Stock tokenization is becoming one of the strongest narratives in the fusion of traditional finance (TradFi) and Web3 in 2025.

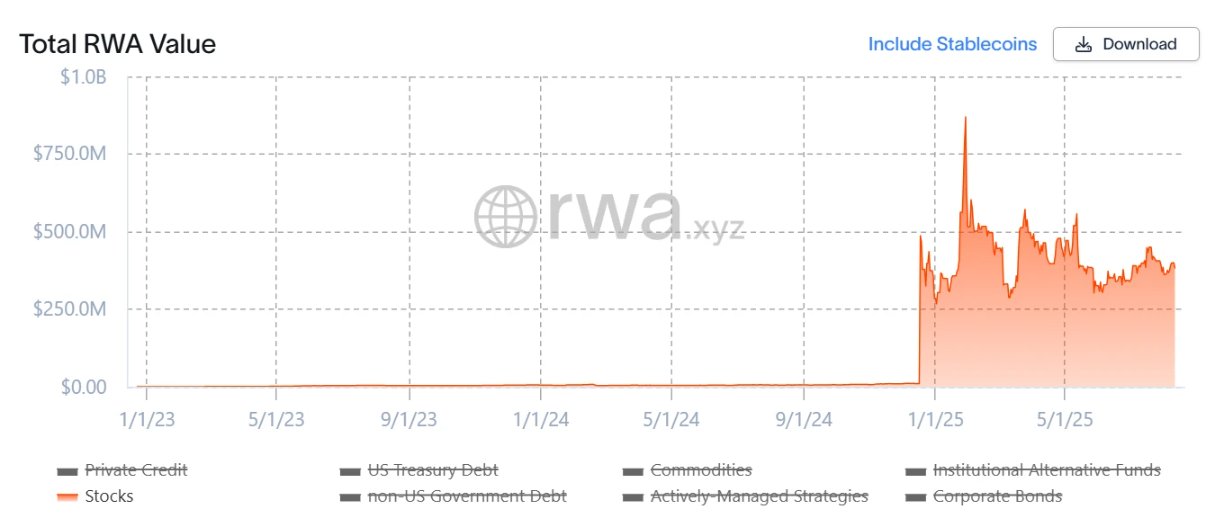

According to data from rwa.xyz, the market value of tokenized stocks has grown from nearly zero to hundreds of millions this year, thanks to a shift in the model—from early synthetic models to the custody of actual stocks—and is increasingly extending to higher-level products such as derivatives.

This article will explain the evolution of this model, highlight key participants, and explore potential future developments—especially the so-called "second growth curve" in terms of derivatives and liquidity.

The Journey of Stock Tokenization in the U.S.

What is Stock Tokenization?

In short, it is the mapping of traditional stocks onto the blockchain in the form of digital tokens, with each token corresponding to one share of the underlying asset. These tokens can be traded on-chain 24/7, breaking through the limitations of traditional market time zones and trading venues, and opening up participation channels for global investors.

Stock tokenization is not a new concept. In the previous cycle, projects like Synthetix and Mirror built on-chain synthetic asset systems. Users could mint and trade stock tokens (e.g., TSLA, AAPL) by over-collateralizing (e.g., with SNX, UST).

This model was later extended to other assets such as fiat currencies, indices, gold, and oil, and settled through oracle pricing and on-chain matching. Since there are no real counterparties (only providing price exposure), theoretically, this system can offer deep liquidity and a low-slippage trading experience.

Limitations: The synthetic model does not grant true ownership of the underlying stocks—it merely provides price exposure. If the oracle fails or collateral becomes unpegged (as happened in the UST incident), these systems may face liquidation, price divergence, and a crisis of confidence.

What’s Different in 2025?

The current growth momentum comes from a model where real stocks are held off-chain and on-chain tokens are issued at a 1:1 ratio. This gives rise to two main paths:

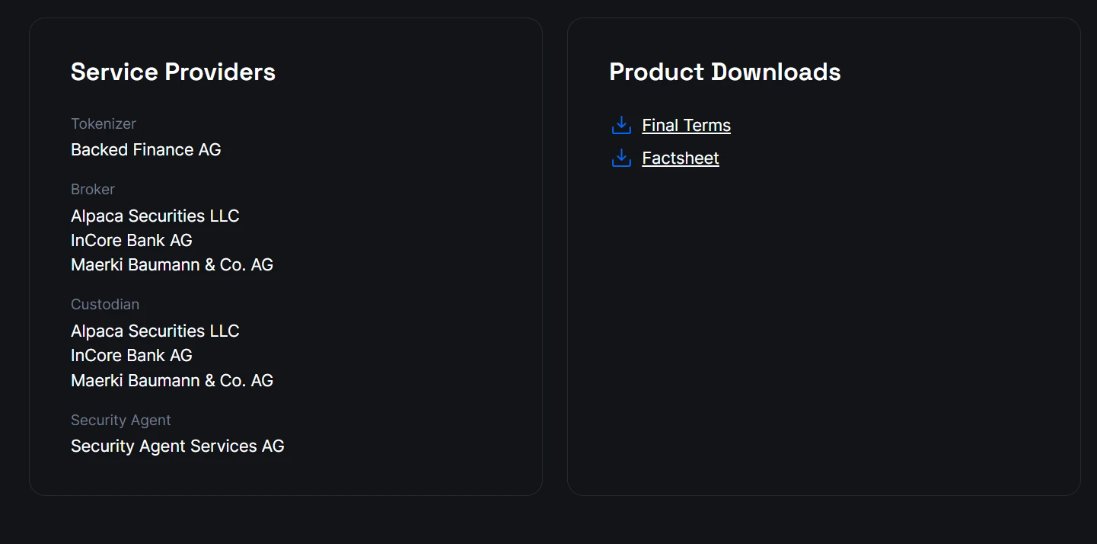

- Third-party compliant issuance with multi-platform access (e.g., Backed Finance / xStocks): xStocks purchases and holds stocks through partners like Alpaca Securities LLC.

- Broker-led closed-loop models (Robinhood-style): Licensed brokers purchase stocks and issue tokens, covering the entire process from purchase to on-chain issuance.

The core upgrade lies in the verifiable backing of real assets. This enhances security and compliance, making the model more acceptable to traditional institutions.

Project Landscape: From Issuance to Trading

A complete stock tokenization ecosystem typically includes:

- Infrastructure: Underlying blockchain, oracles, and settlement channels

- Issuance: Regulated or compliant issuers

- Trading: Centralized exchanges / decentralized exchanges, and DeFi (lending and other derivatives platforms)

The infrastructure is gradually maturing, while the most competitive and ultimately decisive aspects for user experience and liquidity are primarily concentrated in issuance and trading.

Here are some representative projects.

Ondo Finance — Extending from RWA Bonds to Stocks

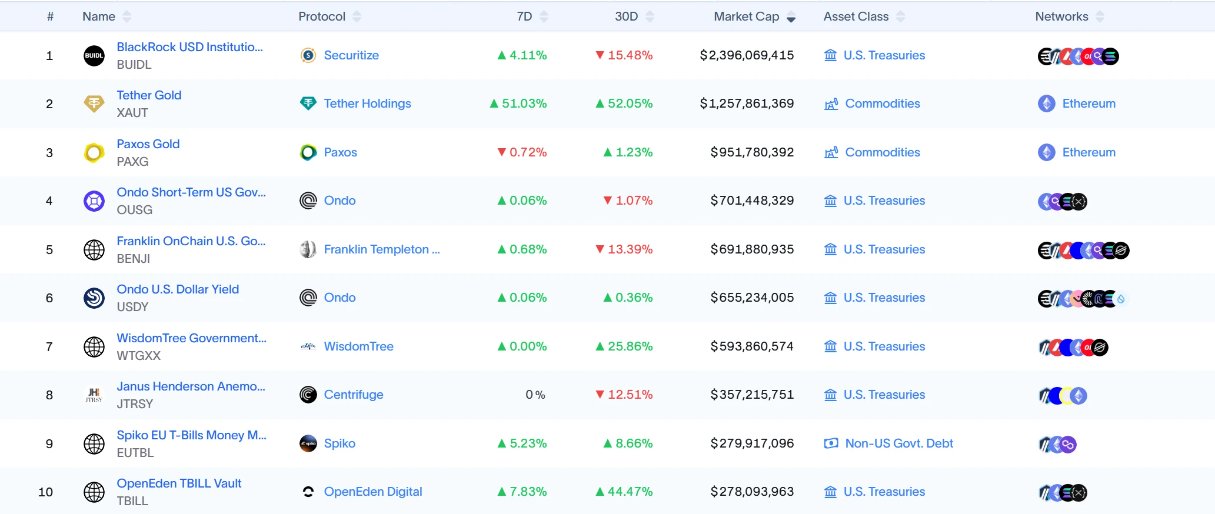

Ondo initially gained recognition for tokenizing government bonds and bond exposures (e.g., USDY, OUSG) and remains one of the largest RWA platforms today.

Recently, Ondo has expanded its business into the stock sector, collaborating with regulated custodians and clearing institutions like Anchorage Digital to hold real U.S. stocks and issue corresponding on-chain tokens. This model provides compliance assurance for institutions and supports the construction of cross-asset liquidity pools, allowing tokenized stocks to interact with stablecoins and RWA debt assets. Ondo and Pantera Capital have also announced plans to establish a $250 million fund to support RWA projects.

Injective — A Blockchain Born for Real-World Financial Assets

Injective positions itself as a high-performance financial blockchain, with built-in order book matching and derivatives modules. Its ecosystem encompasses over 200 projects, including decentralized exchanges (Helix, DojoSwap), lending platforms (Neptune), RWA participants (Ondo, Mountain Protocol), and NFT marketplaces (Talis, Dagora).

