This article is from: Coinbase; Original author: David Duong

Translation|Odaily Planet Daily (@OdailyChina); Translator|Azuma (@azumaeth)_

Core Summary

- We remain optimistic about the outlook for Q3 2025, but our view on the altcoin season has evolved. We believe the current market conditions indicate that as September approaches, the market may shift towards a full altcoin season — our typical definition of an altcoin season is when at least 75% of the top 50 altcoins by market capitalization outperform Bitcoin over the last 90 days.

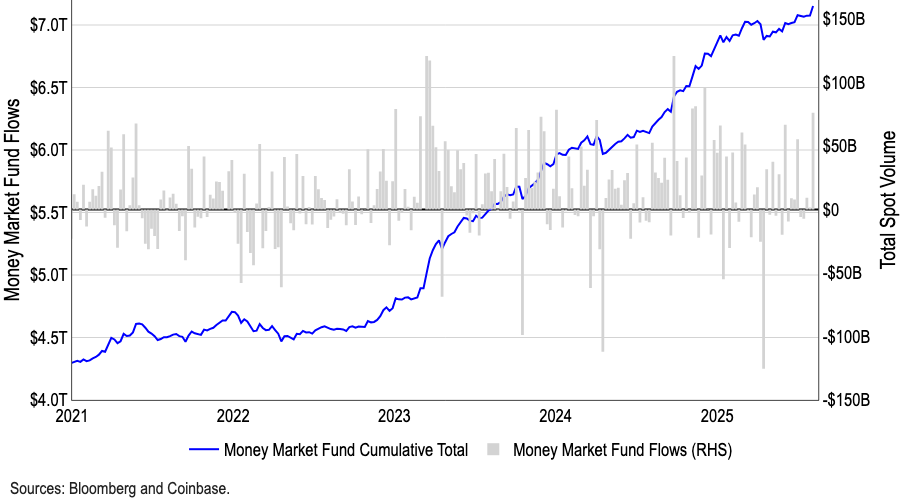

- Many argue whether the Federal Reserve's interest rate cut in September will lead to a local peak in the cryptocurrency market, but we do not believe so. There is currently a large amount of retail funds sitting idle in money market funds (over $7 trillion) and other channels, and we believe the Fed's easing policy may release more retail funds to participate in the market in the medium term.

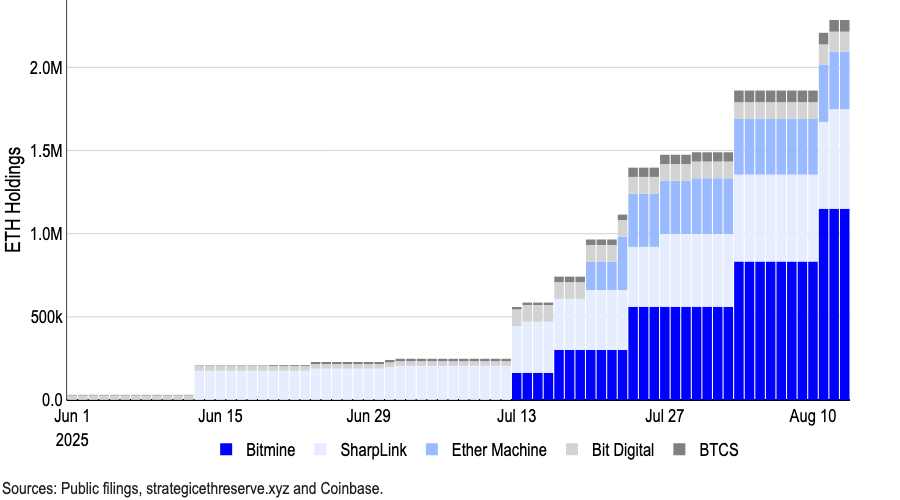

- Focus on Ethereum (ETH). The "overall sluggishness of the altcoin season index on CoinMarketCap" contrasts with the "50% growth in total market capitalization of altcoins since early July," largely reflecting increased institutional interest in ETH. This is attributed to the demand for Digital Asset Treasuries (DAT) and the growing narrative around stablecoins and real-world assets.

