⚡️A financial management method very suitable for BTC/ETH holders——

After writing about Pendle Boros last time, many people wondered if this is only suitable for institutional players like Ethena.

Actually, it's not. Retail investors holding BTC/ETH spot can also easily use @boros_fi for simple arbitrage!

👇👇 Here’s the easiest way to get started

Hold BTC spot (the basis for price hedging) + short BTC perpetual contracts (collect funding fees) + short BTC-YU (lock in high funding rates)

Assumption: You hold 1 BTC (price $100,000), 90-day cycle, short YU on Boros locking Implied APR=8%.

Scenario 1⃣: Funding rate remains at 8% throughout (consistent with the locked rate)

Perpetual short funding fee income: $100,000 × 8% × (90/365) ≈ $1,972

Shorting YU income: actual rate = locked rate, no profit or loss → $0

Total income: $1,972 + $0 = $1,972 (8% annualized)

Scenario 2⃣: Funding rate drops to 5% (lower than the locked rate)

Perpetual short funding fee income: $100,000 × 5% × (90/365) ≈ $1,232

Shorting YU: profit = income corresponding to (locked rate - actual rate)

$100,000 × (8% - 5%) × (90/365) = $740

Total income: $1,232 + $740 = $1,972

Scenario 3⃣: Funding rate rises to 11% (higher than the locked rate)

Perpetual short funding fee income: $100,000 × 11% × (90/365) ≈ $2,712

Shorting YU: loss = cost corresponding to (actual rate - locked rate), $100,000 × (11% - 8%) × (90/365) = $740

Total income: $2,712 - $740 = $1,972

So no matter how the rates change, the perpetual “profit/loss” and YU’s “loss/profit” will always offset each other, and the final income you can get is the Implied APR you locked in on Boros.

Moreover, it does not affect your spot position, making it very suitable for us who do not plan to liquidate in the short term!

By the way, Boros is really impressive! It has only been online for 9 days, and technically it has been on a steady rise——

- TVL increased from $1.78M to $2.75M (+53%)

- Trading volume reached $111.4M

- Opening limit has been raised multiple times to $28.55M

- @pendle_fi token price increased by 41.9%

Market demand is still quite strong!

I strongly recommend you to start with a small position to try it out. Those who have previously used Hyperliquid, understand funding rates, should find it easy to grasp the Boros product!

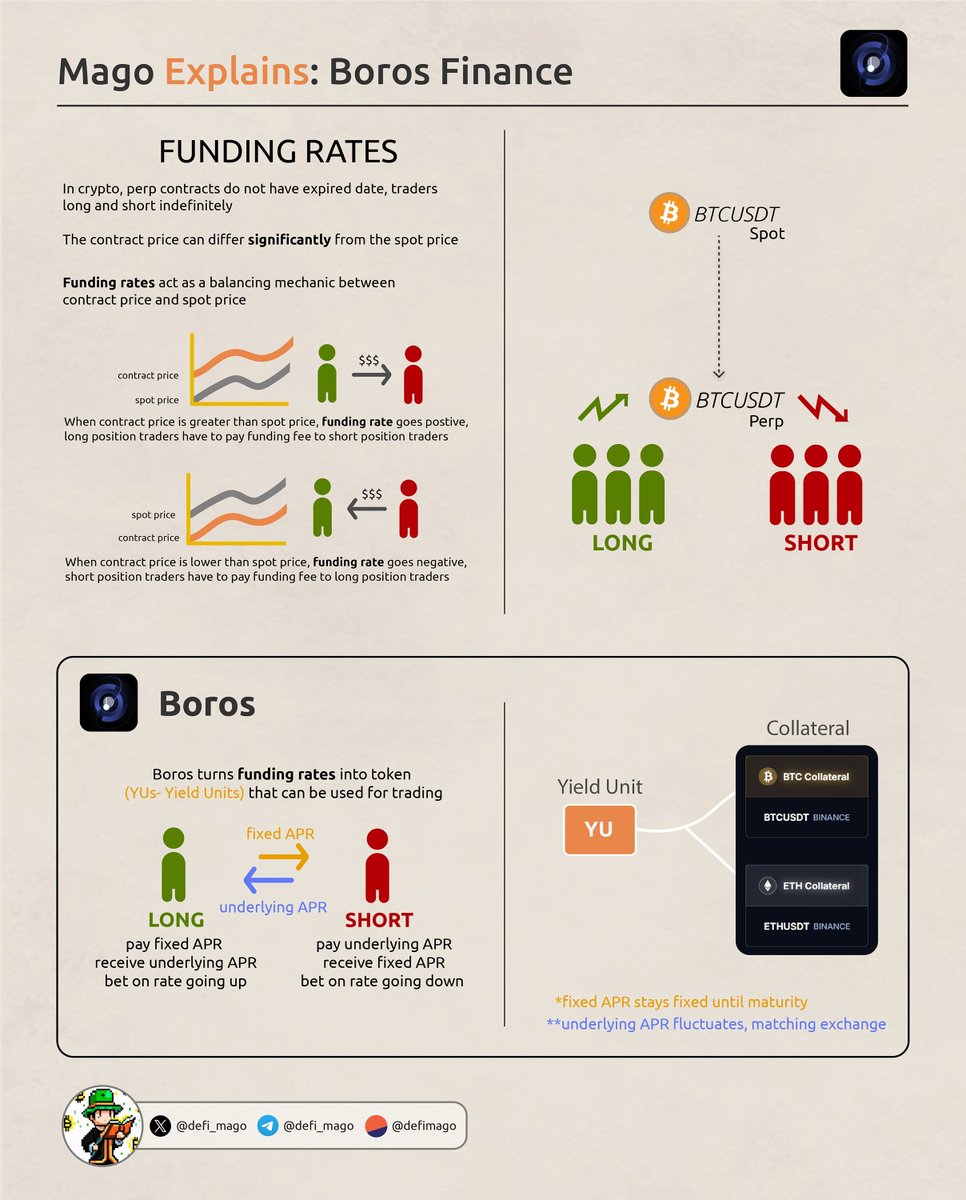

Stealing a picture from @defi_mago to help with understanding——

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。