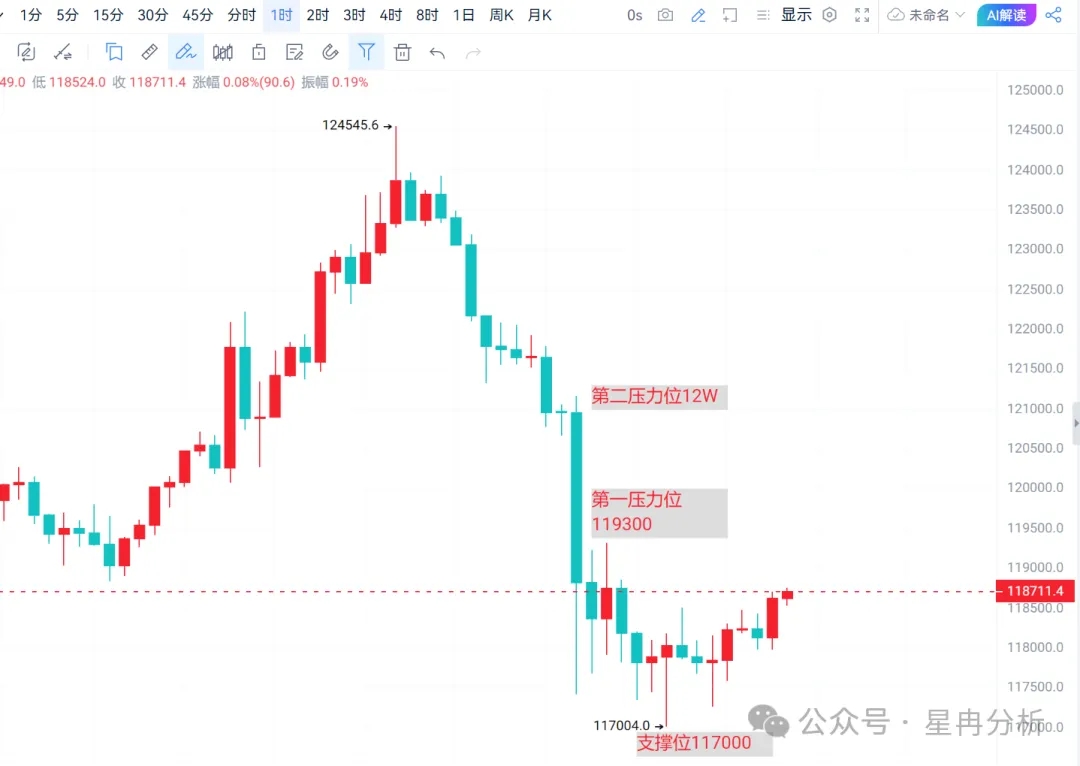

Yesterday, Bitcoin reached a historical high of 124,500 in the morning. In the evening, influenced by the PPI data exceeding expectations and a decrease in bets on Fed rate cuts, the price plummeted, correcting by 7,000 points, closing with a bearish engulfing pattern, and dropping to around 117,000, returning to the previous starting point. In the short term, the market is dominated by bears. The hourly MACD shows signs of forming a golden cross, and the target price may experience a slight pullback. Pay attention to the resistance level around 119,000-119,200; if it breaks effectively, we can look further up. The trading strategy for the day focuses on shorting high and going long low.

Trading Suggestions

For Bitcoin, consider shorting at 119,300-120,000 with a target around 117,000.

Ethereum surged to 4,800 yesterday but faced resistance and fell back by 350 points, catching many latecomers off guard. Fortunately, we had already laid out a short strategy in the afternoon, allowing students who followed along to capture nearly 200 points of movement. The 4-hour MACD shows a death cross pointing downwards, while the hourly chart has been closing with bullish candles, indicating another wave of rebound in the short term. The effective resistance level above is around 4,700; if it does not break, the focus for the day will be on shorting high and going long low.

Trading Suggestions

For Ethereum, consider shorting at 4,680-4,700 with a target around 4,500.

Do not try to predict market tops and bottoms; trading can only be sustainable if you go with the trend.

However, most traders understand this principle but rarely put it into practice.

As the saying goes, knowing is easy, doing is hard. The hardest thing in this world is not the grand principles but the unwavering execution of them.

In fact, the most important thing goes back to Buffett's old saying:

The most important things in investing are: first, preserve your capital; second, preserve your capital; third, preserve your capital.

If there are friends who cannot make accurate judgments about the current market situation and are facing losses, it might be a good idea to follow Xingran's rhythm, allowing Xingran to guide you in the right direction.

The content of this article is time-sensitive and for reference only; risks are to be borne by the reader.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。