Written by: ChandlerZ, Foresight News

Recently, the on-chain US stock trading platform Mystonks has been embroiled in a controversy over a large fund freeze. X user @Caroline claimed that her withdrawal request of $6.2 million on the platform was denied, and she suspected that the funds had been dispersed and transferred. The platform responded that the freeze was in cooperation with regulatory enforcement requests and emphasized that other users' transactions were not affected. This incident has drawn ongoing attention from security companies, on-chain analysts, and community members, making Mystonks' compliance qualifications and custody arrangements a focal point.

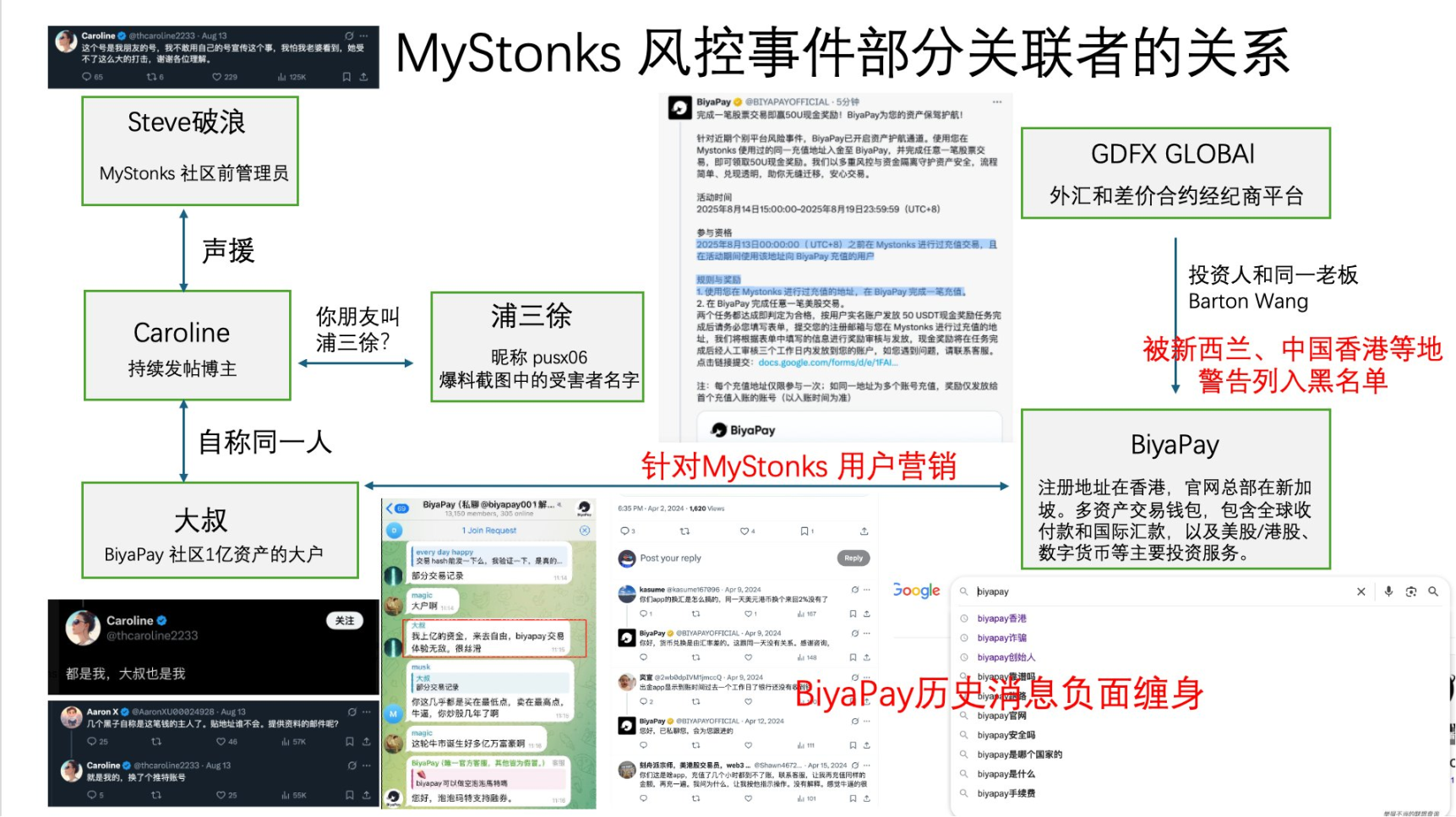

As the situation escalated, some industry insiders and social media accounts suggested another viewpoint, indicating that the user involved might have connections to the competitor Biyapay, suspecting that this controversy could be a premeditated attack on public opinion and business. The varying statements have sparked ongoing discussions about the platform's compliance qualifications, fund security, and underlying motives.