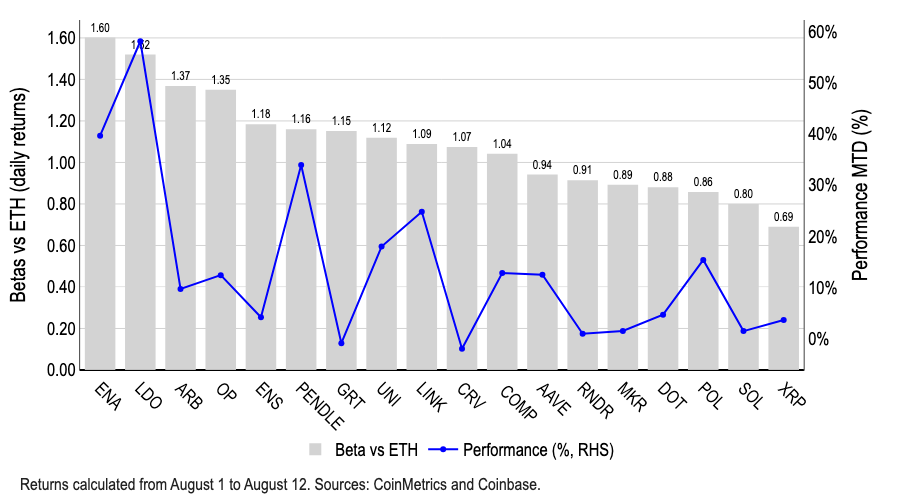

- Although tokens like ARB, ENA, LDO, and OP show higher beta values in daily returns against ETH, it seems that only LDO has significantly benefited from the recent ETH rally (up 58% so far this month). In the past, Lido has provided a relatively direct ETH exposure due to the nature of liquid staking. Additionally, we believe LDO's rise is supported by the U.S. SEC's statement — under certain conditions, liquid staking tokens do not constitute securities.

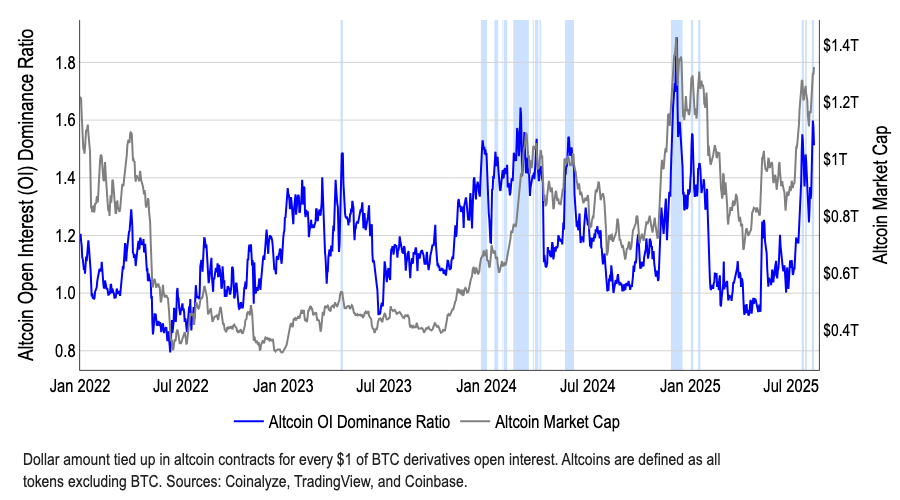

The Altcoin Season is Coming

Bitcoin's market dominance has decreased from 65% in May 2025 to about 59% in August 2025, indicating that funds have begun to rotate into altcoins. Despite the total market capitalization of altcoins growing over 50% since early July (reaching $1.4 trillion as of August 12), the CoinMarketCap "altcoin season index" currently remains low at around 40, far below the historical threshold of 75 that defines an altcoin season. We believe that the current market conditions have begun to signal that as September approaches, the market may shift towards a full altcoin season.

Odaily Note: The proportion of open contracts for altcoins has surged.

Our optimistic outlook is based on a macro perspective and expectations of significant regulatory progress. We previously pointed out that changes in the global M2 money supply index often lead Bitcoin prices by 110 days and point to a potential new round of liquidity at the end of Q3 2025/early Q4. This is crucial because the narrative seems to still revolve around large coins for institutional funds, while the support for altcoins mainly comes from retail investors.

Notably, the current size of U.S. money market funds has reached a record $7.2 trillion, with cash balances decreasing by $150 billion in April, which we believe has driven strong performance in crypto assets and risk assets in the following months. However, interestingly, cash balances have rebounded by over $200 billion since June, contrasting with the rise in cryptocurrencies during the same period. Typically, rising cryptocurrency prices are negatively correlated with cash balances.

Odaily Note: The asset size of money market funds has surpassed $7 trillion.

