.

Arrogance and Prejudice

Success made Do Kwon extremely arrogant.

In July 2021, when British economist Frances Coppola criticized the design flaws of algorithmic stablecoins on Twitter, Do Kwon responded, "I don't debate with the poor; sorry, I don't have any change to spare her right now."

This statement was an insult to a scholar and a declaration of war against all skeptics. In his view, wealth equated to correctness; those who criticized him were not being reasonable but were simply "poor." Such remarks sparked a huge uproar on social media. Supporters cheered for Do Kwon, seeing it as a powerful rebuttal to traditional scholars. Critics, however, believed it exposed his true nature—a nouveau riche intoxicated by success.

There were many similar controversial statements. When someone questioned the sustainability of Terra, Do Kwon would say, "They're all now poor." When someone expressed concerns about the risks of algorithmic stablecoins, he would mockingly respond, "Have fun staying poor."

Driven by this mindset, Do Kwon became increasingly isolated. Few around him dared to voice dissent; even if someone raised doubts, he would counter them with his wealth and success. This environment further reinforced his arrogance and distanced him from reality.

On April 17, 2022, Do Kwon announced the birth of his daughter on Twitter, writing, "Baby Luna, my dearest creation, named after my greatest invention."

This statement sparked further controversy. Supporters believed it reflected his confidence in the project, while critics saw it as an extreme display of narcissism. A father naming his daughter after his business project was unusual in itself. But what was even more unusual was his description of the project as "my greatest invention."

In Do Kwon's view, Terra was not just a business project; it was a manifestation of his personal genius, a legacy he would leave to the world.

In April 2022, the Terra ecosystem reached unprecedented heights. The market capitalization of UST exceeded $18 billion, the market capitalization of Luna surpassed $40 billion, and the total value of the entire ecosystem approached $60 billion.

Do Kwon became a superstar in the crypto world. Major media outlets rushed to report his story, various conferences invited him to give keynote speeches, and investors from all walks of life sought to collaborate with him. In these settings, Do Kwon always wore a meticulously tailored suit, an expensive watch, and a confident smile.

Behind the surface prosperity, risks were continuously accumulating.

Some keen observers had begun to notice the problems. Anonymous researcher FatMan published a series of analyses on Twitter, pointing out the unsustainability of Anchor Protocol. Economist Nouriel Roubini warned of fundamental flaws in algorithmic stablecoins. Even some opinion leaders in the cryptocurrency community began to question Terra's long-term prospects.

Do Kwon dismissed these criticisms. In his view, they were merely the jealousy of losers. This blind confidence would soon come at a painful cost.

In May 2022, the spring sun shone brightly in Singapore, and the Terra office was bustling. Employees were preparing for the upcoming product launch, and investors were continuously pouring in money. No one realized that an unprecedented financial tsunami was about to hit.

Do Kwon leaned back on the office sofa, imagining himself as the hero changing the world, believing that history would remember him.

History will indeed remember him, but not as a hero.

For the full article, please visit the 【动察Beating】 WeChat public account

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。