Million-Dollar Withdrawal Halted, Investor Claims "Risk Control" Suspension

X user @Caroline stated that her $6.2 million funds on the on-chain US stock trading platform Mystonks were denied for withdrawal, and she suspected that the platform had transferred her assets.

According to the user, she recently noticed Mystonks advertising on multiple platforms and subsequently transferred a total of over $7 million from Binance to the platform.

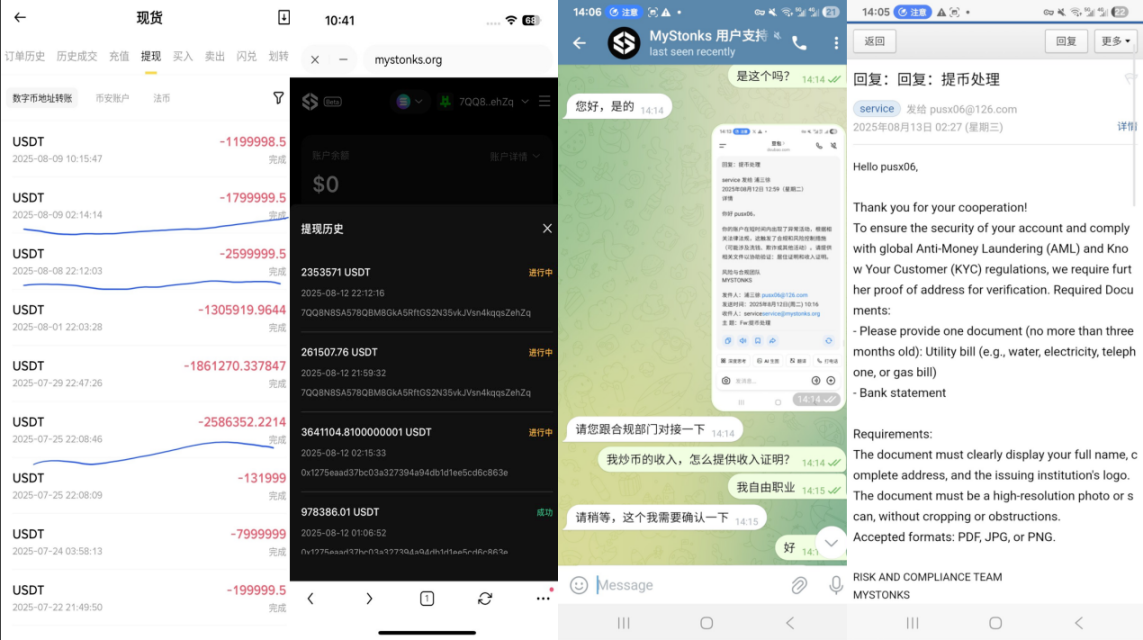

Withdrawal records show that on July 22, August 11, and August 12, three withdrawals of $1,000, $200,000, and $970,000 were successfully credited. However, when she later applied to withdraw $3.6 million, $2.6 million, and $230,000, the platform suddenly cited "risk control" as the reason and requested additional documentation.

@Caroline stated that she complied and provided the requested information, but after mentioning the withdrawal issue in the platform's official Telegram group, she was muted. The customer service representative responsible for her case repeatedly responded with vague statements and then ceased communication. The platform's risk control department initially rejected her submission, citing non-compliance of the materials, and after a second submission, there was no response for over 12 hours. She attempted to leave a message for the management team in the platform's backend but received no reply.

During this time, a friend informed her that on-chain monitoring revealed that the funds had been dispersed and transferred to multiple addresses. The user believes this indicates that the funds are under the platform's control and that it continues to attract new users in the community. If anyone in the group inquires about the withdrawal situation, they are removed from the chat.

Public information shows that MyStonks is a trading platform focused on the "tokenization" of US stocks, aiming to bring traditional US stock assets into the blockchain market in token form. The platform claims to hold a Money Services Business (MSB) license from the US FinCEN and has completed the registration for a Security Token Offering (STO) with the US SEC, emphasizing operational compliance.