Two major advantages in the RWA space:

- Wide Asset Coverage: Applications like Helix have launched tokenized U.S. tech stocks, gold, foreign exchange, and other asset classes.

- Strong Connectivity to Traditional Finance: Collaborations with Coinbase, Circle, Fireblocks, WisdomTree, Galaxy, etc., deeply integrate off-chain custody and clearing with on-chain issuance and trading.

The result is a low-latency, low-cost execution environment that supports collateralization, composability, and the subsequent development of richer stock-linked products.

Backed Finance — Compliance First, Multi-Market Coverage

Backed Finance operates under the Swiss legal framework and aligns with the European MiCA regulatory framework. The company issues fully collateralized tokenized securities and collaborates with institutions like Alpaca Securities LLC for stock acquisition and custody, maintaining a 1:1 mapping between off-chain assets and on-chain tokens. Backed's coverage includes U.S. stocks, ETFs, European securities, and some international indices. This allows investors to gain multi-market, multi-currency exposure on a single on-chain platform, such as combining U.S. tech stocks, European blue chips, and global commodity ETFs without being restricted by traditional market trading venues and hours.

Block Street — Unlocking Liquidity for Tokenized Stocks

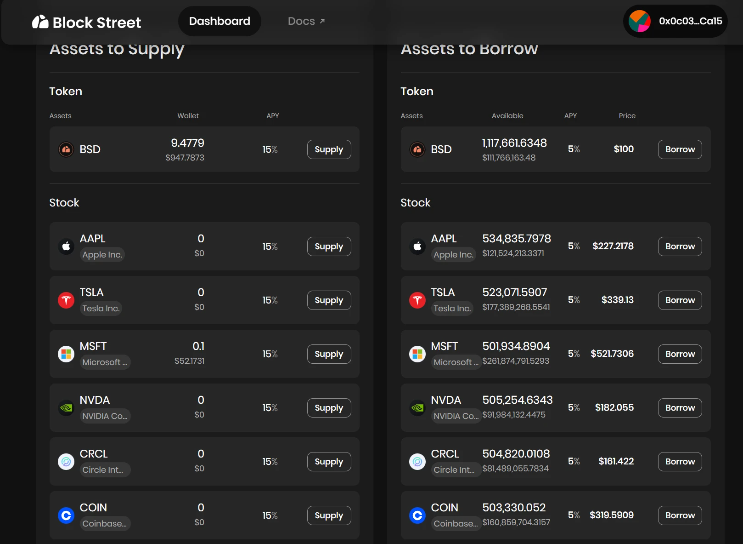

Block Street focuses on lending based on tokenized stocks. Holders can use assets like TSLA.M or CRCL.M as collateral to borrow stablecoins or other tokens, thereby unlocking liquidity without selling their assets. Its test version has recently launched, allowing tokenized stocks to serve as usable collateral, filling a significant gap in DeFi lending. If features like lending, perpetual contracts, and options mature on this platform, they could trigger a "second growth curve" for the entire tokenized stock sector.

The biggest advancement in this wave is the combination of real stock custody with low-barrier participation methods. With just a wallet and stablecoins, anyone can gain price exposure to U.S. stocks on decentralized exchanges (DEX)—without needing a brokerage account, unrestricted by time zones, and with fewer regional barriers. However, most current products still remain in the "certificate stage": they are merely issuing and trading tokens, not fully transforming them into financial building blocks that can be used for trading, hedging, and capital management. If the goal is to attract professional capital flows, high-frequency liquidity, and institutional participation, this will pose a significant challenge.

Before the "DeFi Summer," DeFi also went through a similar phase. At that time, ETH was not widely used for lending or composability until lending protocols emerged. Once ETH became an acceptable collateral, liquidity grew rapidly. Tokenized stocks are likely to undergo the same transformation: becoming collateralizable, tradable, and composable assets.

If the first growth curve represents spot trading volume, then the second growth curve will be driven by market activities spurred by capital efficiency and financial instruments.

Expected development directions include:

- Lending and credit based on tokenized stocks (e.g., Block Street)

- Shorting and hedging tools (inverse tokens, perpetual contracts, options, etc.)

- Structured strategies and baskets

- Cross-platform interoperable basket/investment products in DeFi

Platforms that can provide an integrated on-chain experience—covering spot trading, shorting, leverage, and hedging, and making tokenized stocks available in lending, options, and stablecoin protocols—will have a competitive advantage.

Conclusion

Tokenizing U.S. stocks and ETFs is not just about moving Wall Street onto the blockchain; it is about bridging the gap between traditional capital markets and blockchain. From issuance (Ondo), multi-market access (Backed Finance), to unlocking liquidity (Block Street), the full-stack system of tokenized stocks is steadily taking shape. As institutional participation expands and trading infrastructure matures, composable, tradable, and collateralizable tokenized stocks are expected to evolve into one of the most influential and sustainably appreciating asset classes in the RWA market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。