We believe this unprecedented level of cash reserves reflects an opportunity cost of missed chances, primarily due to:

- Increased uncertainty in traditional markets (triggered by issues like trade conflicts);

- High market valuations;

- Ongoing concerns about economic growth.

However, as the Federal Reserve is set to implement interest rate cuts in September and October, we believe the attractiveness of money market funds will begin to wane, and more funds will flow into cryptocurrencies and other high-risk asset classes.

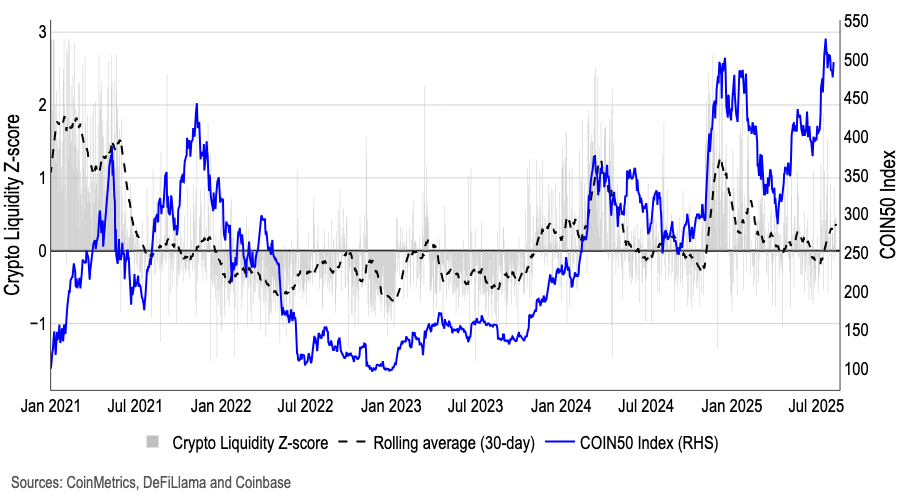

In fact, our cryptocurrency liquidity-weighted Z-score indicator (based on factors such as net issuance of stablecoins, spot and perpetual contract trading volume, order book depth, and free float) shows that liquidity has begun to recover in recent weeks after a six-month decline. The growth of stablecoins is partly due to a clearer regulatory environment.

Odaily Note: There are initial signs of recovery in cryptocurrency liquidity.

ETH's Beta Options

Meanwhile, the divergence between the "altcoin season index" and "total market capitalization of altcoins" mainly reflects the growing institutional interest in Ethereum (ETH) — a trend supported by the demand for Digital Asset Treasuries (DAT) and the narratives around stablecoins and real-world assets (RWA). Just Bitmine Immersion Technologies alone has purchased 1.15 million ETH and plans to continue increasing its holdings through up to $20 billion in financing. Another leading ETH DAT, Sharplink Gaming, currently holds about 598,800 ETH.

Odaily Note: The amount of ETH held by some digital asset treasury companies.

As of the latest data on August 13, the top ETH treasury companies collectively hold about 2.95 million ETH, accounting for over 2% of the total ETH supply (120.7 million ETH).

Among the higher beta options relative to ETH returns, ARB, ENA, LDO, and OP are at the forefront, but it seems that only LDO has significantly benefited from the recent ETH rally (up 58% so far this month). Due to the nature of liquid staking, Lido has historically provided relatively direct ETH exposure, and currently, LDO's beta value relative to ETH is 1.5 — a beta value greater than 1.0 means that the asset is theoretically more volatile than the benchmark, potentially amplifying both gains and losses.

Odaily Note: Some altcoins' beta values relative to ETH.

We believe LDO's price increase is also supported by the U.S. SEC's statement on liquid staking on August 5. SEC staff in the corporate finance department indicated that when the services provided by liquid staking entities are essentially "ministerial" operations and staking rewards are distributed on a 1:1 basis as per the agreement, the related activities do not constitute the issuance or sale of securities. However, it is important to note that: yield guarantees, self-restaking, or additional return mechanisms may still trigger securities classification. Additionally, the current guidance only represents the staff's views — future changes in the committee's stance or litigation could alter this interpretation.

Conclusion

We maintain a constructive outlook for Q3 2025, but our judgment on the altcoin season has evolved. The recent decline in Bitcoin's dominance indicates that funds are beginning to rotate into altcoins, but a full altcoin season has not yet formed. However, as the total market capitalization of altcoins rises and the "altcoin season index" shows early positive signals, we believe the market is creating conditions for a more mature altcoin season that may arrive in September. This optimistic assessment is based on both macro factors and expectations of regulatory progress.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。