The platform disclosed that its founder is X platform crypto KOL Bruce J. He detailed the incident in a Space, emphasizing compliance, team transparency, and that he has been operating mining businesses in the US for seven years, thus asserting that he is not an anonymous team like coinglass.

No public information reveals Bruce J's full name, and specific background and ownership structure details remain unclear. Currently, his identity appears more frequently as "MyStonks founder Bruce J" in community communications.

On-Chain Fund Flow Raises Concerns

After drawing community attention, MyStonks tweeted that it recently received a regulatory enforcement request regarding a specific user, stating that this investigation is a "specific investigation of a single user," which includes: anti-money laundering investigations, involvement with criminal organizations, fraud rings, drug trafficking, sanctions evasion, and suspicious activity reports (SAR). Following the request, MyStonks' compliance department directly contacted the involved user through secure channels and provided specific submission process instructions. All collected information will be securely stored and shared only within the legal requirements. Normal users' deposit and withdrawal operations are completely unaffected by this investigation and can proceed normally, assuring users of safe usage.

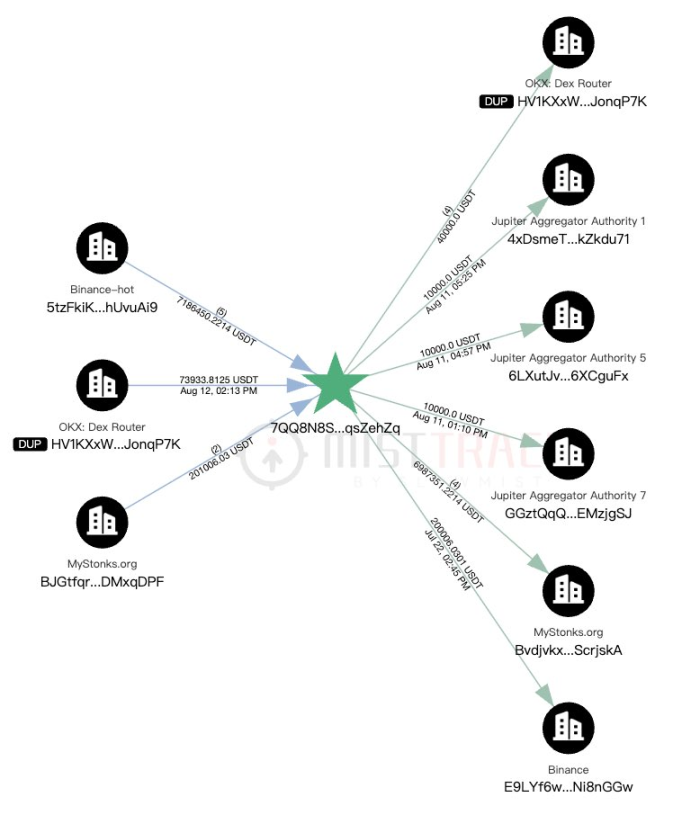

Yusuan, the founder of SlowMist, subsequently stated that preliminary analysis of the on-chain fund flow indicated that large funds came from Binance withdrawals received by the target user. A preliminary look showed that the source of the $6.2 million frozen in MyStonks was USDT, with the green star icon 7QQ8N8S being the user's own SOL address, and large funds primarily coming from Binance withdrawals, with DEX interactions related to STONKS and USDT exchanges.

If MyStonks cooperates with the enforcement request regarding the risk control of the target user's funds on its platform, it may depend on the target user's fund transactions on Binance.

Yusuan remarked, "This matter is quite opaque; we will monitor the follow-up situation."

Paper Compliance? Gaps Beyond Registration Records

After sparking heated discussions in the community, on-chain analyst Nisen Phyrex repeatedly expressed his views, emphasizing, "Firstly, I have no authority or facts to prove whether Mystonks is a scam, nor do I know if the $7 million frozen funds are due to black money, but I did check out of curiosity whether Mystonks is qualified to issue securities tokens in compliance."

Phyrex pointed out that Mystonks Holding LLC has submitted a Reg D 506 (c) filing to the SEC, indicating that it is conducting a private placement exemption for qualified investors, with a total issuance amount of $575,000, all of which has been sold (remaining 0). Key details of this filing show that the issuing entity is Mystonks Holding LLC, established in 2025, with the first sale date on August 4, 2025, and a minimum investment amount of $50,000, signed by director Lie Yang. However, completing the STO filing does not mean that the company possesses comprehensive exchange qualifications. Reg D filings allow for the issuance of securities tokens to qualified investors but do not grant permission for public sales or allow for the operation of digital asset exchanges. To publicly operate securities token trading in the US, Mystonks would need to meet additional licensing requirements such as ATS (Alternative Trading System) or Broker-Dealer.

Additionally, FinCEN's MSB registration information could not be found in public searches. Although Phyrex does not assume that Mystonks Holding LLC has not obtained MSB registration, if it has indeed been obtained, relevant information should be searchable on FinCEN's public website. Currently, this information has not been disclosed in any materials of Mystonks Holding LLC, and its white paper is inaccessible, making it impossible to confirm whether it holds a Money Services Business (MSB) license from the US FinCEN.

Regarding cooperation with Fidelity, if Mystonks indeed has custody or brokerage cooperation with Fidelity, there would typically be retrievable press releases or web pages, but currently, there is only a unilateral narrative from third-party media that has not been verified. No relevant information is found on Fidelity's official website, and the news link provided by Mystonks shows a 404 error, indicating that further evidence is needed to confirm the cooperative relationship with Fidelity, including custody service contract numbers or letters issued by Fidelity.

Based on the information currently available, Mystonks Holding LLC has not provided sufficient public evidence to prove its qualification to sell tokenized stocks to the public. It can be confirmed that it has only completed the Reg D 506 (c) private placement filing and does not possess the qualifications for public sales or operating an exchange. Mystonks is also not listed on the SEC ATS list or under any public records in the FINRA system.

Phyrex pointed out that if Mystonks could provide the following materials, it would help clarify its compliance issues: 1. Broker-Dealer registration and FINRA number; 2. Form ATS or SEC public notice for ATS (or registered exchange); 3. Product-level registration and exemption documents (prospectus or exemption statement), and official announcements of custody and/or settlement arrangements; 4. If selling to non-US jurisdictions, local licensing or application numbers and regulatory website links should be provided.

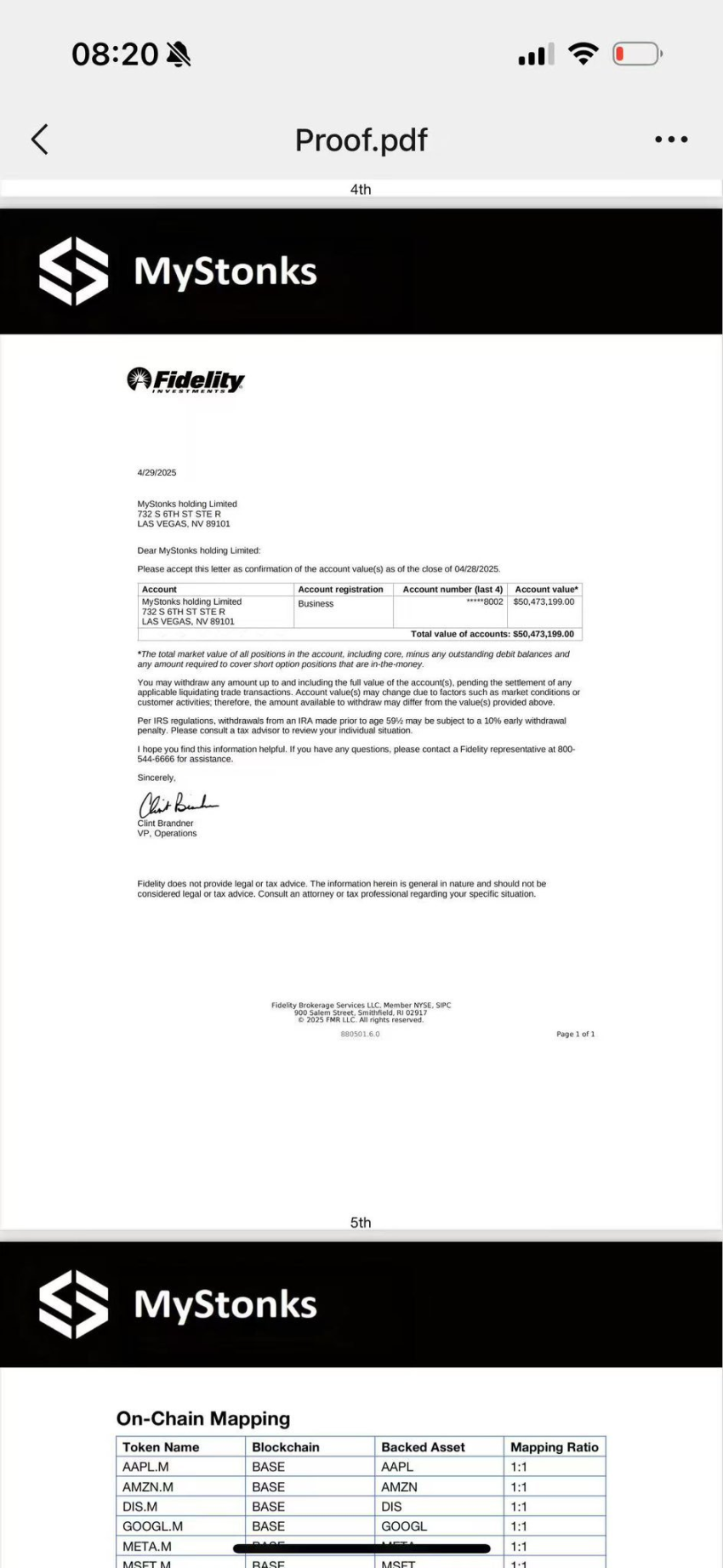

Additionally, Phyrex stated that a "Fidelity custody proof" provided by a user is an account balance confirmation letter issued by Fidelity Investments on April 29, 2025, to MyStonks Holding Limited. The letter shows a total account value of $50,473,199, signed by Clint Brandner (VP, Operations). However, this confirmation letter is merely a balance confirmation requested by the client from the broker and is not an official cooperation announcement or custody agreement.

The lower part of the letter contains a self-made "On-Chain Mapping" table by MyStonks, listing tokens such as AAPL.M, AMZN.M, and stating "Mapping Ratio 1:1," without third-party audits or endorsements from custodians.

Assuming the letter is genuine, MyStonks' account value at Fidelity on April 29, 2025, was approximately $50.47 million. However, this data is four months old, and the current account status is unknown. Furthermore, the letter does not prove the existence of an "official cooperation/custody agreement" between Fidelity and MyStonks, nor does it confirm whether the assets are legally protected or the authenticity and sustainability of the 1:1 mapping. These contents are not directly related to whether it qualifies for public sales of tokenized securities.

Another point of doubt is that MyStonks Holding Limited is registered in the BVI, while the address mentioned in the letter is in Las Vegas, with inconsistent capitalization. It is recommended to provide the company registration certificate and board resolution to confirm the consistency of the entity.

Allegations of Competitor Conspiracy and Doubts

As the situation escalated, social media accounts such as Crypto Fearless and Crypto Veteran suggested another narrative, indicating that the involved user @Caroline has close ties with another trading platform, Biyapay. Biyapay is registered in Hong Kong, with its headquarters in Singapore, and its business covers multi-asset trading, international remittances, US and Hong Kong stock trading, as well as spot and contract services for digital currencies. The key figure publicly disclosed by the platform is CEO Barton Wang.

Their analysis suggests that the involved account was active in the Biyapay community, previously showcasing large transaction screenshots under the identity of "hundreds of millions in funds" and praising the trading experience of the platform; however, it later deposited approximately $6.2 million into Mystonks and initiated public exposure after the withdrawal was subjected to risk control. Additionally, during this period, Mystonks faced a large-scale cyber attack, numerous app reports leading to removal, and marketing activities targeting Mystonks users launched by Biyapay. It is hard not to suspect that this is a premeditated commercial attack process.

Related tweets also listed several specific doubts:

- After the deposit and withdrawal incidents, Mystonks encountered 800,000 network accesses or requests, far exceeding the normal user scale.

- The number of app reports was claimed to be as high as 20,000, with some opinions suspecting automated bulk reporting.

- Biyapay was accused of amplifying public sentiment through paid commenters and KOL retweets, and offering trial experience bonuses to Mystonks users.

Currently, the specific reasons for the fund freeze at Mystonks, the status of on-chain assets, and the platform's custody arrangements remain to be disclosed and verified.

Amid the various narratives surrounding the incident, there are both accusations from investors and speculations of a competitor's planning. This information comes from third-party social media discussions and lacks independent evidence to support it. Biyapay has not publicly responded to the related accusations, and the involved user @Caroline has also not directly addressed the questions regarding her relationship with Biyapay. Different versions of the story continue to circulate in the community, but there are still significant gaps in the information, and the silence and limited responses from the parties involved leave the final outcome of this controversy full of uncertainty.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。